This article is co-authored by BenFen x TX-SHIELD:

The transparency of blockchain is the cornerstone of its trust mechanism, but this characteristic of public records has now become a core obstacle to large-scale application deployment. For the vision of Web3, this is a "double-edged sword": it brings verifiable trust at the cost of sacrificing business secrets, personal wealth privacy, and compliance flexibility.

For enterprises, every on-chain settlement may expose core supplier relationships, procurement costs, and compensation strategies to competitors; for individual users, every on-chain payment permanently records and publicly discloses their consumption habits, asset status, and social relationships; for regulatory agencies, a new balance must be found between "protecting public privacy" and "fulfilling financial compliance responsibilities."

Transparency should not come at the cost of sacrificing core privacy. The BenFen public chain (Powered by TX-SHIELD) officially launches its privacy payment feature. This marks our transition from an era of "public exchange for trust" to a new paradigm of "privacy generates trust." This article will be divided into two parts: the first part will demonstrate how privacy payments address the pressing pains in the business, personal, and regulatory fields; the second part will unfold the future landscape, exploring how we can collectively build a complete ecosystem from on-chain Dark Pools, confidential voting, to confidential auctions, and even new social collaboration models based on this cornerstone of privacy.

TX-SHIELD is a technology company developing privacy payment algorithms, providing a one-stop solution for public chains, stablecoin issuers, and DEXs that is regulatory-friendly and privacy-protecting. www.tx-shield.com

Addressing Current Pain Points—Urgent Application Scenarios and In-Depth Analysis of Privacy Payments

For B-end Enterprises: Privacy Payments as a Strategic Tool for Business Competition and Compliance Management

1. Protecting Salary Payment Privacy: Taking Deel as an Example to Create a "Strategic Tool" for Enterprise Talent Management

In modern enterprises, especially in the global talent competition of multinational companies, the compensation system is a core strategic component. However, when companies attempt to use transparent blockchain technology for salary payments, they face a severe problem.

Taking the global payroll management platform Deel as an example, which is one of the fastest-growing SaaS companies in history, its core business revolves around processing payroll payments for employees worldwide. Deel actively embraces blockchain technology, allowing global employees and contractors to withdraw instantly in cryptocurrencies like Bitcoin and USDC through its "Deel Crypto" service, effectively addressing the slow and costly pain points of traditional cross-border wire transfers. However, this adoption of blockchain payment efficiency poses significant transparency challenges.

For Deel and its tens of thousands of client companies, if they use public and transparent blockchain for salary payments, every on-chain payment would permanently expose the client's compensation structure, salary levels across different countries and positions, and even specific employee income information to the public. This could not only trigger internal salary conflicts and external competitive poaching within client companies but also directly leak Deel's most core business secret—its global salary database, fundamentally threatening its multi-billion dollar valuation.

This reality reflected by real business scenarios has given rise to a clear and urgent demand from enterprises: global companies like Deel that have already adopted blockchain payment efficiency, as well as many others seeking efficient and transparent salary management, urgently need a payment solution. It must efficiently, accurately, and immutably handle global salary payments using blockchain technology while absolutely ensuring the confidentiality of salary data, avoiding catastrophic data leaks due to the transparency of payment tools.

Currently, many leading Web3 companies and DAOs have successfully validated the feasibility and necessity of privacy payments in salary management by adopting privacy technologies like Zcash or Aztec Network. These practices indicate that upgrading salary confidentiality from relying on institutional and trust-based "contractual commitments" to cryptography-based "technical guarantees" has become an inevitable direction for the evolution of modern enterprises, especially global companies.

The privacy payment feature of BenFen Chain (www.benfen.org) is powered by the MPC solution provided by TX-SHIELD, specifically designed to meet the needs of such enterprises. We further propose to build a complete "enterprise-level privacy payroll system" that allows enterprises to issue salaries to global employees through the BenFen chain, with the entire process completed on-chain, ensuring both the accuracy and auditability of the payment process while hiding key information such as payment amounts, identities of the payer and payee. For enterprises, the system will serve as an "invisible strategic asset," supporting efficient and transparent global salary management while fully protecting the most core salary data and business strategies; for the blockchain ecosystem, this system is expected to become a key step in promoting the large-scale deployment of enterprise-level applications—it precisely addresses the core concerns of companies like Deel in the highly sensitive area of salary management, clearing critical obstacles for blockchain technology to enter mainstream business applications.

2. Supply Chain Finance and Settlement: Taking Apple and Foxconn as Examples to Solve the Dual Dilemma of "Data Silos" and "Excessive Transparency"

The current dilemma in supply chain finance stems from the inability to efficiently transmit trust among participants. McKinsey's deep analysis in the "Global Payments Report" points out that there is an annual financing gap of up to trillions of dollars in global supply chain finance. The essence of this gap is a typical "trust" issue. Taking the collaboration between Apple and its core supplier Foxconn as an example, the business data between the two forms a typical "data silo." This makes it difficult for Foxconn to prove the legitimacy of its "accounts receivable," which represent the real transaction background, to financial institutions in order to obtain low-cost financing, ultimately leading to financing difficulties and high costs throughout the entire chain. However, if blockchain is simply adopted in pursuit of data sharing and transparency, it will fall into a more fatal dilemma: the precise procurement prices Apple pays to Foxconn, the settlement periods between the two, and even the production scale of new products will be completely exposed to all on-chain participants, including competitors. Competitors could use this information to accurately deduce Apple's cost structure and product strategy, and this new risk introduced by solving an old problem greatly hinders the landing of blockchain technology in core business scenarios of enterprises.

Complex industrial chains represented by the automotive manufacturing and consumer electronics industries, along with their vast supplier networks, are seeking an innovative solution that can simultaneously meet the following two seemingly contradictory goals: first, it must achieve automation of business processes and verifiability of key data to meet trust needs and break through financing bottlenecks; second, it must ensure that all sensitive business details are absolutely protected during collaboration to avoid leakage of core competitive advantages.

Explorations within the industry have validated the feasibility of this direction. The Baseline Protocol project (jointly promoted by industry giants such as Ernst & Young, Microsoft, and AMD) is a pioneer in this field. Its core lies in utilizing advanced cryptographic technology to enable enterprise systems to synchronize business process statuses on public blockchains while ensuring that all commercially sensitive data remains confidential. This practice strongly demonstrates that achieving "collaboration in competition" through technical means is possible—enhancing the overall efficiency and trust of the supply chain while building a solid data moat for each participant.

