Original Title: "Hyperliquid Personally Engages in Reconciliation, Behind Perfect PR is a Bottom-Up Siege on Competitors"

Original Author: angelilu, Foresight News

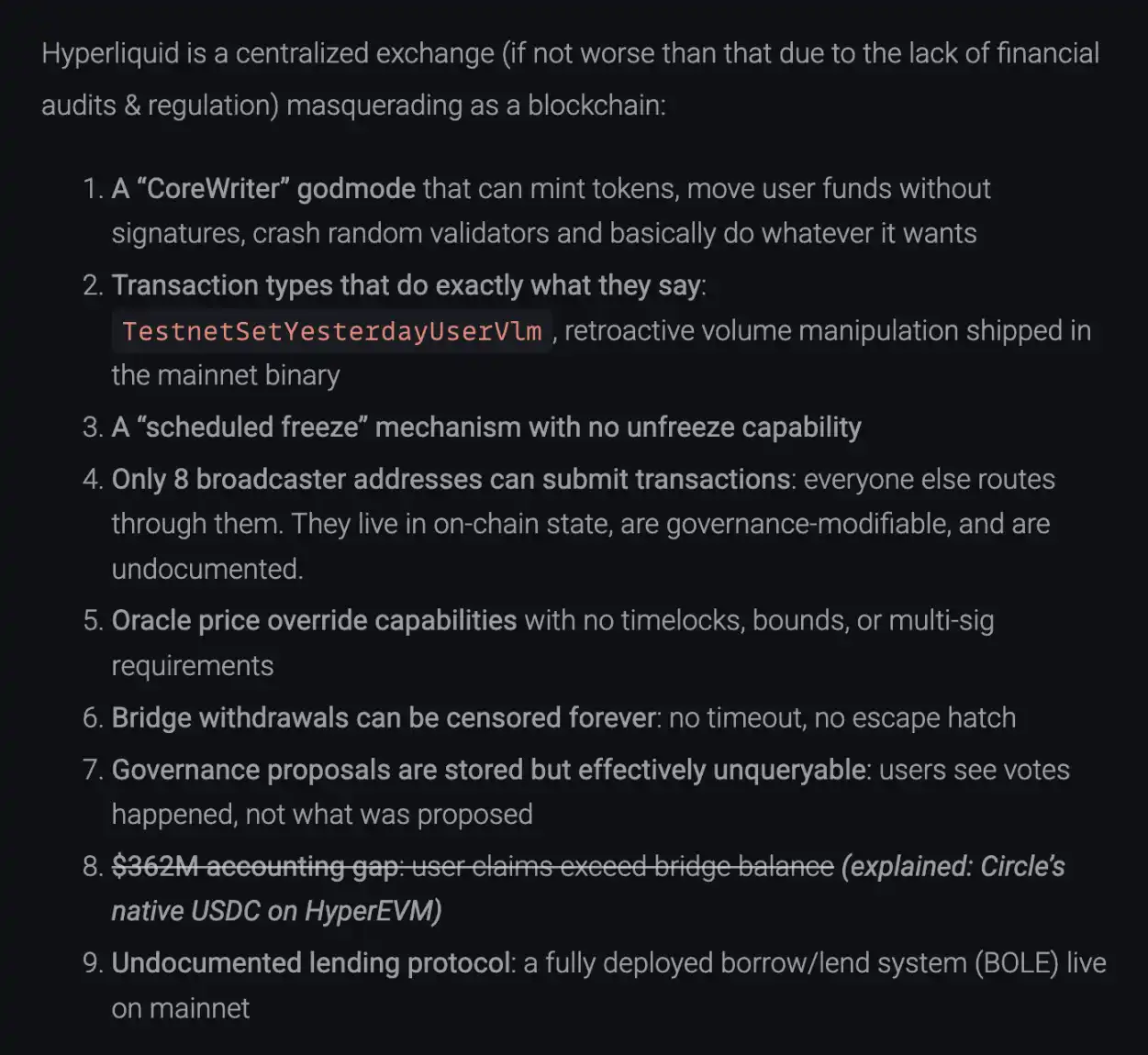

On December 20, 2025, a technical article titled "Reverse Engineering Hyperliquid" published on blog.can.ac directly dismantled Hyperliquid's binary files through reverse engineering, accusing it of nine serious issues ranging from "insolvency" to "God mode backdoor." The article bluntly stated:

"Hyperliquid is a centralized trading platform disguised as a blockchain."

In response to the FUD, Hyperliquid's official team released a lengthy statement, which may not only be a simple refutation but also a declaration of war on the narrative of "who is the true decentralized trading facility." Although the official response successfully clarified the issue of fund security, it still left some intriguing "gaps" in certain sensitive areas of decentralization.

Where did the $362 million go? The audit blind spot under the "dual ledger"

The most damaging accusation is that user assets within the Hyperliquid system are $362 million less than the on-chain reserves. If true, this would mean it operates as a "partially reserved" on-chain FTX.

