Written by: Grayscale Research Team

Translated by: Yangz, Techub News

Key Takeaways

We anticipate a structural transformation in the digital asset investment space accelerating in 2026, supported by two main themes: macro demand for alternative value storage and an increasingly clear regulatory environment. These trends will collectively bring in new capital, broaden adoption (especially among advised wealth management and institutional investors), and more comprehensively integrate public blockchains into mainstream financial infrastructure.

We expect asset valuations to rise in 2026, marking the end of the so-called "four-year cycle" theory, which posits that crypto market trends follow a repeating four-year pattern. We believe Bitcoin's price is likely to reach an all-time high in the first half of the year.

We anticipate bipartisan-supported crypto market structure legislation will become law in the U.S. in 2026. This will drive deeper integration of public blockchains with traditional finance, facilitate regulated trading of digital asset securities, and potentially allow startups and established companies to conduct on-chain issuances.

The outlook for fiat currency is increasingly uncertain; in contrast, we can be highly confident that the 20 millionth Bitcoin will be mined in March 2026. We believe that, given the rising risks associated with fiat currencies, digital currency systems like Bitcoin and Ethereum, which offer transparency, programmability, and ultimately a scarce supply, will face growing demand.

We expect more crypto assets to be offered through exchange-traded products (ETPs) in 2026. These products have successfully launched, but many platforms are still conducting due diligence to incorporate crypto assets into their asset allocation processes. As this process matures, more slower-moving institutional capital is expected to enter the market in 2026.

We also outline the top ten crypto investment themes for 2026, reflecting the broad use cases emerging for public blockchain technology. For each theme, we list relevant crypto assets. They are:

Dollar devaluation risk drives demand for currency alternatives

Regulatory clarity supports the adoption of digital assets

The scope of stablecoins will expand post-GENIUS Act

Asset tokenization is at a turning point

Blockchain technology goes mainstream, and privacy solutions become essential

Centralized AI calls for blockchain solutions

Lending leads the acceleration of DeFi

Mainstream adoption will require next-generation infrastructure

Focus on sustainable income

Investors seek default staking yields

Finally, there are two themes we expect will not impact the crypto market in 2026:

Quantum computing: We believe research and preparation for post-quantum cryptography will continue, but this issue is unlikely to affect asset valuations next year.

DATs: Despite media attention, we believe crypto asset treasuries will not become a major volatility factor in the digital asset market in 2026.

