Recently, Bitcoin prices have continued to fluctuate below historical highs, with increasing divergence in market outlook. Two well-known institutions have released bearish reports, but at the same time, Wall Street giants and top venture capitalists have provided entirely different analytical perspectives. This article will outline the core arguments from various parties and analyze the deeper changes in the market.

1. Bearish Camp: Demand Exhaustion and Technical Breakdown

Renowned for on-chain data analysis, CryptoQuant and strategy analysis expert Fundstrat have both issued bearish warnings, with their core arguments pointing to stagnation in demand growth and breakdown of key support levels.

1. CryptoQuant: Demand Cycle Peaks, Clearly Announcing Bear Market Onset

In a report released on December 20, CryptoQuant bluntly stated: the growth in Bitcoin demand has significantly slowed, marking the market's transition to a bear market.

● Demand Wave Has Passed: The report analyzes that the three major waves of spot demand driving price increases since 2023—the launch of the US spot ETF, the results of the 2024 US presidential election, and the trend of public companies incorporating Bitcoin into their financial reserves—have largely exhausted their momentum. Since early October 2025, demand growth has consistently remained below trend levels.

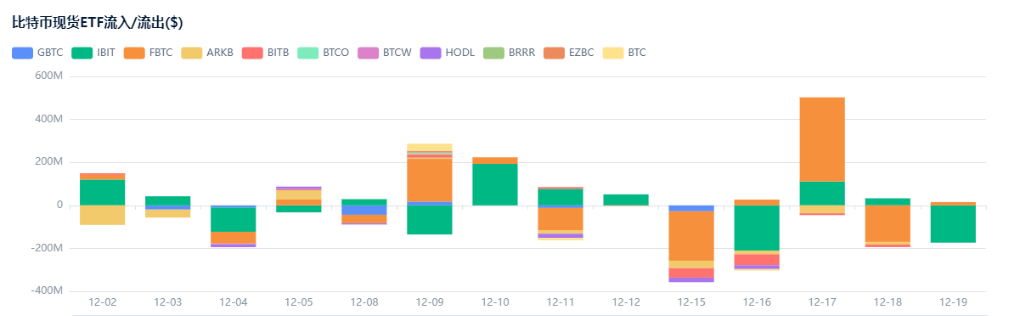

● Institutional Behavior Reversal: A key piece of micro evidence is that the US spot Bitcoin ETF turned into net selling in the fourth quarter of 2025, with holdings decreasing by about 24,000 Bitcoins. This starkly contrasts with the strong net buying during the same period in 2024. Additionally, the growth of addresses holding 100 to 1,000 Bitcoins (typically including ETFs and public companies) has also fallen below trend, resembling the situation before the bear market began at the end of 2021.

● Derivatives Market Cooling: The 365-day moving average funding rate for perpetual futures contracts has dropped to its lowest level since December 2023. Historically, a sustained decline in funding rates reflects a reduced willingness to maintain long positions in the market, which is a typical characteristic of a bear market, not a bull market.

● Key Technical Levels Lost: Bitcoin prices have fallen below their 365-day moving average (dynamic support level), which has historically been viewed as the dividing line between bull and bear markets.

Based on the above judgments, CryptoQuant has provided specific price predictions: the mid-term support level is around $70,000. If the downward trend continues, in the long term, Bitcoin's bear market bottom typically coincides with the "realized price" (currently about $56,000), suggesting a potential maximum drop of about 55% from recent highs—despite this, it could still be the smallest bear market retracement on record.

2. Fundstrat: Expecting Deep Corrections, Providing Opportunities for the Second Half of the Year

Sean Farrell, the head of digital asset strategy at Tom Lee's Fundstrat Global Advisors, also predicts that the market will face pressure in the short term in the "2026 Cryptocurrency Outlook" provided to internal clients.

● Clear Correction Targets: The report predicts that Bitcoin may fall to the $60,000-$65,000 range in the first half of 2026. Other major cryptocurrencies will also face significant declines: Ethereum (ETH) may drop to $1,800-$2,000, and Solana (SOL) may fall to $50-$75.

● Short-term Defense, Long-term Optimism: Farrell believes that this correction will provide more attractive entry opportunities for positioning before the end of 2026. He remains optimistic about Bitcoin and Ethereum's year-end targets, setting them at approximately $115,000 and $4,500, respectively. He suggests that if this correction prediction does not materialize, investors should maintain a defensive posture and wait for confirmation signals of a strengthening trend.

Interestingly, this contradicts the optimistic statement made by the company's co-founder Tom Lee in public, betting that Bitcoin and Ethereum will reach new highs in January, highlighting the significant divergence in short-term market outlooks.

2. Bullish/Neutral Camp: A "Golden Pit" in the Institutionalization Process?

In contrast to the aforementioned pessimistic views, traditional financial giants and some venture capital institutions have drawn different conclusions based on a more macro perspective of cycles and capital flows.