The privacy payment feature of the BenFen chain is designed to address this complex challenge. Based on TX-SHIELD's verifiable privacy technology, we can build a trusted settlement layer on the blockchain. At this layer, suppliers can prove the validity and compliance of their accounts receivable to financial institutions without disclosing any sensitive information related to specific amounts, counterparty identities, or contract details. This provides the key trust elements needed for financial institutions' decision-making without leaking any business secrets. Referring to McKinsey's predictions for digital supply chains, such solutions are expected to significantly optimize the efficiency of supply chain capital turnover, shortening settlement cycles from months to days, providing a powerful next-generation infrastructure to activate the vitality of the industrial chain and reduce overall financing costs.

3. Cross-Border B2B Payments and Settlements: Taking SHEIN's Global Supply Chain as an Example to Balance Efficiency, Cost, and Business Secrets

The traditional cross-border payment system has been constrained by speed and cost issues for decades. Payments made through traditional agency channels like SWIFT typically take 2 to 5 days to complete, accompanied by high fees and opaque intermediaries. Taking the global fast fashion giant SHEIN as an example, its business model heavily relies on a global supply chain network composed of thousands of suppliers that need to respond quickly. Therefore, it is extremely sensitive to the efficiency and cost of cross-border payments. To address the shortcomings of the traditional SWIFT system, the industry naturally explores more efficient blockchain solutions like stablecoins. However, even with the introduction of new tools like stablecoins to enhance efficiency, companies still face the compounded challenges posed by different jurisdictions' data privacy regulations (such as the EU GDPR) and complex compliance requirements. Moreover, for SHEIN, every payment on a transparent blockchain could inadvertently reveal its precise procurement prices, order allocation strategies, and even global fund allocation paths to its competitor Temu, posing a direct threat to its most core competitive barriers. Companies urgently need a payment solution that must simultaneously provide the privacy protection of traditional banking systems, the settlement speed of stablecoins, and the compliance flexibility to navigate the complex global regulatory framework.

BenFen Chain's privacy payment provides a brand new solution: a "B2B cross-border privacy settlement layer." This solution utilizes TX-SHIELD's privacy-protecting stablecoin technology, allowing cross-border transactions between enterprises to be completed on-chain almost instantaneously, while key transaction amounts and counterparty identity information are hidden, visible only to the trading parties and authorized regulatory agencies. The expected effect of this solution is to achieve second-level settlements, reduce average transaction fees by over 50%, and ensure zero leakage of core business secrets such as procurement strategies and sales channels, thereby building a critical information advantage for enterprises in the fierce global trade competition.

4. Privacy in Treasury Management: Taking MicroStrategy as an Example to Reshape the Enterprise-Level Blockchain Financial System

In the process of global enterprises accelerating digitalization, Treasury Management has transformed from a backend function into one of the core components of corporate strategy. It not only determines the safety and liquidity of corporate funds but also directly impacts capital structure, market signals, and strategic decision-making. However, as more enterprises attempt to optimize their treasury structures using blockchain and crypto assets, new problems have emerged—while efficiency improves, information transparency brings the risk of strategic exposure. Taking the publicly listed company MicroStrategy as an example, this company is one of the most well-known "pioneers of blockchain treasury." Since 2020, MicroStrategy has continuously purchased Bitcoin through bond financing and its own funds, incorporating it into its corporate balance sheet to combat inflation and optimize long-term value reserves. While this move has become a milestone in corporate asset allocation innovation, it has also exposed the privacy dilemma of blockchain's public ledger. Every time the company transfers funds, rebalances assets, or makes a new purchase, it is recorded and analyzed in real-time on the chain, allowing any market observer to infer its positions, cost ranges, and even future operational intentions from the transaction paths. This means that while blockchain brings transparency and trust, it also exposes the company's fund scheduling, investment rhythm, and even internal financial structure to global analysts. For a publicly listed company, this could not only trigger market volatility and speculative behavior but also affect the precise control of corporate value management, bond ratings, and capital market signals.

More and more enterprises are no longer satisfied with the closed and slow traditional treasury systems and are beginning to explore real-time financial systems based on blockchain, but they are also concerned—once they adopt a public ledger, does it mean that all fund flows will be made public? Therefore, enterprises urgently need a treasury solution that can achieve the advantages of blockchain "instant settlement and automated scheduling" while also protecting fund privacy and meeting audit compliance like traditional banking systems.

This is precisely the unique value of the BenFen Chain privacy payment system. Through the complex MPC technology provided by TX-SHIELD, BenFen Chain allows enterprises to complete operations such as asset allocation, reinvestment of earnings, or stablecoin liquidity scheduling on-chain while encrypting key financial information (including transaction amounts, flows, and asset structures) for privacy. The system automatically generates verifiable cryptographic proofs, granting access to authorized audit institutions or regulatory nodes for verification. In this way, enterprises can execute treasury operations with the high efficiency of blockchain while achieving "off-chain invisibility" privacy protection under the premise of "on-chain verifiability."

If MicroStrategy were to operate its treasury management under this framework, its fund scheduling, currency allocation, and asset rebalancing actions would no longer be exposed to the public market, while still ensuring that all on-chain operations comply with regulations, are auditable, and consistent with financial reports. In other words, BenFen Chain enables enterprises to achieve a truly "cryptographically verifiable treasury": publicly regulated, privately executed.

5. DAO Treasury Management and Anonymous Funding: Taking Uniswap DAO as an Example to Establish a "Strategic Barrier" for Decentralized Organizations

Large DAOs (such as Uniswap DAO) typically manage hundreds of millions or even billions of dollars in assets. While the complete transparency of their treasury is the cornerstone of community governance, it also brings about real-world situations and pain points: when Uniswap DAO considers investing in an early-stage DeFi project, the fully public negotiation and transfer details can be easily captured by other whales or competitors, leading to skyrocketing buying costs and complete failure of investment strategies. A strong real-world demand arises to provide a certain degree of operational privacy for teams or specific committees when executing investments, granting funding, and rewarding contributors, while still maintaining effective oversight of the overall health of the treasury and the general direction of fund usage.

We envision providing a dedicated "treasury privacy vault" module for DAOs on BenFen Chain. DAOs can use the privacy payment feature of BenFen Chain for specific confidential investments, anonymous funding for projects, and private rewards for contributors. Subsequently, DAOs can demonstrate the overall reasonableness and compliance of fund usage during a specific period to the community through a selective disclosure mechanism, without needing to disclose the details of every sensitive transaction. The technical feasibility of this solution has been validated by privacy-focused blockchain projects like Aztec Network in their official use cases. Additionally, the Messari report "Understanding Decentralized Confidential Computing (DeCC)" provides a theoretical framework for exploring the introduction of data confidentiality capabilities while maintaining decentralization from an industry perspective. This solution will empower DAOs, enabling them to gain the "trade secret" protection capabilities similar to traditional companies, thereby attracting more traditional capital and institutions seeking strategic privacy to enter the Web3 world through the DAO model, promoting further prosperity and maturity of the decentralized ecosystem.

