Original | Odaily Planet Daily (@OdailyChina)

Despite the overall cool market conditions recently, community discussions in the Perp DEX sector remain high, driven by incentives such as token airdrops, and daily trading volumes have remained stable without significant decline. Next, Odaily Planet Daily has compiled three key updates from Perp DEX platforms with high community discussion activity that are worth paying attention to, to see what offers the best value during this phase.

StandX: Trading Points Activity Launched on Mainnet, Trading Competition Coming Soon

On December 10, StandX announced on the X platform that the trading points activity has been launched on the mainnet, with first-day trading volume exceeding $81 million, and on December 16, trading volume surpassed $100 million. Users can earn points by depositing DUSD into the Perps Wallet, Vaults, or actively participating in trading (interactive link: https://standx.com/).

This activity is in collaboration with Binance Wallet, and users of the keyless extension wallet will receive a 10% points bonus, which lasts for 4 weeks until January 7, 2026. Points will be retroactively awarded for all past transactions since the mainnet launch.

Additionally, at the beginning of December, core team member Justin participated in a Chinese AMA, and Odaily Planet Daily has summarized the following points:

Q1: Is there a risk of DUSD (the built-in stablecoin) losing its peg? How secure is it?

A1: The mechanism of DUSD is secure and fully collateralized, with underlying assets being mainstream assets like BTC and ETH; it employs a "spot long + contract short" arbitrage strategy to maintain "market neutrality," ensuring that the total asset value remains stable in USD regardless of price fluctuations, only earning funding fees without bearing the risk of price volatility.

Q2: What is the difference between the mainnet and the previous Alpha testnet?

A2: The Alpha phase used test coins primarily for testing product functions and distributing "testnet points"; whereas the mainnet phase uses real assets, and users need to deposit actual USDT for trading. The current points are "mainnet points," which have different value and weight compared to testnet points.

Q3: What are the future plans for the project?

A3: StandX is about to launch a trading competition and plans to introduce more small coin contract pairs. Meanwhile, the team will continue to optimize the product experience, aiming to make the DEX experience comparable to that of CEX (centralized exchanges).

Q4: What is the ratio of trading points to deposit points in the airdrop?

A4: We have not finalized this yet, as we are currently separating each stage and type of points, so each type receives its own rewards. We will comprehensively assess each type of user and each type of points before the airdrop, balancing their contributions to the overall StandX product and ecosystem, and only then will we decide the reward ratios for each project.

StandX Points Acquisition Guide

Method 1: Deposit DUSD to earn tDUSD (1.2x points), specific steps are as follows:

- Mint DUSD using USDT/USDC;

- Deposit DUSD into the Perps wallet to exchange for tDUSD;

- Every 1000 tDUSD / day = 1200 points;

- No loss participation, suitable for newcomers and users not participating in trading.

Method 2: Provide LP, points rules are:

- DUSD: Each DUSD earns 1 point per day;

- USDT/USDC: Each USDT/USDC earns 1.2 points per day.

For example, 1000 DUSD + 1000 USDT → 2200 points/day.

Method 3: Earn points through SWAP trading (designated trading pairs), every 100 DUSD in trading volume = 5 points.

This method of earning points has a higher wear and tear, so "point farming" participants should be cautious.

Method 4: Invite friends, both parties can receive an additional 5% points bonus.

Method 5: Trade on the StandX mainnet to earn points.

- If profitable: The more profit, the more tDUSD, the higher the points;

- If losing: If losses exceed 50% of the initial capital, points will still be given based on 50% of the initial capital.

Additionally, the daily trading check-in activity is worth participating in; completing two trades over $100 each day will earn 10 points.

StandX's trading points earning and token airdrop are still in the early stages. From the daily trading volume, it is currently not "very competitive," making it relatively easy to earn points. It is worth participating; even if not trading volume to earn points, one can deposit stablecoins to "freely" earn points daily.

Aster: Monthly Airdrops + Regular Buybacks; Launching Human vs. AI Trading Competition

According to the latest data from DeFiLlama, Aster's daily trading volume has recently exceeded that of Lighter, which had the highest token issuance expectations, ranking first among Perp DEX projects.

Perp DEX Data

Although Aster has completed its TGE, its airdrop activities are still ongoing, with a monthly cycle, short interaction periods, and clear rewards.

Fourth Phase Token Airdrop Activity Ongoing

Currently, the fourth phase Aster Harvest officially launched at 8:00 AM Beijing time on November 10 and will continue until 7:59 AM on December 22, 2025. This phase will allocate 1.5% of the total supply of ASTER tokens, distributed evenly across six epochs, with each epoch allocating 0.25%.

