Written by: Jae, PANews

As Perp DEX (decentralized perpetual contract exchanges) attempts to replicate Wall Street's playbook, a more efficient margin system may simultaneously unleash profits and risks.

The Perp DEX arena has become the bloodiest battlefield. While most players are still competing on fees and UI, the leading protocol Hyperliquid has quietly raised its sights, targeting more professional institutional users.

On December 15, Hyperliquid announced the launch of a portfolio margin system, which is now live on the testnet. This is not just a simple feature update, but a reconstruction of capital efficiency and risk logic in on-chain derivatives trading, attempting to capture market makers and high-frequency trading firms that have been "spoiled" by CEX (centralized exchanges).

However, in a DeFi market lacking a lender of last resort, higher efficiency often means greater risk. When a unified account is liquidated with a single click in extreme market conditions, it could trigger an on-chain liquidation tsunami sweeping across multiple markets.

Capital efficiency can be improved by 30%, aiding Hyperliquid's institutional transformation

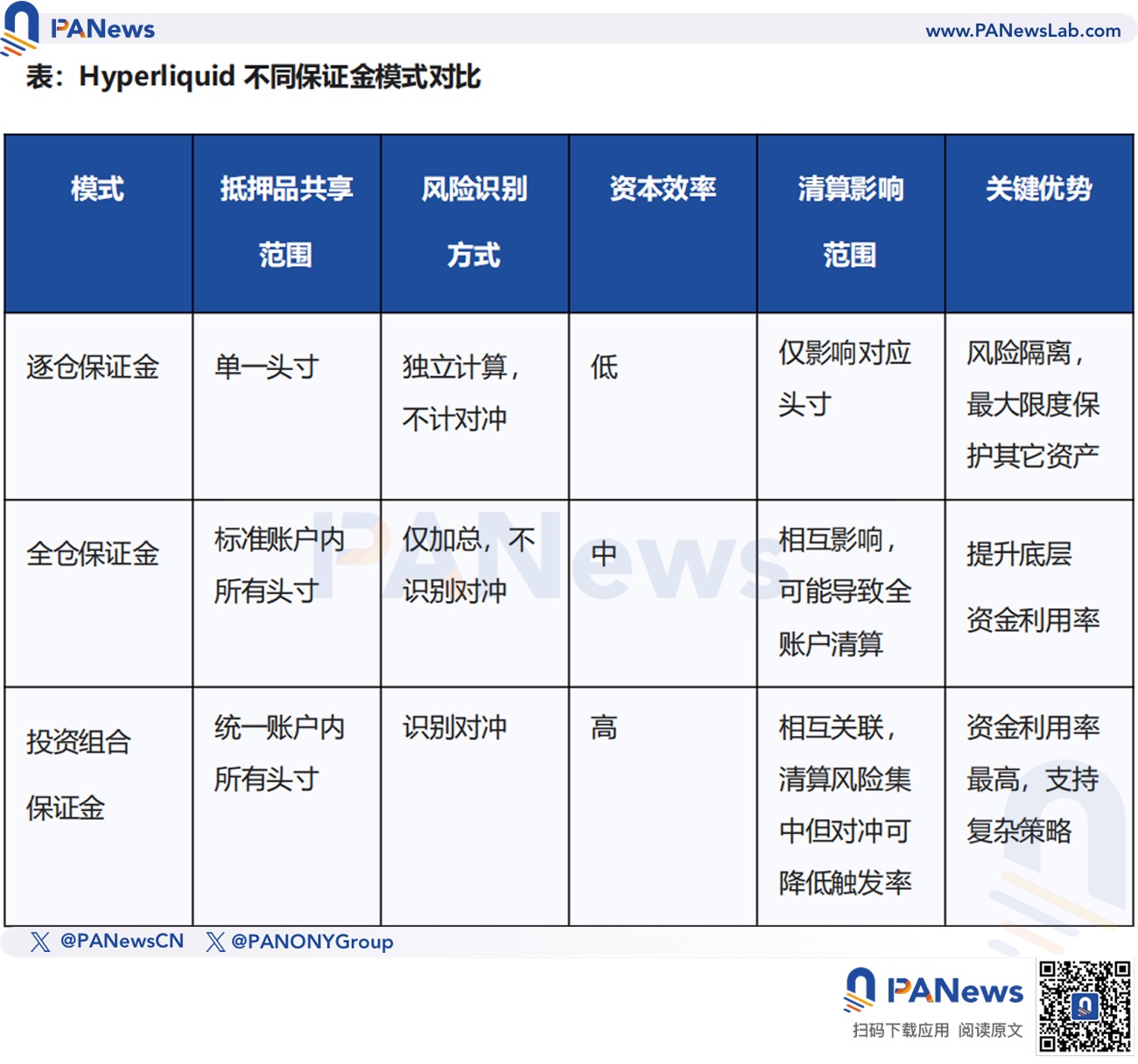

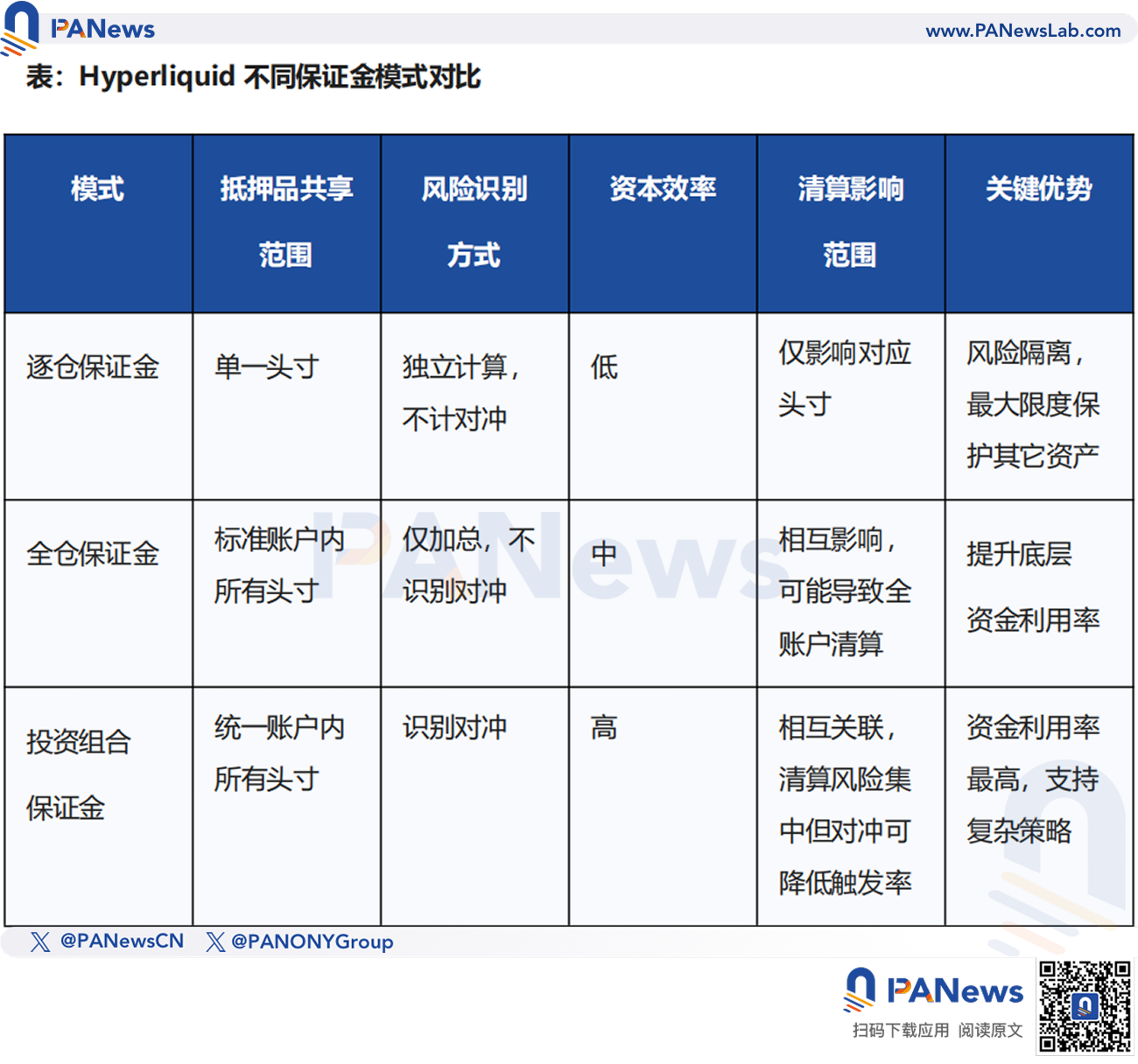

The portfolio margin system has existed in CEX for many years, and Hyperliquid's portfolio margin system fundamentally differs from the common full margin or isolated margin models. In a conventional full margin model, the overall margin requirement for a portfolio is typically just the sum of the margin requirements for each individual position, without recognizing the risk hedging effects between positions.

In contrast, the portfolio margin system unifies users' spot and perpetual contract accounts, employing a net risk exposure-based settlement mechanism to set margin requirements based on the net risk of the entire portfolio.