For C-end Users: Privacy Payments as the Technological Cornerstone of Personal Financial Dignity and Freedom of Life

1. Protecting Daily Consumption and Digital Life: Taking Cryptocurrency Traders as an Example to Safeguard "Digital Persona"

With the improvement of global cryptocurrency payment infrastructure—from crypto cards launched by Visa and Mastercard to mainstream fintech companies like PayPal and Revolut integrating USDC payments—more and more users are beginning to use cryptocurrencies for daily transactions in the real world. Blockchain payments are transitioning from "niche behaviors of investors" to "lifestyles of the general public." However, one overlooked fact is that the complete transparency of public chains is turning "digital life" into a glass house that can be scrutinized.

Imagine a well-known cryptocurrency trader or Web3 entrepreneur; if all of their consumption behaviors—from buying Starbucks coffee, paying for Netflix subscriptions, to purchasing holiday gifts for family—are conducted through the same public wallet, this information can be easily tracked, aggregated, and cross-analyzed. Blockchain analytics companies, advertisers, and others can outline their life trajectory, wealth distribution, interest preferences, and even health status and family relationships. This complete transparency of data exposure threatens personal privacy, security, and even personal freedom. In fact, this is not an isolated case. The annual reports from Chainalysis and CipherTrace in 2024 both pointed out that over 70% of on-chain identity profiles are established from users' behavior exposure in "daily transactions," rather than in large investment activities. CoinDesk and The Block have also commented: "Without privacy, cryptocurrency payments will remain in the experimental stage forever."

To truly bring Web3 payments into the mainstream, it is not only necessary to solve the "efficiency and cost" issues but also to allow users to regain the "privacy boundaries of their digital persona." In other words, privacy is a prerequisite for payments to become mainstream, not just an added technical option.

The privacy payment system of BenFen Chain is designed specifically to address this core pain point. Based on the BenPay (www.benpay.com) ecosystem built on BenFen Chain, users can use applications within the BenPay ecosystem—such as the BenPay Card—to complete daily small payments for dining, subscriptions, travel, and online consumption, integrating stablecoin payments into daily life with lower thresholds and higher frequencies. The system, based on complex MPC technology, automatically hides the amount, time, recipient information, and address associations of each transaction. Additionally, BenFen Chain has designed a "selective disclosure mechanism"—users can grant limited transaction visibility to merchants or regulatory agencies when needed, achieving a payment experience that is "verifiable but not traceable."

The expected effects of this solution are not only to protect personal privacy but also to promote blockchain payments toward true social adoption:

• For ordinary consumers, it means restoring cash-like freedom in the digital world—consumption no longer becomes an entry point for data mining;

• For merchants, it enhances user trust and promotes more frequent use of Web3 native payments;

• For regulators, privacy is no longer equated with "black boxes," but rather a form of "bounded transparency."

In a broader sense, privacy payments will become a foundational public facility for digital life. They are both a technological embodiment of personal data sovereignty and a prerequisite for the true integration of the Web3 economy into social life.

2. Protecting Purchases of Sensitive Goods and Services: Taking Prescription Drug Purchases as an Example to Uphold Personal Consumption Privacy Rights

In the context of increasing global compliance pressures and the centralization of payment platforms, consumers are gradually losing the last line of privacy protection when purchasing legal but sensitive goods or services. Traditional payment systems, through centralized accounts and identity verification mechanisms, make every transaction traceable and analyzable, which is akin to exposing personal lives to the spotlight for groups that need to regularly purchase prescription drugs or mental health services.

Blockchain payments, especially the rise of stablecoin payments, provide a new possibility for such scenarios: they possess advantages such as instant settlement, cross-border reach, and no intermediary freezing risks, making them particularly suitable for sensitive consumption scenarios in international digital life. However, this characteristic of a transparent ledger also brings about more challenging issues—when a transaction for purchasing medication or mental health consultation is recorded on the chain, anyone can trace the purchasing behavior, thereby revealing personal health, living conditions, and economic status. This "transparency backlash" renders blockchain payments unusable in areas where privacy is most needed.

Mainstream media like CoinDesk have repeatedly commented: "Without privacy, cryptocurrency payments will struggle to be adopted in mainstream consumption scenarios." This judgment has empirical support in the market—privacy coins like Monero are being used in certain e-commerce and sensitive service areas, indicating a rigid demand for privacy protection among users. However, such solutions often conflict with compliance requirements, making it difficult to enter mainstream payment systems.

The privacy payment feature of BenFen Chain is very helpful for such scenarios. Users can pay merchants through the BenPay ecosystem application BenPay Merchant, with the entire process completed on-chain, ensuring the execution of the transaction while hiding key transaction amounts, both parties' address information, and the specific consumption details derived from this. This allows users to safely obtain the services they need without worrying about the core details of their private lives being permanently recorded on a public ledger, becoming a future risk. We aim to further promote privacy payments as the "default payment option for sensitive consumption scenarios." For users, it acts as a "consumption freedom amulet," safeguarding their basic right to consume according to personal will without harming others, thus defending personal dignity; for the blockchain payment ecosystem, this is a key step into the mainstream consumption market, meeting users' deeper needs, as it addresses a real pain point that exists in traditional electronic payments but is greatly amplified on the blockchain.

3. Protecting Freelancers and Small Businesses: Taking Upwork Designers as an Example to Empower Individuals with "Business Secret Protection"

In today's booming global digital economy and remote collaboration, the demand for efficiency and flexibility in cross-border settlements among freelancers and small businesses is rapidly increasing. More and more people are adopting blockchain and stablecoin payments as a new option for cross-border receipts and settlements. Whether they are creative workers on traditional platforms like Upwork and Fiverr or Web3 developers providing services for DAOs and NFT projects, they are increasingly accepting stablecoin payments such as USDT and USDC. The reasons are practical: blockchain payments are barrier-free across borders, settle instantly, incur lower fees, and can avoid the complex processes and regional restrictions of traditional banks. This has made stablecoins the new universal currency in the global freelance market.

However, as more individual economic activities go on-chain, they are also passively exposed to a "completely transparent" ledger. A top UI designer taking orders on Upwork may simultaneously serve cash-strapped startups and Fortune 500 clients; if their pricing strategies, income fluctuations, and even major client sources are all made public on-chain, competitors, clients, and even third-party data analysis companies can easily gain insights. This state of "nakedness on-chain" puts her at a disadvantage in price negotiations and may even lead to trust and dispute issues, directly undermining her pricing power and market competitiveness. Individual operators also need to protect their "business secrets"—especially pricing strategies and client relationships. In the traditional economy, this information is naturally protected by bank account privacy and business confidentiality systems; however, in the on-chain economy, they have almost no barriers.

