Original Author: Prathik Desai

Original Translation: Chopper, Foresight News

As a staunchly bullish ETH investor, I have developed an annoying habit this year. Every day, I open the ETH price chart and silently calculate how much my portfolio has lost. After finishing the calculation, I close the market page, hoping that it won't be long before I can turn my losses into profits.

As the year comes to a close, I think most investors who bought ETH at the beginning of the year must feel disappointed. However, over the past 12 months, despite the unsatisfactory price performance of ETH in terms of wealth appreciation, the Ethereum blockchain has stood out among its competitors.

If "making money" is the measure, 2025 is undoubtedly a bad year. But looking beyond token returns, holding ETH has become more convenient in 2025, mainly due to the rise of market tools like ETFs and Digital Asset Treasuries (DAT). Additionally, the two major upgrades, Pectra and Fusaka, completed by Ethereum this year have enabled this public chain to support large-scale applications more easily and efficiently.

In this article, I will reveal why the development trajectories of the Ethereum network and the ETH token diverged in 2025, and what this implies for their future directions.

Ethereum Finally Gains Recognition

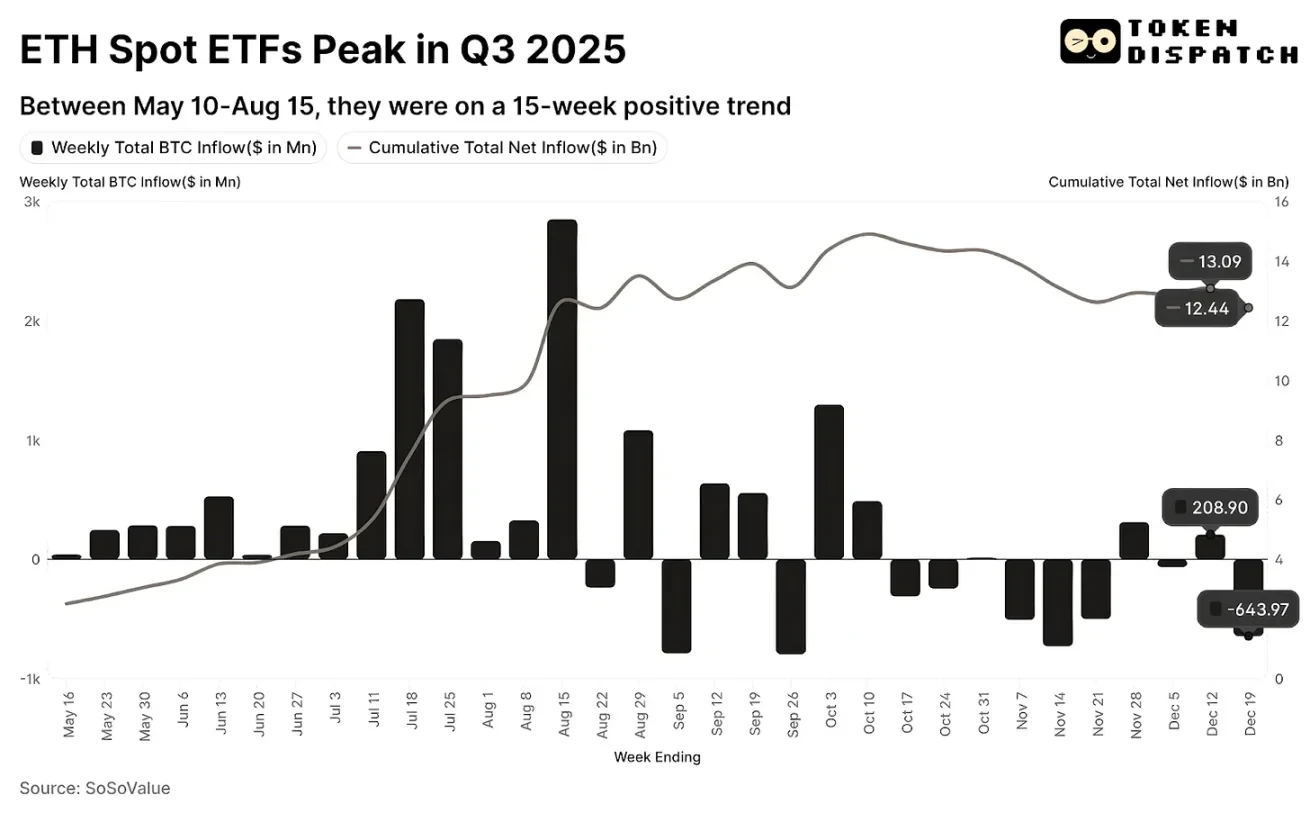

For most of the past two years, "institutional-grade ETH investment" has seemed like an unattainable dream for many. As of June 30, the cumulative inflow of ETH ETFs since their inception a year ago was just over $4 billion. At that time, publicly traded companies had only just begun to consider incorporating ETH into their corporate treasuries.

A turning point quietly emerged in the second half of this year.

From June 1 to September 30, 2025, the cumulative inflow of ETH ETFs grew nearly fivefold, surpassing the $10 billion mark.

This ETF funding boom not only brought in capital but also triggered a psychological shift in the market. It significantly lowered the threshold for ordinary investors to buy ETH, expanding its audience from blockchain developers and traders to a third group—ordinary investors looking to allocate this second-largest cryptocurrency asset globally.

This brings us to another major industry change that emerged this year.

Ethereum Welcomes New Buyers

Over the past five years, influenced by the investment strategy proposed by the CEO of Strategy, Bitcoin corporate treasuries seemed to become the only paradigm for cryptocurrency asset allocation. Before this model exposed its flaws, it was once seen as the simplest path for companies to allocate cryptocurrency assets: publicly traded companies would purchase scarce cryptocurrency assets, driving up coin prices and subsequently boosting their stock prices; then, companies could issue more shares at a premium to raise additional funds.