However, upon verification, this was a misinterpretation caused by "architectural upgrades" leading to information asymmetry. The auditor's logic was: Hyperliquid reserves = USDC balance on the Arbitrum cross-chain bridge. Based on this logic, they checked the cross-chain bridge address and found that the balance was indeed less than the total user deposits.

Hyperliquid responded that it is undergoing a complete evolution from "L2 AppChain" to "independent L1." In this process, asset reserves have transitioned to a dual-track system:

The accuser completely overlooked the native USDC on HyperEVM, according to on-chain data (as of the time of publication):

· Arbitrum cross-chain balance: 3.989 billion USDC (verifiable on Arbiscan)

· HyperEVM native balance: 362 million USDC (verifiable on Hyperevmscan)

· HyperEVM contract balance: 59 million USDC

Total solvency = 3.989 billion + 362 million + 59 million ≈ 4.351 billion USDC

This figure perfectly matches the total user balances on HyperCore. The so-called "gap of $362 million" is precisely the native assets that have already migrated to HyperEVM. This is not a case of funds disappearing, but rather funds circulating between different ledgers.

9-point accusation reconciliation: What has been clarified? What has been avoided?

Clarified accusations

Accusation: "CoreWriter" God mode: It is accused of being able to mint money out of thin air and misappropriate funds.

Response: The official explanation is that this is an interface for L1 and HyperEVM interaction (such as staking), with limited permissions and no ability to misappropriate funds.

Accusation: $362 million funding gap.

Response: As mentioned above, this is due to the uncalculated Native USDC.

Accusation: Unpublished lending protocol.

Response: The official pointed out that the documentation for the spot/lending function (HIP-1) has been made public and is in the pre-release stage, not operating in secrecy.

Accusations acknowledged but reasonably explained

Accusation: The binary file contains "modify transaction volume" code (TestnetSetYesterdayUserVlm).

Response: Acknowledged. However, it is explained as residual code from the testnet (Testnet) used to simulate fee logic, and the mainnet nodes have physically isolated this path, making it non-executable.

Accusation: Only 8 broadcast addresses can submit transactions.

Response: Acknowledged. Explained as an anti-MEV (Maximum Extractable Value) measure to prevent users from being front-run. A commitment was made to implement a "multi-proposer" mechanism in the future.

Accusation: The chain can be "planned to freeze" with no revocation function.

Response: Acknowledged. Explained as a standard process for network upgrades, requiring the entire network to pause to switch versions.

Accusation: Oracle prices can be instantaneously overridden.

Response: Explained as a design for system security. To ensure timely liquidation of bad debts during extreme fluctuations like 10/10, the validator oracle indeed has not set a time lock.

Missing / vague responses

In our verification, there are two accusations that were not directly addressed or fully resolved in the official response:

Accusation: Governance proposals are unqueryable; users can only see that voting occurred, but the on-chain data does not include the specific text content of the proposals.

Response: The official did not address this point in the lengthy statement. This means that Hyperliquid's governance is still a "black box" for ordinary users; you can only see the results, not the process.

Accusation: The cross-chain bridge has no "escape hatch," and withdrawals may be subject to indefinite review, preventing users from forcibly withdrawing back to L1.

Response: Although the official explained that the locking of the bridge during the POPCAT incident was for security, they did not refute the structural fact of "no escape hatch." This indicates that at the current stage, user assets' entry and exit highly depend on the release of the validator set, lacking the forced withdrawal capability of L2 Rollup.

"Pulling down" competitors

The most interesting aspect of this incident is that it forced Hyperliquid to reveal its cards, allowing us to re-examine the landscape of the Perp track. In its response, the official rarely "pulled down" competitors, targeting Lighter, Aster, and even industry giant Binance.

It stated, "Lighter uses a single centralized sequencer, and its execution logic and zero-knowledge proof (ZK) circuits are not public. Aster uses centralized matching and even offers dark pool trading, which can only be achieved under a single centralized sequencer with unverifiable execution processes. Other protocols that include open-source contracts lack verifiable sequencers."

Hyperliquid bluntly categorized these competitors together, claiming they all rely on "centralized sequencers." The official emphasized that on these platforms, no one besides the sequencer operator can see the complete state snapshot (including order book history and position details). In contrast, Hyperliquid attempts to eliminate this "privilege" by having all validators execute the same state machine.

