CoinW Research Institute

Key Points

The total market capitalization of global cryptocurrencies is $3.09 trillion, down from $3.22 trillion last week, representing a decrease of 4.03% this week. As of the time of writing, the cumulative net inflow of the U.S. Bitcoin spot ETF is approximately $57.41 billion, with a net outflow of $497 million this week; the cumulative net inflow of the U.S. Ethereum spot ETF is approximately $12.44 billion, with a net outflow of $643 million this week.

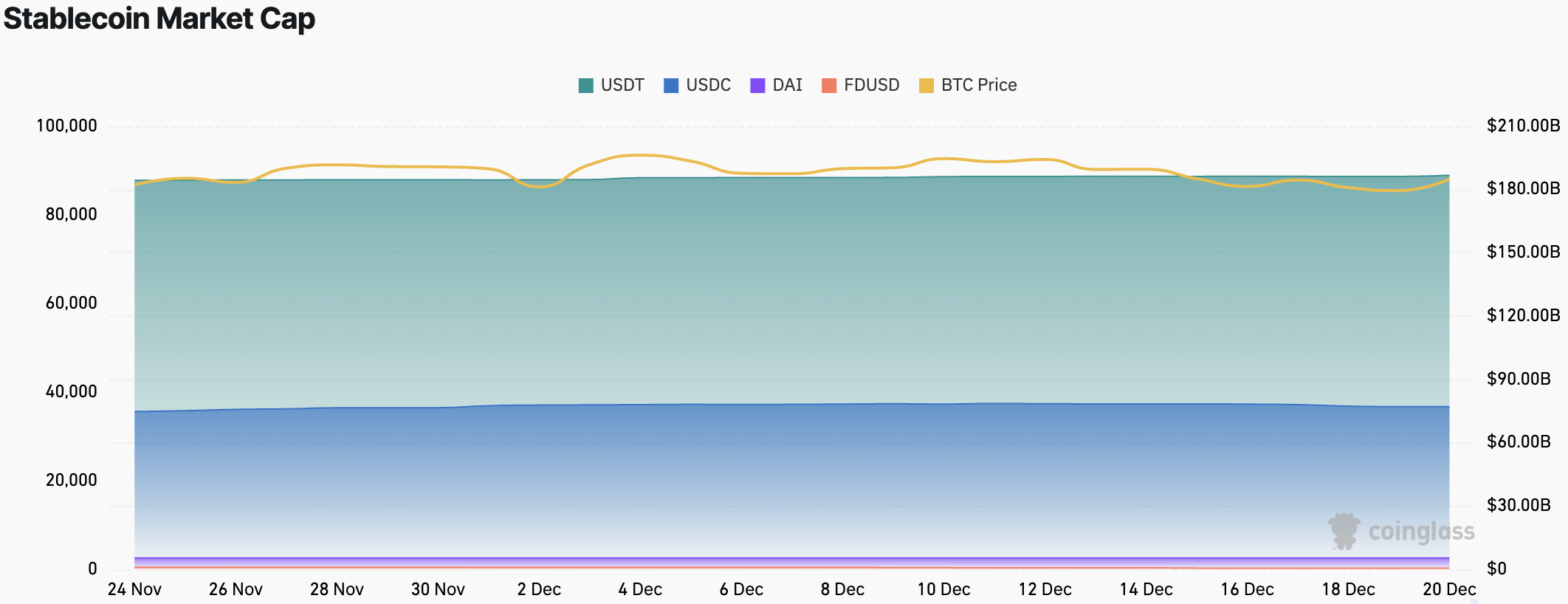

The total market capitalization of stablecoins is $307.9 billion, with USDT having a market cap of $186.7 billion, accounting for 60.92% of the total stablecoin market cap; followed by USDC with a market cap of $77 billion, accounting for 25.01%; and DAI with a market cap of $5.36 billion, accounting for 1.74% of the total stablecoin market cap.