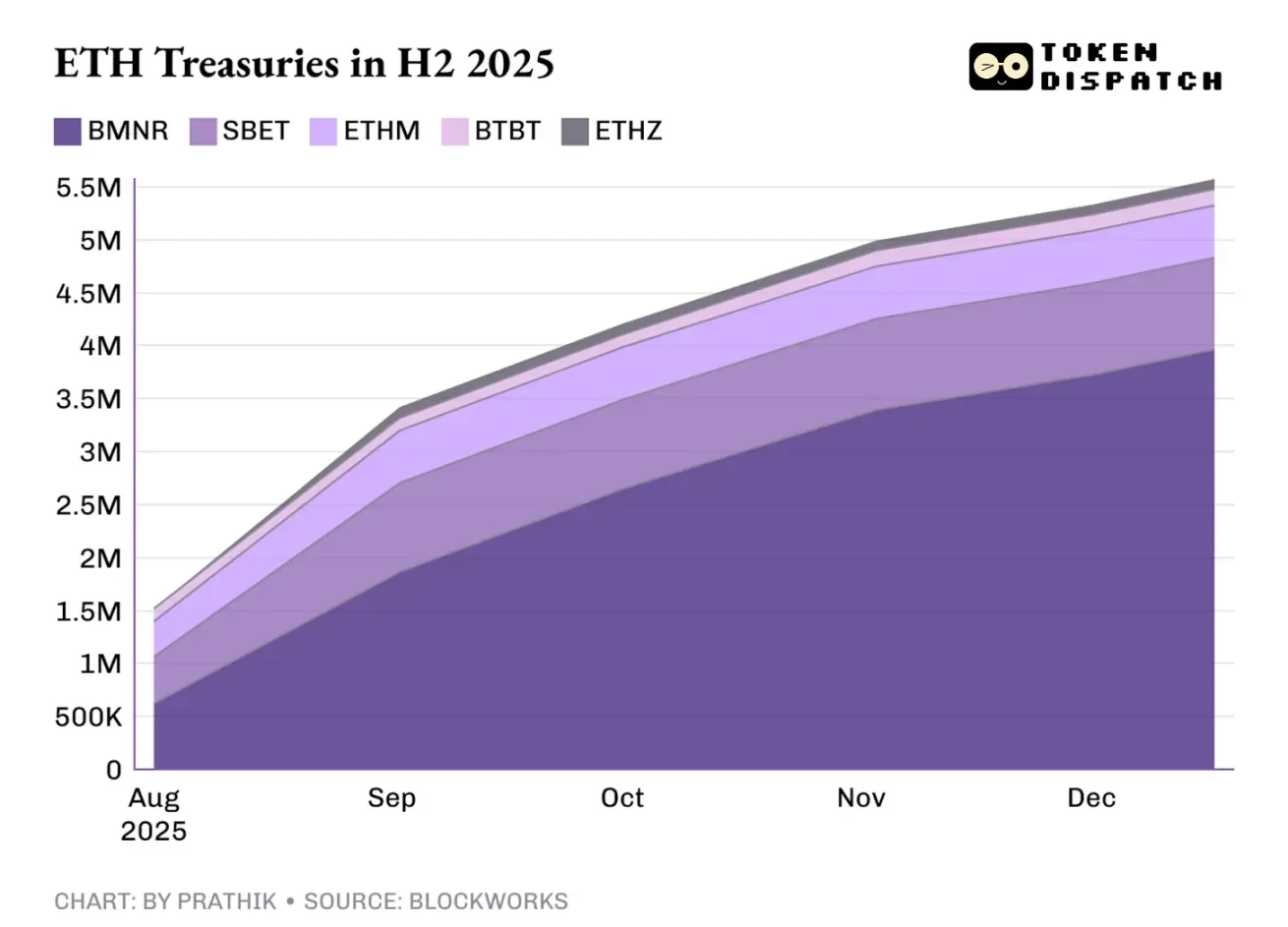

As a result, when ETH corporate treasuries became a hot topic in June this year, many were puzzled. The reason ETH corporate treasuries could rise to prominence lies in their ability to achieve functions that Bitcoin treasuries cannot. It was only after Ethereum co-founder and ConsenSys CEO Joe Lubin announced his joining of the SharpLink Gaming board and leading its $425 million ETH treasury investment strategy that the market realized the foresight of this layout.

Shortly thereafter, many companies began to follow SharpLink Gaming's example.

As of now, the top five ETH treasury-holding companies collectively hold 5.56 million ETH, accounting for over 4.6% of the total supply, valued at over $16 billion at current prices.

When investors hold an asset through packaged tools like ETFs and corporate treasuries, the asset's attributes gradually align with "balance sheet items." It becomes part of the corporate governance framework, requiring regular financial disclosures, special discussions by the board, quarterly performance updates, and oversight by risk committees.

Moreover, the staking characteristics of ETH give ETH treasuries an advantage that Bitcoin treasuries cannot match.

Bitcoin treasuries can only generate profits for companies when they sell Bitcoin for a profit; in contrast, ETH treasuries allow companies to simply hold ETH and stake it to provide security for the Ethereum network, earning more ETH as staking rewards.

If companies can combine staking rewards with their main business income, they can make ETH treasury operations sustainable.

It was from this point that the market truly began to recognize Ethereum's value.

The "Low-Key" Ethereum Finally Gains Attention

Those who have long followed Ethereum's development know that Ethereum has never been good at proactive marketing. Without external events (such as the launch of asset packaging tools, market cycle shifts, or the birth of new narratives) driving it, Ethereum often remains unnoticed until these external factors emerge, prompting people to recognize its potential.

