Author | @SilvioBusonero

Compiled | Odaily Planet Daily (@OdailyChina)

Translator | Dingdang (@XiaMiPP)

As the market share of vaults and curators in the DeFi world continues to rise, questions are being raised: Are lending protocols being squeezed for profit? Is lending no longer a good business?

However, if we shift our perspective back to the entire on-chain credit value chain, the conclusion is quite the opposite. Lending protocols still occupy the most solid moat in this value chain. We can quantify this with data.

On Aave and SparkLend, the interest fees paid by vaults to lending protocols actually exceed the income generated by the vaults themselves. This fact directly challenges the mainstream narrative that "distribution is king."

At least in the lending sector, distribution is not king.

In simple terms: Aave not only earns more than the various vaults built on top of it, but it also surpasses the asset issuers used for lending, such as Lido and Ether.fi.

To understand the reasons behind this, we need to break down the complete value chain of DeFi lending and re-examine the value capture capabilities of each role along the flow of funds and fees.

Breakdown of the Lending Value Chain

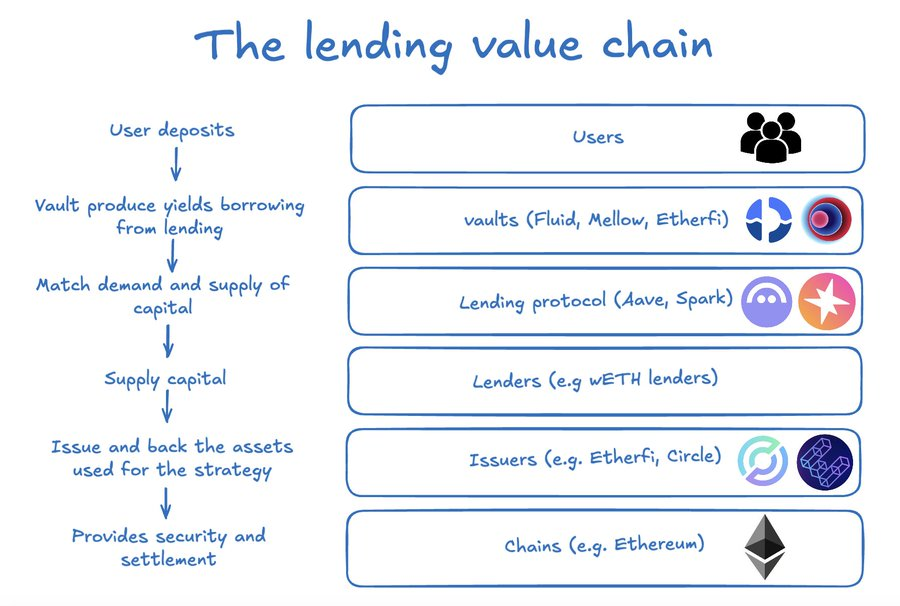

The annual revenue scale of the entire lending market has exceeded $100 million. This value is not generated by a single link but is composed of a complex stack: the underlying settlement blockchain, asset issuers, capital lenders, the lending protocol itself, and the vaults responsible for distribution and strategy execution.

In previous articles, we mentioned that many current use cases in the lending market stem from basis trading and liquidity mining opportunities, and we broke down the main strategic logic behind them.

So, who is truly "demanding" capital in the lending market?

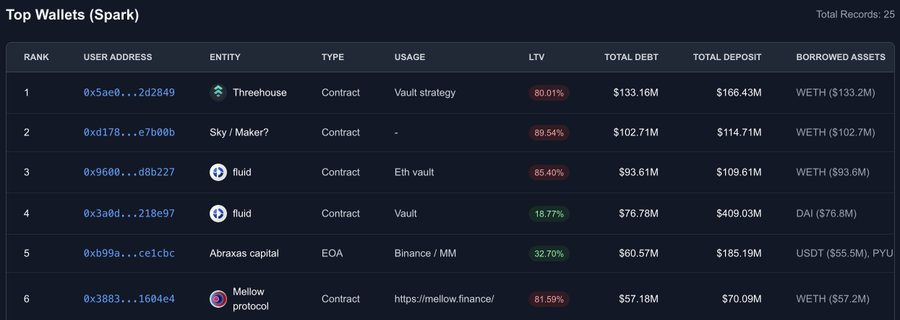

I analyzed the top 50 wallet addresses on Aave and SparkLend and annotated the main borrowers.