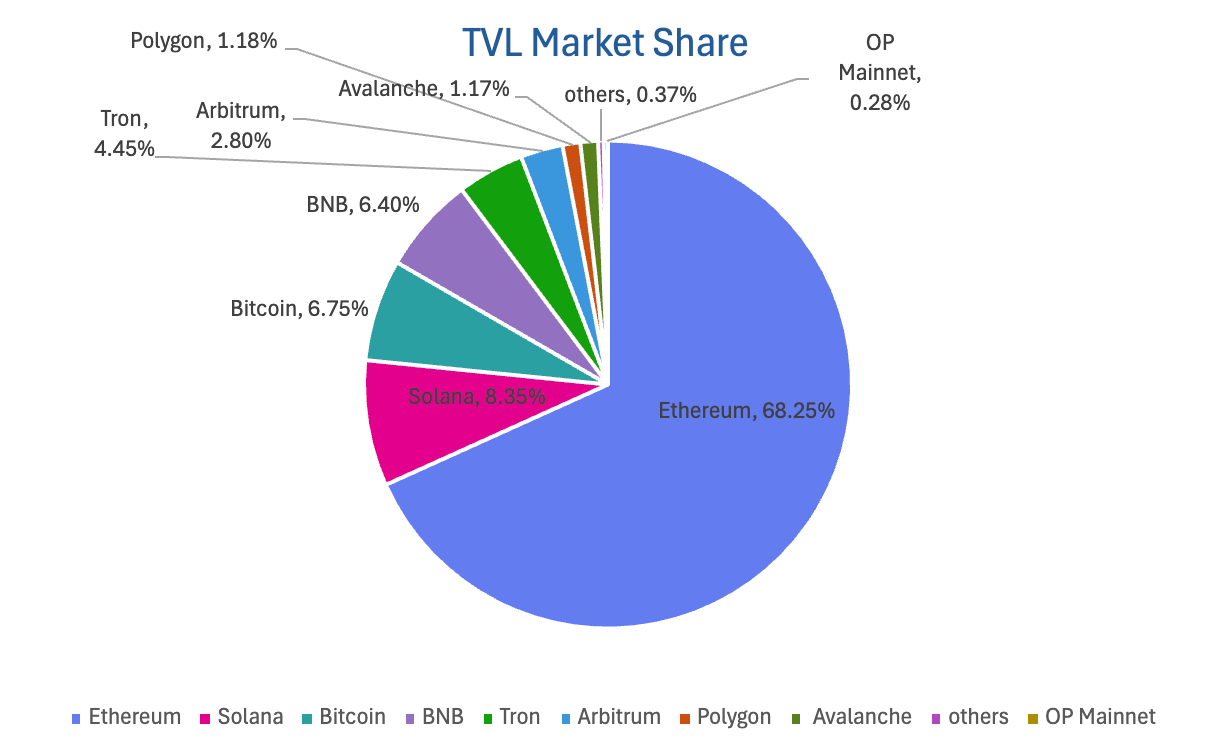

According to DeFiLlama, the total TVL of DeFi this week is $119.6 billion, down from $121.4 billion last week, a decrease of approximately 1.48%. By public chain, the top three chains by TVL are Ethereum at 68.25%; Solana at 8.35%; and Bitcoin at 6.75%.

This week, the performance of various public chains showed significant divergence. In terms of daily trading volume, only BNB Chain (+27.11%) and Sui (+12.93%) saw growth, while Ton (-28.00%) and Ethereum (-26.74%) experienced declines, and Solana (-4.11%) and Aptos (-0.58%) saw slight pullbacks. Overall, transaction fees remained relatively stable, with Ethereum, BNB Chain, and Ton remaining flat compared to last week, while Sui (-13.92%) and Aptos (-8.16%) saw declines, and Solana increased by 64.22%. In terms of users and funds, daily active addresses saw growth for all chains except for slight declines in Solana (-6.74%) and Sui (-0.27%), with increases in Ethereum (+28.12%), Aptos (+21.83%), Ton (+5.58%), and BNB Chain (+2.52%). TVL faced overall pressure, with only Sui seeing a slight increase of 4.14%, while other public chains experienced moderate pullbacks of 1%-3%.

New Project Focus: Strata is a perpetual yield layering protocol built on Ethena's risk-neutral synthetic stablecoin USDe, aimed at providing users with structured yield exposure. HolmesAI aims to help users replicate their thinking patterns and experiences through Persona (personalized knowledge and thinking models), creating a true AI Agent that "thinks like the user and acts for the user," thereby unleashing human creativity and time. Worm is a decentralized prediction market platform built on Solana, allowing users to connect their wallets to create and trade various prediction markets (such as sports, crypto, etc.), expressing their probability judgments on event outcomes by buying and selling "yes/no" shares and earning from transaction fees.

Table of Contents

Key Points

I. Market Overview

Total Cryptocurrency Market Cap / Bitcoin Market Cap Proportion

Fear Index

ETF Inflow and Outflow Data

ETH/BTC and ETH/USD Exchange Rates

Decentralized Finance (DeFi)

On-chain Data

Stablecoin Market Cap and Issuance Status

II. This Week's Hot Money Trends

Top Five VC Coins and Meme Coins by Growth This Week

New Project Insights

III. New Industry Dynamics

Major Industry Events This Week

Major Upcoming Events Next Week

Important Investments and Financing from Last Week

IV. Reference Links

I. Market Overview

1. Total Cryptocurrency Market Cap / Bitcoin Market Cap Proportion

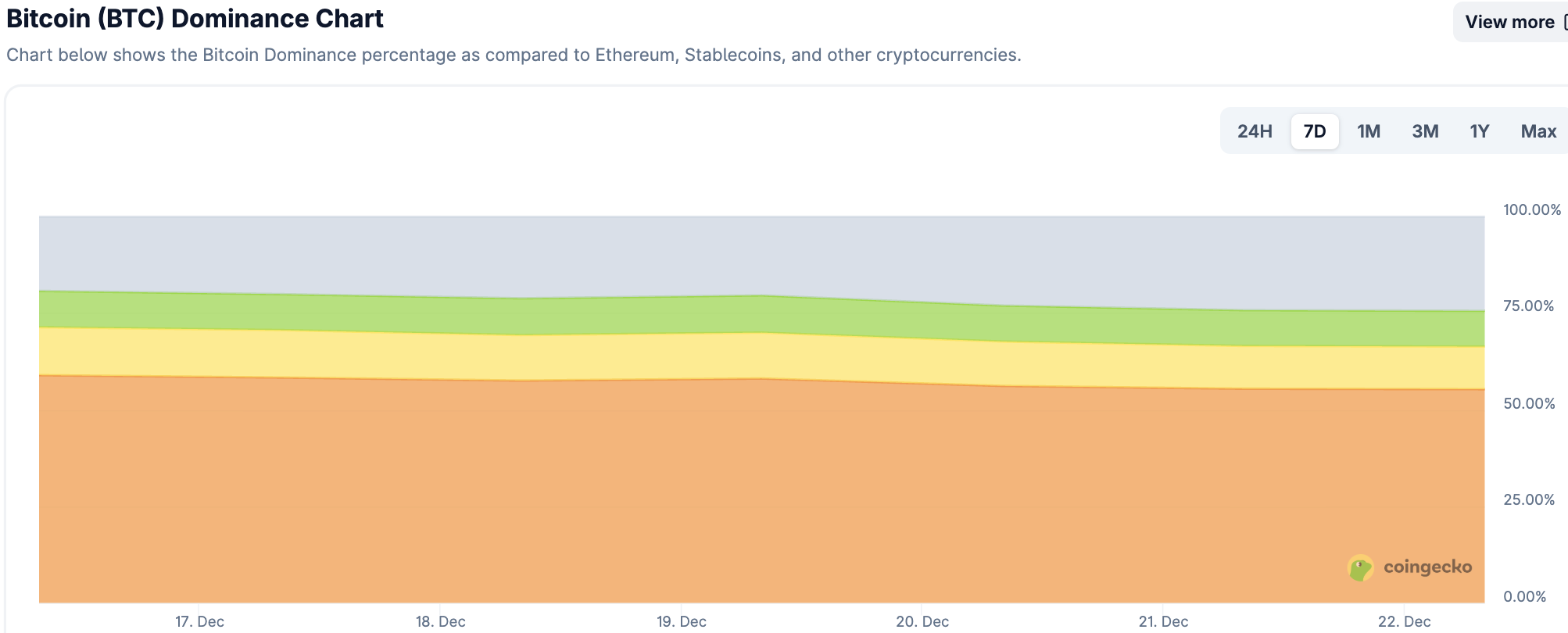

The global total cryptocurrency market cap is $3.09 trillion, down from $3.22 trillion last week, representing a decrease of 4.03% this week.