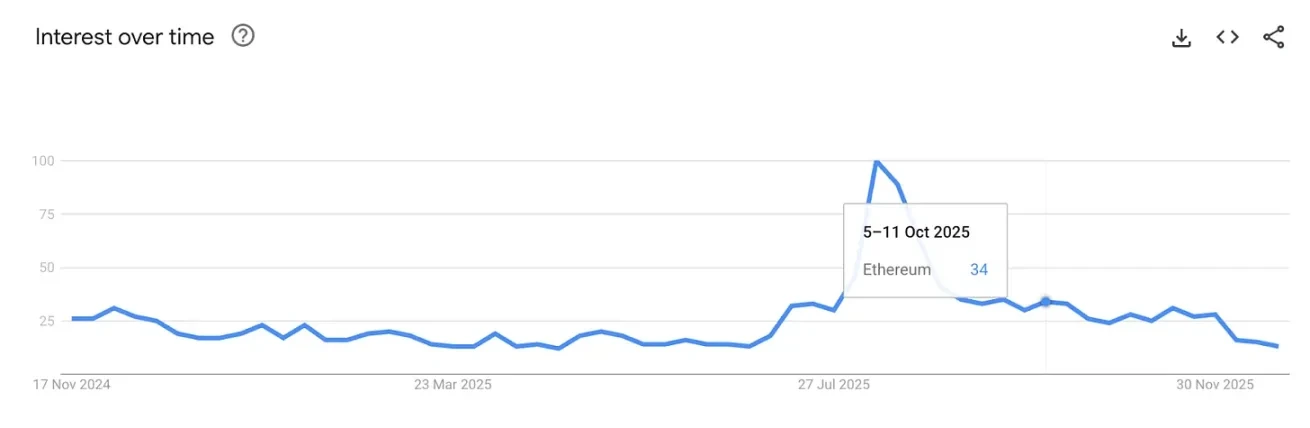

This year, the rise of ETH corporate treasuries and the surge in ETF inflows finally brought Ethereum into the market spotlight. I measured this change in attention in a very intuitive way: by observing whether retail investors, who usually have no interest in blockchain technology roadmaps, began discussing Ethereum.

From July to September this year, Google Trends data showed a significant spike in Ethereum's search popularity, a trend that closely aligned with the development momentum of ETH corporate treasuries and ETFs. It was these traditional asset allocation channels that ignited retail investors' curiosity about Ethereum, which further transformed into market attention.

However, mere popularity is far from enough. Market attention is notoriously fickle, arriving quickly and departing just as fast. This leads to another important reason why Ethereum supporters view 2025 as a "year of great victory": a key factor often overlooked by the outside world.

On-Chain Dollars Supporting the Internet

If we step back from short-term price charts and extend our time horizon, the fluctuations in cryptocurrency prices are merely products of market sentiment. However, stablecoins and the tokenization of real-world assets (RWA) are entirely different; they have solid fundamental support and serve as a bridge connecting the traditional financial system with decentralized finance (DeFi).

