Written by: Gino Matos

Translated by: Saoirse, Foresight News

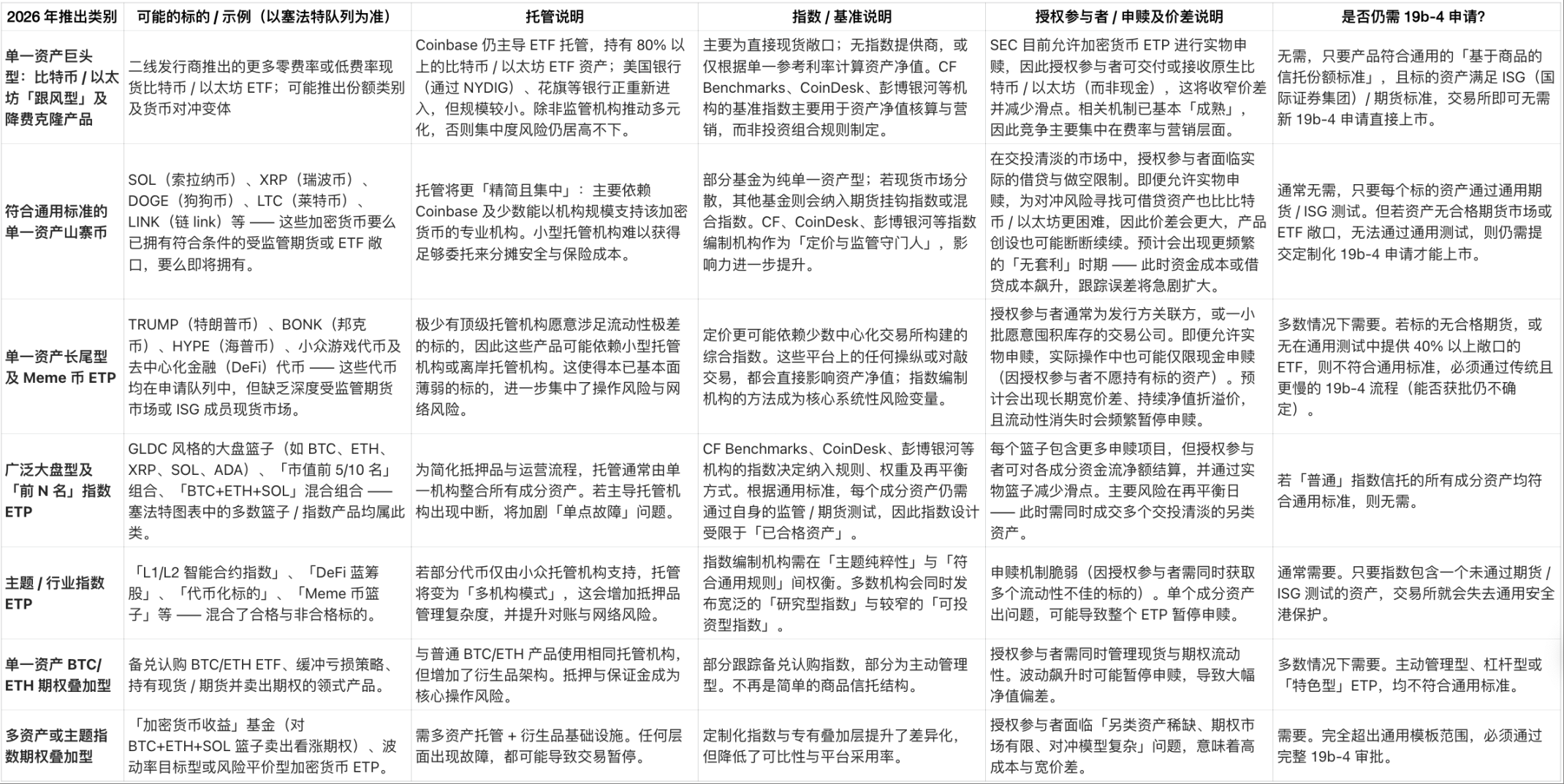

On September 17, 2025, the SEC approved a universal listing standard for exchange-traded products (ETPs) in cryptocurrency, shortening the product listing cycle to 75 days and opening the market for "plain" cryptocurrency ETFs (such as passively managed spot ETFs).

Bitwise predicts that over 100 cryptocurrency-related ETFs will be launched in 2026. Bloomberg's senior ETF analyst James Seyffart supports this prediction but also raises a warning:

"We will witness a large number of ETF liquidations."

This pattern of "explosive growth and rapid elimination" will become the next phase of cryptocurrency ETF development — the universal standard addresses the issue of "listing speed" rather than "liquidity." For Bitcoin, Ethereum, and Solana, the surge in ETFs will solidify their market dominance; however, for other cryptocurrencies, this will undoubtedly be a severe "stress test."

This rule mirrors the SEC's reforms for stock and bond ETFs in 2019: at that time, the annual number of new ETFs jumped from 117 to over 370, followed by immediate fee compression, with dozens of small funds liquidating within two years.

Cryptocurrency ETFs are repeating this experiment under "worse initial conditions."

First, there is a high concentration of custody: Coinbase holds assets for the vast majority of cryptocurrency ETFs, with an 85% share in the global Bitcoin ETF market. By the third quarter of 2025, Coinbase's custodial assets had reached $300 billion.