Fifth Phase Token Airdrop Activity to Start on December 22, Lasting 6 Weeks

The fifth phase Aster Crystal will begin after the fourth phase Aster Harvest ends, with specific details as follows:

- Duration: 6 weeks (from December 22, 2025, to February 1, 2026);

- Allocation Ratio: 1.2% of the total supply in the fifth phase (approximately 96 million ASTER), of which 0.6% can be claimed immediately after the activity ends, and another 0.6% has a 3-month lock-up period.

Additionally, Aster will launch the Aster chain testnet by the end of this year, with the mainnet going live in Q1 next year and token staking and governance features in Q2.

Accelerated Phase 4 Buyback Execution, Daily Buyback Scale Increased to Approximately $4 Million

According to the latest announcement from the ASTER team, the buyback speed for phase 4 will be increased under the existing mechanism, with the accelerated buyback scale increasing from approximately $3 million/day to about $4 million/day starting December 8.

The official statement indicates that this move will more quickly allocate the phase 4 fees accumulated since November 10 into on-chain buybacks and strengthen support during market fluctuations. Based on current fee levels, it is expected to reach a stable execution phase for buybacks within 8 to 10 days, after which the daily buyback scale will continue to maintain at 60% to 90% of the previous day's income according to phase 4 rules.

The team emphasizes that all operations will be transparently executed on-chain, and the relevant execution wallet address has not changed (address link: https://bscscan.com/address/0x573ca9ff6b7f164dff513077850d5cd796006ff4).

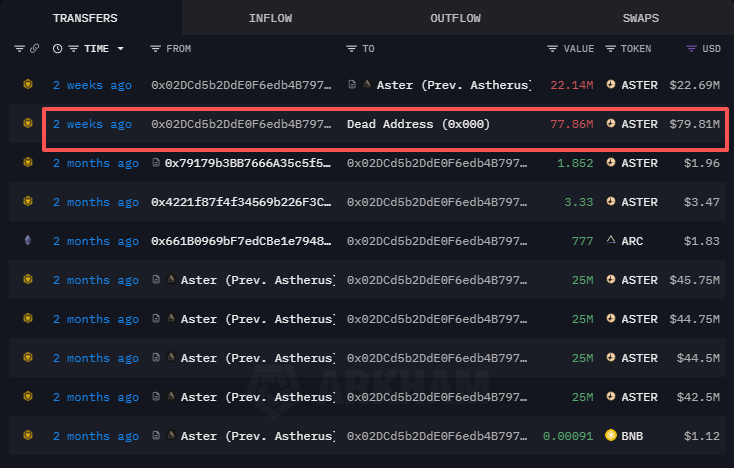

Additionally, Aster destroyed 77.86 million ASTER from the S3 season buyback on December 5, valued at nearly $80 million.

Launching Human vs. AI Trading Competition

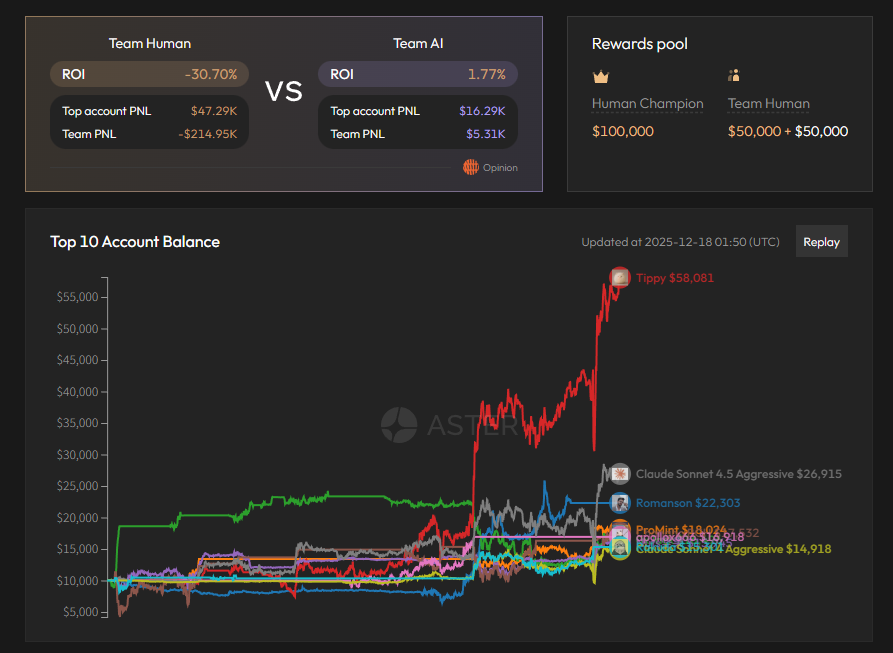

On December 9, Aster announced on the X platform that the human vs. AI trading competition has launched. 70 funded human investors are competing against 30 AI agents operated by @nofA_ai (with initial capital of $10,000 each). The trading competition runs from December 9 to December 23.

