Two weeks ago, I wrote that Bitcoin might not have broken through the $100,000 mark yet. After briefly touching $99,000, the price has retreated and is currently consolidating below $90,000.

Most people are asking the same question: "Is now the time to buy?"

First: Yes. It is appropriate to buy in batches at this time.

But you must set strict stop-loss orders.

This report is independently written by Ryan Yoon.

1. Bitcoin Consolidation: The Decision Approaches

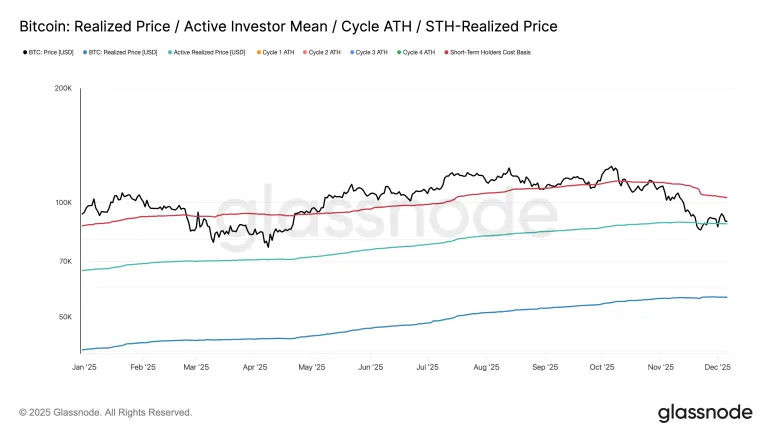

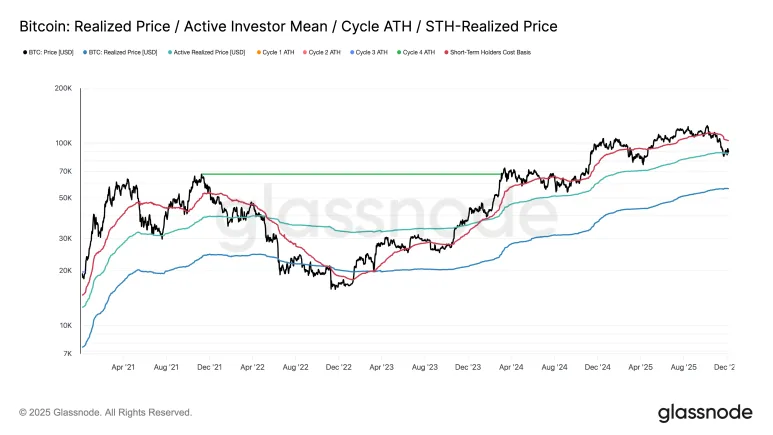

The price is safely above $87,900 (active realized price). This is the average cost line for active buyers.

It serves as the breakeven line for the entire market. It took a year and a half to recover this level after the crash in 2022. With the price having fallen and then rebounded, the market can catch its breath.

Keep a close eye on this point. Use it as your stop-loss line.

At the same time, pay attention to the relationship between the cost of short-term holders and the active realized price. If the short-term line falls below the active line, the risk will increase rapidly. Currently, this adverse crossover has not occurred.

2. Weak Signals, High Returns

Key on-chain indicators show a market pullback, but the opportunity for profit is high. We are at the bottom of the fair value area.

The MVRV Z-Score is at 1.17. It has left the cheap area, but the upside is limited. Buyers and sellers are interwoven here, and growth is slowing. The trend is weak and unclear.

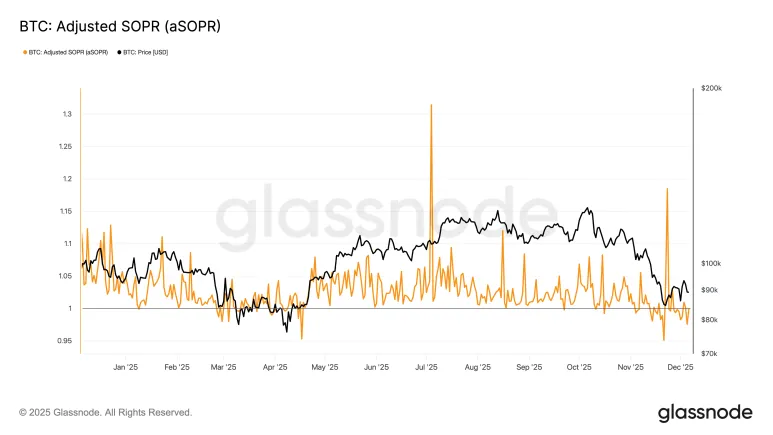

aSOPR is flat at 1.0. Sellers are trading at cost price. They will sell even if they make a small profit.