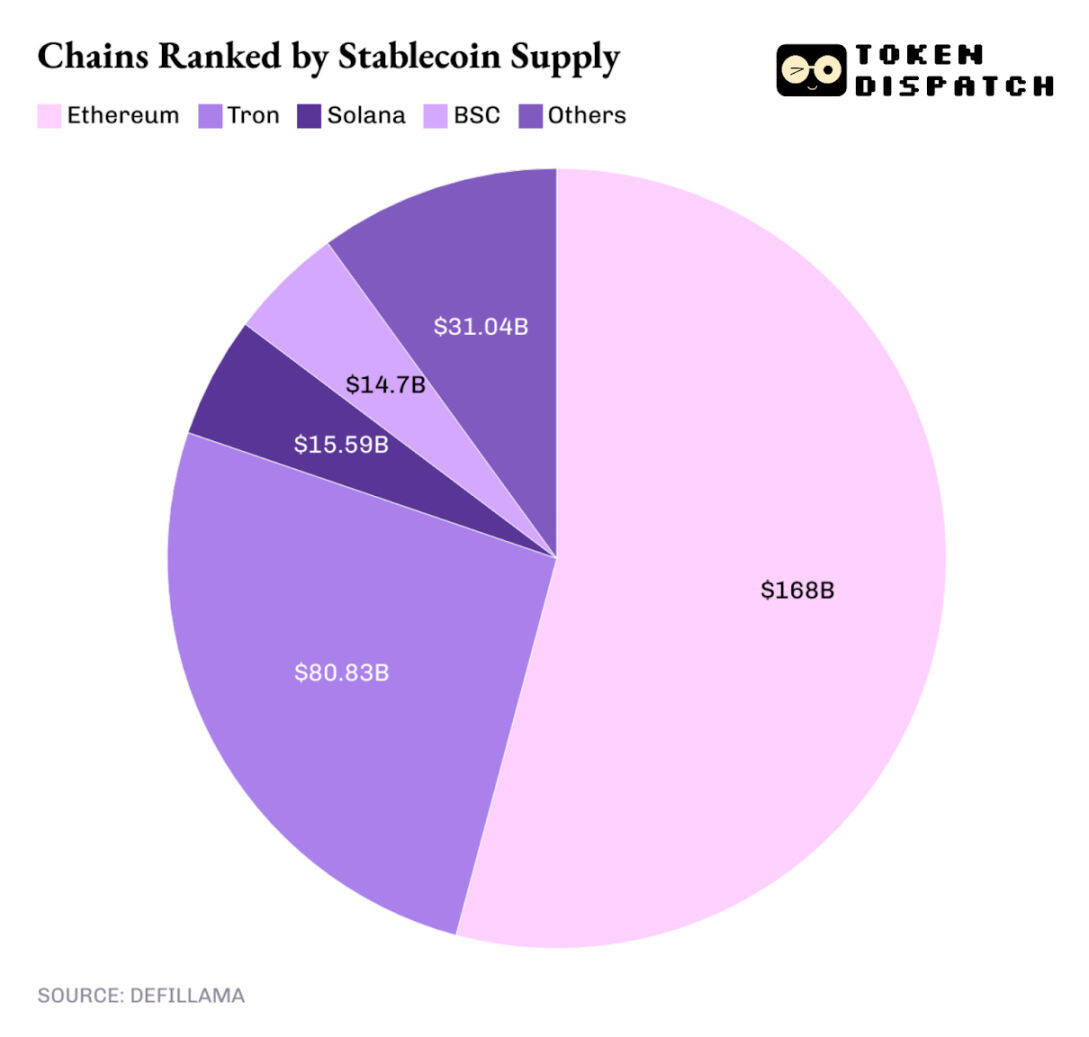

In 2025, Ethereum will continue to hold its position as the preferred platform for on-chain dollars, continuously supporting the circulation of stablecoins.

