Original | Odaily Planet Daily (@OdailyChina)

The leading lending protocol Aave is caught in a whirlpool of public opinion, with increasing tensions between the team and the community, which has objectively affected the confidence of token holders in the AAVE token itself.

In the early hours of today, excluding the project party, protocol contracts, and CEX, the second largest AAVE whale sold off 230,000 AAVE** (worth about 38 million USD), causing AAVE to drop 12% in the short term.** It is reported that this "second big brother" held AAVE purchased at an average price of 223.4 USD from the end of last year to the beginning of this year, and today’s sell-off average price was about 165 USD, resulting in a final loss of 13.45 million USD.

- Odaily Note: The whale address is https://debank.com/profile/0xa923b13270f8622b5d5960634200dc4302b7611e.

Cause of the Incident: Dispute Over Fee Flow

To clarify the community crisis at Aave, we need to start with a recent change in Aave's front end.

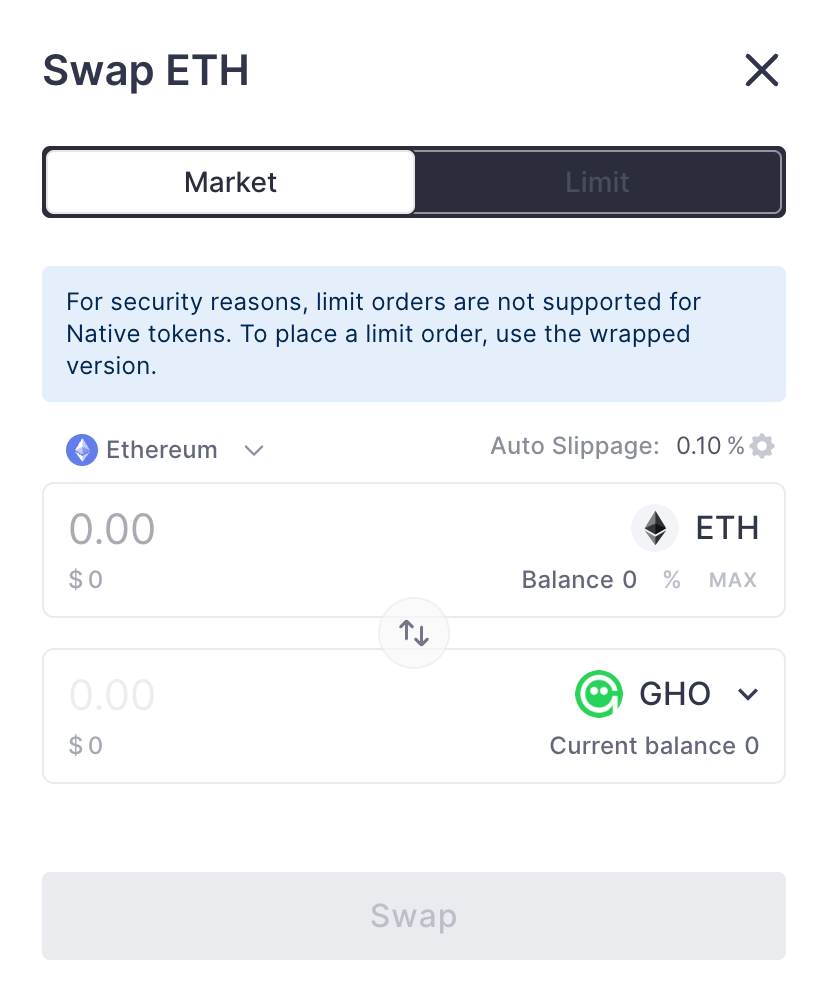

On December 4, Aave announced a partnership with Cow Swap, adopting the latter as the default trading path for Aave's front-end exchange function (Odaily Note: Previously it was ParaSwap), achieving better pricing through the latter's anti-MEV feature.

This seemed like a normal functional upgrade, but the community quickly discovered that when using ParaSwap, the additional fees generated by this function (including referral fees or positive slippage surplus fees) would flow to the Aave DAO treasury address, but after switching to Cow Swap, they changed to flow to the Aave Labs address.

Community representative EzR3aL was the first to notice this change that Aave did not actively mention, questioning the Aave team in the governance forum and calculating that, based on tracking Aave's income flow on Ethereum and Arbitrum, this fee is expected to generate about 200,000 USD in revenue per week, corresponding to an annualized income of over 10 million USD — this means that Aave has transferred at least tens of millions of dollars in revenue from the community address to the team address without almost anyone knowing.