Data Source: cryptorank, https://cryptorank.io/charts/btc-dominance

Data as of December 21, 2025

As of the time of writing, the market cap of Bitcoin is $1.77 trillion, accounting for 57.3% of the total cryptocurrency market cap. Meanwhile, the market cap of stablecoins is $307.9 billion, accounting for 9.96% of the total cryptocurrency market cap.

Data Source: coingecko, https://www.coingecko.com/en/charts

Data as of December 21, 2025

2. Fear Index

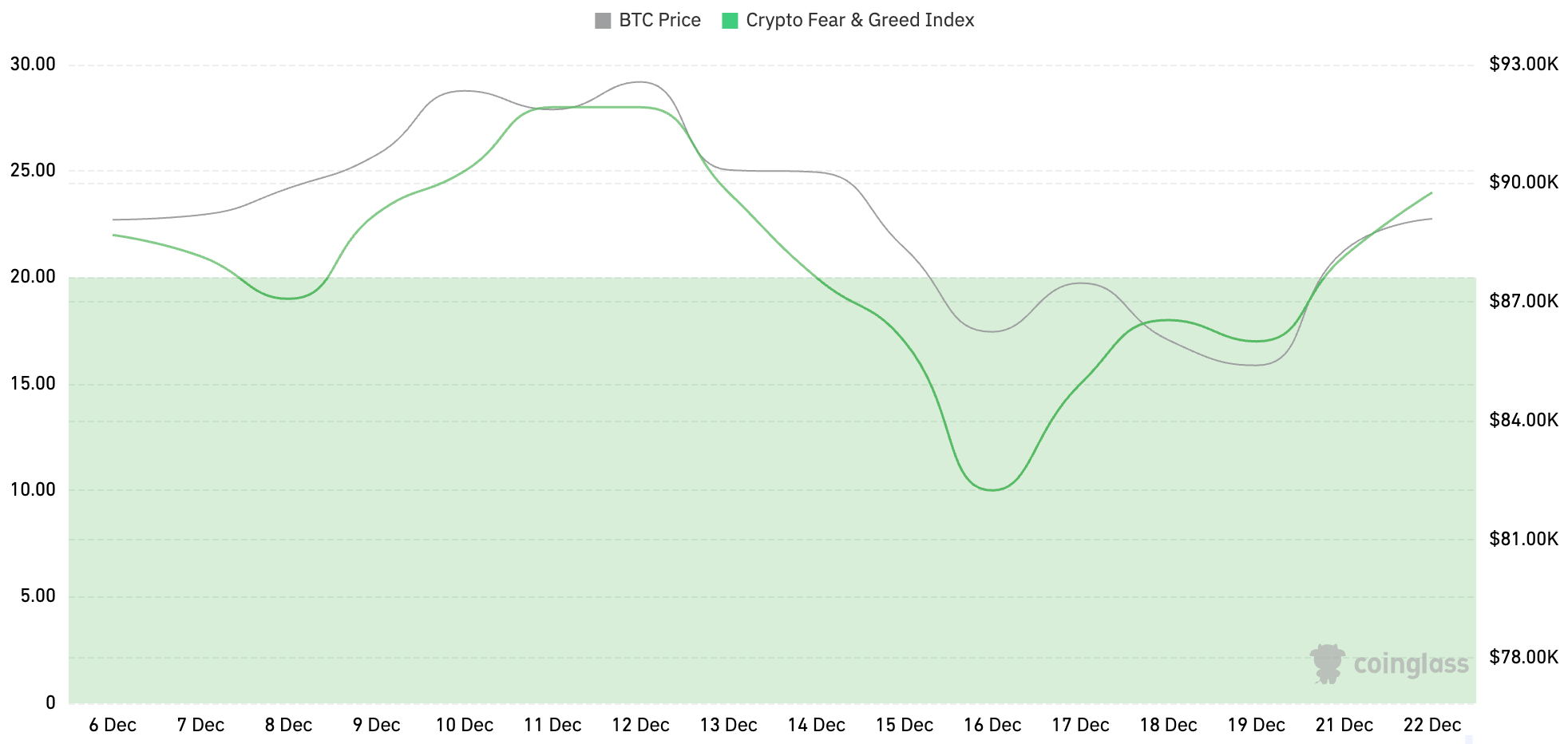

The cryptocurrency fear index is at 24, indicating fear.

Data Source: coinglass, https://www.coinglass.com/pro/i/FearGreedIndex

Data as of December 21, 2025

3. ETF Inflow and Outflow Data

As of the time of writing, the cumulative net inflow of the U.S. Bitcoin spot ETF is approximately $57.41 billion, with a net outflow of $497 million this week; the cumulative net inflow of the U.S. Ethereum spot ETF is approximately $12.44 billion, with a net outflow of $643 million this week.