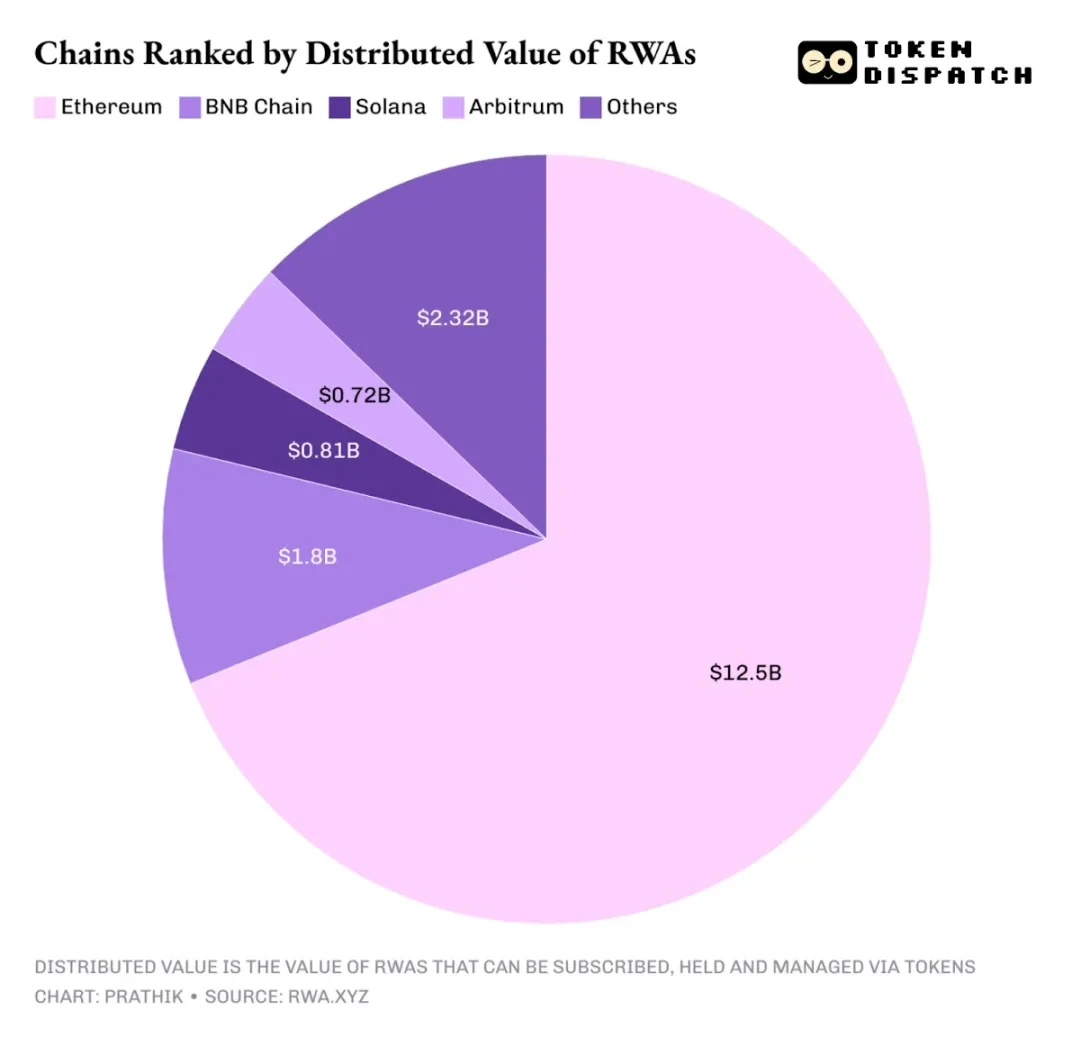

In the realm of real-world asset tokenization, Ethereum also occupies an absolute dominant position.

As of the time of writing, tokenized assets issued on the Ethereum network still account for half of the total value of global tokenized assets. This means that over half of the real-world assets available for holders to buy, sell, and manage are issued based on the Ethereum network.

Thus, while ETFs have lowered the threshold for ordinary investors to buy ETH, corporate treasuries provide investors with a path to hold ETH through compliant channels on Wall Street, allowing them to gain leveraged exposure to ETH.

All these developments are further promoting the integration of Ethereum with traditional capital markets, enabling investors to confidently allocate ETH assets in a familiar compliance environment.

Two Major Upgrades

In 2025, Ethereum completed two significant technical upgrades. These upgrades greatly alleviated network congestion issues, enhanced system stability, and significantly improved Ethereum's practicality as a trusted transaction settlement layer.

The Pectra upgrade officially launched in May this year, enhancing Ethereum's scalability through data sharding (Blob) and providing greater compressed data storage space for layer two networks, thereby reducing transaction costs for layer two networks. This upgrade also increased Ethereum's transaction throughput, accelerated transaction confirmation speeds, and further optimized the operational efficiency of applications centered around the Rollup scaling solution.

Following the Pectra upgrade, the Fusaka upgrade followed suit, further enhancing Ethereum's network scalability and optimizing user experience.