Additionally, authorized participants (APs) and market makers rely on a few platforms for pricing and lending services, and many altcoins lack sufficiently deep derivatives markets to hedge redemption flows without impacting prices.

In the "Physical Redemption Directive" released by the SEC on July 29, 2025, Bitcoin and Ethereum trusts are allowed to settle product creation trades with actual tokens instead of cash — this rule strengthens asset tracking but requires authorized participants to source, hold, and manage tax-related matters for each "basket of tokens." For BTC and ETH, this operation is still manageable.

However, for less liquid underlying assets, available borrowing funds may be completely exhausted during market volatility, forcing ETFs to suspend creation, leading to products trading at a premium until supply is restored.

Financial Infrastructure Under Pressure

In the redemption operations of highly liquid cryptocurrencies, authorized participants and market makers can handle larger capital flows, with their core limitation being the "availability of shorting tools": when the lending market for a new ETF's tracked token is "thin," authorized participants either demand larger bid-ask spreads or completely exit the market, causing the ETF to trade only through cash redemptions, thereby widening tracking errors.

If reference prices stop updating, exchanges may suspend trading — a report by Dechert LLP in October 2025 emphasized that even under a "fast-track approval process," this risk still exists.

Coinbase's custodial position, bolstered by its first-mover advantage, is now both its revenue engine and the focus of industry attention. U.S. Bancorp has restarted its institutional Bitcoin custody program, while Citigroup and State Street are also exploring custody partnerships for cryptocurrency ETFs.

These new custodial entrants have a clear "selling point": "Are you willing to let 85% of ETF capital flows depend on a single counterparty?" For Coinbase, more ETFs mean more revenue, more regulatory scrutiny, and a higher risk of "industry-wide panic triggered by a single operational misstep."

Index providers hold "invisible power." The universal standard links the "eligibility" of ETFs to "regulatory agreements" and "reference indices that meet exchange standards," effectively setting a threshold for "who can design benchmark indices." In the traditional ETF space, a few institutions like CF Benchmarks, MVIS, and S&P have already dominated; the same logic applies in the cryptocurrency space — wealth management platforms typically default to using indices they recognize, making it difficult for newly entered index providers with better methodologies to break through the existing landscape.

ETF "Elimination Wave": Who Will Be the First to Exit?

According to ETF.com, dozens of ETFs are liquidated each year — funds with assets below $50 million typically close within two years due to difficulty covering costs. Seyffart predicts that the wave of cryptocurrency ETF liquidations will arrive between late 2026 and early 2027, with the following three types of products being the most vulnerable:

- High-fee, redundant single-asset funds: The fees for Bitcoin ETFs launched in 2024 have already dropped to 20-25 basis points (50% lower than earlier products), and as the market becomes crowded, issuers will further lower flagship product fees, making high-fee redundant products uncompetitive;

- Niche index products: Poor liquidity and large tracking errors make it difficult to attract long-term capital;

- Thematic products: If the underlying market changes faster than the ETF structure can adjust (such as rapid iterations of certain DeFi tokens), products will be abandoned by investors due to "lagging."

In contrast, for Bitcoin, Ethereum, and Solana, the situation is the opposite: more ETF products will deepen their "spot-derivative linkage," narrow spreads, and solidify their status as "core institutional collateral." Bitwise predicts that ETFs will absorb over 100% of the new net supply of these three assets, creating a positive cycle of "ETF scale expansion → active lending market → narrowed spreads → attracting more institutional capital."

Unresolved Issues with the Rules: Who Controls "Access Rights"?

The universal standard does not cover all types of cryptocurrency ETFs — actively managed, leveraged, and "special" ETPs still need to submit separate 19b-4 applications (for example, a 2x leveraged daily reset ETF still follows the traditional approval process).

SEC Commissioner Caroline Crenshaw warned that the universal standard could allow a large number of "unreviewed" products to flood the market, creating "vulnerabilities that regulators can only discover in a crisis." Essentially, these rules direct the "flood" of ETFs toward the areas of cryptocurrency that are "most liquid and institutionalized."

The core issue remains unresolved: will this ETF frenzy ultimately lead to the integration of cryptocurrency's institutional infrastructure "around a few mainstream tokens and custodial institutions," or will it "broaden market access and diversify risk"?

For Coinbase, the $300 billion in custodial assets is both a "network effect" and a "risk bomb"; for long-tail cryptocurrencies, more ETFs mean "increased legitimacy," but also come with "market fragmentation, decreased liquidity for single products, and higher liquidation probabilities"; for issuers and authorized participants, it feels more like a "game" — issuers bet on "a few products surviving and subsidizing the rest," while authorized participants bet on "earning spreads and lending fees before a redemption wave."

The universal standard has made the "launch" of cryptocurrency ETFs easier, but it has not made "survival" easier.

免责声明:本文章仅代表作者个人观点,不代表本平台的立场和观点。本文章仅供信息分享,不构成对任何人的任何投资建议。用户与作者之间的任何争议,与本平台无关。如网页中刊载的文章或图片涉及侵权,请提供相关的权利证明和身份证明发送邮件到support@aicoin.com,本平台相关工作人员将会进行核查。