- The largest borrowers are various vaults and strategy platforms such as Fluid, Treehouse, Mellow, Ether.fi, Lido (which are also asset issuers). They possess distribution capabilities aimed at end users, helping them achieve higher returns without having to manage complex cycles and risks themselves.

- There are also some large institutional capital providers, such as Abraxas Capital, deploying external capital into similar strategies, whose economic models are essentially very close to those of vaults.

But vaults are not everything. This chain includes at least the following types of participants:

- Users: Deposit assets and hope to gain additional returns through vaults or strategy managers.

- Lending Protocols: Provide infrastructure and liquidity matching, charging interest to borrowers and taking a certain percentage as protocol income.

- Lenders: Capital providers, which can be ordinary users or other vaults.

- Asset Issuers: Most on-chain lending assets have underlying supported assets that generate income, part of which is captured by the issuers.

- Blockchain Network: The underlying "track" where all activities occur.

Lending Protocols Earn More Than Downstream Vaults

Taking Ether.fi's ETH liquidity staking vault as an example. It is the second-largest borrower on Aave, with an outstanding loan size of about $1.5 billion. The strategy itself is very typical:

- Deposit weETH (approximately +2.9%)

- Borrow wETH (approximately -2%)

- The vault charges a 0.5% platform management fee on TVL.

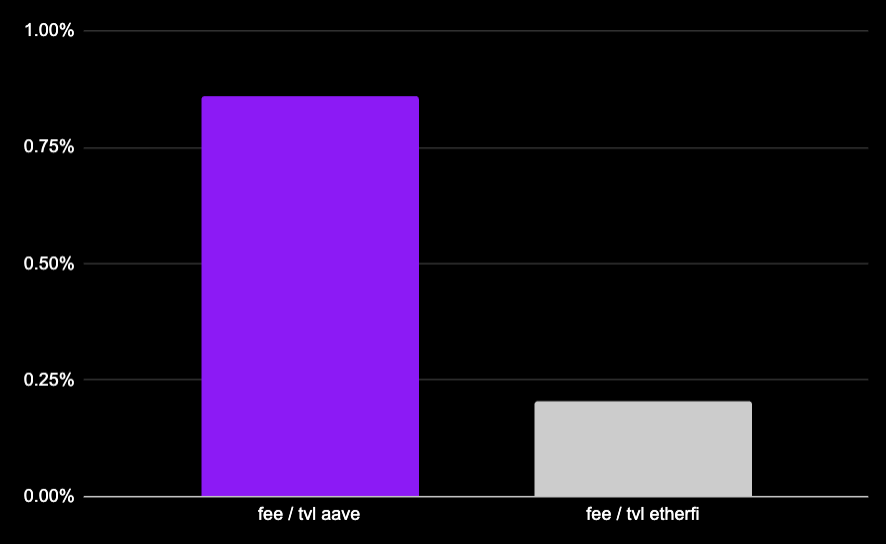

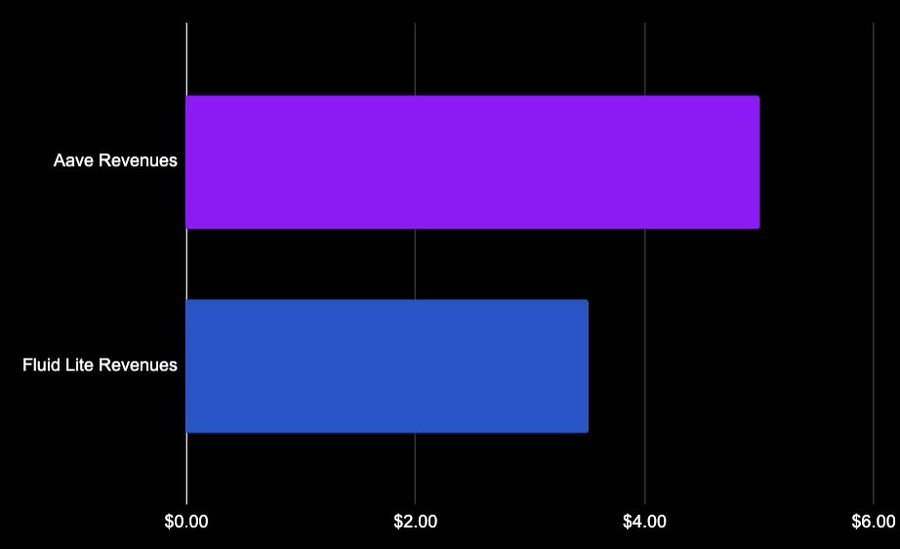

In Ether.fi's total TVL, about $215 million is actual net liquidity deployed on Aave. This portion of TVL generates about $1.07 million in platform fee income for the vault each year.

