Source: Fintech Blueprint

Translation and Compilation: BitpushNews

Structural Issues in the Crypto Market

The adoption of on-chain financial tools and the trend of machine economy are thriving.

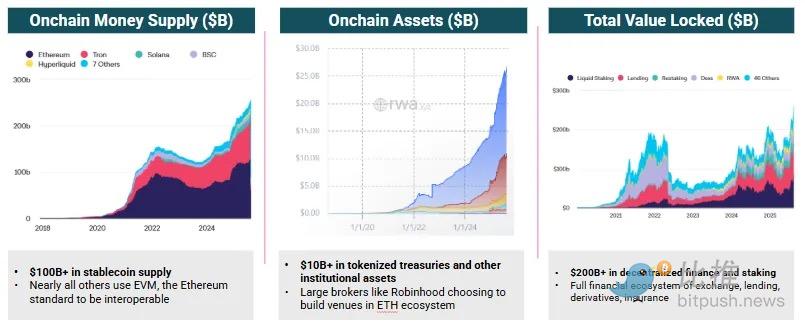

In the past year, we have witnessed significant expansion in blockchain-native finance across five dimensions: (1) stablecoins, (2) decentralized lending and trading, (3) perpetual contracts, (4) prediction markets, and (5) digital asset treasuries (DATs). The regulatory environment in the United States has become extremely favorable, leading to an increase in both the number of projects and risk appetite.

Setting aside the uncertainties brought by tariffs and market structure, a tolerant macro environment has also provided fertile ground for crypto innovation to take root. These trends are well-known and do not require further elaboration with data.

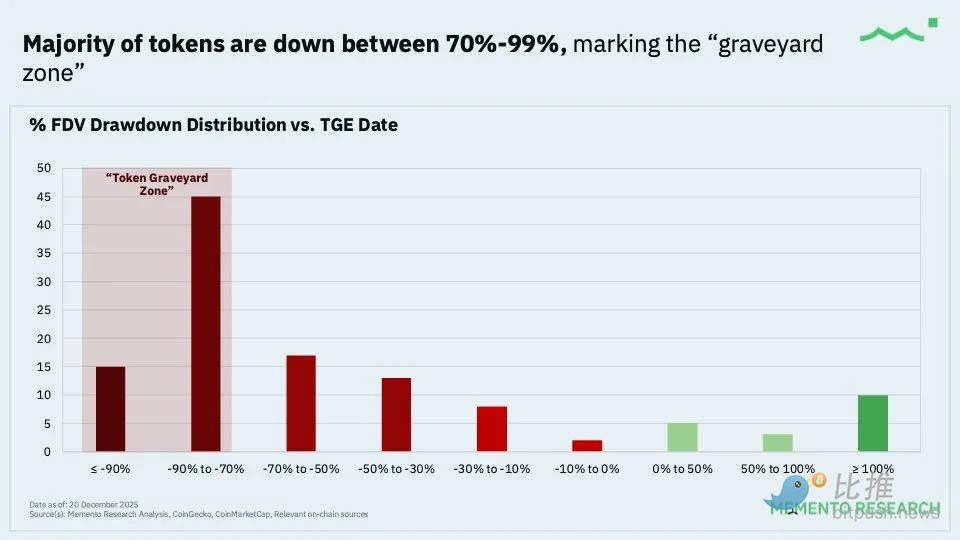

However, 2025 will be an extremely difficult year for long-term investors in tokens and crypto assets outside of Bitcoin.

If you are a trader or banker, times may be decent — we have seen record commissions pushing DATs to market, as well as huge fee revenues generated by exchanges like Binance during the listing process.

But for those of us with a 3-5 year investment horizon, the market structure has been terrible.

