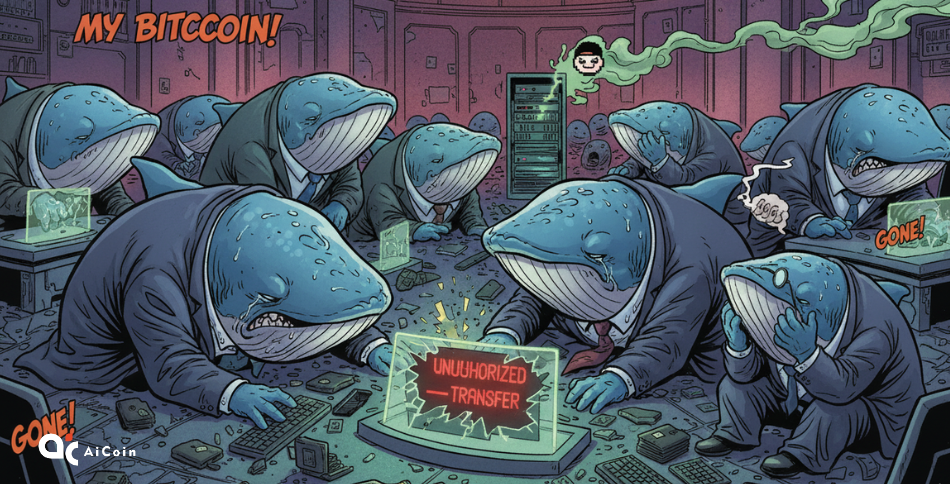

In the world of cryptocurrency, security issues always hang like the sword of Damocles, with significant security incidents occurring frequently in recent years, shocking many.

As digital assets become a new vehicle for wealth, security risks have also escalated. Recently, the Chinese pop superstar Jay Chou's post on a social platform seeking a missing person drew widespread attention, bringing the issue of cryptocurrency custody security back to the forefront. Jay Chou wrote: “Has anyone seen this magician who made himself disappear? You think I’m not a magician? If you don’t show up soon, you’re done.” His words were filled with anger and helplessness, and he subsequently unfollowed the person involved — magician Cai Weize.

It is reported that Cai Weize, as a friend of Jay Chou, was entrusted to manage and invest over hundreds of millions in Bitcoin assets. However, a year ago, Cai Weize suddenly claimed that his account was locked, and since then he has completely vanished, with this massive cryptocurrency asset still not returned.

Coincidentally, according to Pionex monitoring, on December 18, a cryptocurrency whale's multi-signature wallet was stolen due to a private key leak, resulting in a loss of up to 27.3 million dollars. After the hacker succeeded, they quickly laundered 12.6 million dollars (equivalent to 4,100 ETH) through Tornado Cash, while also controlling the victim's multi-signature wallet, which still held 25 million dollars worth of ETH as collateral and had borrowed 12.3 million DAI in a leveraged long position, further exacerbating asset risk.

Even more alarming, in another case, a whale withdrew 50 million USDT from Binance and first tested a transfer of 50 USDT to a target address, but was phished by attackers who generated a similar address with the same first and last three characters, and transferred 0.005 USDT to it. When the whale directly copied this similar address from the transaction record for the formal transfer, the 50 million USDT instantly fell into the hands of the phisher, who quickly exchanged it for DAI to avoid freezing, and then converted it into 16,624 ETH through Tornado mixing services, all within a few hours.

These real cases reveal the diversity and severity of security risks in the cryptocurrency field, from custody trust crises to technical phishing attacks, from private key management vulnerabilities to operational errors in transactions, every link can become a breakthrough point for asset loss. For cryptocurrency holders, establishing a comprehensive security protection system has become a necessary course.

Common Security Threats Analysis

1. Custody and Trust Risks

Jay Chou's experience is not an isolated case; during the custody process of crypto assets, situations where trustees go missing, misappropriate assets, or maliciously occupy them occur frequently. Due to the decentralized nature of cryptocurrencies, lacking the regulatory constraints of traditional financial systems, once a custody model is chosen, the control of assets shifts to the trustee. If the other party has moral hazards or operates improperly, investors will face the risk of total loss. Such risks exist not only in personal custody scenarios; even professional custody institutions may encounter asset security issues due to internal management loopholes.