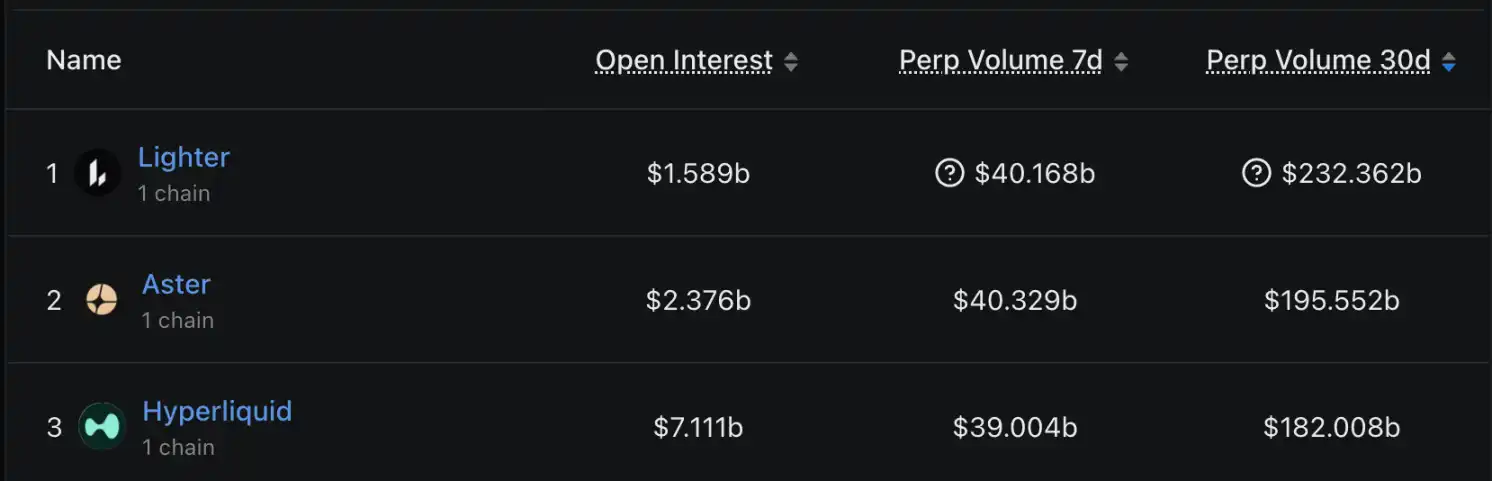

This "pulling down" may also stem from Hyperliquid's concerns about its current market share. According to DefiLlama's trading volume data over the past 30 days, the market landscape has formed a three-way standoff:

· Lighter: Trading volume of $232.3 billion, currently in first place, accounting for about 26.6%.

· Aster: Trading volume of $195.5 billion, in second place, accounting for about 22.3%.

· Hyperliquid: Trading volume of $182 billion, in third place, accounting for about 20.8%.

Faced with the trading volumes of latecomers Lighter and Aster, Hyperliquid attempted to play the "transparency" card—"Although I have 8 centralized broadcast addresses, my entire state is on-chain and verifiable; while you can't even check." However, it is worth noting that although Hyperliquid slightly lags behind the top two in trading volume, it shows a crushing advantage in open interest (OI).

Public response: Who is shorting HYPE?

In addition to technical and funding issues, the community is also concerned about recent rumors that the HYPE token may have been shorted and dumped by "insiders." In response, a member of the Hyperliquid team provided a qualitative response on Discord: "The shorting address starting with 0x7ae4 belongs to a former employee," who was once a team member but was dismissed in early 2024. The personal trading behavior of this former employee is unrelated to the current Hyperliquid team. The platform emphasized that extremely strict HYPE trading restrictions and compliance reviews are currently in place for all active employees and contractors, prohibiting insider trading.

This response attempts to downgrade the accusation of "team wrongdoing" to "former employee personal behavior," but the community may still expect more detailed disclosures regarding the transparency of the token distribution and unlocking mechanisms.

Don't Trust, Verify

Hyperliquid's clarification tweet can be considered a textbook-level crisis public relations response—not relying on emotional output, but on data, code links, and architectural logic. It did not stop at proving its innocence but instead took the offensive by comparing the architecture of competitors, reinforcing its brand and advantages of "full state on-chain."

Although the FUD has been debunked, the implications of this incident for the industry are profound. As DeFi protocols evolve towards independent application chains (AppChains), the architecture becomes increasingly complex, and asset distribution becomes more fragmented (Bridge + Native). The traditional method of "just looking at contract balances" for auditing has become ineffective.

For Hyperliquid, proving that "the money is there" is just the first step. The real challenge lies in how to gradually transfer the permissions of those 8 submission addresses while maintaining high performance and anti-MEV advantages, truly achieving the leap from "transparent centralization" to "transparent decentralization," which is the necessary path to becoming the "ultimate DEX."

For users, this incident once again confirms the iron law of the crypto world: do not trust any narrative, but verify every byte.

免责声明:本文章仅代表作者个人观点,不代表本平台的立场和观点。本文章仅供信息分享,不构成对任何人的任何投资建议。用户与作者之间的任何争议,与本平台无关。如网页中刊载的文章或图片涉及侵权,请提供相关的权利证明和身份证明发送邮件到support@aicoin.com,本平台相关工作人员将会进行核查。