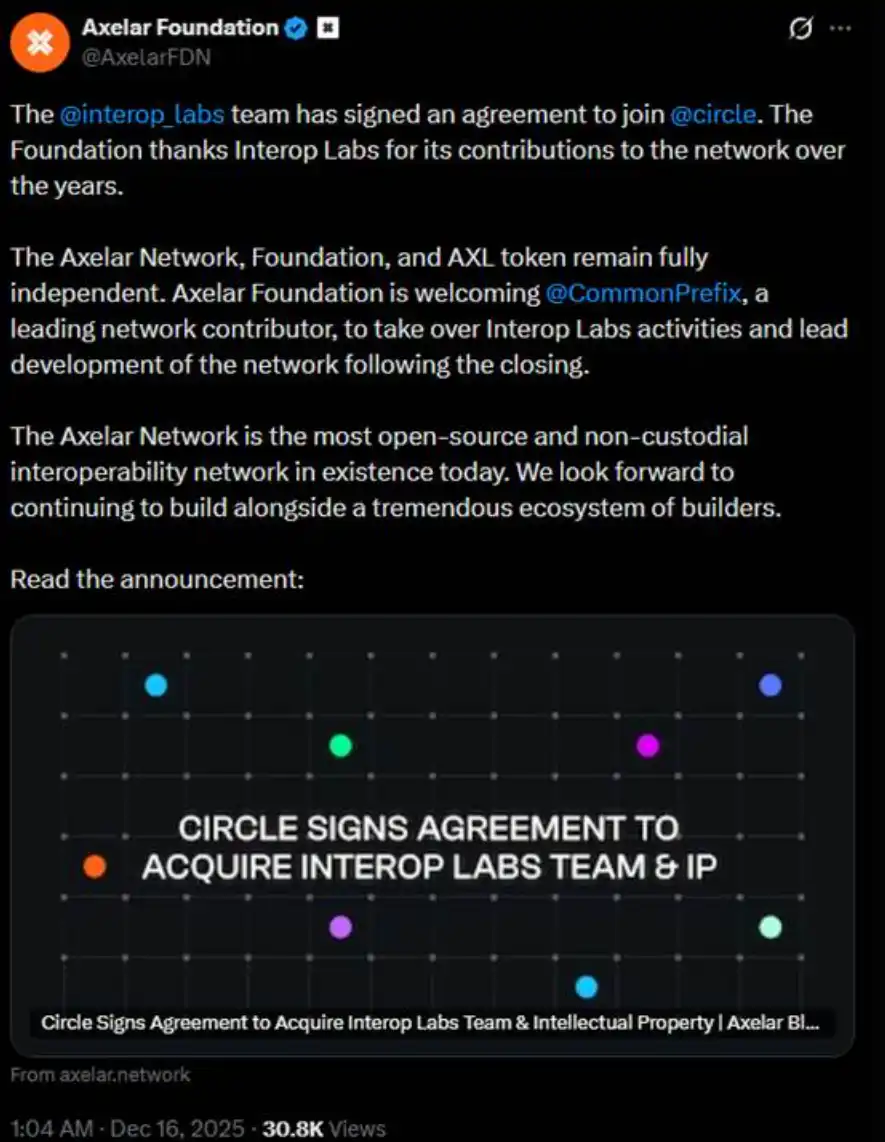

In the early hours of the day before yesterday, the Interop Labs team (the initial developers of Axelar Network) announced its acquisition by Circle to accelerate the development of its multi-chain infrastructure Arc and CCTP.

Logically, being acquired is a good thing. However, the further details provided by the Interop Labs team in the same tweet caused a huge uproar. They stated that the Axelar network, the foundation, and the AXL token will continue to operate independently, with development work being taken over by CommonPrefix.

In other words, the core of this transaction is that "the team is integrated into Circle" to promote the application of USDC in the fields of privacy computing and compliant payments, rather than an overall acquisition of the Axelar network or its token system. Circle has bought the team and technology, but your original project is not Circle's concern.