2. Technical Phishing Attacks

Similar address attacks have become a common tactic for phishers. Cryptocurrency wallet addresses consist of a string of random characters, and ordinary users often only check the first and last few characters to confirm transfers, which gives phishers an opportunity. By generating a fake address that matches the first and last characters of the target address, and creating a false transaction record with a small transfer, they lure users into mistakenly transferring assets. Such attacks precisely exploit users' operational habits and are highly covert; once the transfer is completed, due to the irreversible nature of blockchain, assets are almost impossible to recover.

3. Private Key Management Vulnerabilities

The private key, as the "digital key" of cryptocurrency, directly determines asset ownership. The theft of whales due to multi-signature wallet private key leaks once again confirms the importance of private key management. Some users engage in high-risk behaviors such as storing private keys in mobile apps, computer hard drives, or conspicuous places at home, or due to insufficient password strength and shared private keys, leaving opportunities for hackers. Even worse, some users leak their private keys due to misplaced trust in others, directly leading to asset transfers.

4. Real-World Security Threats

In addition to cyber attacks, cryptocurrency holders also face real-world security risks. Recently, kidnapping and robbery cases in the crypto circle have surged; the ex-boyfriend of OpenAI's co-founder encountered a related incident in San Francisco, and the co-founder of Ledger in France also experienced organized kidnapping. Attackers may be neighbors or acquaintances (targeted due to boasting about holdings at parties) or professional criminal gangs, who use tracking, violence, and coercion to demand mnemonic phrases or large ransoms, posing dual threats to the personal and property safety of holders.

Comprehensive Security Protection Measures

1. Asset Storage and Custody Security

- Prioritize self-custody models, avoiding entrusting large assets to individuals or informal institutions. If custody is necessary, verify the institution's qualifications, sign formal legal agreements, and regularly check the asset status.

- Recommended use of professional secure storage solutions: Casa Vault (multi-signature + geographically distributed storage), Safe multi-signature wallet, ZenGo MPC (supports setting fund lock times), etc., to reduce single point failure risks through technical means.

- Absolutely avoid storing large assets in mobile apps or browser plugins, as these tools are vulnerable to malware attacks and have weak security protection capabilities.

2. Transaction Operation Security Norms

- Before transferring, thoroughly verify the wallet address, avoiding only checking the first and last characters. It is recommended to obtain the target address through official channels or use QR code scanning for transfers, refusing to directly copy unknown addresses from transaction records.

- For large transfers, conduct a small test transfer first, confirming the address is correct before executing the formal transfer, and record the transfer hash for future reference.

- Avoid conducting transaction operations in public Wi-Fi environments, as public networks are at risk of being monitored or hijacked; it is advisable to use encrypted private networks or mobile data networks.

- Regularly check the contract authorization status of wallets, revoke unnecessary authorizations to prevent malicious contracts from stealing assets.

3. Private Key and Mnemonic Phrase Management

- Private keys and mnemonic phrases should be stored offline, recorded on encrypted hardware devices or paper media, and kept in secure locations such as bank safes to avoid digital storage.

- Mnemonic phrases should not be shared with others, including friends, family, or platform customer service, and attention should be paid to the storage environment to prevent fire, moisture, and theft.

- Multi-signature wallets should reasonably allocate signing permissions, avoiding a single private key controlling all assets, and regularly changing private keys to reduce leakage risks.

4. Personal Information and Real-World Security Protection

- Do not flaunt wealth on social platforms, including images of cryptocurrency asset gains, holding screenshots, luxury cars, and mansions, to avoid becoming a target due to information leaks.

- Use tools like DeleteMe/Optery to remove sensitive information such as addresses and phone numbers from the internet, hold property through LLCs/trusts, and apply for Google Street View blurring to hide personal privacy.

- Strengthen home security, installing cameras, alarm buttons, safe rooms, anti-explosion films, and motion-sensor lights, and do not store cryptocurrency-related items at home.

- When traveling or attending cryptocurrency conferences, maintain a low profile, avoid wearing cryptocurrency brand clothing, not wearing conference badges, not discussing cryptocurrency-related topics with strangers, and not revealing itineraries or locations in advance. High-net-worth individuals and public figures (HNWIs/KOLs) may hire professional privacy monitoring/threat assessment teams, and for travel in high-risk areas, it is advisable to have temporary bodyguards and educate family members on anti-kidnapping measures.

Emergency Response Mechanism

If encountering real-world attacks such as kidnapping or robbery, follow the "RUN>HIDE>FIGHT" response framework: prioritize leaving the scene, if escape is not possible, choose a hiding place where counterattack is possible, and if necessary, use pepper spray, sticks, fire extinguishers, and other tools to resist vigorously, creating noise to attract onlookers. In legal areas, accept professional self-defense training and understand relevant laws; in areas with restricted self-defense tools, prepare compliant protective equipment.