Data Source: sosovalue, https://sosovalue.com/zh/assets/etf

Data as of December 21, 2025

4. ETH/BTC and ETH/USD Exchange Rates

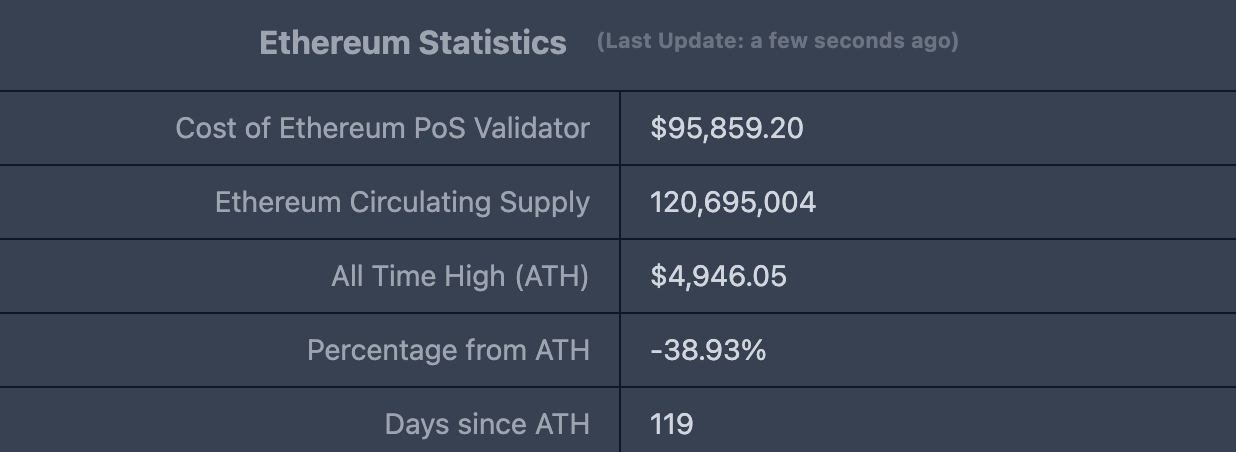

ETHUSD: Current price $2,994.09, historical highest price $4,878.26, down approximately 38.93% from the highest price.

ETHBTC: Currently at 0.033949, historical highest at 0.1238.

Data Source: ratiogang, https://ratiogang.com/

Data as of December 21, 2025

5. Decentralized Finance (DeFi)

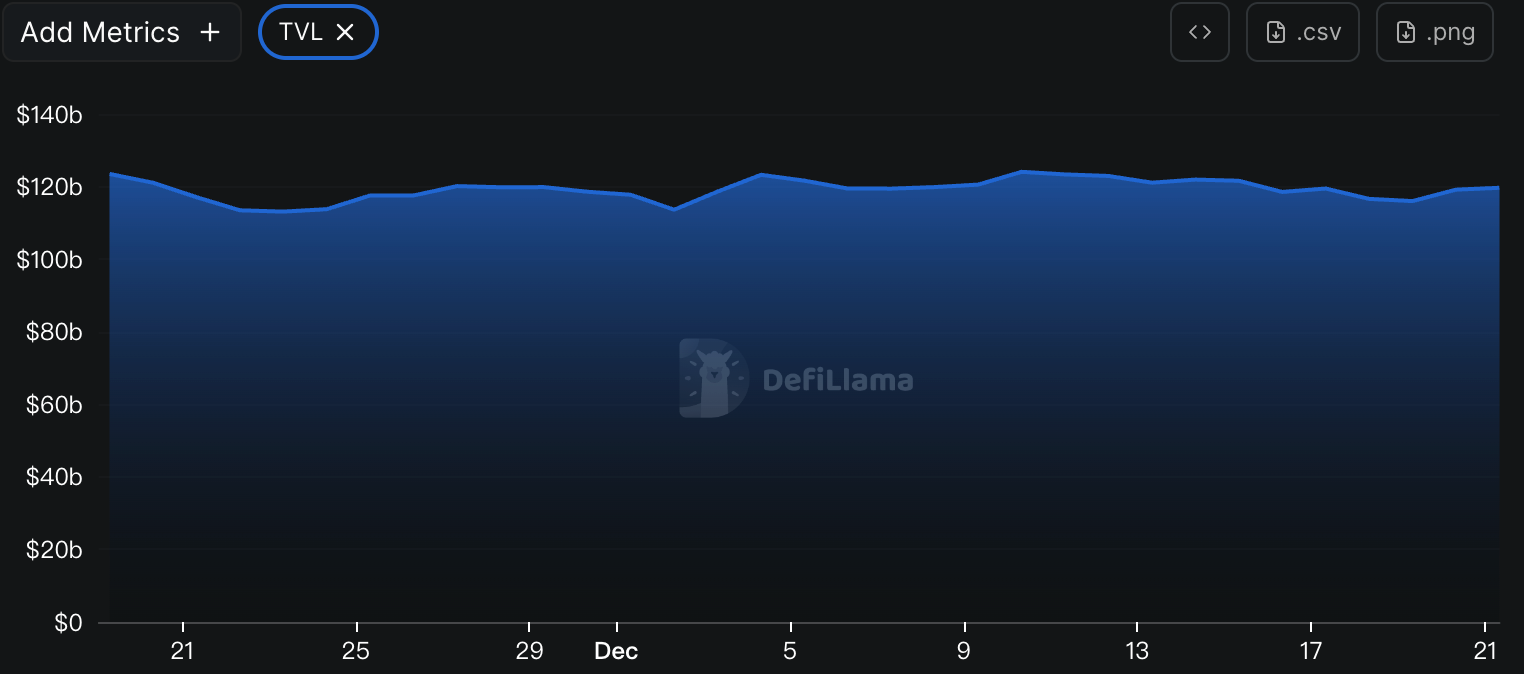

According to DeFiLlama, the total TVL of DeFi this week is $119.6 billion, down from $121.4 billion last week, a decrease of approximately 1.48%.

Data Source: defillama, https://defillama.com

Data as of December 21, 2025

By public chain, the top three chains by TVL are Ethereum at 68.25%; Solana at 8.35%; and Bitcoin at 6.75%.

Data Source: CoinW Research Institute, defillama, https://defillama.com

Data as of December 21, 2025

6. On-chain Data

Layer 1 Related Data

Mainly analyzing the current data of major Layer 1 chains including ETH, SOL, BNB, TON, SUI, and APTOS based on daily trading volume, daily active addresses, and transaction fees.

Data Source: CoinW Research Institute, defillama, https://defillama.com

Data as of December 21, 2025

Daily Trading Volume and Transaction Fees: Daily trading volume and transaction fees are core indicators of public chain activity and user experience. In terms of daily trading volume, this week only BNB Chain and Sui saw increases, with growth rates of 27.11% and 12.93%, respectively; Ton and Ethereum decreased by 28.00% and 26.74%, respectively; Solana and Aptos saw slight pullbacks of 4.11% and 0.58%. Regarding transaction fees, this week Ethereum, BNB Chain, and Ton Chain remained flat compared to last week; Sui and Aptos decreased by 13.92% and 8.16%, respectively; Solana increased by 64.22%.