This phenomenon of "transparency backlash" is becoming a hidden concern for the new generation of individual economies. Centralized payment platforms like Stripe and Payoneer provide some privacy protection, but users must fully entrust their data to the platform and cannot independently control their business information. CoinDesk's 2024 report also pointed out that "in the Web3 economy, privacy is no longer just a personal issue, but a part of business competitiveness." The privacy payment of BenFen Chain is a structural solution provided for such user groups. By using BenFen Chain for receipts, individual workers and merchants can securely complete payments on-chain while hiding transaction amounts, counterparty identities, and transaction associations, effectively preventing external inferences about their pricing strategies or client relationships. This mechanism retains the efficiency, low cost, and global reach advantages of blockchain payments while providing confidentiality similar to traditional business systems, allowing individual economic participants to have "technical bargaining protection" for the first time. Independent designers, developers, content creators, and cross-border merchants can now control their business data security like large enterprises, continuously creating value in a fair and respectful market environment.

4. Financial Self-Defense in Geopolitics: Taking Turkish Designers as an Example to Build an "Economic Lifeline"

In the current context of intertwined geopolitical and macroeconomic risks, blockchain is gradually becoming a "financial self-defense tool" for people in certain regions. In countries like Turkey and Argentina, which experience hyperinflation or strict capital controls, freelancers, small business owners, and even ordinary savers often cannot safely preserve their wealth or conduct cross-border payments through traditional banking systems. As a result, they are turning to blockchain and stablecoins, with digital assets becoming an "alternative lifeline" to resist currency depreciation and evade capital blockades.

However, new dilemmas arise: the public transparency of blockchain leaves these users "naked on-chain." For example, if a Turkish resident wishes to convert part of their income into dollar stablecoins to resist the depreciation of the lira, they may find that all transfers, asset balances, and conversion paths are exposed on-chain, meaning all their financial footprints could be visible to the public. This poses a dual threat: regulatory agencies may determine that their actions violate capital flow policies based on these public records, triggering a "freeze first, review later" process, leading to asset lock-up; at the same time, public wealth makes them easy targets for criminals. This "vulnerability brought by transparency" significantly undermines the protective role of blockchain in high-risk countries.

This has created a strong real-world demand: in regions with capital restrictions and currency turmoil, people need not only decentralized value storage tools but also privacy protection mechanisms—a financial infrastructure that can "survive" in an untrustworthy environment. The privacy payment of BenFen Chain is a response to this need. When users save on-chain and complete peer-to-peer transfers through BenPay C2C, their asset balances and counterparty information will be hidden, allowing them to use stablecoins to resist inflation while avoiding the risks brought by on-chain transparency. Research from Chainalysis shows that in regions with high inflation and political turmoil, the adoption rate of cryptocurrency retail has significantly increased, confirming the urgency of this trend. We believe that privacy payments are not only a technological innovation but also a "financial human rights" infrastructure. They provide individuals in difficult situations with the last line of defense to protect their wealth and freedom of transaction, becoming their "economic escape pod" to maintain economic activity and safeguard their dignity in extreme environments.

5. Maintaining the Purity of Charitable Donations: Taking Anonymous Acts of Kindness as an Example to Safeguard the Original Intention of Charity

In today's charitable sector, public figures, entrepreneurs, or ordinary kind-hearted individuals often face public pressure, moral coercion, or ongoing donation requests after making large or sensitive donations. For example, an entrepreneur wishing to fund cutting-edge technological exploration or marginal artistic creation may not want their name publicly associated with the donation to avoid unnecessary commercial attention or public misunderstanding. This turns what should be a pure act of kindness into something else, even deterring some potential donors. Individuals wishing to donate anonymously and charitable organizations focused on protecting donor privacy need a payment method that ensures the safety of donations, allows traceability to the beneficiaries, and fully protects the anonymity of the donors, enabling goodwill to flow freely. The case of Ethereum founder Vitalik Buterin using Tornado Cash to make an anonymous donation to Ukraine is a strong example, indicating that even industry leaders have a strong desire to protect donation privacy in certain situations.

The privacy payment of BenFen Chain is the ideal tool to achieve this goal. Donors can directly donate to the public address of charitable organizations through BenFen Chain, with the entire process completely hiding the donor's wallet address and specific donation amount. BenFen can further promote cooperation with large public welfare foundations to jointly advance the establishment of "charity privacy payment" standards. This will reshape the culture of charity, encouraging more heartfelt donations, especially attracting those who do not wish to flaunt their wealth or who want to remain low-key for various reasons, allowing good deeds to return to their purest and freest essence.

For G-end and Third Parties: Privacy Payments as the Next Generation of Regulatory Technology for Achieving "Precise Compliance"

1. Achieving "Auditable Privacy": Taking the Tornado Cash Incident as an Example to Explore a New Paradigm for AML/CFT Compliance

As blockchain technology continues to evolve, especially with the strengthening of anonymity and privacy protection features, traditional financial regulatory systems are under unprecedented pressure. Regulatory agencies have historically relied on transaction traceability and entity identifiability as the two pillars to perform AML/CFT duties, but strong privacy technologies, while protecting user data, also weaken regulators' ability to obtain transaction information on-chain. This "technical blindness" forces regulatory agencies to rely on traditional means such as territorial jurisdiction and sanctions against controllable entities, making it difficult to distinguish between legitimate users and violators, leading to regulatory measures often exhibiting a "one-size-fits-all" characteristic—both cracking down on illegal activities and restricting citizens' freedom to conduct legitimate privacy transactions.

The Tornado Cash incident is a typical case of this dilemma. In 2022, the U.S. Treasury sanctioned Tornado Cash because the mixer was used by some malicious actors for money laundering, including funds linked to North Korean hacker organizations (U.S. Treasury, 2022). The incident shows that in the absence of efficient management of anonymous transactions, regulators can only take indirect measures to control risks without being able to accurately identify legitimate and illegal transactions. This reveals a deep-seated contradiction: privacy technologies aimed at protecting individual rights are in a game with regulatory systems that maintain public safety, trapped in the existing framework. Regulatory agencies urgently need a technological means that allows them to achieve efficient and precise identification and prevention of illegal activities without monitoring all legitimate transactions or infringing on public privacy rights, transitioning from "broad blocking" to "precise governance."

In this context, BenFen Chain proposes an innovative solution of "auditable privacy." We embed compliance capabilities into the protocol layer through complex multi-party secure computation (MPC), making "regulatory compliance" a core feature rather than an afterthought. Specifically, regulatory agencies can verify transaction compliance (e.g., "this transaction does not involve addresses on the sanctions list") without needing to view transaction amounts and participant identities, achieving a technological paradigm shift from traditional "data regulation" to "logical regulation."