1. Citibank: Benchmark Target of $143,000, Huge Bull Market Potential

On the same day that CryptoQuant released its bearish report, Citibank analysts provided a multi-scenario forecast, with their benchmark expectation significantly higher than current levels.

● Three Scenario Predictions: Citibank sets the benchmark price for Bitcoin over the next 12 months at $143,000. They also provided an optimistic scenario of $189,000 and a pessimistic scenario of $78,500.

● Core Drivers: The report emphasizes that expected ETF capital inflows and a clearer regulatory environment are the main upward driving factors. It notes that if Bitcoin breaks through key technical levels (such as the 50-day moving average), it could open up upward space. Notably, their pessimistic scenario of $78,500 is roughly equivalent to the mid-term support level of $70,000 mentioned by CryptoQuant, indicating a consensus among different institutions regarding key support levels.

2. IOSG Ventures: Current Phase is "Institutional Accumulation," Not Bull Market Peak

Jocy Lin, founding partner of top cryptocurrency venture capital firm IOSG, shared a disruptive cyclical perspective on social media.

● Paradigm Shift: Jocy believes that 2025 marks a fundamental structural shift in the crypto market, transitioning from retail speculation dominance to institutional asset allocation dominance. Core data shows that institutional holdings have reached 24%, while retail investors have significantly exited.

● "Buy the Dip" Institutional Logic: He points out that the current phase is not the "bull market peak," but rather an "institutional accumulation phase." Institutions are continuously buying at high levels, looking at cycles over the next few years rather than short-term prices. Therefore, although Bitcoin's price closed down for the year in 2025, the spot Bitcoin ETF recorded a massive net inflow of about $25 billion.

● Policy-Driven Market Outlook: Based on the US political cycle, he predicts that the first half of 2026 will be in a "policy honeymoon period," driven by institutions and policies, with target ranges between $120,000 and $150,000. Political uncertainty in the second half of the year will increase market volatility.

3. Divergence of Institutional KOL Views and Market Structure Insights

In addition to professional reports, the views of key opinion leaders (KOLs) with institutional backgrounds or significant market influence are also noteworthy.

● Macro and KOL Influence: MicroStrategy CEO Michael Saylor, recognized as the "ultimate KOL" in the industry due to his company's continuous massive accumulation of Bitcoin and his bullish statements, significantly influences market sentiment and trading volume.

● Altcoin Valuation Warning: Pranav Kanade, a portfolio manager at asset management firm VanEck, previously pointed out a deep-seated issue: most assets constituting the altcoin market are severely overvalued, lacking long-term value. This suggests that if the overall market turns bearish, altcoins may face more severe adjustments than Bitcoin, and investors should be wary of risks.

4. Conclusion: The Market is in a Complex Game and Structural Restructuring Phase

Integrating various viewpoints, it is clear that the current market is in a phase of complex games and structural restructuring:

● Short-term Consensus and Long-term Divergence: For the short term (next 3-6 months), multiple institutions acknowledge that the market faces correction pressure, with the $65,000 to $75,000 range widely viewed as an important mid-term support zone. However, for the long term (12 months and beyond), there is significant divergence, ranging from bearish predictions of $56,000 to bullish predictions of $189,000, showcasing a remarkable span.

● Differences in Data Interpretation: The same data is assigned different narratives. Bears view net ETF outflows and prices breaking below the annual line as evidence of demand exhaustion and the onset of a bear market. In contrast, bulls interpret the massive net inflows of ETFs during price declines and the rising proportion of institutional holdings as signals of market structural health and long-term foundation strengthening. This divergence essentially represents a clash between the "cycle peak theory" and the "institutional mid-term theory."

● Evolution of Investment Logic: IOSG partner Jocy's perspective is highly enlightening, as he points out that the valuation logic of the old cycle may be failing. As pricing power gradually shifts from retail to institutions that follow different assessment cycles and risk preferences, the market's volatility patterns and top-bottom characteristics may change. The current fluctuations may no longer simply represent a transition between bull and bear markets, but rather growing pains in the alternation between old and new market structures.

For investors, amidst such a myriad of viewpoints and signals, it may be more essential to return to the essence: examine one's investment cycle and risk tolerance, understand the structural changes occurring in the market, avoid simply applying historical patterns, and maintain sufficient flexibility amid significant uncertainty.

Join our community to discuss and grow stronger together!

Official Telegram community: https://t.me/aicoincn

AiCoin Chinese Twitter: https://x.com/AiCoinzh

OKX benefits group: https://aicoin.com/link/chat?cid=l61eM4owQ

Binance benefits group: https://aicoin.com/link/chat?cid=ynr7d1P6Z

免责声明:本文章仅代表作者个人观点,不代表本平台的立场和观点。本文章仅供信息分享,不构成对任何人的任何投资建议。用户与作者之间的任何争议,与本平台无关。如网页中刊载的文章或图片涉及侵权,请提供相关的权利证明和身份证明发送邮件到support@aicoin.com,本平台相关工作人员将会进行核查。