The latest precise points have arrived. After today's CPI trend has almost concluded and has been digested, there are currently two trades that can be made.

The first one is to go long at 2889, with a stop loss at 2839 and a target near 2988.

The second one is to short 2% near 2988 and short 3% near 3028, with a stop loss at 3059 and a target near 2889. Both are at 100X leverage with a 5% position size.

Follow the Warehouse God public account for timely updates.

Today's article is a must-read. It covers how the US and Japan navigate finance, the upcoming trends in the cryptocurrency market, and precise points!

The analysis from the Warehouse God is not limited to the cryptocurrency market; it's because this is all that is needed! Those who understand me know this well!

Regarding the yen interest rate hike, this is the first time in nearly 30 years that the yen, which has been used for arbitrage loans at 0% interest, has broken the balance, meaning the ATM has ultimately pulled up the sluice gate!

In the past 30 years, the active arbitrage yen has certainly amounted to several trillion dollars. Although this interest rate hike is not significant, even after the hike, there will still be profitable investments. It won't cause a chain reaction, but a return to a scale of around a trillion dollars should be expected!

How should we anticipate the direction of funds in advance? How does the US and Japan strategize? Below are the Warehouse God's views, and I believe there are few like my judgments online!

Looking back in time, what major events have occurred recently between the US and Japan? Trump's visit to Japan, the resurgence of Japanese militarism, Japan's $550 billion investment in the US, the US interest rate cut, China's rise in various fields, and the geopolitical games among countries, etc. Here, I will only take the content related to the cryptocurrency market.

From the above major events, it is not difficult to judge that the US policy aims to cut interest rates to save the economy, but they do not want funds to flow to China. Therefore, they adopt a tough stance towards Japan, forcing Japan to raise interest rates. It is important to note that Japan has not raised interest rates in 30 years. Why now? It's simple: the US is opening the floodgates, and Japan is acting as a reservoir to collect the water. Remember I mentioned Japan's $550 billion investment in the US? Japan basically cannot take this $550 billion back; this is the fundamental information of the big picture! The US has completed a rough closed loop for the direction of funds!

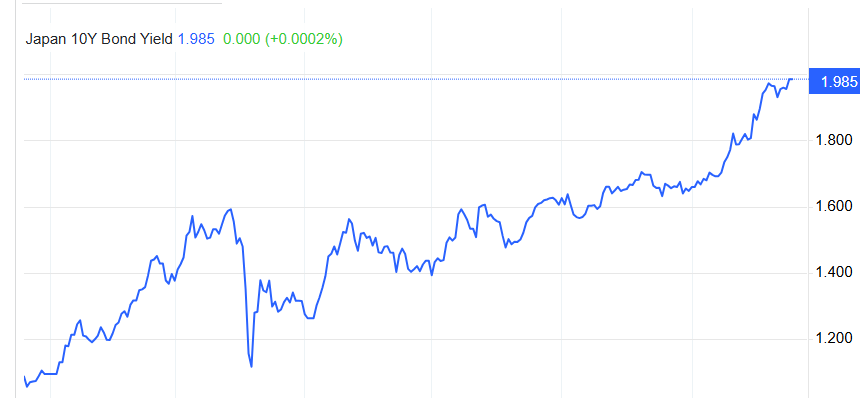

Next, we need to analyze how we can see, predict, and anticipate this wave of nuclear bombs before they arrive. The answer is US Treasury bonds. Recently, US Treasury bonds have been stable, with an annualized rate above 4%. The key is to look at Japan, where Japanese government bonds are also approaching 2%.

Looking at the following images, Figure 1 and Figure 2, Figure 3 show US and Japanese bonds, which have already soared, indicating that those who are concerned have already made their arrangements!

Now, let's move on to the analysis of the cryptocurrency market. Continue reading, skipping the images.

Japanese bond trends

US bond trends

Regarding our cryptocurrency market, their trends are not what we imagine as a decline. Why do I say this? It's simple.

The cryptocurrency market is merely a field for Wall Street's chives; they are harvesting chives, not overturning the field.

There will be sharp declines, but there will also be strong rebounds because with such large funds, as long as a small portion comes to the cryptocurrency market, it will be a major earthquake. This earthquake does not necessarily refer to a crash! Some large institutions have reached a consensus, and a strong rebound is also very normal. They are just making money; it’s not only through crashing the market that one can make money. For example, if I want to crash from 2800 to 2700, as an institution, I can crash the market without affecting my ability to push it back up to 2900 before crashing again. However, from 2800 to 2900, how many chives will be there to take the fall?

What I want to illustrate is that there has never been an absolute bull or bear market in the cryptocurrency space; it must be viewed rationally!

Next, I won't waste any more words. Regarding today's points, the strategy is definitely to primarily short with auxiliary longs.

Follow the Warehouse God to avoid getting lost. The Warehouse God not only provides precise points but also position sizes. Many people may question why the Warehouse God has over 3400 followers and still dares to publish such precise points without fear of having no way out. I can seriously reply that having no way out and high accuracy is my only way out because the Warehouse God's analysis does not stop at the cryptocurrency market!

免责声明:本文章仅代表作者个人观点,不代表本平台的立场和观点。本文章仅供信息分享,不构成对任何人的任何投资建议。用户与作者之间的任何争议,与本平台无关。如网页中刊载的文章或图片涉及侵权,请提供相关的权利证明和身份证明发送邮件到support@aicoin.com,本平台相关工作人员将会进行核查。