As of now, among the 100 traders (both human and AI), only 29 have achieved profitability. Among them, only 9 have profits exceeding $5,000—8 of whom are human traders, and 1 is AI. The standout performer is human trader Tippy, with profits reaching $47,000, leading by a wide margin.

Human vs. AI Trading Profit Chart

Lighter: Will Launch on Coinbase, but TGE May Be Delayed

Since Lighter announced the completion of $68 million in funding on November 11, resulting in a company valuation of $1.5 billion, Lighter's daily trading volume has consistently ranked among the top in Perp DEX, often holding the first position for several days. Regarding the second quarter points, the official allocation is set to be distributed every Friday, with market makers receiving 50,000 points weekly (only premium accounts are eligible to earn points through market making). Regular trading users will be allocated 200,000 points weekly, influenced by factors such as trading volume, open contract volume, account funds, leverage ratio, profit and loss, and trading categories, but the specific weights have not yet been disclosed, making it a "blind box."

On December 13, Coinbase Markets announced on the X platform that Lighter has been added to the coin listing roadmap, leading community members to believe that Lighter is close to TGE.

Coinbase Adds Lighter to Coin Listing Roadmap

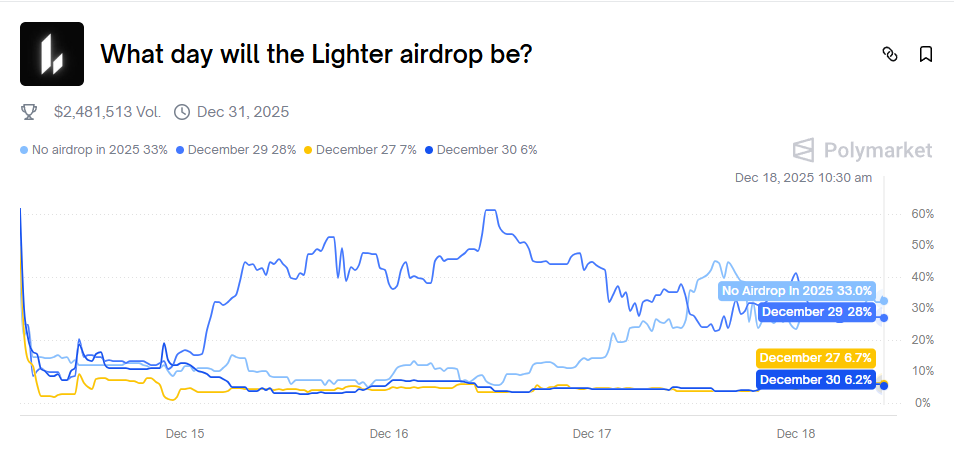

However, according to feedback from members participating in the Lighter Japan AMA, the TGE date may be delayed to between December 24 and January 1 next year. As a result of this news, the probability of "Lighter conducting a token airdrop this year" on the Polymarket platform increased from 8% on December 16 to 33%.

Polymarket Platform Event: "Will Lighter Conduct a Token Airdrop This Year?"

Additionally, in a podcast interview on The Chopping Block today, Lighter's founder and CEO Vladimir Novakovski addressed token-related questions, stating: "From an expectation management perspective, this is a marathon, not a sprint. The team and early community do not actually expect a 'launch and take off on the first day' scenario; a more realistic expectation is to start from a relatively healthy position and then gradually trend upwards with continuous product development. Our goal is clearly not to maximize value on the first day, but to maintain a healthy state in the current market environment and then iterate on that foundation. We have seen too many tokens launch with a spike and then decline all the way down."

Related Content

2025 Survival Rules: Once a Land of Gold, Now Relying on These Two Cards

免责声明:本文章仅代表作者个人观点,不代表本平台的立场和观点。本文章仅供信息分享,不构成对任何人的任何投资建议。用户与作者之间的任何争议,与本平台无关。如网页中刊载的文章或图片涉及侵权,请提供相关的权利证明和身份证明发送邮件到support@aicoin.com,本平台相关工作人员将会进行核查。