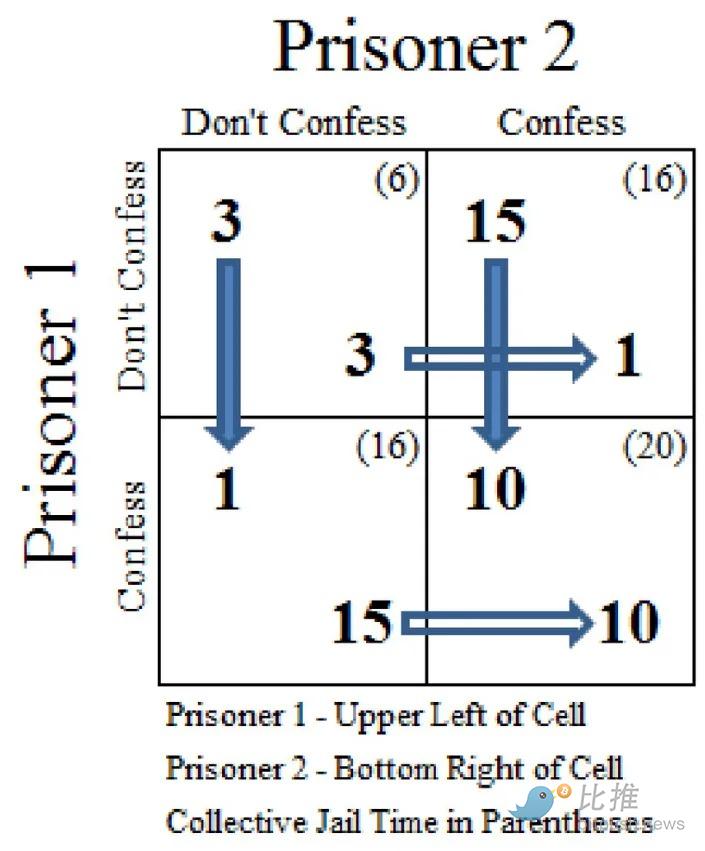

We are completely trapped in a "negative prisoner’s dilemma": token holders expect future selling pressure, thus selling off any and all assets; meanwhile, market makers and exchanges supporting the entire crypto economy are taking speculative positions focused solely on short-term gains. The unlocking mechanisms of tokens and their issuance prices often drag them down before the projects have achieved profitability or found market fit.

Additionally, the structural failure of the market on October 10 this year has clearly dealt a heavy blow to several major participants, and although the losses have not been disclosed, the aftermath of liquidations continues. The correlation among all crypto assets has risen to nearly 1, indicating a broad-based deleveraging behavior among industry participants, despite their fundamentally different logics.

At this moment, it is easy to choose to retreat and become cynical.

But we prefer to conduct "mark-to-market" as clearly as possible to plan for future positioning.

The downturn in the crypto investment space in 2025 is information, but not a conclusion. It is likely that 2026 will see massive liquidations in the secondary market for private companies, at which point we will analyze how so many special purpose vehicles (SPVs) were issued at inflated valuations during the crypto boom.

Meanwhile, the vision of programmable finance and "Robot Money" continues to materialize, and we must keep striving to find the best positioning in its inevitable rise.

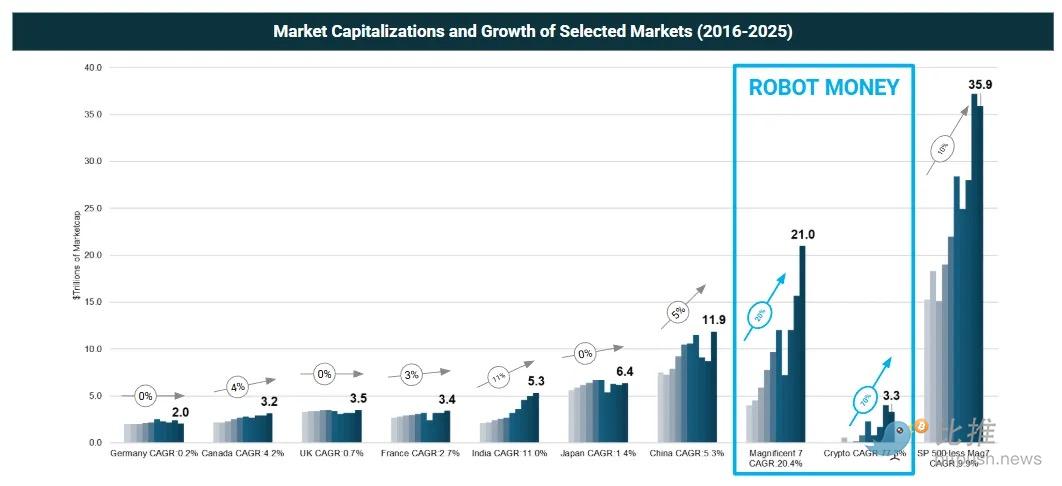

To provide context, see the chart below. This chart zooms in on the past decade, showcasing the value creation across several regions and industries.