AiCoin: A Professional Choice for Cryptocurrency Asset Security Protection

AiCoin occupies an important position in the field of cryptocurrency asset security protection, with compliance operations as the baseline and technological innovation as the core, building a reliable digital asset security barrier for global users.

1. Intelligent Address Verification to Block Phishing Attacks

In response to similar address phishing traps, AiCoin has established a multi-level address verification system. During transfers, the full target address is displayed, and through cross-comparison of blockchain data across the network, it automatically identifies risk addresses with matching first and last characters but abnormal middle fields. When phishing characteristics or tampering traces are detected, pop-up warnings, risk markings, or even temporary transfer restrictions are triggered, forcing a second verification. It supports preset binding of commonly used legal addresses for automatic consistency comparison, eliminating asset loss caused by copying unknown addresses.

2. Full-Process Asset Monitoring to Capture Risk Movements

Relying on real-time data synchronization technology of blockchain, it provides comprehensive asset dynamic monitoring. After binding a wallet, it tracks incoming and outgoing transfers, contract authorizations, staking and lending operations in real-time, and issues instant alerts through multiple channels for unusual activities such as transfers from unfamiliar addresses or large concentrated transfers. It supports customizable asset change thresholds; if the preset limit is exceeded, operations are paused and require multiple verifications for confirmation to prevent hacker theft. It integrates global security agency risk data, marking high-risk addresses and suspicious transactions in real-time to avoid risks in advance.

3. Compliant Private Key Custody Balancing Security and Convenience

Using bank-grade encryption technology to build a compliant custody system, private keys are split using MPC technology, and key fragments are stored in a distributed manner to eliminate single point leakage risks. It supports customizable fund lock times and multiple verification rules; large transfers can set a cooling-off period requiring multiple confirmations such as facial recognition and hardware keys. It provides compliant private key export services for self-custody users, completed offline and requiring multiple identity verifications to ensure storage and usage security.

4. Compliant Operations to Strengthen Privacy Defense

Strictly adhering to global privacy regulations, it does not collect unnecessary personal information, and sensitive data is stored with end-to-end encryption. It supports anonymous asset display, allowing users to hide holding amounts and transaction records to prevent information leaks. It connects with global mainstream regulatory frameworks, serving only compliant regional users, refusing illegal fund inflows, and reducing platform compliance risks.

Are there any safe and reliable exchanges?

Yes, there are, my friend.

OKX: A Strong Guardian of Digital Asset Trading

A Professional and Reliable Platform:

Trusted by over 70 million users, instantly understand the fluctuations in the digital asset market, trade with peace of mind.

Transparent and Verifiable Reserves:

OKX holds a 1:1 reserve for all assets, which can be verified through reserve proof.

Convenient and Easy Deposit Process:

Deposits are credited in real-time, with smooth operations, no delays affecting trading, and support for C2C trading for buying and selling.

Safe and Reliable Identity Verification:

Easily complete identity verification through facial recognition. Once verified, you can start your trading journey on OKX.

Join OKX now to enjoy ultra-low fees and worry-free asset security!

https://jump.do/zh-Hans/xlink?checkProxy=true&proxyId=2

Registering with OKX now also gives you a chance to win an OKX VIP experience card! Enhanced security protection!

Join the AiCoin community, let's discuss and become stronger together!

Official Telegram community: t.me/aicoincn

AiCoin Chinese Twitter: https://x.com/AiCoinzh

Binance benefits group:

https://aicoin.com/link/chat?cid=ynr7d1P6Z

There are no shortcuts to the security protection of digital assets; it requires building defenses from multiple dimensions such as technology, operational habits, privacy protection, and emergency preparedness. Whether ordinary investors or high-net-worth individuals, everyone should abandon the mentality of luck, pay attention to every security detail, and make cryptocurrency assets a truly safe and controllable wealth vehicle. In this digital age of risks and opportunities, only by maintaining a security baseline can one navigate the waves of cryptocurrency steadily and far.

免责声明:本文章仅代表作者个人观点,不代表本平台的立场和观点。本文章仅供信息分享,不构成对任何人的任何投资建议。用户与作者之间的任何争议,与本平台无关。如网页中刊载的文章或图片涉及侵权,请提供相关的权利证明和身份证明发送邮件到support@aicoin.com,本平台相关工作人员将会进行核查。