This essentially rewards risk hedgers by freeing up funds from redundant collateral. For portfolios holding both long and short positions on the same underlying asset, the overall margin requirement will be significantly lower than the sum of the margin requirements calculated on an individual position basis due to the risk offsetting effect between positions. Data from CEX has already verified that the portfolio margin system can enhance capital efficiency by over 30%. Industry insiders claim that a derivatives-focused CEX saw its trading volume double after launching the portfolio margin system.

For Hyperliquid, launching this mechanism signals its strategic shift: from competing for retail traffic to focusing on the capital efficiency-sensitive institutional market. The portfolio margin system is also an important chip for Hyperliquid in the heated competition of the Perp DEX arena, attracting market makers and high-frequency trading firms by improving capital utilization.

However, Hyperliquid has shown a cautious attitude towards the development of the portfolio margin system, launching it in the Pre-Alpha phase on the testnet to ensure the robustness of the new feature. Currently, users can only borrow USDC, and the HYPE token is designated as the sole collateral.

In fact, this is a risk-minimizing launch path. The protocol validates through a single asset verification model while strategically increasing the utility of the HYPE token, providing early liquidity guidance and economic incentives for its native L1 ecosystem.

Hyperliquid officials stated that as the system matures, it will gradually expand the supported assets, including introducing USDH and BTC as collateral assets.

In the long run, Hyperliquid's portfolio margin system is highly scalable. It can not only expand to new asset classes through HyperCore but also supports the creation of on-chain strategies. This suggests that the portfolio margin system may become the cornerstone of complex arbitrage and yield strategies within the HyperEVM ecosystem, injecting more vitality into the on-chain derivatives trading ecosystem.

Theoretical leverage capacity increases by 3.35 times, supporting institutional-level strategy matrices

The appeal of Hyperliquid's portfolio margin system will manifest in three dimensions, constructing a closed-loop product model aimed at institutions:

Seamless trading experience with unified accounts: Institutions no longer need to manually allocate funds across multiple sub-accounts for spot, perpetual contracts, etc. All assets are managed in a unified account, significantly simplifying operational processes, eliminating friction and time loss in fund transfers, thereby reducing operational costs and enhancing the execution efficiency of high-frequency trading strategies.

Automatic yield generation from idle assets: The portfolio margin system will also optimize the yield structure. Idle collateral will automatically earn interest within the system and can even be used as collateral to support short positions in perpetual contracts or execute arbitrage strategies, further optimizing the yield potential of assets, achieving "one asset, multiple utilities" in capital layering.

Qualitative change in leverage capacity: Referencing similar systems in the U.S. stock market, the leverage multiple available to qualified investors can theoretically increase by 3.35 times. This will provide institutions seeking greater nominal exposure and higher capital turnover rates with a richer selection of tools.

In short, Hyperliquid supports not just a single strategy, but an institutional-level strategy matrix. Long-short hedging, cash-and-carry arbitrage, options combinations, and other trading strategies all require an optimized margin system as a foundation. However, executing similar strategies on-chain currently incurs significant costs.

By attracting large institutions, Hyperliquid's on-chain order book is also expected to achieve more substantial trading depth, narrowing bid-ask spreads and further enhancing its competitiveness as an institutional trading venue, creating a positive flywheel effect.