Core Controversy: Who Does the Aave Brand Belong To?

As EzR3aL's post gained traction, many AAVE holders felt betrayed, especially considering that Aave did not communicate with the community during this change and made no disclosures, which somewhat suggested an intention to conceal this change.

In response to community doubts, Aave Labs directly replied below EzR3aL's post, stating that there should be a clear distinction between the protocol layer and the product layer. The exchange function interface of Aave's front end is entirely operated by Aave Labs, which is responsible for funding, building, and maintaining it. This function is completely independent of the DAO-managed protocol, so Aave Labs has the right to decide how to operate and profit from it… The income that previously flowed to the Aave DAO address was a donation from Aave Labs, but not an obligation.

In short, Aave Labs' stance is that the front-end interface and ancillary functions of Aave essentially belong to the team product, and the income generated from it should also be regarded as company property, not to be mixed with the protocol and related income controlled by the DAO.

Once this statement was made, a heated discussion quickly arose in the community regarding the ownership of the Aave protocol and product. A well-known DeFi analyst wrote an article titled “Who Really Owns Aave?” (Aave Labs vs Aave DAO), and Odaily Planet Daily also reprinted the Chinese translation, which interested parties may read as supplementary material.

On December 16, the conflict was further intensified. Aave's former CTO Ernesto Boado initiated a proposal in the governance forum, requesting the control of Aave's brand assets (including domain names, social media accounts, naming rights, etc.) to be transferred to AAVE holders. The relevant assets would be managed through an entity controlled by the DAO (specific form to be determined later) and strict anti-encroachment protection mechanisms would be set up.

The related proposal received nearly 10,000 views and hundreds of high-quality replies in the Aave governance forum, with various participants in the Aave ecosystem expressing their positions below this proposal. Although some voices argued that the execution plan of this proposal was not perfect and suspected of exacerbating divisions, most replies expressed support.