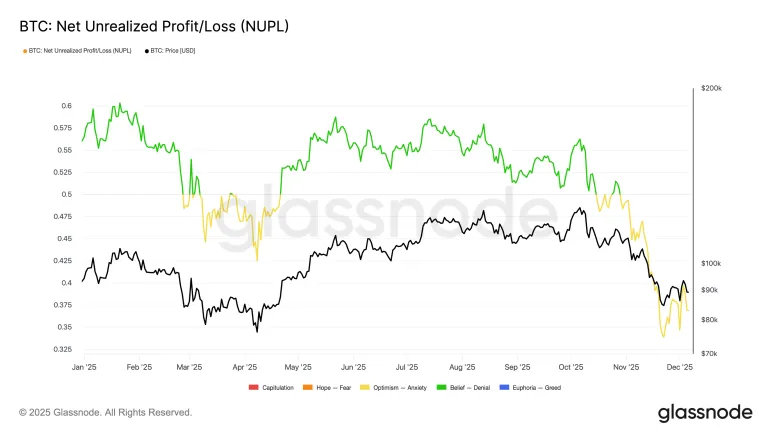

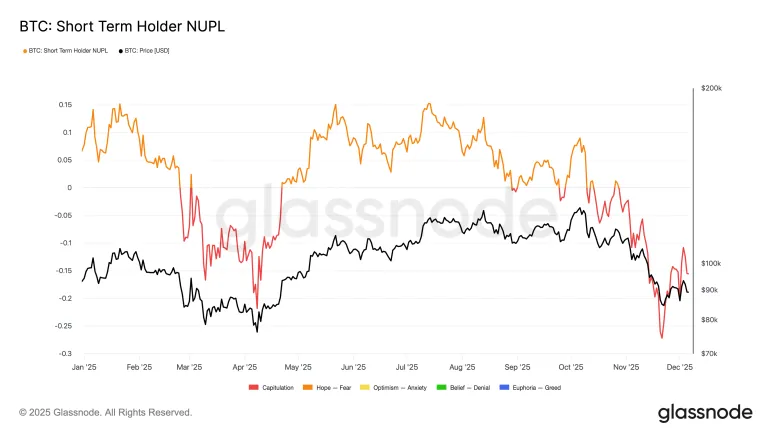

NUPL is at 0.36, just within the fair area. The NUPL for short-term holders is -0.155. New buyers are in a loss position. Once the price reaches their cost, they will sell. This confirms the weakness of market sentiment.

In summary, holders sell at small profits. But note: MVRV close to 1.10 is an excellent position for long-term buying. The risk is lower. Historical data shows a 40% return one year after starting from this point.

3. Never Lose the $84,000 Level

If it falls below $84,000, it will bring significant risk. This could lead to long-term damage.

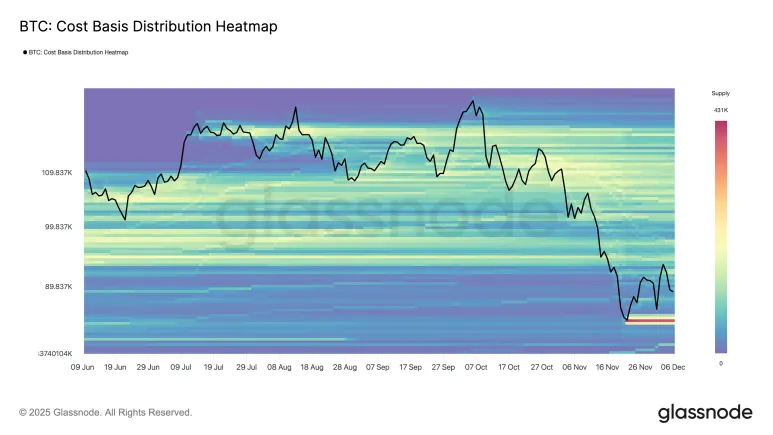

The cost basis chart shows a thick supply wall around $84,000 ($83,000 to $85,000). This is the recent buying price for the group. If the price loses this level, short-term holders will face deep losses. This could trigger panic selling.

A hard break below $84,000 would damage the market structure. When the price touched $83,000 on December 1, fear surged. $84,000 is not just a line on the chart. It is the last line of defense for the group's breakeven point.

4. Open Interest: Returning to Low Levels

Open interest (OI) in the futures market has fallen back to April lows. This decline indicates that the frenzied leveraged bets have been cleared.

This sharp decline is good news. Low leverage reduces the risk of a crash or cascading effects. The market has cleared the bubble. Now it can attempt to rise on solid foundations. We can look for the beginning of a new trend from this safe base.

5. Buy Immediately, Strictly Adhere to Stop-Loss

On-chain indicators show that now is an ideal time to buy. The bubble has dissipated. Expected returns outweigh risks. It is reasonable to build a position at this time.

But if you care about risk, don’t just buy. Set a clear stop-loss line. The market is still directionless.

If the price falls below the active realized price, most active traders will face losses. This will shift market sentiment to fear, potentially triggering a crash.

Set your stop-loss at $87,900. This allows you to buy on dips, but if the main support level is broken, it reduces risk. If the bottom collapses, preserve your cash.

免责声明:本文章仅代表作者个人观点,不代表本平台的立场和观点。本文章仅供信息分享,不构成对任何人的任何投资建议。用户与作者之间的任何争议,与本平台无关。如网页中刊载的文章或图片涉及侵权,请提供相关的权利证明和身份证明发送邮件到support@aicoin.com,本平台相关工作人员将会进行核查。