2026 Digital Asset Outlook: The Dawn of the Institutional Era

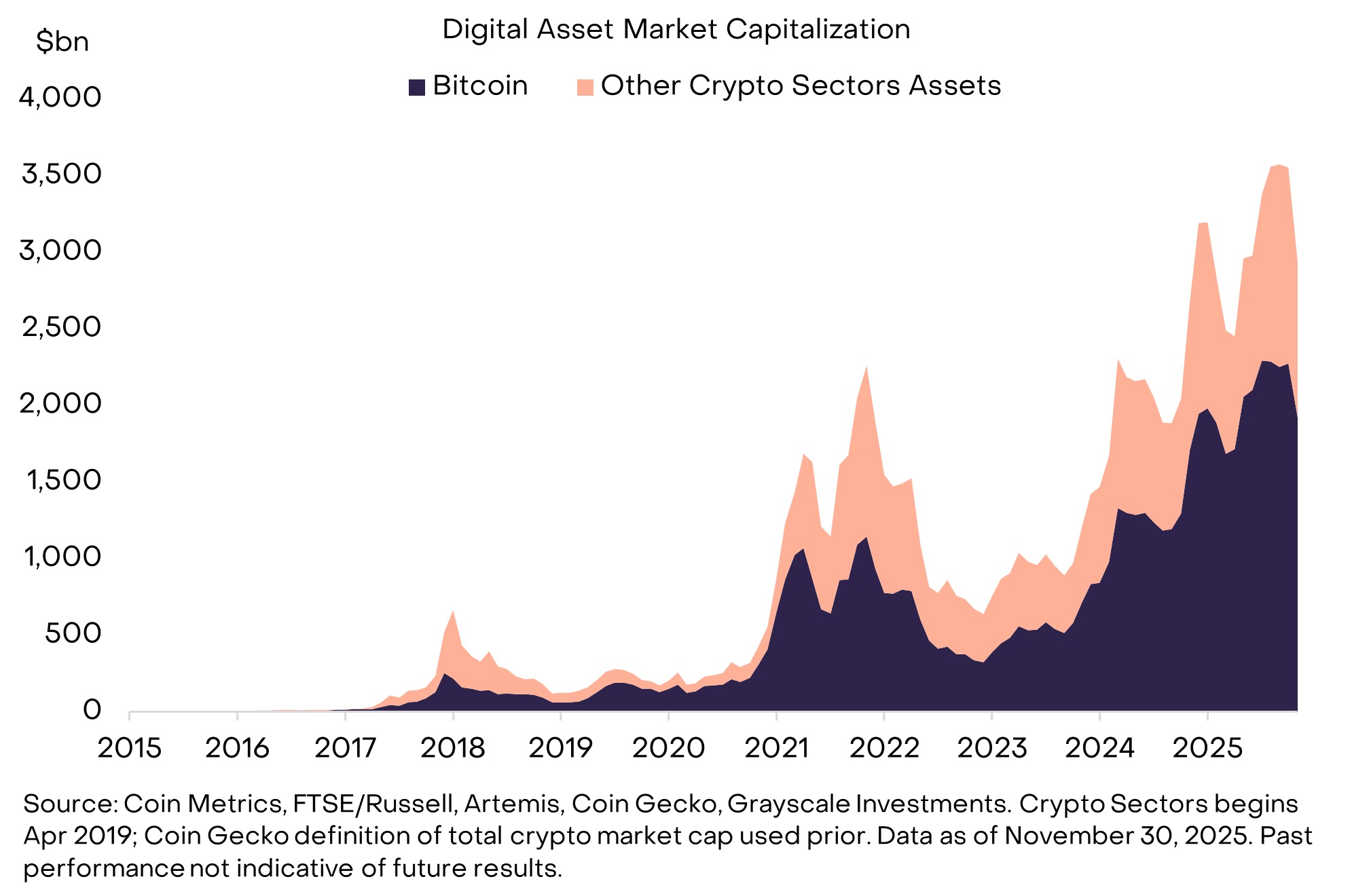

Fifteen years ago, cryptocurrency was an experiment: there was only one asset (Bitcoin), with a market cap of about $1 million. Today, cryptocurrency has become an emerging industry and a mid-sized alternative asset class, consisting of millions of independent tokens, with a total market cap of approximately $3 trillion (Chart 1). Currently, more developed regulatory frameworks in major economies are deepening the integration of public blockchains with traditional finance and bringing long-term capital inflows to the market.