However, at the same time, this strategy needs to pay about $4.5 million in interest fees to Aave each year (calculation: $1.5 billion borrowed × 2% borrowing APY × 15% reserve factor).

Even in one of the largest and most successful cyclical strategies in DeFi, the value captured by the lending protocol is still several times that of the vault.

Of course, Ether.fi is also the issuer of weETH, and this vault itself is also directly creating demand for weETH.

But even considering vault strategy income + asset issuer income, the economic value created by the lending layer (Aave) is still higher.

In other words, lending protocols are the segment with the largest value increment in the entire stack.

We can perform the same analysis on other commonly used vaults:

Fluid Lite ETH: 20% performance fee + 0.05% exit fee, no platform management fee. Borrowed $1.7 billion wETH from Aave, paying about $33 million in interest, of which about $5 million goes to Aave, and Fluid's own income is close to $4 million.

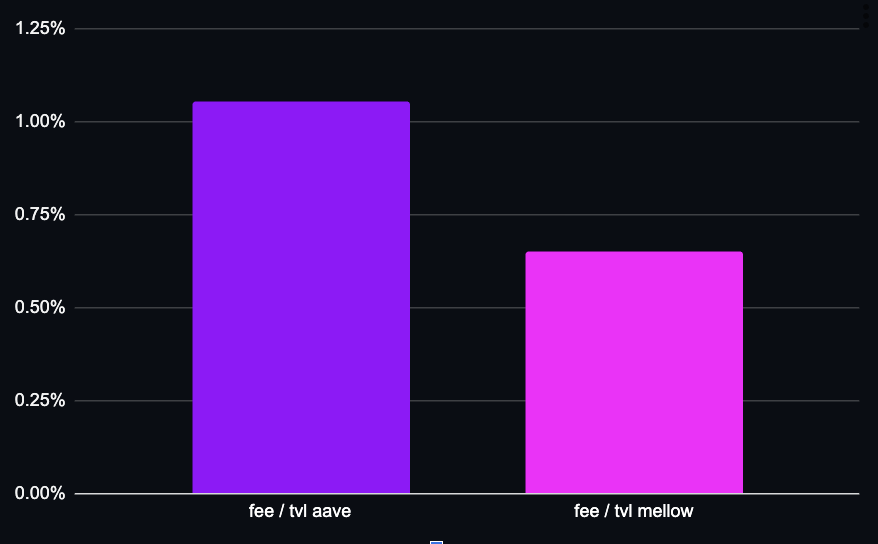

Mellow protocol strETH charges a 10% performance fee, with a borrowing scale of $165 million and a TVL of only about $37 million. Again, we see that in terms of TVL, the value captured by Aave exceeds that of the vault itself.

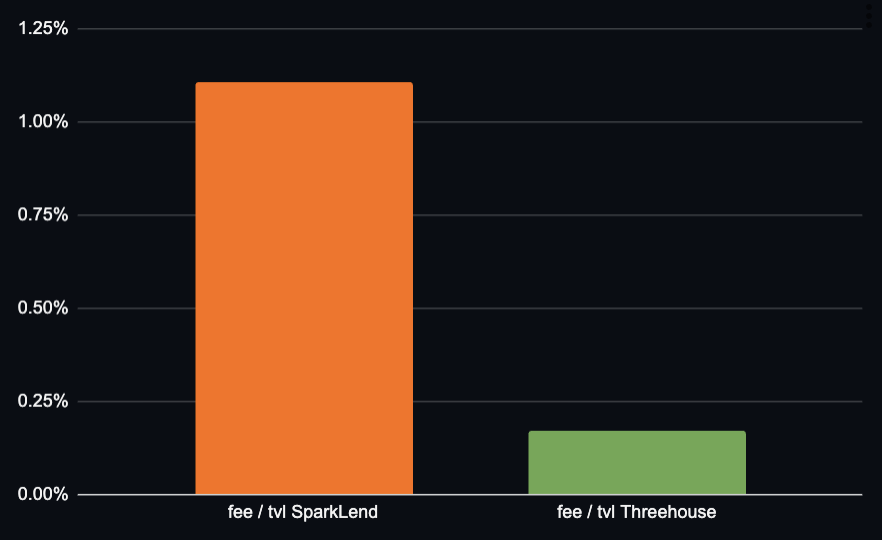

Let's look at another example, where Treehouse is an important participant in SparkLend, the second-ranked lending protocol on Ethereum, running an ETH cyclical strategy:

- TVL of about $34 million

- Borrowed $133 million

- Charges a performance fee only on marginal returns above 2.6%

As a lending protocol, SparkLend's value capture capability in terms of TVL is higher than that of the vault.

The pricing structure of the vault has a huge impact on its own value capture; however, for lending protocols, their income depends more on the nominal scale of borrowing, which is relatively stable.

Even when shifting to dollar-denominated strategies, although the leverage is lower, higher interest rate levels often offset this effect. I do not believe the conclusion will fundamentally change.

In a relatively closed market, more value may flow to curators, such as Stakehouse Prime Vault (26% performance fee, with incentives provided by Morpho). But this is not the end state of Morpho's pricing mechanism, as curators are also collaborating with other platforms for distribution.

Lending Protocols vs Asset Issuers

So the question arises: Is it better to be Aave or Lido?

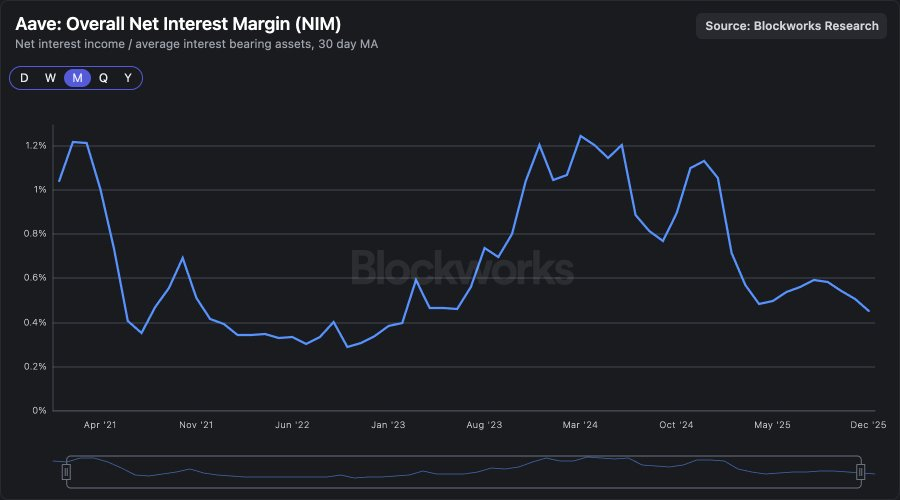

This question is more complex than comparing vaults because staked assets not only generate income themselves but also indirectly create stablecoin interest income for the protocol through the lending market. We can only make approximate estimates.

Lido has about $4.42 billion in assets in the core Ethereum market, which are used to support lending positions, generating an annual performance fee income of about $11 million.

These positions roughly support ETH and stablecoin lending in equal proportions. With the current net interest margin (NIM) of about 0.4%, the corresponding lending income is about $17 million, which is already significantly higher than Lido's direct income (and this is a historically low NIM level).

The True Moat of Lending Protocols

If we only compare using the traditional financial deposit profit model, DeFi lending protocols may seem like a low-profit industry. However, this comparison overlooks where the true moat lies.

In the on-chain credit system, the value captured by lending protocols exceeds the downstream distribution layer and overall surpasses the upstream asset issuers.

Looking at lending alone, it seems to be a low-margin business; but placed within the complete credit stack, it is the layer with the strongest value capture capability relative to all other participants—vaults, issuers, and distribution channels.

免责声明:本文章仅代表作者个人观点,不代表本平台的立场和观点。本文章仅供信息分享,不构成对任何人的任何投资建议。用户与作者之间的任何争议,与本平台无关。如网页中刊载的文章或图片涉及侵权,请提供相关的权利证明和身份证明发送邮件到support@aicoin.com,本平台相关工作人员将会进行核查。