When we observe this history, the value creation in the cryptocurrency and AI sectors is astonishing compared to the rest of the world.

European capital markets (approximately $20-30 trillion across countries) have made almost no progress, merely maintaining the status quo. You might as well invest in government bonds and earn 3% interest annually, which could create more value. On the right side of the chart, India and China show compound annual growth rates (CAGR) of 5-10%, with net market value growth of approximately $3 trillion and $5 trillion, respectively, during the same period.

With this scale in mind, let’s look at what we define as "Robot Money":

(1) The "Magnificent 7" representing technology and AI has increased its market value by approximately $17 trillion at an annual rate of 20%;

(2) The crypto asset market, representing the modern financial track, has increased by $3 trillion during the same period, with a CAGR of up to 70%.

This is the future financial center.

But being logically correct is not enough. We must delve deeply to identify those parts of the value chain that have yet to be recognized by the world. Reflecting on discussions about robo-advisors in 2009, new banks (Neobanks) in 2011, or DeFi in 2017, the vocabulary and associations were not yet formed, and it took 2-5 years for these outcomes to solidify into clear business opportunities.

Value Capture in the Machine Economy

As a "self-flagellating" exercise, we have compiled a 158-page summary report covering the most relevant participants in the machine economy for 2025.

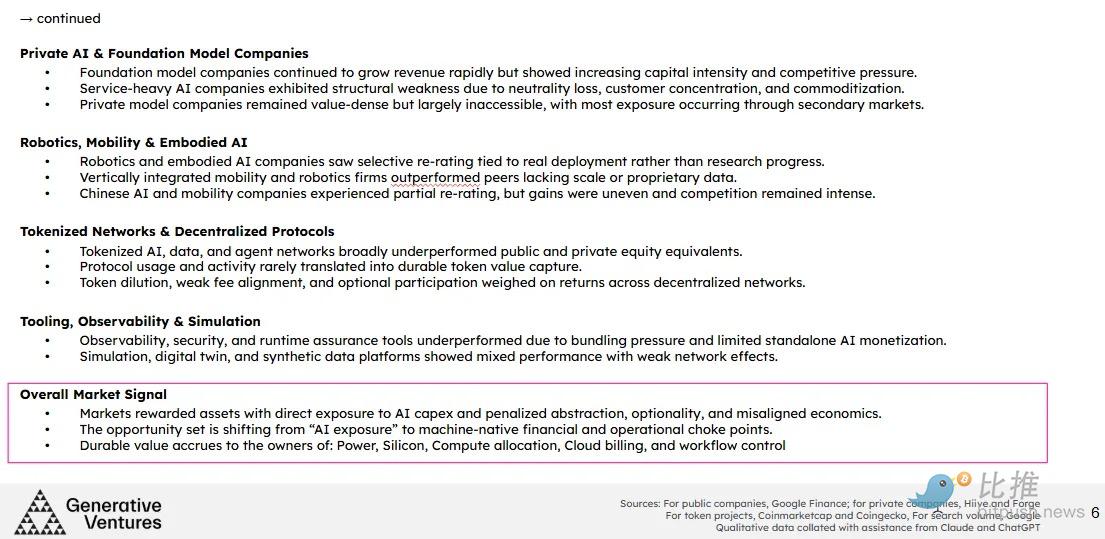

In the public market, 2025 will be a year of "the strong get stronger, and the weak fall behind."

The obvious winners are the owners of physical and financial bottlenecks: electricity, semiconductors, and scarce computing power.

