Gold continues to lead in the Debasement Trend.

We flagged it as "one of the best charts to watch" at the start of the year. Price has surged +60% over the following 9 months.

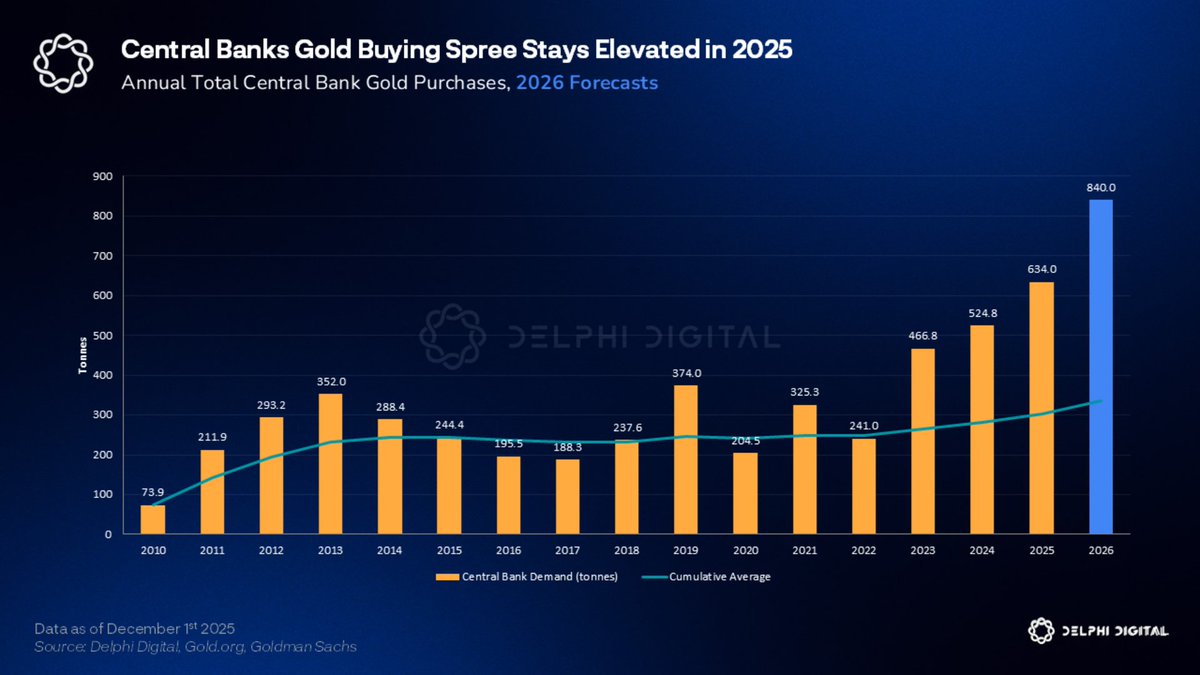

Central banks have purchased more than 600 tonnes of gold in 2025, following record prints in 2023 and 2024 that exceeded the highs seen after the GFC.

When gold’s price jumps to new highs, we typically see central banks stop buying or sell some of their holdings.

But we’ve seen continued aggressive buying despite this huge price run up, and gold is a big story for China right now.

The PBOC has been one of the most consistent buyers in the world, and that's just official data. The real numbers are likely much higher.

Speculation is growing that China has been trying accelerate de-dollarization, with heavy gold purchases potentially playing a key role.

Some have suggested that China's strategy would be to accumulate gold reserves, allow the gold price to rise, then devalue the yuan relative to gold.

This would effectively increase the real value of those holdings and strengthen the case for settling more international trade in a yuan backed by substantially larger gold reserves. While plausible, this specific mechanism remains unconfirmed.

Our full Markets Year Ahead Report covers this trend and the macro forces driving it heading into 2026.

免责声明:本文章仅代表作者个人观点,不代表本平台的立场和观点。本文章仅供信息分享,不构成对任何人的任何投资建议。用户与作者之间的任何争议,与本平台无关。如网页中刊载的文章或图片涉及侵权,请提供相关的权利证明和身份证明发送邮件到support@aicoin.com,本平台相关工作人员将会进行核查。