Today, the GDP growth for the third quarter in the United States was announced, and it was quite good, far exceeding expectations. However, the impact on risk markets has been very weak, mainly because the market is concerned that a strong economy will hinder the Federal Reserve from cutting interest rates in 2026. This concern even prompted Trump to make a statement, essentially calling for trust in the Federal Reserve Chairman to lower interest rates. Trump feels powerless against Powell, and all that’s left is to wait for Powell's term to end.

In the ETF data, it has been repeatedly mentioned that we have already entered the Christmas market. Some investors have already started their holidays, and liquidity and trading volume have begun to show a significant decline. In this situation, narrow fluctuations are highly likely. The willingness to buy and sell in the market has decreased at this stage, and tomorrow is Christmas Eve, so trading volume will inevitably decline further.

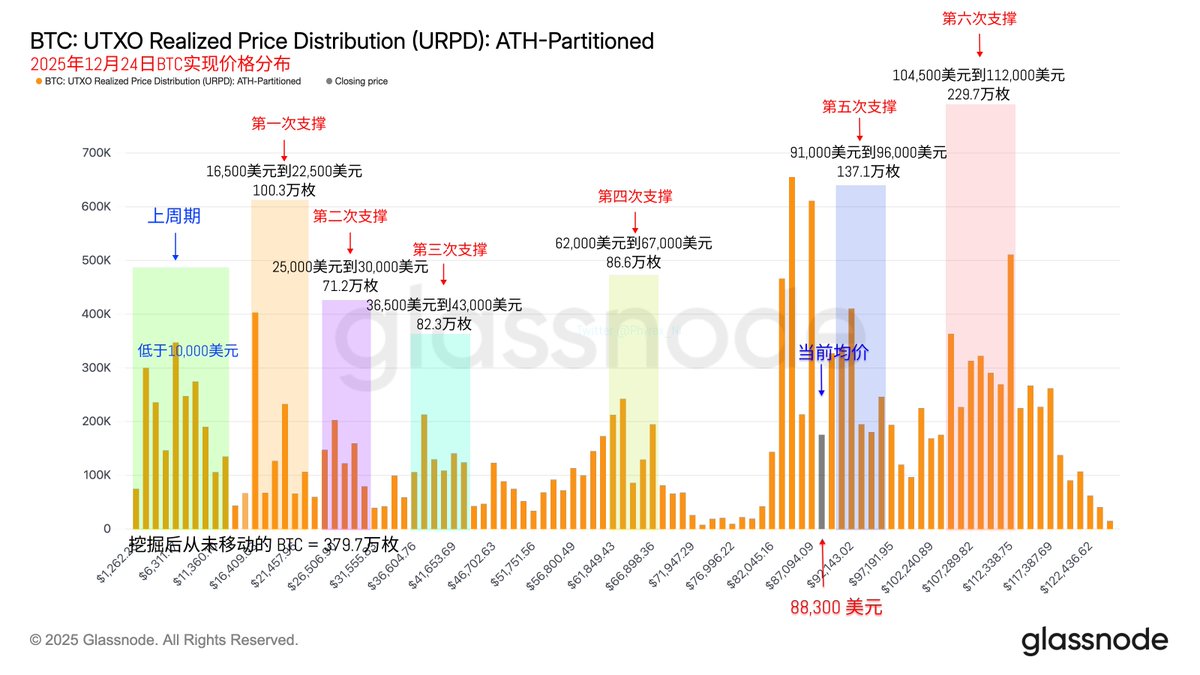

Looking back at Bitcoin data, the price of $BTC is still struggling to break through $90,000. Even though trading volume has started to decline, there has been no decrease in turnover rate. I’m a bit confused now; I used to think it was quant trading back and forth, but now the trading volume has clearly dropped by over 20%, yet the turnover rate is still rising. What are all these Bitcoins on-chain doing?

However, the overall structure of the chips remains stable, and there are no signs of panic among investors. Most holders are still in a wait-and-see attitude. Personally, I think the next change may start when Trump announces a new Federal Reserve Chairman.

@bitget VIP, lower fees, better benefits

免责声明:本文章仅代表作者个人观点,不代表本平台的立场和观点。本文章仅供信息分享,不构成对任何人的任何投资建议。用户与作者之间的任何争议,与本平台无关。如网页中刊载的文章或图片涉及侵权,请提供相关的权利证明和身份证明发送邮件到support@aicoin.com,本平台相关工作人员将会进行核查。