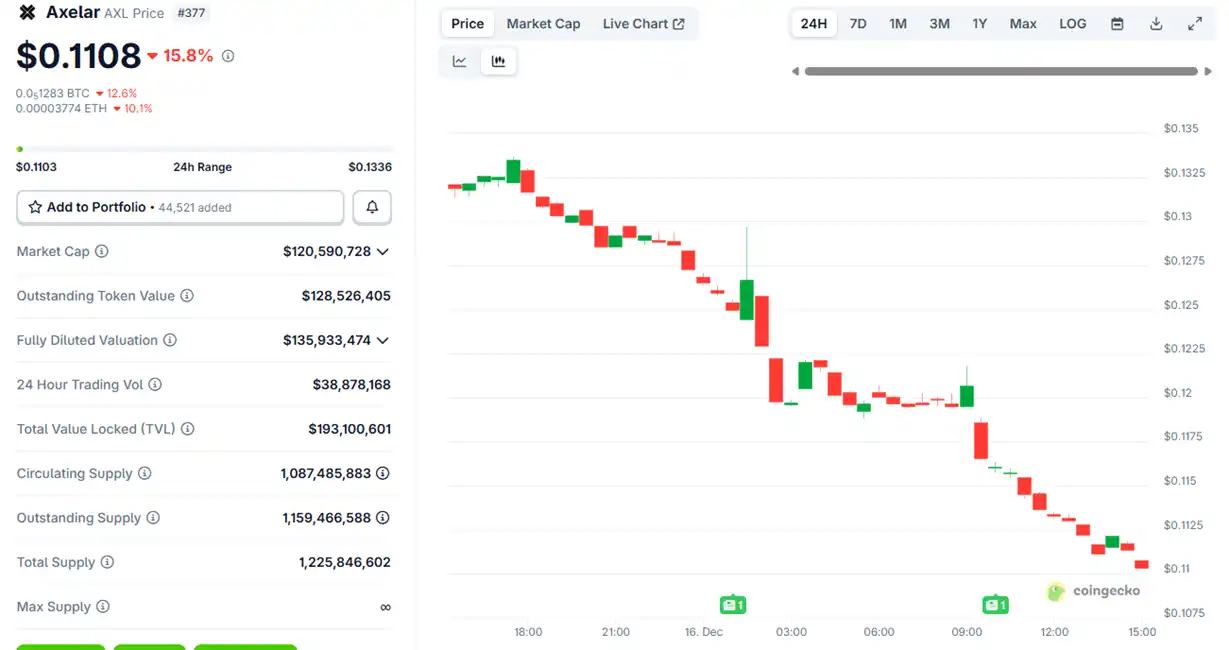

After the acquisition news was announced, the price of the Axelar token $AXL initially surged slightly before starting to decline, currently down about 15%.

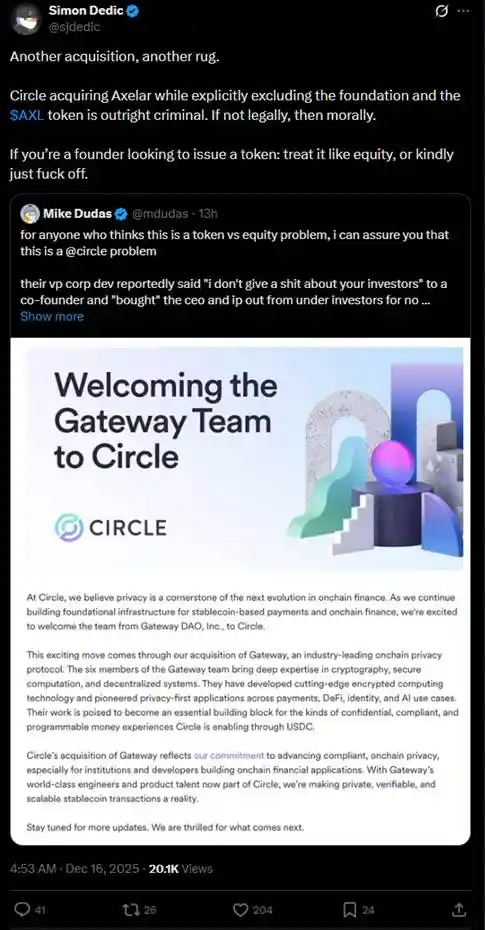

This arrangement quickly sparked intense discussions in the community about "token vs equity." Several investors questioned that Circle, through the acquisition of the team and intellectual property, has substantially obtained core assets while bypassing the rights of AXL token holders.

"If you are a founder and want to issue a token, treat it like equity or get lost."

In the past year, similar cases of "wanting the team, wanting technology, but not the tokens" have repeatedly occurred in the crypto space, causing serious harm to retail investors.

In July, the foundation of Kraken's Layer 2 network Ink acquired the decentralized trading platform Vertex Protocol based on Arbitrum, taking over its engineering team and trading technology architecture, including synchronized order books, perpetual contract engines, and money market code. After the acquisition, Vertex shut down its services on nine EVM chains, and the token $VRTX was abandoned. Following the announcement, $VRTX plummeted over 75% on the same day, gradually "going to zero" (currently with a market cap of only $73,000).

However, $VRTX holders at least had a slight consolation, as they would receive a 1% airdrop during the Ink TGE (the snapshot has ended). Next, there were even worse cases where tokens were directly invalidated without any compensation.