The architecture of BenFen Chain adopts a dual-layer compliance design:

• First Layer: KYC Identity Foundation

Collaborating with compliance service providers to offer off-chain KYC certification for enterprises and high-frequency users, generating verifiable credentials. This not only ensures the legality of participants but also provides a systemic foundation for AML/CFT, serving as a trust anchor for all high-level financial activities (especially corporate payments, payroll, etc.).

• Second Layer: Protocol Layer Auditable Privacy

Based on confirming identity compliance, combining MPC with zero-knowledge proof technology to achieve transaction privacy protection and auditability. Regulators can verify transaction compliance without exposing transaction amounts or both parties' identity information, ensuring that the vast majority of legitimate transactions enjoy default privacy while providing regulators with precise governance tools.

This dual-layer architecture systematically addresses the core contradiction of regulation: regulatory agencies can efficiently crack down on illegal activities, while corporate and individual users can protect their financial data and business secrets within a compliance framework. Thus, BenFen Chain provides the key infrastructure for large-scale enterprise applications of blockchain finance, making "privacy and compliance" no longer oppositional and ushering in a new era of compliance technology.

2. Enhancing Tax Audit Efficiency: Building a More Harmonious Taxpayer Relationship with Small and Medium-Sized Tech Companies as an Example

In traditional tax audits, tax authorities typically require companies to provide several years of bank statements and account details to verify the accuracy and compliance of their tax declarations. For example, a medium-sized tech company undergoing a routine tax audit not only needs to provide transaction ledgers from the past few years but also faces the issue of the audit process taking several months, severely disrupting research and development and operational rhythms. More importantly, the company's management is always concerned that core business secrets, such as client lists, partners, and pricing strategies, may be leaked during the lengthy audit process. This model reflects a dilemma faced by both parties: ensuring tax fairness while minimizing disruption to the normal operations of the business.

As blockchain technology matures, companies are beginning to explore using blockchain to record transaction data in their daily operations to enhance efficiency, transparency, and security. Some blockchain platforms (such as Ethereum and Hyperledger) can achieve real-time on-chain financial transactions and automated records, potentially facilitating tax audits. PwC has also proposed using blockchain technology to track corporate tax payments and transactions, aiming to improve tax compliance and transparency while reducing the manual audit burden through on-chain data.

However, existing blockchain solutions still face significant issues: while transparent ledgers provide complete transaction records, the amounts of each transaction, the parties involved, and their relationships are all publicly disclosed, which can lead to the exposure of corporate trade secrets, especially sensitive data involving client lists, revenue structures, and partner information. Therefore, relying solely on traditional blockchain records does not address the need for privacy protection for businesses during the audit process.

The privacy payment and related technologies of BenFen Chain have emerged to fill this gap. When companies use BenFen Chain to record transactions in their daily operations, they can generate necessary proofs during the audit process to verify propositions to the tax authorities without disclosing the details of each transaction. This "data available but not visible" design effectively protects the business's trade secrets and client privacy while ensuring audit compliance. Furthermore, BenFen Chain integrates complex privacy computing technology (complex MPC) at the protocol layer, combined with off-chain KYC certification, forming a "dual-layer compliance system." Regulatory agencies can verify transaction compliance without needing to view specific amounts and party information, achieving a high standard of "default privacy with selective disclosure." This not only enhances tax audit efficiency and reduces compliance costs for businesses but also helps build a more trusting and efficient taxpayer relationship, promoting the large-scale application of blockchain in corporate financial management and tax compliance.

The twelve scenarios we have deeply analyzed together confirm a core viewpoint: privacy payments are not a marginalized feature but a core component that repairs key flaws in the existing blockchain paradigm and unleashes its true potential. By providing refined technical guarantees for business secrets, personal dignity, and compliance efficiency, blockchain technology can better serve mainstream business society, individual users, and regulatory systems.

However, this is just the beginning. When "payment privacy" becomes a reliable foundational capability, a broader space for innovation will be opened. Imagine:

• How much more liquidity would DeFi have if institutions could execute strategies on-chain without being targeted?

• How fair would governance become if DAO voting were no longer influenced by large holders? (e.g., A16Z having a veto vote in Uniswap)

• How accurate would price discovery be if auctions were no longer anchored by "first bids"?

• How many new collaborative models would emerge if companies could analyze data together without leaking trade secrets?

These scenarios were previously unattainable, not because the technology was immature, but because the contradiction between "transparency" and "privacy" had not been resolved. When you must choose between "public for trust" and "privacy but isolated," many high-value collaborations simply cannot occur. Now, let us further consider what we can build when privacy becomes infrastructure rather than a luxury.

This is not a technical showcase but a redefinition of "trust"—from "trust through transparency" to "trust through encryption," from "collaboration through transparency" to "collaboration through privacy."

Building the Dream of the Future — From "Privacy Payments" to "Privacy Collaboration": A Paradigm Leap

In the past decade, we have witnessed breakthroughs in privacy technology in the payment field—protocols like Zcash, Monero, and Tornado Cash have made "who transferred how much to whom" untraceable. This marks the 1.0 era of privacy technology: information hiding.

But payment privacy is just the beginning. The real future lies in: flow privacy, behavioral privacy, and ultimately collaborative privacy.

What are the distinctions among these three?

• Flow Privacy: Hiding transaction strategies, market behaviors, and intent patterns.

• Behavioral Privacy: Hiding transaction behaviors, strategy paths, and market intentions to prevent inference of operational patterns.

• Collaborative Privacy: Establishing a "protected collaborative space" among multiple parties, where data does not leave the local environment, and insights are shared in encrypted states.

We believe that the future world will center around "protected collaboration," redefining the boundaries of payments, transactions, governance, and social cooperation.

Privacy is no longer "invisible," but "selectively visible."

Trust no longer comes from the center, but from verifiable encrypted collaboration.

This is not a minor adjustment in technology; it is a reconstruction of the trust infrastructure.

- Transaction Process Privacy: The Birth of On-Chain Dark Pools

Why do institutions need privacy markets?

The transparency of traditional blockchains is a protection for retail investors but a curse for institutions.

When an asset management institution executes a large transaction on-chain, the entire market can see it: counterparties can infer your strategy, arbitrageurs can front-run your orders, and competitors can replicate your models. This "forced transparency" fills the on-chain market with information asymmetry, distorting the price discovery mechanism.

In traditional finance, the existence of Dark Pools is precisely to solve this problem—allowing large transactions to occur in an anonymous environment to avoid market impact. However, centralized Dark Pools have fatal flaws:

• Operators can engage in malfeasance: front-running trades, leaking information, manipulating prices.

• Regulatory opacity: it is impossible to verify whether transactions are executed fairly.

• Single point of risk: the collapse of a centralized system can destroy the entire market.

TX-SHIELD is building a regulated privacy market layer (Regulated Dark Pool On-Chain)—a trading infrastructure that achieves "selective transparency" in a decentralized environment. BenFen is the embodiment and core carrier of this infrastructure.

