It's quite strange that today marks the third consecutive day and the fourth time this week that Bitcoin has surged past $90,000 only to retreat. It feels like $90,000 is an insurmountable barrier; as soon as there’s an upward momentum, it gets slammed back down. Moreover, the rise in the U.S. stock market today is also quite good, with the Nasdaq recovering all its losses for the week. This indicates that the ongoing rise in the stock market can boost some sentiment for $BTC. If the stock market were to decline, it would be even more troublesome.

I also looked at the ETF data earlier. Although the returns are currently negative, it still ranks sixth in net fund flows among U.S. ETFs as of 2025. This shows that even though the price of Bitcoin is falling, most investors are not showing signs of panic selling. Additionally, compared to December 20, 2024, the current spot ETF holdings of BTC are still over 100,000 BTC more than at that time.

Therefore, it is quite normal for funds to be net inflowing. Of course, the price is still more than $10,000 apart, which indicates that most ETF investors are not aiming for hedging but indeed show signs of building positions.

Looking back at Bitcoin's data, the turnover rate, which had just decreased for two days, has risen again, which is a bit concerning. If the turnover rate does not come down, it will have a significant impact on the stability of the current price, indicating that a large number of investors are engaging in short-term trading. Next week is Christmas week, and liquidity will significantly decrease, which could help stabilize the current market for about two weeks.

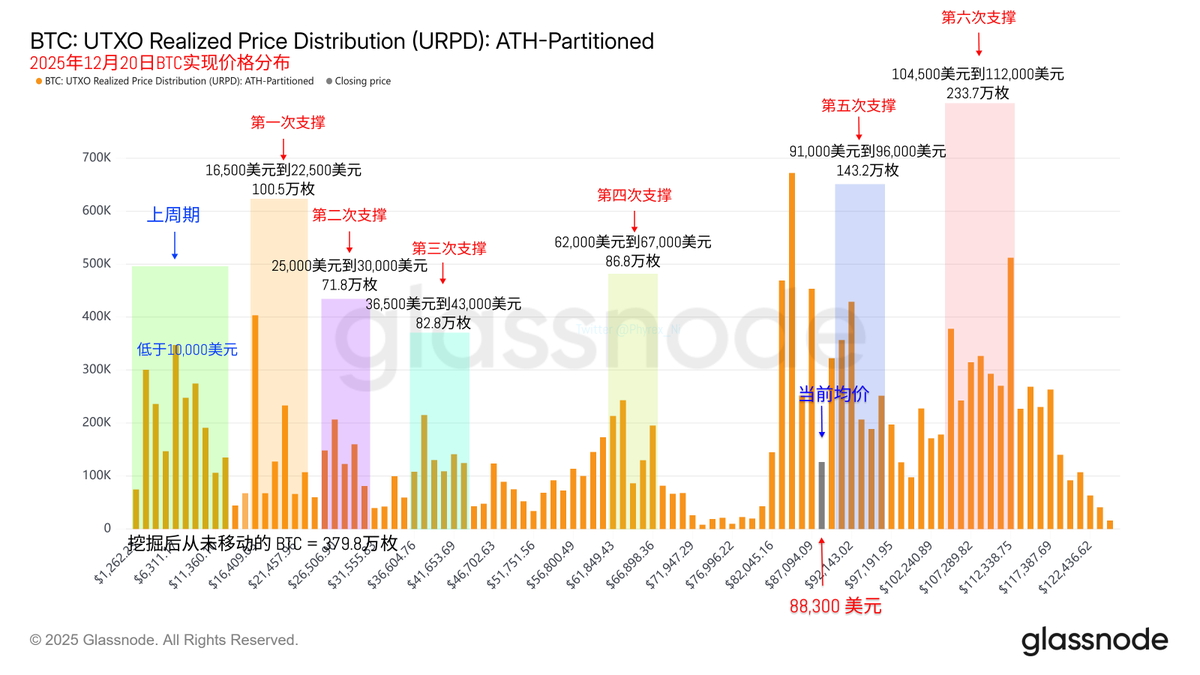

Currently, the chip structure is still quite healthy, and there hasn’t been much movement from the chips that are stuck at high positions. This should represent the portion dominated by ETF holdings, indicating that the sentiment of most loss-making investors remains quite stable.

@bitget VIP, lower fees, better benefits

免责声明:本文章仅代表作者个人观点,不代表本平台的立场和观点。本文章仅供信息分享,不构成对任何人的任何投资建议。用户与作者之间的任何争议,与本平台无关。如网页中刊载的文章或图片涉及侵权,请提供相关的权利证明和身份证明发送邮件到support@aicoin.com,本平台相关工作人员将会进行核查。