Written by: Jin Shi Data

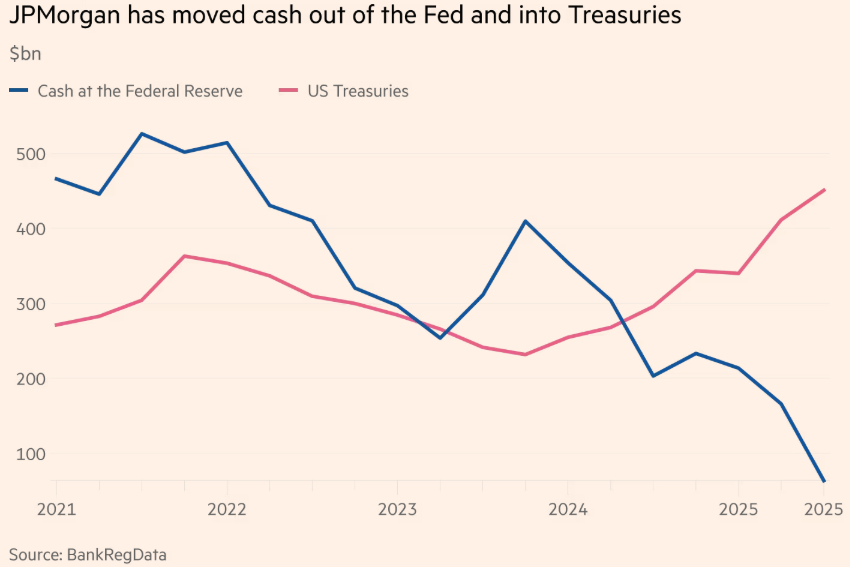

Since 2023, JPMorgan Chase has withdrawn nearly $350 billion in cash from its Federal Reserve account, investing most of it into U.S. government bonds. This move is part of the bank's defensive strategy to guard against the threat of interest rate cuts that could erode its profits.

According to data compiled by industry data tracking agency BankRegData, as of the third quarter of this year, the bank, which has assets exceeding $4 trillion, saw its balance at the Federal Reserve plummet from $409 billion at the end of 2023 to just $63 billion.

During the same period, the bank increased its holdings of U.S. Treasury bonds from $231 billion to $450 billion. This operation allowed it to lock in higher yields in anticipation of Federal Reserve rate cuts.

These fund transfers reflect how the largest bank in the U.S. is preparing for the end of a period of easy profits. During that time, banks could earn returns by keeping cash at the Federal Reserve while paying most depositors very low interest rates.

JPMorgan Chase transfers cash from the Federal Reserve to U.S. Treasuries

In 2022 and early 2023, the Federal Reserve rapidly raised its benchmark federal funds rate target range from near-zero levels to above 5%. The central bank then began to lower its target range at the end of 2024 and has indicated further rate cuts. This month, the Federal Reserve lowered rates to their lowest level in three years.

"It is clear that JPMorgan Chase is moving funds from the Federal Reserve to Treasuries," said Bill Moreland, founder of BankRegData. "Interest rates are falling, and they are acting preemptively." JPMorgan Chase declined to comment.

JPMorgan Chase has not disclosed the maturities of the U.S. Treasuries in its portfolio, nor has it specified the extent to which it uses interest rate swap contracts to manage risk. Unlike competitors such as Bank of America, which suffered significant paper losses on investments when rates surged in 2022, JPMorgan Chase avoided large investments in long-term bonds when rates were low in 2020 and 2021. At that time, JPMorgan Chase's stable deposit base allowed it to earn returns on cash held at the Federal Reserve that exceeded the costs it had to pay to depositors during high interest rate periods.

10-year U.S. Treasury yield exceeds the Federal Reserve's interest on reserves

The latest move to shift from cash to Treasuries before rate cuts helps lock in higher rates, thereby limiting the impact of falling rates on profits. The scale of JPMorgan Chase's withdrawals is so large that it offsets the total changes in Federal Reserve funding for the remaining 4,000+ banks in the U.S. Since the end of 2023, total deposits at the Federal Reserve from various banks have decreased from $1.9 trillion to about $1.6 trillion.

Since 2008, banks have been able to earn interest on cash held at the Federal Reserve, providing the Fed with a mechanism to influence short-term interest rates and liquidity in the financial system. However, interest payments have surged over the past two years, with the amount paid as interest on reserves reaching $186.5 billion in 2024.

Interest paid by the Federal Reserve to banks skyrockets

The Federal Reserve's practice of paying interest on reserve balances is controversial. In October, the U.S. Senate voted down a bill aimed at prohibiting the Fed from making these interest payments. Senator Rand Paul, who pushed for this change, argued that the Federal Reserve is paying banks hundreds of billions while leaving funds idle. Other Republican senators, including Ted Cruz and Rick Scott, also expressed opposition.

In a report earlier this month, Paul claimed that since 2013, the top 20 recipients of Federal Reserve interest payments have received $305 billion, with JPMorgan Chase receiving $15 billion in 2024, while the bank's total profit for that year was $58.5 billion.

免责声明:本文章仅代表作者个人观点,不代表本平台的立场和观点。本文章仅供信息分享,不构成对任何人的任何投资建议。用户与作者之间的任何争议,与本平台无关。如网页中刊载的文章或图片涉及侵权,请提供相关的权利证明和身份证明发送邮件到support@aicoin.com,本平台相关工作人员将会进行核查。