How does technology achieve "selective transparency"?

The core challenge here is: how to allow both parties to see each other, enable regulators to intervene when necessary, but keep other market participants completely unaware?

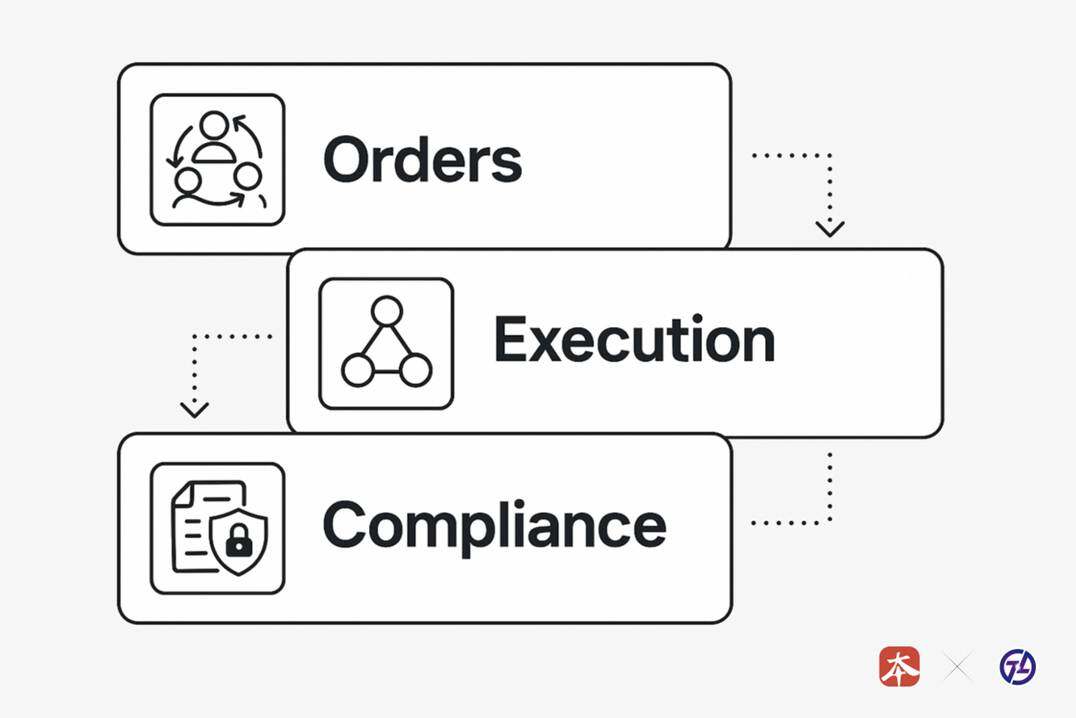

TX-SHIELD employs a multi-layer privacy architecture:

Order Layer: An order matching mechanism based on multi-party secure computation (MPC), where trading intentions are submitted and matched in encrypted states.

Execution Layer: Zero-knowledge proofs (ZKP) ensure that the validity of transactions can be verified, but specific parameters (price, quantity, identity) are not disclosed.

Compliance Layer: A selective disclosure mechanism, where regulators hold decryption keys and can access specific transaction records under judicial procedures.

This means:

• The market is no longer manipulated by public visibility — trading intentions are kept confidential before execution.

• Institutions can safely execute strategies on-chain — without worrying about information leaks.

• Stablecoins and RWAs (real-world assets) can circulate in privacy — achieving compliance and privacy simultaneously.

Dark Pools are not just market tools; they are the underlying infrastructure of privacy finance. They allow traditional financial institutions to seriously consider "going on-chain" for the first time, as they no longer need to choose between transparency and strategy protection.

- DAO Governance: How Confidential Voting Reshapes DAOs

The Dilemma of DAO Governance: The Cost of Transparency

The ideal of Decentralized Autonomous Organizations (DAOs) is to allow community members to make joint decisions through voting, replacing traditional hierarchical structures with code and consensus.

However, in reality, DAO governance often falls short:

• Voting results are observed in advance: large holders' votes influence small holders' decisions, creating a "herding effect" (e.g., Uniswap, Radiant Capital).

• Social influence hijacks rationality: public positions of well-known KOLs suppress dissenting opinions.

• Vote-buying and collusion: when voting results are visible in real-time, coordinated attacks become easy.

The root of these issues lies in: excessive transparency leads to information asymmetry rather than resolving it.

True democracy requires two conditions: free expression (unaffected by others) and verifiable results (ensuring no cheating). Traditional public voting only meets the second condition.

Confidential Voting: Restoring Honesty in Governance

The confidential voting mechanism of TX-SHIELD is based on homomorphic encryption and multi-party secure computation (MPC):

• Votes submitted by voters are sent to the chain in encrypted states.

• The counting process occurs in encrypted states, and no one can see individual voting content.

• The final results are publicly verified through zero-knowledge proofs, ensuring the correctness of the counting process.

This may seem simple, but it redefines the trust logic of DAOs:

"Privacy makes governance honest."

In this framework:

• Everyone's vote is independent and unaffected by others.

• Large holders cannot manipulate small holders through "signal display."

• The correctness of the results can be mathematically verified rather than relying on trust.

More importantly, this mechanism can be extended to more complex governance scenarios:

• Hierarchical Governance: Voters with different weights, aggregated in encrypted states.

• Delegated Voting: Delegation relationships are confidential, but voting results are traceable.

• Prediction Markets: Decentralized prediction markets based on confidential voting.

When governance shifts from "public transparency" to "verifiable privacy," DAOs truly have the potential to become a new form of organization.

- Confidential Auctions Release True Value

What is the essence of auctions?

In economics, auctions are seen as a "price discovery mechanism"—through competition, items return to their true value.

However, traditional auctions have a fundamental flaw: the Anchoring Effect.

When the first bidder offers 1 million, the psychological expectations of others become anchored around that number. Even if someone believes the item is worth 2 million, they might only bid 1.1 million—because they fear appearing foolish by "bidding too high."

The result is: auctions do not discover prices; they guide prices. The first bidder controls the psychological expectations of the entire market.

Blockchain Implementation of Sealed Auctions

TX-SHIELD's privacy auction mechanism adopts a digital form of Sealed-Bid Auction:

Submission Phase: Bidders submit encrypted bids, and no one (including the auctioneer) can see the specific amounts.

Revealing Phase: All bids are automatically decrypted through smart contracts after a predetermined time.

Settlement Phase: The highest bidder wins, and other bids are returned (or a second-price auction mechanism is used based on design).

This allows the market to truly achieve "information-symmetric competition" for the first time—each bidder's bid is based on their true valuation, not on signals from others.