Daily Active Addresses and TVL: Daily active addresses reflect the ecological participation and user stickiness of public chains, while TVL reflects user trust in the platform. In terms of daily active addresses, this week only Solana and Sui saw decreases of 6.74% and 0.27%, while the other chains experienced increases. Ethereum and Aptos increased by 28.12% and 21.83%, respectively; Ton and BNB Chain saw slight growth of 5.58% and 2.52%. In terms of TVL, this week only Sui Chain saw a slight increase of 4.14%; the other chains experienced slight declines, with BNB Chain (-3.36%), Ton (-2.38%), Aptos (-2.00%), Solana (-1.81%), and Ethereum (-1.53%).

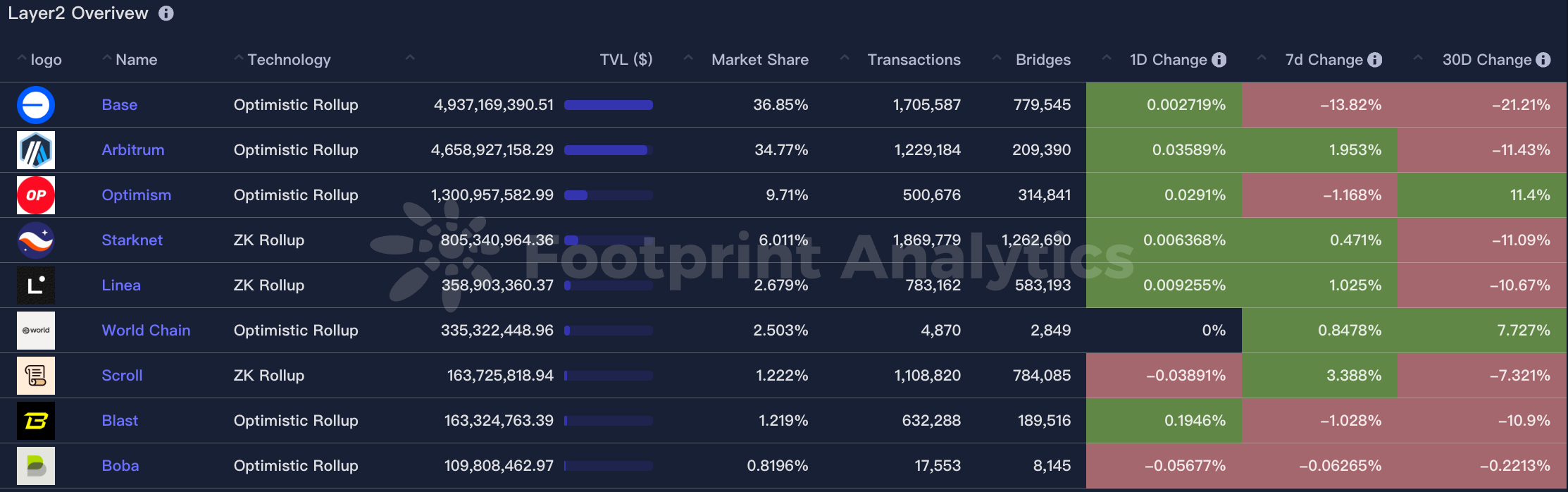

Layer 2 Related Data

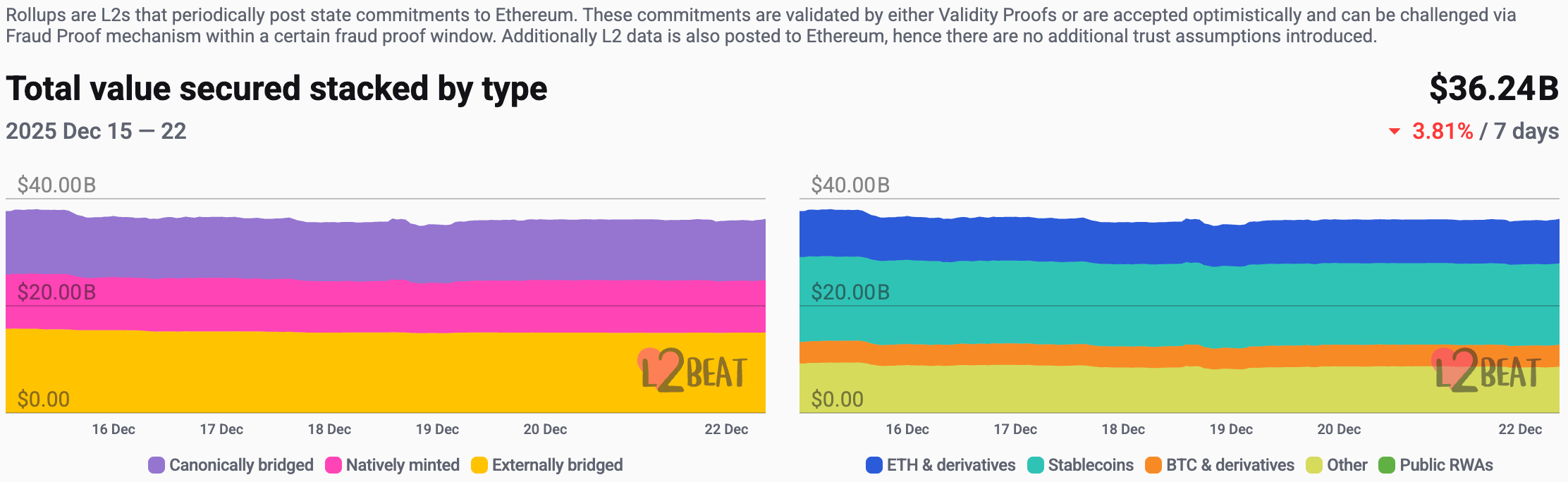

According to L2Beat data, the total TVL of Ethereum Layer 2 is $36.24 billion, down 3.74% from last week ($37.65 billion).