In October, pump.fun announced the acquisition of the trading terminal Padre. When the news of the acquisition was announced, pump.fun also stated that the Padre token would no longer be used on the platform and directly indicated that there were no future plans for the token. Due to the declaration of token invalidation in the last reply of the thread, the token briefly doubled before sharply declining, and currently, $PADRE has only a market cap of $100,000.

In November, Coinbase announced the acquisition of the Solana trading terminal Vector.fun built by Tensor Labs. Coinbase integrated Vector's technology into its DEX infrastructure but did not involve the Tensor NFT marketplace itself or the $TNSR token rights, with some members of the Tensor Labs team moving to Coinbase or other projects.

The price movement of $TNSR has been relatively stable among these examples, experiencing a rise and fall, currently returning to a level appropriate for an NFT marketplace token, and still above the low point before the acquisition news.

In Web2, small companies are legally acquired by large enterprises in a manner described as "acquihire," where the focus is on "wanting the team, wanting technical intellectual property, but not equity." Particularly in the tech industry, "acquihire" allows large companies to quickly integrate excellent teams and technologies, avoiding the lengthy process of hiring from scratch or internal development, thus accelerating product development, entering new markets, or enhancing competitiveness. Although this is unfavorable for small shareholders, it stimulates overall economic growth and technological innovation.

Nevertheless, "acquihire" must also adhere to the principle of "acting in the best interest of the company." The reason these examples in the crypto space have caused such anger in the community is that the "small shareholders" as token holders completely disagree that the project parties are "acting in the best interest of the company" for the better development of the project. Project parties often dream of listing on the US stock market when the project itself can make a lot of money, while at the same time issuing tokens to make money when everything is just starting or nearing its end (the most typical example being OpenSea). When these project parties make money from tokens, they turn around and look for their next opportunity, leaving past projects only as part of their resumes.

So, do retail investors in the crypto space have to keep swallowing their grievances? Just the day before yesterday, former Aave Labs CTO Ernesto released a governance proposal titled "$AAVE Alignment Phase 1: Ownership," making a stand for token rights in the crypto space.

The proposal advocates that Aave DAO and Aave token holders should explicitly control core rights such as protocol IP, brand, equity, and revenue. Aave service provider representative Marc Zeller and others publicly endorsed the proposal, calling it "one of the most influential proposals in Aave governance history."

In the proposal, Ernesto mentioned, "Due to some past events, previous posts and comments have held strong hostility towards Aave Labs, but this proposal seeks to remain neutral. This proposal does not imply that Aave Labs should not be a contributor to the DAO or lacks legitimacy or capability in its contributions, but the decisions should be made by Aave DAO."

According to crypto KOL @cmdefi's interpretation, the conflict arose when Aave Labs replaced the front-end integration of ParaSwap with CoW Swap, resulting in the fee flow going to Aave Labs' private address. Correspondingly, Aave DAO supporters believe this is a form of plunder, as with the existence of AAVE governance tokens, all benefits should prioritize flowing to AAVE holders or remain in the treasury to be decided by DAO votes. Additionally, previously, ParaSwap's revenue would continuously flow into the DAO, and the new CoW Swap integration changed this status, further leading the DAO to view it as a form of plunder.

This directly reflects a conflict similar to "shareholders vs management," and again highlights the awkward positioning of token rights in the crypto industry. In the early days of the industry, many projects promoted the "value capture" of tokens (such as earning rewards through staking or directly sharing profits). However, since 2020, the SEC's enforcement actions (such as lawsuits against Ripple and Telegram) have forced the industry to shift towards "utility tokens" or "governance tokens," which emphasize usage rights rather than economic rights. The result is that token holders often cannot directly share in project profits—project revenues may flow to teams or equity held by VCs, while token holders are left like small shareholders generating love without compensation.

As seen in the examples mentioned in this article, project parties often sell teams, technical resources, or equity to VCs or large enterprises while selling tokens to retail investors, resulting in a situation where resource and equity holders profit first, while token holders are marginalized or left with nothing. This is because tokens do not possess legal investor rights.

To avoid the regulation that "tokens cannot be securities," tokens are designed to be increasingly "useless." By circumventing regulation, retail investors find themselves in a very passive and unprotected position. The various cases that have occurred this year have, in a sense, reminded us that the current "narrative failure" in the crypto space may not be that people no longer believe in narratives—narratives are still good, profits are still decent, but when we purchase tokens, what can we actually expect?

免责声明:本文章仅代表作者个人观点,不代表本平台的立场和观点。本文章仅供信息分享,不构成对任何人的任何投资建议。用户与作者之间的任何争议,与本平台无关。如网页中刊载的文章或图片涉及侵权,请提供相关的权利证明和身份证明发送邮件到support@aicoin.com,本平台相关工作人员将会进行核查。