Overall, Ethereum's core goal in 2025 is to evolve towards a reliable financial infrastructure. Both upgrades prioritized network stability, transaction throughput, and cost predictability. These features are crucial for Rollup scaling solutions, stablecoin issuers, and institutional users needing on-chain value settlement. Although these upgrades did not create a strong correlation between Ethereum network activity and ETH prices in the short term, they effectively enhanced Ethereum's reliability in large-scale application scenarios.

Future Outlook

If we were to draw a simple and blunt conclusion about Ethereum's development in 2025, whether "Ethereum succeeded" or "Ethereum failed," it would be difficult to find a clear answer.

On the contrary, the market in 2025 presents a more intriguing yet somewhat frustrating fact:

In 2025, Ethereum successfully entered the investment portfolios of fund issuance institutions and the balance sheets of publicly traded companies, maintaining market attention through the continuous inflow of institutional funds.

However, ETH holders experienced a disappointing year, with the token price trajectory severely disconnected from the robust development of the Ethereum network.

Investors who bought ETH at the beginning of the year are currently facing at least a 15% loss. Although ETH briefly reached a historical high of $4,953 in August this year, the good times did not last long, and its price has now fallen back to a near five-month low.

Looking ahead to 2026, Ethereum will continue to lead the industry with solid technological upgrade results and a large scale of stablecoins and real-world asset tokenization. If the Ethereum network can leverage these advantages to gain momentum, it is expected to transform the momentum of ecological development into long-term price appreciation for ETH.

免责声明:本文章仅代表作者个人观点,不代表本平台的立场和观点。本文章仅供信息分享,不构成对任何人的任何投资建议。用户与作者之间的任何争议,与本平台无关。如网页中刊载的文章或图片涉及侵权,请提供相关的权利证明和身份证明发送邮件到support@aicoin.com,本平台相关工作人员将会进行核查。