Data Source: L2Beat, https://l2beat.com/scaling/tvs

Data as of December 21, 2025

Base and Arbitrum occupy the top positions with market shares of 36.85% and 34.77%, respectively. Base Chain's market share has decreased over the past week, while Arbitrum has seen a slight increase.

Data Source: footprint, https://www.footprint.network/public/research/chain/chain-ecosystem/layer-2-overview

Data as of December 21, 2025

7. Stablecoin Market Cap and Issuance Status

According to Coinglass data, the total market cap of stablecoins is $30.79 billion, with USDT having a market cap of $18.67 billion, accounting for 60.92% of the total stablecoin market cap; followed by USDC with a market cap of $7.7 billion, accounting for 25.01%; and DAI with a market cap of $536 million, accounting for 1.74%.

Data Source: CoinW Research Institute, Coinglass, https://www.coinglass.com/pro/stablecoin

Data as of December 21, 2025

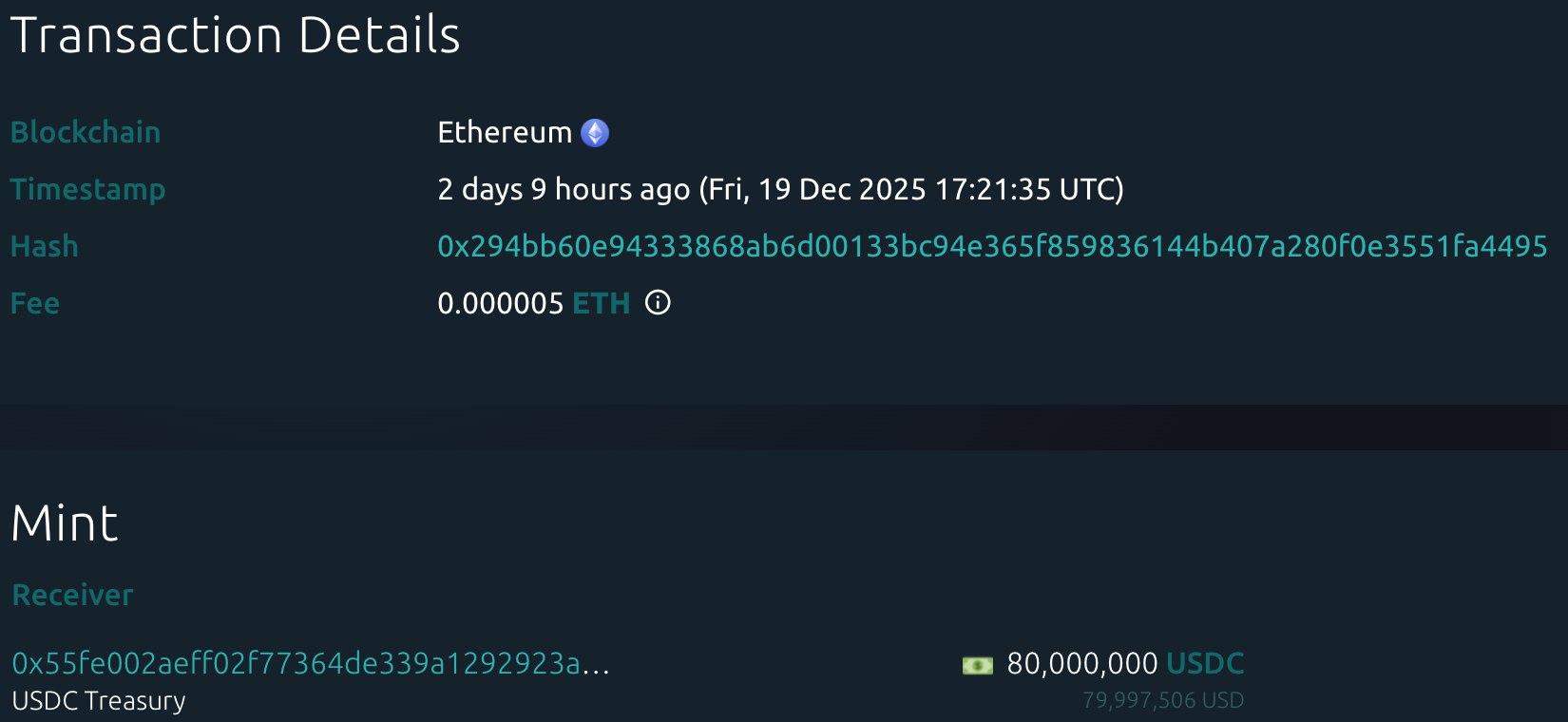

According to Whale Alert data, this week the USDC Treasury issued a total of 1.007 billion USDC, while Tether Treasury had no issuance of USDT this week. The total issuance of stablecoins this week was 1.007 billion, a decrease of 72.53% compared to last week's total issuance of 3.667 billion.

