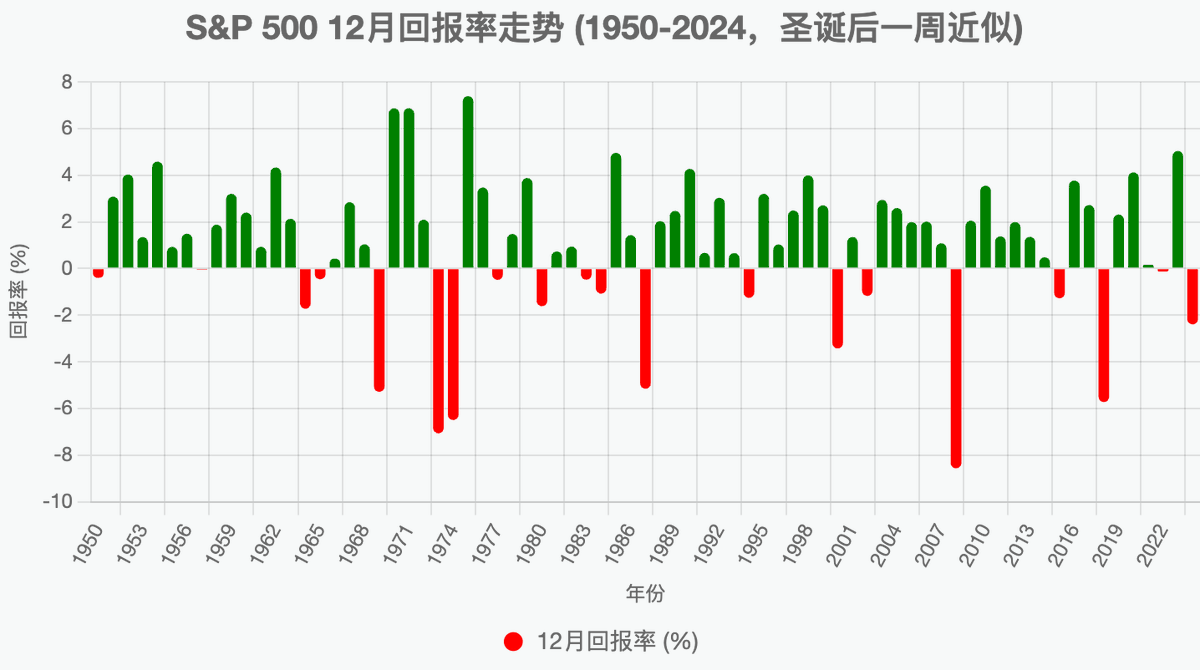

Starting next week, we will enter the Christmas market, referred to in the English-speaking world as the "Santa Claus Rally." This term refers to the performance of the S&P 500 during the week after Christmas, specifically the last five trading days of the year and the first two trading days of the following year. Historically, the Christmas rally has been positive 79% of the time, with the highest increase during this week being 7.4% and the largest decline being 4.2%. The average increase is around 1.3%.

From historical experience, the Christmas rally is not just a simple seasonal statistical phenomenon; it resembles a barometer of market risk appetite. If the market rises as expected from Christmas to New Year, it usually indicates that investors are still willing to allocate to risk assets despite a lack of new macroeconomic stimulus. This confirms risk appetite at the end of the year and lays the emotional foundation for asset pricing in the new year. Conversely, if the market does not rise, it often suggests that risk appetite has not recovered, making the market more susceptible to weakness or volatility in January and beyond.

From an institutional and seasonal perspective, on one hand, after tax-loss harvesting completed in mid-December, funds should flow back into the market. On the other hand, during the holiday period, institutional trading activity decreases and trading volume drops, meaning that a small amount of buying can push the index upward while also lowering short-term volatility. Additionally, year-end bonuses and automatic contributions to pensions (like 401k) may provide buying support for the market.

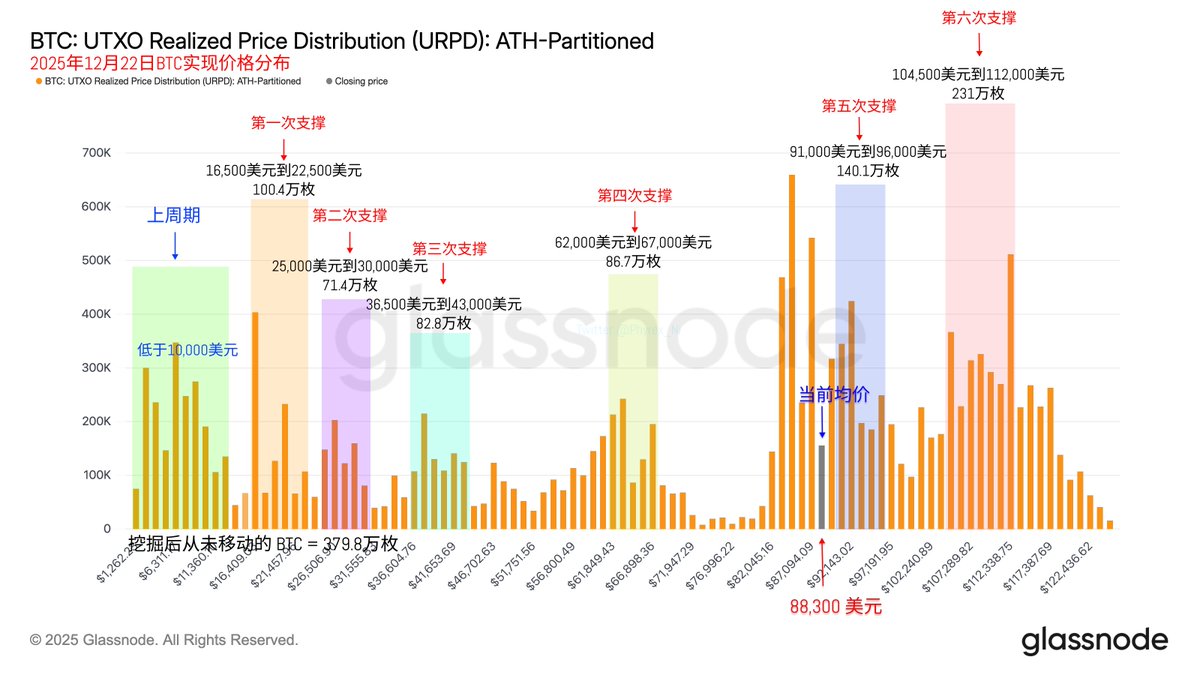

Looking at Bitcoin data, the trading volume finally decreased over the weekend, indicating that the real user transaction volume is indeed quite low. The usual high turnover rate is likely due to changes from quantitative or high-frequency short-term investors. The weekend figures should reflect the changes of actual holders. However, as we enter the Christmas market next week, overall trading volume and turnover rates are expected to decline.

This Christmas rally essentially sets the expectations for the first quarter of 2026. If the market fails to form an effective upward trend under favorable seasonal conditions, emotional vacuum, and gradually recovering liquidity, it may indicate that the current high-interest-rate environment is suppressing the economy, overshadowing the emotional boost from the holiday factors.

@bitget VIP, lower fees, better benefits

免责声明:本文章仅代表作者个人观点,不代表本平台的立场和观点。本文章仅供信息分享,不构成对任何人的任何投资建议。用户与作者之间的任何争议,与本平台无关。如网页中刊载的文章或图片涉及侵权,请提供相关的权利证明和身份证明发送邮件到support@aicoin.com,本平台相关工作人员将会进行核查。