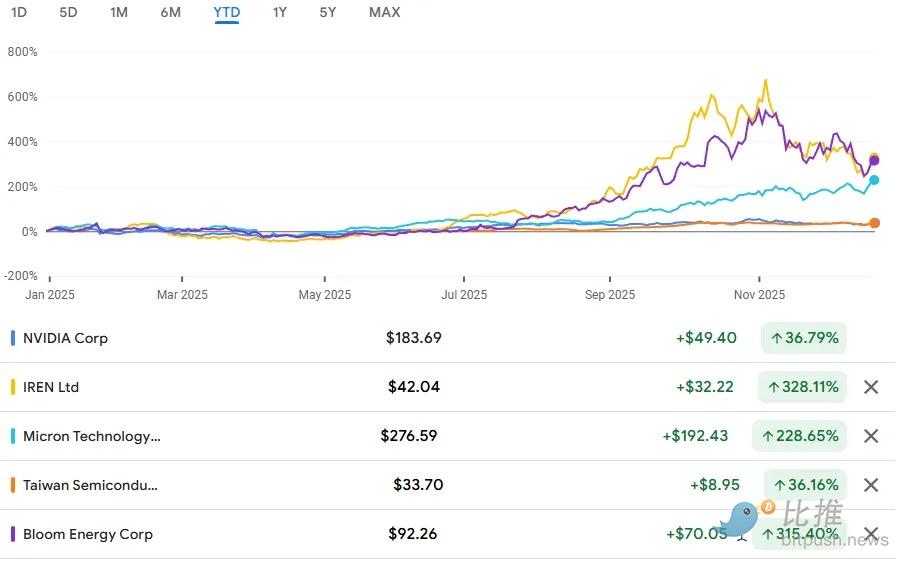

Bloom Energy, IREN, Micron, TSMC, and NVIDIA have all significantly outperformed the market, as capital chases those assets that "machines must go through."

Bloom and IREN are typical examples: they are directly positioned at the forefront of AI capital expenditure, converting urgency into revenue.

In contrast, traditional infrastructure companies like Equinix have underperformed, reflecting the market's belief that the value of general capacity is far lower than that of power security and high-density customized computing power.

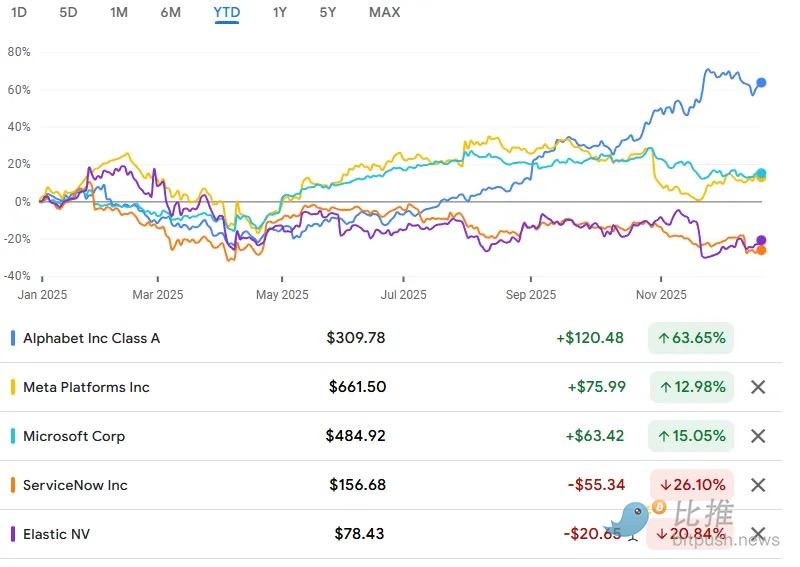

In the software and data sectors, performance has diverged along another dimension: (1) mandatory vs. (2) optional. Platform enterprises that embed into workflows and require mandatory renewals (such as Alphabet and Meta) continue to grow at a compound rate, both rising year-to-date, as AI spending strengthens their existing distribution moats. Despite strong product capabilities, ServiceNow and Datadog have seen returns dragged down by valuation pressures, bundling pressures from hyperscale cloud providers, and slow AI monetization. Elastic illustrates the adverse situation: strong technical capabilities but squeezed by cloud-native alternatives, with unit economic returns deteriorating.