Data Source: Whale Alert, https://x.com/whale_alert

Data as of December 21, 2025

II. This Week's Hot Money Trends

1. Top Five VC Coins and Meme Coins by Growth This Week

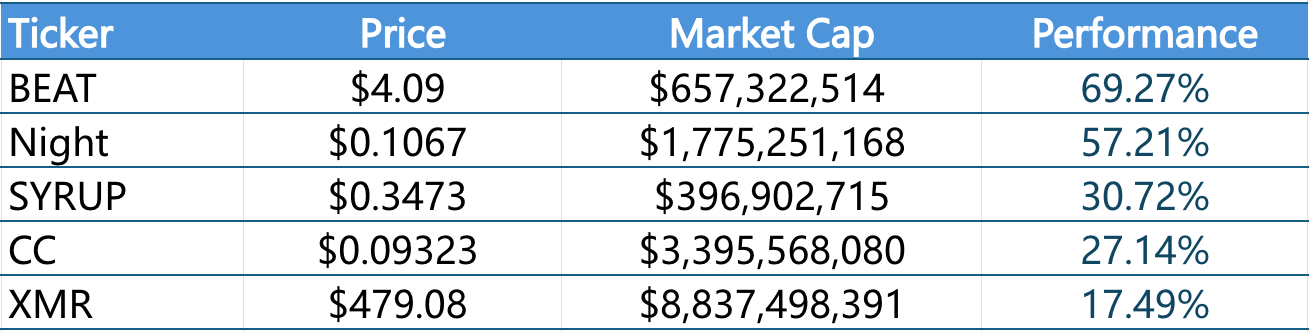

Top Five VC Coins by Growth in the Past Week

Data Source: CoinW Research Institute, coinmarketcap, https://coinmarketcap.com/

Data as of December 21, 2025

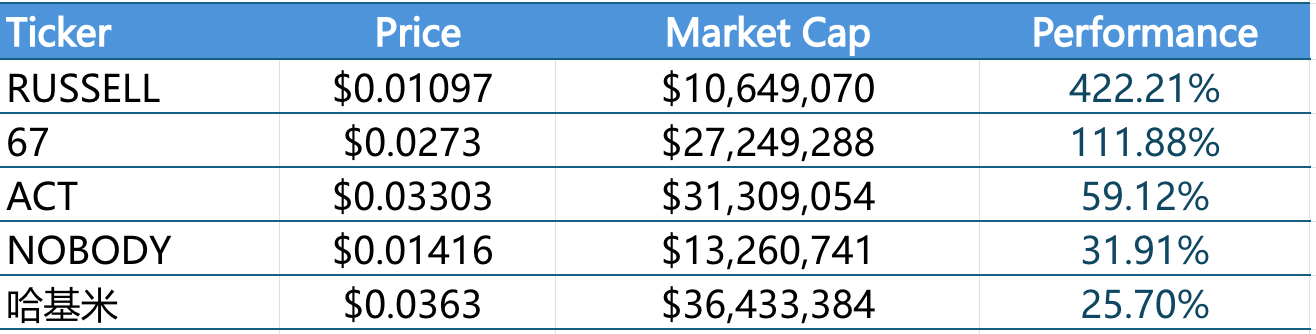

Top Five Meme Coins by Growth in the Past Week

Data Source: CoinW Research Institute, coinmarketcap, https://coinmarketcap.com/

Data as of December 21, 2025

2. New Project Insights

Strata is a Perpetual Yield Tranching protocol built on Ethena's risk-neutral synthetic stablecoin USDe, aimed at providing users with structured yield exposure. By splitting yields into Senior and Junior risk-return tiers, Strata enables investors to participate in the yield generated by Ethena's arbitrage strategies (carry trade) according to their risk preferences, achieving more refined yield allocation at different risk levels.

HolmesAI aims to help users replicate their thinking patterns and experiences through Persona (personalized knowledge and thinking models), creating a true AI Agent that "thinks like the user and acts for the user," thereby unleashing human creativity and time. By distilling users' knowledge, cognition, and decision-making logic into Persona, HolmesAI endows the AI Agent with highly anthropomorphic capabilities, overcoming the traditional AI's lack of personalization and long-term memory issues, making it applicable across various industries and use cases.

Worm is a decentralized prediction market platform built on Solana, allowing users to connect their wallets to create and trade various prediction markets (such as sports, crypto, etc.), expressing their probability judgments on event outcomes by buying and selling "yes/no" shares and earning from transaction fees. The platform employs a permissionless mechanism, allowing market creators to earn a share of transaction fees while introducing pre-sale and curved incentive mechanisms to encourage early liquidity, utilizing UMA decentralized oracles to ensure objective settlement of market outcomes.

III. New Industry Dynamics

1. Major Industry Events This Week

Infrared (IR) completed its TGE on December 17, 2025 (UTC), with tokens officially generated and entering circulation. The project conducted an airdrop distribution to early supporters, primarily covering users who participated in the Boyco pre-storage activities, testnet experiences, and community building. The airdrop was open for collection on the day of the TGE and continued to be distributed over the following period. In terms of initial token distribution, Infrared completed early circulation through token generation and community allocation, without adopting a multi-round IDO structure. The IR token is now used for protocol governance, staking, and participation in protocol revenue-related mechanisms, forming the core asset of the Infrared ecosystem. Infrared is a liquid staking protocol within the Berachain ecosystem.

On December 17, the decentralized prediction market platform predict.fun officially launched on BNB Chain and initiated an initial points airdrop activity aimed at prediction market participants and active users of BNB Chain, with the airdrop query page now open. This new market is incubated by YZi Labs, with a founding team that includes developers who previously worked at Binance, and received early announcements and attention from Binance founder CZ on social media on December 4. The core feature of predict.fun is that it allows users to earn returns on their funds while making predictions, aiming to leverage BNB Chain's low fees and high performance to provide users with a more capital-efficient prediction market experience.

On December 16, the sports prediction application Football.Fun on Base Chain announced the tokenomics of its native token FUN, with a total supply of 1 billion tokens, of which 25% is allocated to the community (including 4% for the genesis airdrop), 25% to the team, 24.8% to investors, 17.7% to the treasury, and 7.5% for public sale. On the same day at 21:00 (UTC+8), the public sale of FUN tokens officially commenced, lasting approximately 48 hours, with a fundraising target of $3 million, aimed at supporting ecosystem development and incentivizing early user participation. The genesis airdrop portion is used to reward early community supporters, enhancing user engagement and initial liquidity, while the public sale of tokens lays the foundation for market expansion and future gameplay.

On December 16, Perp DEX aggregator vooi announced that the airdrop for its native token will open for claims at 20:00 Beijing time on December 18, 2025, with a claim window of 30 days. The snapshot was completed on December 8 at 08:00 (Beijing time), and the airdrop recipients include trading point holders, V1 old users, and winners of the Cookie event. The token economic model of vooi shows a total supply of 1 billion tokens, with airdrops and community sales accounting for 10.53%, community development and marketing (including second-quarter airdrops) accounting for 27.82%, community contributors accounting for 17%, private placements and strategic investors accounting for 13.65%, and the project foundation accounting for 31%.