Founder's Statement, but the Community is Unconvinced

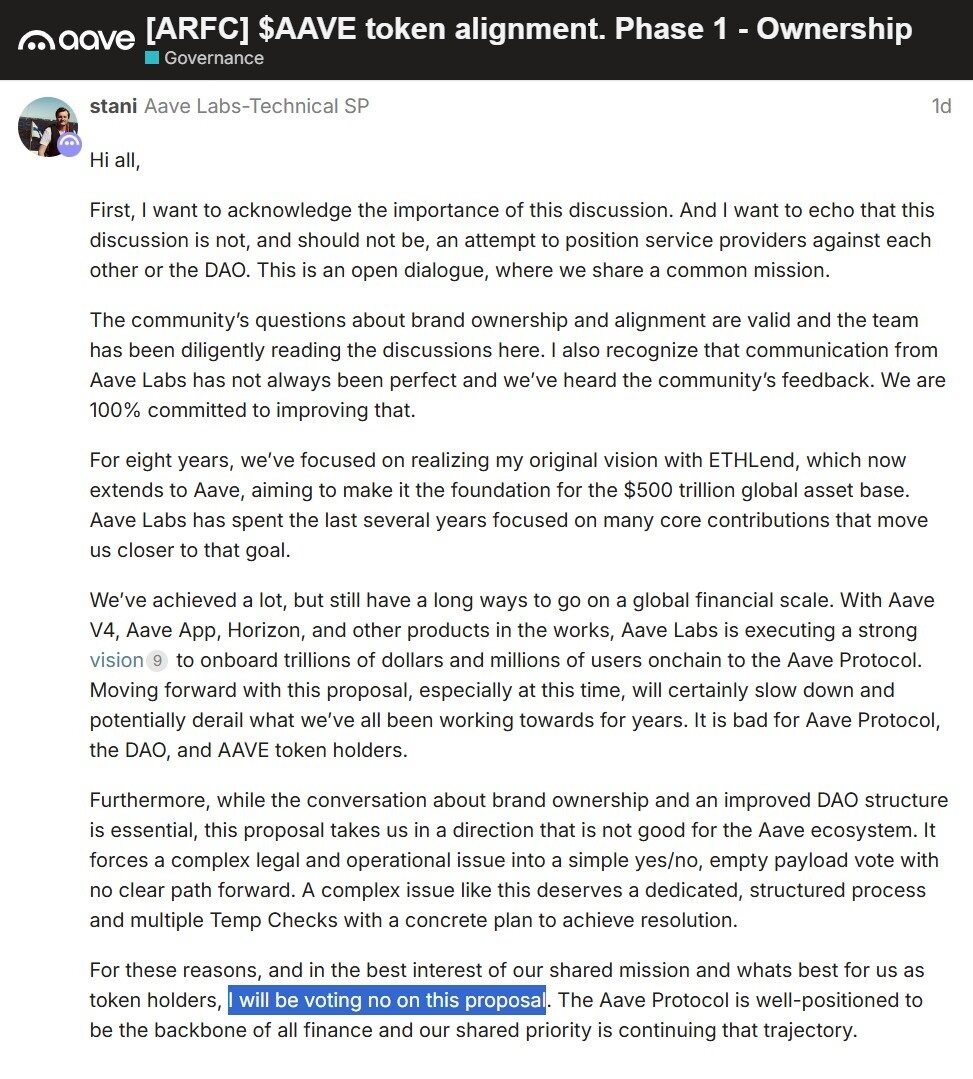

As community sentiment continued to escalate, Aave founder Stani appeared in the forum to respond, stating: “…this proposal leads us in a direction that is detrimental to the Aave ecosystem. It attempts to simplify a complex legal and operational issue into a simple 'yes/no' vote, without providing a clear execution path. Such complex issues should be handled through a specially designed structured process, achieving consensus through multiple interim checks and specific solutions. For the above reasons, I will vote against this proposal…”

From a business operation perspective, Stani's claim that the proposal is too hasty may not be wrong, but in the current discussion atmosphere, this statement can easily be interpreted as "the Aave founder disagrees with transferring brand assets to token holders," which clearly further exacerbates the tension between the community and the team.

After Stani's statement, some aggressive comments targeting Stani even appeared below the original post, and more users expressed dissatisfaction through the forum or social media. Some OG users mentioned that they first considered liquidating their AAVE holdings, while some loyal AAVE believers stated: “AAVE holders should realize that this is just another DeFi junk coin. It is neither better nor worse than other coins.”

The latest community dynamic is the aforementioned significant loss of over 13 million USD by the second largest whale selling off.

Can AAVE Still Be Bought?

Just two weeks ago, Odaily Planet Daily wrote an article titled “What Did the Smart Money See in Buying AAVE at a Low Price?.” At that time, AAVE was still a favorite of top institutions like Multicoin Capital, with its strong brand reputation, substantial capital reserves, clear expansion path, and robust income and buyback flow proving that AAVE is a "true value coin" distinct from other altcoins.

However, in just two weeks, a public opinion crisis from fee attribution to brand control and team-community relations has rapidly plunged AAVE from being a "value coin representative" to the center of controversy, even landing on the short-term decline list under emotional impact.

As of the time of writing, Aave Labs has stated below Ernesto's proposal that it has initiated an ARFC snapshot vote regarding the proposal, allowing AAVE holders to formally express their positions to clarify the future development direction. The outcome of this vote and the subsequent handling attitude of the Aave Labs team will significantly influence Aave's community faith and the short-term price performance of AAVE.

It is important to emphasize that this incident is not merely a "negative news" or "performance change," but a concentrated inquiry into Aave's existing governance structure and rights boundaries.

If you believe that Aave Labs will continue to align closely with Aave DAO in long-term interests, and that the current friction is more of a communication and process error, then the price pullback driven by emotions may be a good entry window; but if you think that the controversy exposed is not an isolated issue, but a structural contradiction of long-term unclear rights between the team and the protocol, lacking institutional constraints, then this turmoil may just be the beginning.

From a broader perspective, the controversy surrounding Aave is not an isolated case. As DeFi matures, with protocol revenues becoming real and considerable, and brands and front ends beginning to possess commercial value, some structural contradictions between protocols and products, teams and communities will surface. Aave being pushed into the spotlight this time is not because it has made more mistakes, but because it has gone further.

This debate over fees, brand, and control is not just a question for AAVE, but a question that the entire DeFi industry will inevitably face sooner or later.

免责声明:本文章仅代表作者个人观点,不代表本平台的立场和观点。本文章仅供信息分享,不构成对任何人的任何投资建议。用户与作者之间的任何争议,与本平台无关。如网页中刊载的文章或图片涉及侵权,请提供相关的权利证明和身份证明发送邮件到support@aicoin.com,本平台相关工作人员将会进行核查。