Recently, there has been a lot of discussion about CIRCLE. Today, a friend privately messaged me to ask if the tweet from Brother Dayu is correct, as there are many different opinions online. First of all, the application for the bank started on June 30, 2025. The approval that Circle received on December 12 is a "conditional approval" (pending final OCC approval), not a fully effective banking license.

In simple terms, Circle has not yet obtained a banking license. Although the probability of approval is high, it has not been received yet, and it is indeed not the first. A total of five companies were approved together this time, including Circle, Ripple, BitGo, Paxos, and Fidelity Digital Assets. One of Paxos's stablecoins is PYUSD.

Additionally, Circle's license does not allow for lending, deposit-taking, or leveraging activities. It has obtained a National Trust Bank status, rather than what we typically understand as a commercial bank. The core function of a trust bank is custody and clearing.

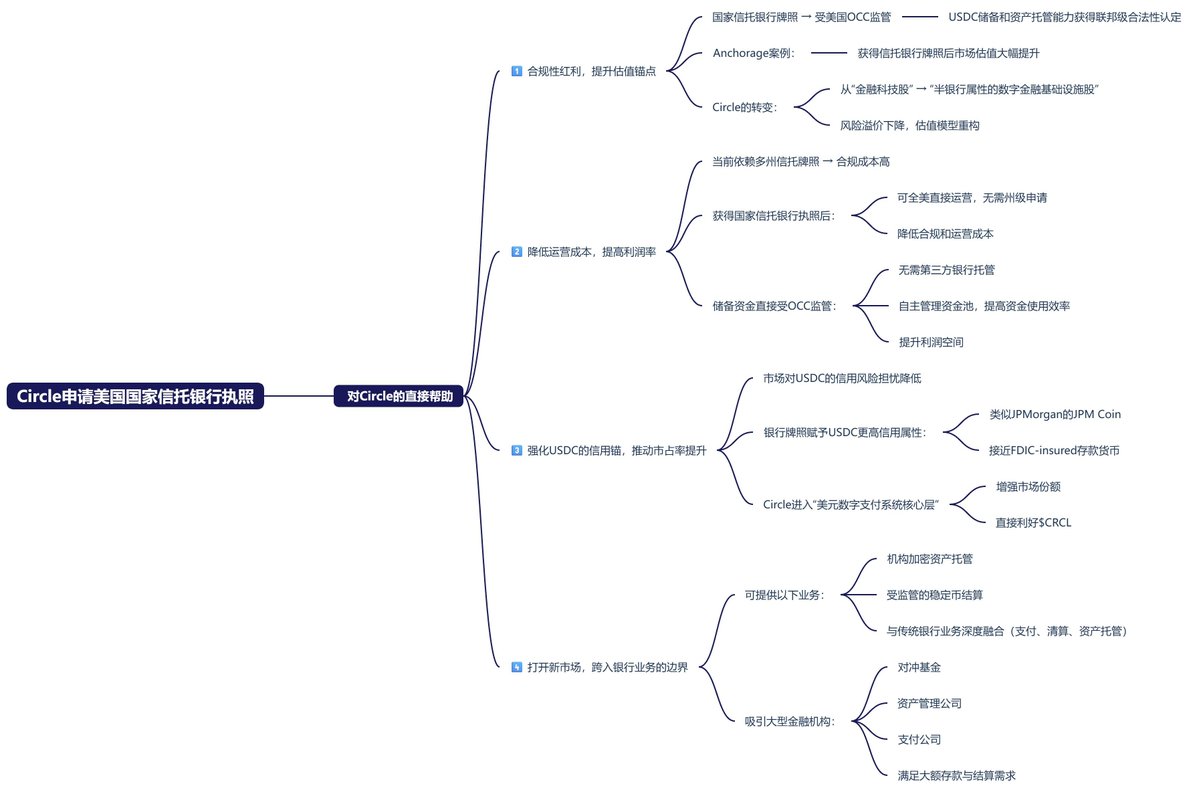

Essentially, the biggest benefit for Circle is that it upgrades from a relatively compliant stablecoin issuance company to a financial infrastructure node directly included in the U.S. federal banking regulatory system. (It has not yet been fully approved.)

In the past, while the reserves of USDC were also safe, they were essentially held in third-party commercial banks or custodial institutions. If a custodial bank experiences systemic risk, such as the SVB incident, it can impact the liquidity and confidence in USDC. After becoming a National Trust Bank, Circle can self-custody and manage USDC's reserve assets under a regulatory framework, reducing reliance on a single commercial bank and lowering the risk of passive exposure to failures.

At the same time, this significantly enhances the compliance level of USDC on the institutional side. For many pension funds, insurance funds, and clearing institutions, the biggest issue with stablecoins has never been technology, but whether they fall under the federal regulatory system. When Circle operates as a trust bank, USDC has at least completed a critical step in regulatory identity, transforming from a stablecoin issued by a tech company to a digital dollar tool operating under the federal banking regulatory framework, which has substantial implications for settlement, clearing, and margin use.

However, it is important to emphasize that this does not mean USDC has become a dollar deposit, nor does it mean Circle can lend or leverage like a commercial bank, much less engage in so-called money printing. It addresses issues of custody security, regulatory trust, and institutional access thresholds, rather than issues of yield, scale, or price.

Therefore, I personally prefer to view this step as Circle positioning itself "within the system," rather than having already reached the finish line. The most critical factor remains whether Circle's profitability can be expanded. Currently, Circle's core revenue source still heavily relies on the interest income from USDC's reserve assets corresponding to U.S. Treasury bonds and cash. This is certainly favorable in a high-interest-rate environment, but once we enter a rate-cutting cycle, the interest margin will naturally be compressed, which is an unavoidable reality.

Even obtaining the final license for National Trust Bank does not mean Circle can hedge against downward pressure on interest rates like a commercial bank through lending, leveraging, or maturity mismatches. On the contrary, the positioning of a trust bank dictates that it must maintain a low-risk, low-leverage asset structure over the long term. This is an advantage in terms of regulation, but it also means that the ceiling on the profitability model is relatively clear.

Therefore, from the perspective of investment and long-term development, this step primarily addresses Circle's "survival certainty" and "identity within the system," rather than immediately opening new sources of profit. Whether Circle can truly break free from the constraints of the interest rate cycle in the future depends not on whether it is a bank, but on the actual penetration rate of USDC in scenarios such as settlement, clearing, margin, and cross-border payments, and whether it can bring about economies of scale and service-based income, rather than simply relying on interest.

In conclusion, profit is the greatest guarantee for a company's development, and currently, Circle has not seen any changes in the profit area. As I mentioned earlier, in payments, $CRCL will also face tax issues, which are challenges they need to address.

Bitget VIP, lower fees, better benefits

免责声明:本文章仅代表作者个人观点,不代表本平台的立场和观点。本文章仅供信息分享,不构成对任何人的任何投资建议。用户与作者之间的任何争议,与本平台无关。如网页中刊载的文章或图片涉及侵权,请提供相关的权利证明和身份证明发送邮件到support@aicoin.com,本平台相关工作人员将会进行核查。