The decentralized health economy network DNAi will launch its $DNAi token generation event (TGE) on December 19 at 00:00 UTC, with the official website registration opening at 01:58 UTC. The total supply of $DNAi is fixed at 8,255,093,950 tokens, inspired by the global population scale in 2025. The project adopts a "fair launch" mechanism: 70% (approximately 577.8 million tokens) will be distributed to verified individual data providers through health data mining, with no pre-mining; the remaining 30% will be allocated to early investors, core contributors, and the DNAi Foundation, all of which will be locked for the long term and not circulated immediately. $DNAi will serve as both a governance and interactive token within the ecosystem, allowing individual users to earn rewards by contributing verified health data, while institutions can obtain liquidity support based on $DNAi by staking real-world assets (such as R&D pipelines, patents, or equity). The overall distribution design emphasizes fair participation and long-term value alignment.

2. Major Events Coming Up Next Week

Aster officially announced on December 18 that its fifth phase airdrop "Stage 5: Crystal" will start on December 22, 2025, and continue until February 1, 2026, lasting a total of 6 weeks. The total amount of this phase airdrop accounts for 1.2% of the total ASTER supply (approximately 96 million ASTER), divided into two parts: 0.6% of the basic share can be claimed immediately, while 0.6% of the locked rewards will be unlocked after a 3-month lock-up period. Users can choose to claim immediately but forfeit the locked rewards, or wait until the lock-up is completed to claim the full share. This design balances liquidity and long-term holding incentives while increasing token deflation through early claim and destruction of rewards.

FOXRPFUN will hold its IDO from December 21 to December 22, with a public sale price of approximately $0.006, selling tokens through Launchpad platforms like KingdomStarter and raising about $100,000. After the sale, tokens will begin circulating at TGE, with approximately 30% unlocked at TGE and the remaining 70% released according to schedule over the next 6 months. FOXRPFUN is a meme token and decentralized exchange ecosystem project based on the XRP Ledger (XRPL), with a total supply of 500 million FRP tokens. The design of FRP aims to combine a viral meme community with the low fees and high-speed transaction characteristics of XRPL to promote a decentralized trading experience.

Rainbow announced that its native token RNBW will have its TGE on February 5, 2026. The token issuance will be led by the Rainbow Foundation, which will become the largest single shareholder of Rainbow Company, holding 20% equity, and establish a mechanism for token holders to share profits with company shareholders; if an acquisition occurs in the future, the foundation will gradually dissolve and distribute net assets, including equity profits, to token holders. According to the published tokenomics, the total supply of RNBW is 1 billion tokens, with 15% allocated for airdrops at TGE, approximately 3% for CoinList community pre-sale, 47% for the treasury, 12.2% for the team, 7.8% for investors, and 15% for the community, with an expected initial circulation ratio of about 20% at TGE.

3. Important Financing Events from Last Week

ETHGas announced the completion of a $12 million token round financing, led by Polychain Capital, with participation from Stake Capital, BlueYard Capital, Lafayette Macro Advisors, SIG DT, and Amber Group. In addition to financial support, ETHGas also secured commitments for approximately $800 million in block space liquidity from Ethereum validators, block builders, and relayers, which will be used for market and product development. ETHGas has built a futures market that allows for the advance buying and selling of block space, enhancing the trading efficiency of Ethereum block space. This system interfaces with Ethereum's existing proposer-builder separation (PBS) process, optimizing but not replacing the current block production mechanism. (December 17, 2025)

Hong Kong fintech company RedotPay completed a $107 million Series B financing, led by Goodwater Capital, with participation from Pantera Capital, Blockchain Capital, and Circle Ventures. The funds will primarily be used for product development, compliance licensing, and strategic acquisitions. RedotPay is a blockchain technology company focused on crypto wallets and payment solutions, aiming to drive a global paradigm shift in payment methods and accelerate the adoption of cryptocurrencies in everyday transactions and payments. The company has over 6 million registered users and operates in more than 100 markets. (December 16, 2025)

The decentralized wireless network protocol DAWN announced the completion of a $13 million Series B financing, led by Polychain Capital. Built on Solana, DAWN aims to reconstruct internet access models through a "protocol + hardware" approach, allowing individuals and institutions to deploy wireless nodes, own and operate local broadband infrastructure, and receive incentives based on coverage quality and actual demand. Its network achieves trustless bandwidth trading through encrypted verification mechanisms of backhaul capacity, geographic location, and spectrum usage. This round of financing will be used to expand domestic network coverage in the U.S. and promote international deployment (including early landing in Accra, Ghana), while launching Black Box terminal devices that support multiple blockchain ecosystems. (December 18, 2025)

The decentralized physical infrastructure network (DePIN) Fuse Energy, based on Solana, announced the completion of a $70 million Series B financing, led by Lowercarbon Capital and Balderton Capital, with the company's valuation reaching approximately $5 billion. Fuse Energy has built a decentralized renewable energy network covering distributed energy resource (DER) installations, electricity trading, and retail services, and promotes decentralized trading and participation in energy production and consumption through token incentives. Additionally, the project has launched Project Zero, aimed at creating a global decentralized energy infrastructure network that incentivizes the deployment and use of clean energy through blockchain technology, promoting the democratization and sustainable development of energy systems. (December 18, 2025)

### Reference Links

Coingeck: https://www.coingecko.com/en/charts

Sosovalue: https://sosovalue.com/zh/assets/etf

Ratiogang: https://ratiogang.com/

Defillama: https://defillama.com

L2Beat: https://l2beat.com/scaling/tvs

Footprint: https://www.footprint.network/public/research/chain/chain-ecosystem/layer-2-overview

Coinglass: https://www.coinglass.com/pro/stablecoin

Whale Alert: https://x.com/whale_alert

Coinmarketcap: https://coinmarketcap.com/

ETHGas: https://www.ethgas.com/

RedotPay: https://www.redotpay.com/

Strata: https://www.strata.money/

HolmesAI: https://holmesai.xyz/

Worm: https://www.worm.wtf/

免责声明:本文章仅代表作者个人观点,不代表本平台的立场和观点。本文章仅供信息分享,不构成对任何人的任何投资建议。用户与作者之间的任何争议,与本平台无关。如网页中刊载的文章或图片涉及侵权,请提供相关的权利证明和身份证明发送邮件到support@aicoin.com,本平台相关工作人员将会进行核查。