Application Scenarios: From NFTs to Carbon Credits

This mechanism can be applied to all scenarios requiring "fair price discovery":

• NFT Auctions: The value of artworks is determined by genuine demand, not speculative expectations.

• Carbon Credit Markets: Companies bid based on actual emission reduction costs, rather than strategic pricing.

• Spectrum Auctions: Governments sell spectrum resources, and operators cannot lower prices through signaling games.

• Data Auctions: Companies bid for datasets under privacy protection, avoiding price leaks of business strategies.

Confidential auctions are not just a technical tool; they are a key step for privacy technology to enter the value discovery layer. They prove that privacy is not the enemy of efficiency but the prerequisite for a fair market.

- Unlocking New Collaborative Models

The Endgame of Privacy: The Reconstruction of Social Collaboration

If the first three scenarios represent the application of privacy technology in "transactions" and "governance," then the fourth dimension is the reconstruction of social collaboration itself.

When individuals, institutions, and machines can collaborate securely in encrypted states, we begin to unlock new socio-economic models—models that were previously unattainable due to "high trust costs" or "lack of privacy protection."

Scenario One: Anonymous Creation Reward System

Problem: Creators often face "identity bias" when publishing works—well-known authors' works easily gain attention, while newcomers' works get buried. This leads to a distorted evaluation system.

TX-SHIELD Solution:

• Identities are encrypted and hidden when works are submitted.

• Reviews and rewards are conducted anonymously.

• Once the quality of the work reaches a threshold, creators can choose to reveal their identities.

• Revenue sharing is automatically executed through smart contracts, with creators, curators, and platforms sharing proportionally.

This model has already shown potential in music, literature, design, and other fields—when "works" are decoupled from "authors," the value of creativity can be assessed purely.

Scenario Two: Decentralized Credit Lending

Problem: Traditional credit assessments rely on centralized institutions (banks, credit companies), but these institutions either cannot cover global users or have issues with data monopolies and privacy abuses.

TX-SHIELD Solution:

• Users' on-chain behaviors (transaction history, DeFi participation, social reputation) are aggregated into a "credit score" in encrypted states.

• Both lending parties do not need to expose specific data but can verify each other's credit levels.

• The scoring model is governed by the community, with algorithms transparent but data privacy maintained.

This model of "evaluating credit based on encrypted data rather than identity" allows unbanked populations to access financial services while protecting privacy from abuse.

Scenario Three: Cross-Enterprise Joint Data Collaboration

Problem: Industries like healthcare, finance, and logistics possess vast amounts of high-value data, but due to privacy regulations (GDPR, HIPAA) and competitive relationships, this data cannot be shared. This limits AI model training and prevents industry insights from emerging.

TX-SHIELD Solution:

• Based on Federated Learning and Multi-Party Secure Computation (MPC) frameworks, data remains on the enterprise's premises.

• Model training occurs in encrypted states, sharing only gradient updates (with gradients processed through differential privacy).

• The final model is jointly owned by all participants, but no party can access another's raw data.

This model is changing fields such as medical research (multi-hospital joint training of diagnostic models), financial risk control (multi-bank joint anti-fraud efforts), and supply chain optimization (multi-enterprise joint demand forecasting).

This is precisely the vision of TX-SHIELD's MPC-FL (Multi-Party Secure Computation + Federated Learning) framework: a system that allows "privacy to become the infrastructure for social collaboration." More importantly, TX-SHIELD addresses the core challenge in federated learning: how to fairly quantify each party's contribution. This is the essential difference between TX-SHIELD and traditional federated learning solutions.

In traditional federated learning, all participants jointly train a model but cannot accurately measure who contributed how much value. This leads to two fatal problems:

• Free-Rider Problem: A party with poor data quality can enjoy equal rights.

• Incentive Imbalance: A party with high data value has no motivation to continue participating.

TX-SHIELD's framework can quantify and score each party's model contribution without exposing raw data through encrypted computation:

• Company A contributed 30% — its data's marginal contribution to model accuracy improvement.

• Company B contributed 34% — its data covered critical long-tail scenarios.

• Company C contributed 36% — its data quality was the highest, reducing model variance.

Based on this contribution measurement, rights are automatically allocated:

• Governance Rights: Voting weight is proportional to contribution, with high-contribution parties having greater say in model iteration decisions.

• Revenue Rights: Model commercialization income is distributed according to contribution, rewarding more effort.

• Data Sovereignty: Any party can exit at any time, with their contributions recorded but data not retained.

This contribution measurement is not a one-time calculation but dynamically updated with model iterations. When a party continues to provide high-quality data, their rights share will gradually increase; if data quality declines or contributions stop, their share will decrease accordingly. Rights distribution only solidifies when the model is no longer updated. This creates a self-optimizing incentive mechanism—participants are motivated to continuously provide high-quality data rather than engage in a "one-off transaction."

This is the essential difference between TX-SHIELD and traditional federated learning solutions.

Google's Federated Learning, OpenMined, and other solutions address the issue of "how to train models under privacy protection," but they assume all participants are equal—whether you provide 1 million high-quality data points or 10,000 noisy data points, your rights are the same.

TX-SHIELD further answers: how to ensure fairness in collaboration under privacy protection? We not only protect privacy but also quantify contributions and allocate rights.

This "verifiable fairness" transforms collaboration from "moral constraint" to "mechanism guarantee":

In the healthcare field, large tertiary hospitals and grassroots clinics can collaborate fairly—tertiary hospitals provide complex case data, while grassroots clinics provide common disease data, with both parties' contributions accurately measured, no longer dominated by "large hospitals leading, small clinics trailing."

In the financial sector, large banks and small fintech companies can jointly combat fraud—both the historical data of large banks and the real-time data of small companies hold value, with rights allocated based on actual contributions, no longer a zero-sum game of "big eating small."

In the supply chain sector, brand owners, logistics companies, and retailers can jointly optimize inventory—each party's data (sales forecasts, transportation efficiency, inventory turnover) is quantified as a specific contribution to model improvement, with profits shared proportionally.

This is not only a technological innovation but also a revolution in collaborative paradigms: when contributions can be quantified, trust can be calculated; when rights can be verified, collaboration can occur and persist.

Scenario Four: Encrypted Collaboration Infrastructure and Data Quantification

The most radical vision is: the future of intelligence does not belong to a single AI but to an AI network. Multiple AI agents will collaborate within a trusted privacy layer, just as neurons form a brain—individual neurons are ordinary, but network connections create consciousness.

Why do AIs need to collaborate?

Today's AI models are becoming increasingly specialized: some excel in image recognition, some are proficient in natural language, and others specialize in mathematical reasoning. However, real-world problems often require cross-domain capabilities—diagnosing diseases requires analyzing medical images, medical history texts, and genetic data simultaneously; autonomous driving requires integrating visual perception, path planning, and traffic prediction.