Chart 1: Cryptocurrency has now become a mid-sized alternative asset class

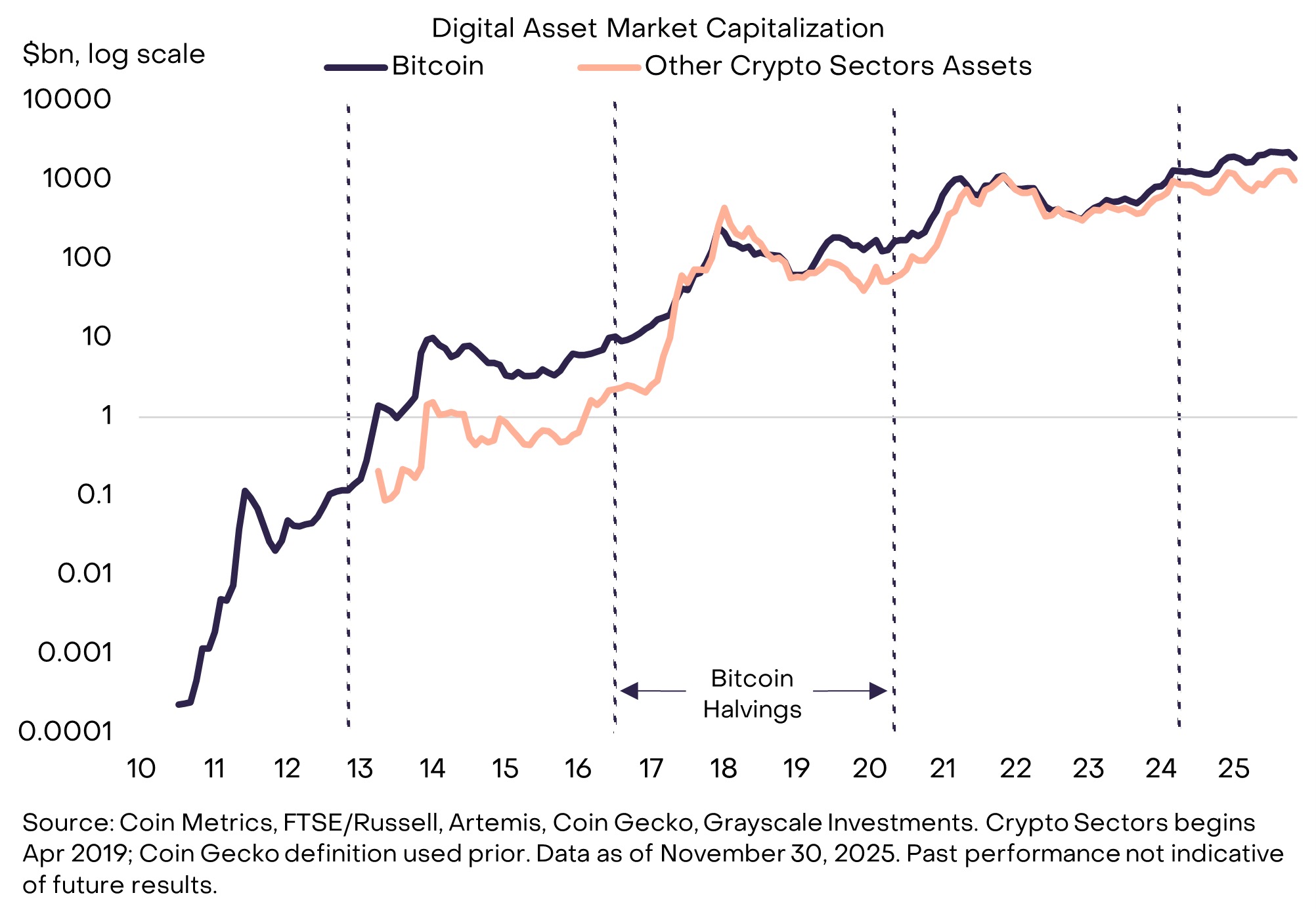

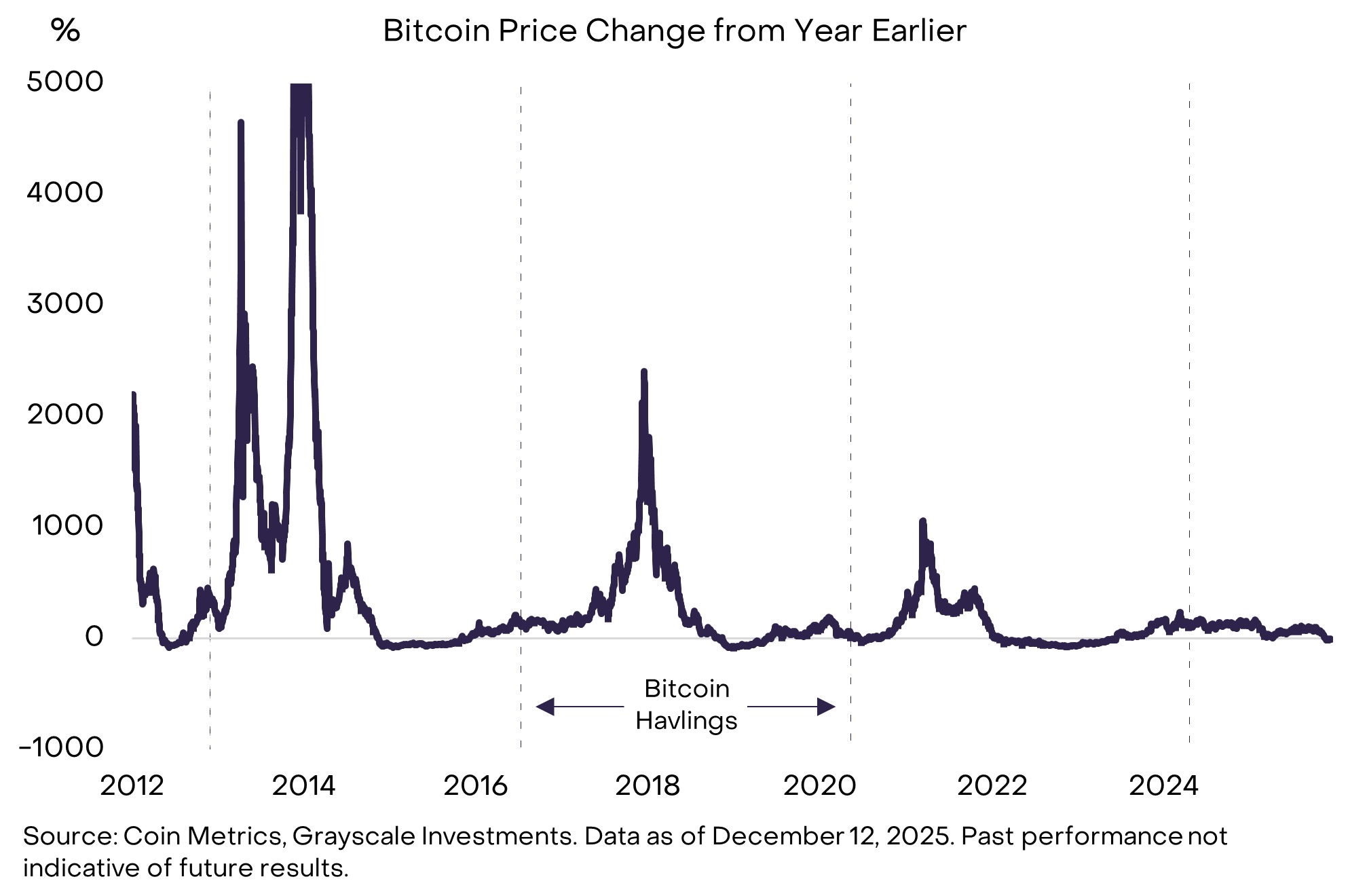

From the early development stage of cryptocurrency to now, token valuations have undergone four significant cyclical pullbacks, approximately every four years (Chart 2). Three of these valuation cycle peaks occurred within 1 to 1.5 years after Bitcoin halving events, which also happen every four years. The current bull market has lasted over three years, with the most recent Bitcoin halving occurring in April 2024, more than 1.5 years ago. Therefore, some market participants traditionally believe that Bitcoin's price may have peaked last October, and 2026 will be a challenging year for cryptocurrency.

Chart 2: The valuation increase in 2026 will mark the end of the "four-year cycle" theory

However, we believe the crypto asset class is in a sustained bull market, and 2026 will mark the end of this apparent four-year cycle. We expect valuations across all six major crypto sectors to rise in 2026 and believe Bitcoin's price may surpass previous highs in the first half of the year.

