Selected News

Base App's first day of full opening saw over 12,000 new users, setting a new single-day record

Solana ecosystem meme coin JELLYJELLY continues to rise, with a 24-hour increase of about 40%

Japan's interest rate hike is finalized, well-known traders and analysts are unanimously bullish

RateX announces RTX token economics, with 44.18% allocated to the ecosystem and community

Selected Articles

In the past 24 hours, the crypto market has unfolded across multiple dimensions. Mainstream topics focus on the divergence in the issuance rhythm and buyback strategies of Perp DEX projects, as well as ongoing discussions about the expected TGE timing of Lighter and whether Hyperliquid's buyback will squeeze long-term development. In terms of ecosystem development, the Solana ecosystem has seen real-world attempts at DePIN, while Ethereum is simultaneously advancing changes in DEX fee structures and upgrades to the AI protocol layer. Stablecoins and high-performance infrastructure are accelerating their integration with traditional finance.

Whether stablecoins will impact the banking system has been one of the core debates over the past few years. However, as data, research, and regulatory frameworks become clearer, the answer is becoming more rational: stablecoins have not triggered large-scale deposit outflows; rather, under the real-world constraint of "deposit stickiness," they have become a competitive force that compels banks to improve interest rates and efficiency. This article reinterprets stablecoins from the perspective of banks. They may not be a threat but rather a catalyst forcing the financial system to renew itself.

On-chain Data

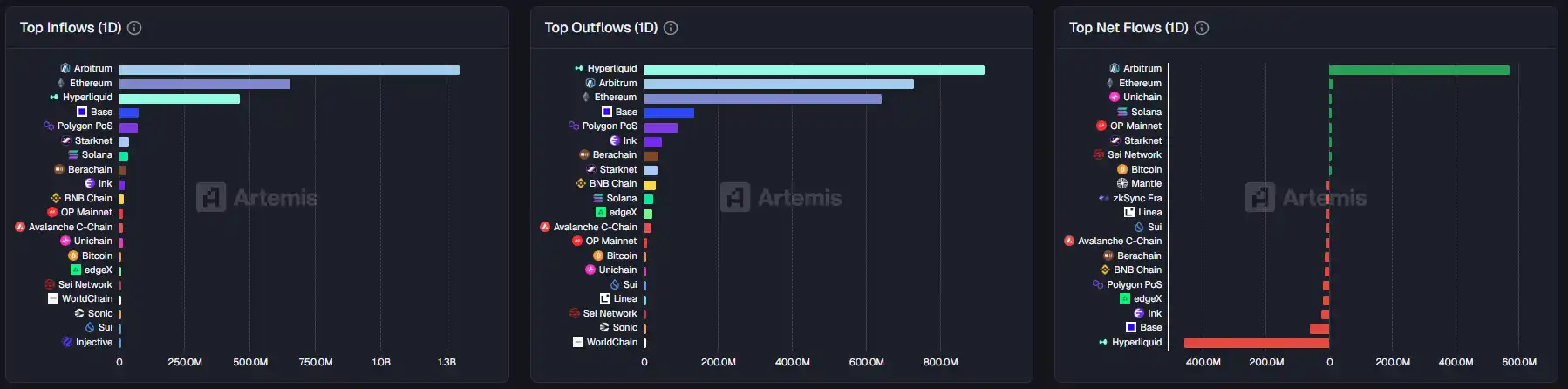

On-chain capital flow situation on December 19

免责声明:本文章仅代表作者个人观点,不代表本平台的立场和观点。本文章仅供信息分享,不构成对任何人的任何投资建议。用户与作者之间的任何争议,与本平台无关。如网页中刊载的文章或图片涉及侵权,请提供相关的权利证明和身份证明发送邮件到support@aicoin.com,本平台相关工作人员将会进行核查。