A single AI cannot handle everything; collaboration becomes inevitable.

But there is a fundamental contradiction: AI models are assets, they are competitive. When two AIs need to collaborate, they cannot simply "disclose everything to each other"—this would lead to reverse engineering of models, inference of training data, and leakage of trade secrets.

TX-SHIELD's core solution is to provide a cryptographic infrastructure for building AI collaboration.

Specific Scenarios:

Medical Diagnosis Collaboration

• Agent A (Imaging AI) analyzes CT scans and discovers lung abnormalities.

• Agent B (Pathology AI) infers possible causes based on symptom descriptions.

• Agent C (Genetic AI) evaluates treatment plans based on the patient's genotype.

• The three AIs exchange reasoning results in encrypted states, generating a comprehensive diagnostic report.

• However, no AI can see the model parameters or training data of the others.

Financial Risk Control Collaboration

• Agent A (Trading AI) detects abnormal trading patterns.

• Agent B (Credit AI) assesses the user's historical credit record.

• Agent C (Anti-Fraud AI) cross-verifies multi-source data.

• The final output is a risk score, but each AI's model and data remain isolated.

Autonomous Driving Collaboration

• Vehicle AIs need to collaborate with city traffic system AIs, weather prediction AIs, and logistics scheduling AIs.

• They share necessary information (traffic conditions, weather, delivery demands) in encrypted states.

• However, their respective algorithmic logic, historical trajectory data, and business strategies remain confidential.

Technical Implementation: Encrypted Model Inference Collaboration

When AI entities need to share models, experiences, and inference results, they should not directly expose data to each other (as this could lead to model reverse engineering or data leakage), but should exchange information in encrypted states:

• Agent A and Agent B jointly infer a conclusion without exposing their respective models.

• Agent C can verify the correctness of this conclusion but cannot deduce the model parameters of A and B.

• The collaboration process can be audited, but the inference details remain private.

This "encrypted collaboration" will become the foundation of the future AI economy.

As AI agents begin to possess assets (cryptographic wallets, digital identities), execute contracts (on-chain smart contracts), and provide services (API calls, data exchanges), the trust mechanism between them must be at a cryptographic level—not "I trust you won't do harm," but "cryptography guarantees you cannot do harm."

Furthermore, TX-SHIELD's contribution quantification mechanism can also be applied to AI collaboration: the contribution of each agent to the final result can be quantified, and profits distributed proportionally. This allows for true "economic collaboration" between AIs rather than mere technical integration.

Imagine a future Web3 collaboration scenario based on the TX-SHIELD framework:

• A medical diagnosis task is completed by 5 specialized AIs, charging $100.

• Imaging AI contributes 35%, Pathology AI contributes 30%, Genetic AI contributes 20%, Drug AI contributes 10%, Coordination AI contributes 5%.

• Profits are automatically distributed: $35/$30/$20/$10/$5.

• The entire process is verifiable on-chain, but each AI's model and data remain completely private.

This is not science fiction; it is the inevitable direction of the integration of cryptography, blockchain, and AI.

TX-SHIELD aims to become the trust infrastructure of this AI collaboration network—allowing agentic AIs or robots to collaborate like humans, but with greater trustworthiness. In this new paradigm, trust comes from cryptography—you do not need to disclose information, only prove that you have followed the rules. Zero-knowledge proofs, multi-party secure computation, federated learning—these technologies decouple "verification" from "disclosure" and separate "collaboration" from "exposure." We believe that privacy is not a boundary but a bridge to the future.

Conclusion: Privacy is the New Language of Trust

Starting from "solving current pains," we have witnessed how privacy payments serve as a robust barrier, protecting business secrets, defending personal dignity, and achieving precise compliance. It has repaired the inherent flaws of transparent blockchains, enabling them to truly serve the real world. Furthermore, we move towards "building the dream of the future," envisioning the infinite possibilities unleashed when privacy becomes the default setting. From on-chain Dark Pools to confidential voting, from confidential auctions to new data collaboration paradigms, we clearly see that privacy is no longer merely about "hiding," but about "empowering"; it is not just a shield for defense but an engine for collaboration.

This is a profound paradigm shift: we are moving from an era where "trust must be exchanged for transparency" to a new epoch where "trust can be guaranteed by cryptography." The source of trust is shifting from forced public exposure to verifiable confidential computation.

The joint exploration of the public chain and TX-SHIELD envisions this: we are not just developing a function or a set of protocols, but jointly laying the trust foundation for the next generation of the internet. In this future:

Enterprises can collaborate without concerns in competition, sparking innovation;

Individuals can live freely in the digital world, reclaiming sovereignty;

Society can achieve more efficient collaboration while protecting privacy, unleashing collective wisdom.

Privacy has never been the endpoint. It is the starting point for a more free, fair, and efficient digital civilization. And we are working hand in hand to make it a reality.

About BenFen

BenFen Chain is a high-performance public chain built specifically for stablecoin payments. Based on the Move language, we have created a secure, low-cost, and highly scalable underlying network. Its core feature is supporting users to directly use stablecoins to pay Gas fees, significantly lowering the usage threshold and paving the way for large-scale applications. With strong cross-chain and multi-currency settlement capabilities, BenFen Chain covers diverse payment scenarios through rich ecological applications. More importantly, we provide crucial privacy payment options for enterprise users, ensuring that they can enjoy the efficiency advantages of blockchain while protecting core business data from leakage.

BenFen is committed to becoming a global stablecoin circulation network serving enterprise payroll, cross-border payments, e-commerce, and offline merchants—a next-generation financial infrastructure that balances efficiency, cost, and security.

About TX-SHIELD

TX-SHIELD is a regulatory-compliant on-chain privacy settlement infrastructure that provides both privacy and regulatory visibility for stablecoin and blockchain applications.

Core Solutions:

• TX-SHIELD: A privacy infrastructure for blockchain applications, enabling confidential transactions, Dark Pools, and privacy-centric protocol layers.

Our Innovation:

We not only protect transaction privacy but also reshape asset ownership and security through distributed cryptography. TX-SHIELD's solution allows enterprises and financial institutions to achieve joint custody of assets, privacy clearing, and regulatory compliance audits without disclosing business secrets.

We are building such an infrastructure: to ensure that privacy is no longer an obstacle to regulation and institutional adoption, but rather a protective layer for financial flows._

TX-SHIELD — The private and regulatable settlement base-layer for stablecoin, blockchain, and enterprise.

免责声明:本文章仅代表作者个人观点,不代表本平台的立场和观点。本文章仅供信息分享,不构成对任何人的任何投资建议。用户与作者之间的任何争议,与本平台无关。如网页中刊载的文章或图片涉及侵权,请提供相关的权利证明和身份证明发送邮件到support@aicoin.com,本平台相关工作人员将会进行核查。