Behind the efficiency, hedging failures may evolve into a liquidation spiral

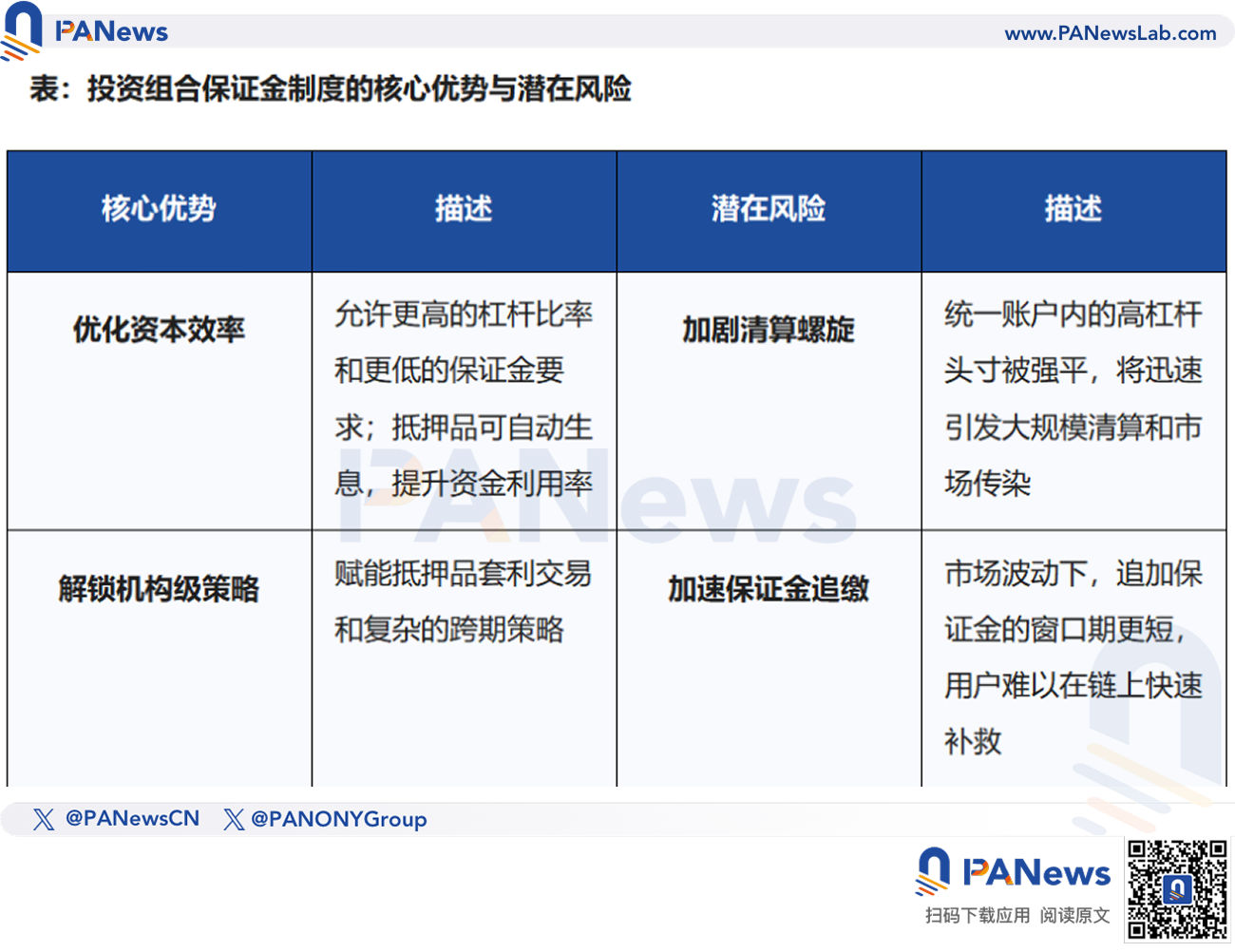

However, higher efficiency always resonates with greater risk. Especially in a DeFi market lacking a final backstop, portfolio margin may become an amplifier of systemic risk.

The primary risk lies in the expansion of losses and the acceleration of liquidations. While the portfolio margin system reduces requirements, it also means that losses will be equally magnified. Although margin requirements may decrease due to the offsetting effects of hedged positions, if the market moves against the entire portfolio, users' losses could quickly exceed expectations.

The characteristic of the portfolio margin system is to concentrate all risks into a unified account for net settlement, but once the market experiences an irrational broad decline, leading to correlated declines in assets with low correlation, hedging strategies may instantly fail, causing risk exposure to expand dramatically. Compared to standard models, the margin call mechanism for unified accounts typically requires traders to complete margin replenishment in a shorter time frame. In the highly volatile crypto market, a significantly compressed margin replenishment window will greatly increase the risk of users being unable to deposit funds on-chain in time, leading to forced liquidations.

A deeper systemic risk is that the portfolio margin system may weave a network of cascading liquidations. The liquidation activities of unified accounts often exhibit multi-market impact characteristics. When a highly leveraged unified account is liquidated, the system must simultaneously close all related spot and derivatives positions. Such large-scale, multi-asset automatic sell-offs can create a massive shock across multiple related markets in a short time, further depressing the underlying prices, causing more accounts to fall below maintenance margin requirements, triggering a chain of forced liquidations, and forming an algorithm-driven liquidation spiral.

Equally important is that Hyperliquid's portfolio margin system will be deeply integrated with the lending protocols within its HyperEVM ecosystem. The inherent interconnectedness of DeFi Lego often has a strong risk transmission effect. This means that a sharp drop in the price of underlying collateral could not only trigger liquidations at the trading layer of Hyperliquid but may also spread through collateral links to the lending market, causing large-scale liquidity depletion or credit freezes.

Portfolio margin, a path that Wall Street has walked for decades, is being retraced by Hyperliquid using blockchain code. It is Hyperliquid's gamble on entering the institutional market and will also be a limit test of the resilience of the DeFi system.

免责声明:本文章仅代表作者个人观点,不代表本平台的立场和观点。本文章仅供信息分享,不构成对任何人的任何投资建议。用户与作者之间的任何争议,与本平台无关。如网页中刊载的文章或图片涉及侵权,请提供相关的权利证明和身份证明发送邮件到support@aicoin.com,本平台相关工作人员将会进行核查。