The private market also shows a similar filtering mechanism.

Basic model companies are the protagonists of the story, but vulnerabilities are increasing. OpenAI and Anthropic are experiencing rapid revenue growth, but neutrality, capital intensity, and margin compression have now become clear risks. Scale AI serves as a cautionary case this year: a partial acquisition by Meta destroyed its "neutral" position and triggered customer attrition, demonstrating how quickly a service-heavy business model can collapse once trust is broken. In contrast, companies that control value (Applied Intuition, Anduril, Samsara, and emerging fleet operation systems) appear better positioned, even if value realization is mostly still in the private domain.

Tokenized networks are the weakest performing sector.

With few exceptions, decentralized data, storage, agents, and automation protocols have all underperformed, as usage has failed to translate into token value capture.

Chainlink remains strategically important, but it struggles to align protocol revenue with token economic models; Bittensor is the largest bet in the crypto AI space but does not yet pose a substantial threat to Web2 lab companies; Giza and similar agent protocols show real activity but remain trapped by dilution and thin fees. The market no longer rewards "collaborative narratives" that lack mandatory charging mechanisms.

Value is accumulating in areas where machines have already paid — electricity, silicon, computing contracts, cloud bills, and regulated balance sheets — rather than in areas they may choose in the future.

In 2025, the market rewards ownership of "choke points" while punishing projects that are idealistic but lack control over cash flow or computing power. The core of the future lies in identifying where economic forces already exist and betting on those assets that machines cannot bypass.

Core Insights:

- The realization of AI value is "deeper" than most people expect.

- Neutrality is now a first-class economic asset (refer to Scale AI).

- "Platforms" are only effective when combined with control points, not merely as a function.

- AI software is deflationary (pricing pressure); AI infrastructure is inflationary.

- Vertical integration is only important when it can lock in data or economic effects.

- Token networks are repeatedly undergoing the same market structure tests.

- Simply having AI exposure is not enough; the quality of positioning determines everything.

Robot hardware and software will be the next hype cycle, and we may see similar waves of investment and selective winners.

Positioning for 2026

Over the past two years, we have built a core portfolio covering the key themes discussed here. Looking ahead to 2026, our positioning and investment execution will be further strengthened.

Next, I will discuss our holding strategy.

While the long-term vision for autonomous agents, robotics, and machine-native finance is correct, the market is currently in a phase of extremely outrageous valuations in the private AI and robotics sectors. Aggressive secondary liquidity and implied valuations exceeding $100 billion mark the transition from the "discovery phase" to the "exit phase."

As an early fund with a fintech angle, we must lock in targets downstream of this spending:

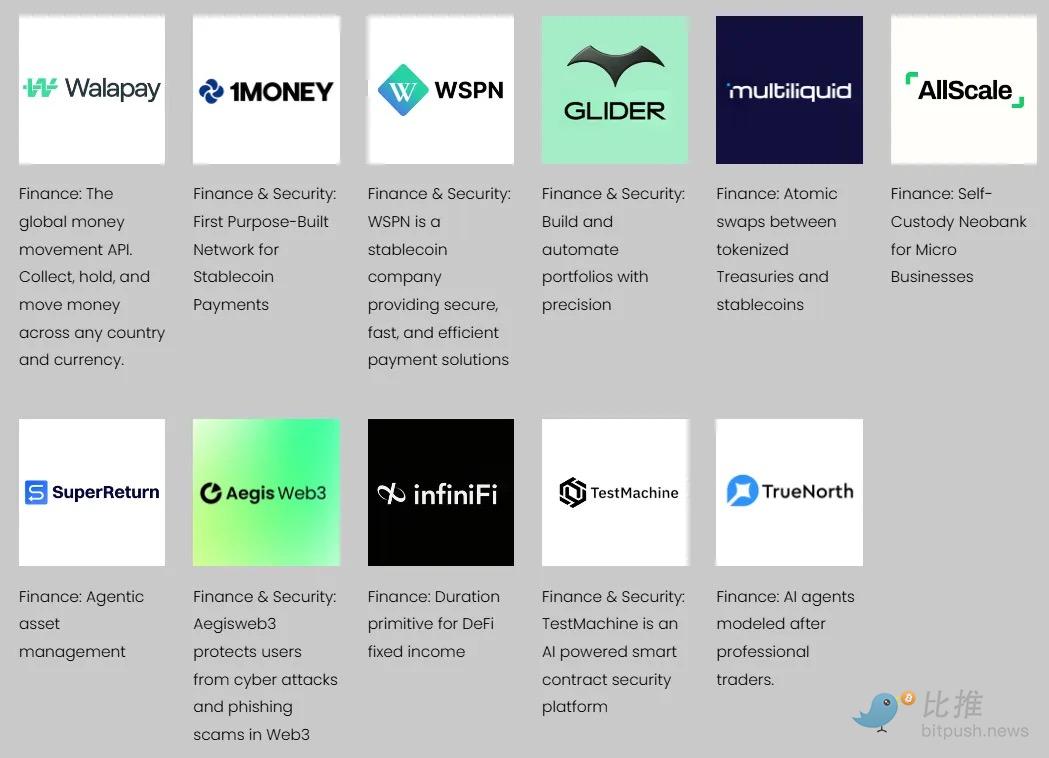

Machine Transaction Surfaces: The levels at which machines or their operators have already carried out economic activities, such as payments, billing, metering, routing, and the orchestration, compliance, custody, and settlement primitives of capital or computing power. Returns are obtained through transaction volume, acquisitions, or regulatory status, rather than speculative narratives. Walapay and Nevermined in our portfolio are examples.

Applied Infrastructure With Budgets: Infrastructure that enterprises or platforms have already procured, such as computing power aggregation and optimization, data services embedded in workflows, and tools with recurring expenses and switching costs. The focus is on ownership of budgets and the depth of integration. Examples include Yotta Labs and Exabits.

High Novelty Opportunities: A few asymmetric upside opportunities that are uncertain in timing: fundamental research, frontier science, AI-related cultural or IP platforms. Our recent investment in Netholabs (a lab dedicated to simulating a complete digital brain of a mouse) fits this characteristic.

Furthermore, before the structural issues in the token market are resolved, we will invest more aggressively in equity. Previously, our exposure was 40% in tokens and 40% in equity, with the remaining 20% flexibly allocated. We believe the token space needs 12-24 months to digest the current predicament.

Key Insights

You don’t need to be a venture capitalist to learn from and benefit from these market dynamics.

Massive capital expenditures are flowing from tech giants to energy and component suppliers. A few companies are expected to become winners in the public market worth trillions of dollars, but they choose to remain private while divesting special purpose vehicles (SPVs). Public companies are doing their best to defend themselves. Political power is centralizing and nationalizing these initiatives — whether it’s Musk and Trump, or China and DeepSeek — rather than supporting their decentralized alternatives in Web3. Robots are intertwined with the national manufacturing and military-industrial complex.

In the creative industries (from gaming to film and music), there is a growing resistance to AI, with those engaged in "human craftsmanship" rejecting robots that pretend to do the same things.

In contrast, in the software, science, and mathematics sectors, people view AI as a great achievement that can help discover and build efficient business architectures.

We need to stop believing in this collective illusion and return to reality. On one hand, dozens of companies have achieved over $100 million in annual revenue by serving users; on the other hand, the market is also filled with numerous falsehoods and scams. Both can coexist without contradiction.

The new year will bring a comprehensive reshuffling, but it also contains enormous opportunities. Only by cautiously walking the tightrope of opportunity can we achieve success. Let’s meet again on the other side!

免责声明:本文章仅代表作者个人观点,不代表本平台的立场和观点。本文章仅供信息分享,不构成对任何人的任何投资建议。用户与作者之间的任何争议,与本平台无关。如网页中刊载的文章或图片涉及侵权,请提供相关的权利证明和身份证明发送邮件到support@aicoin.com,本平台相关工作人员将会进行核查。