Our optimistic outlook is primarily based on two pillars:

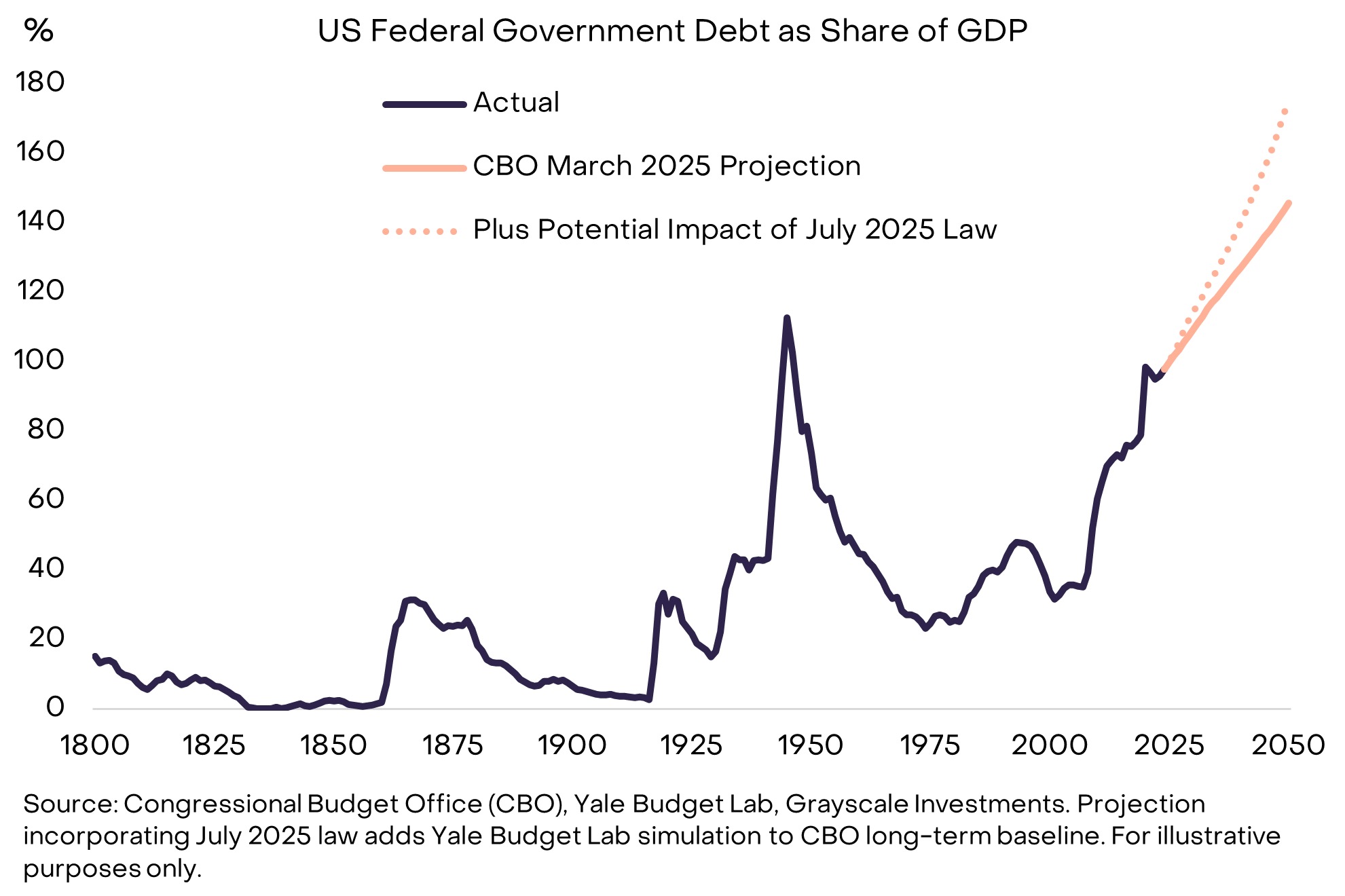

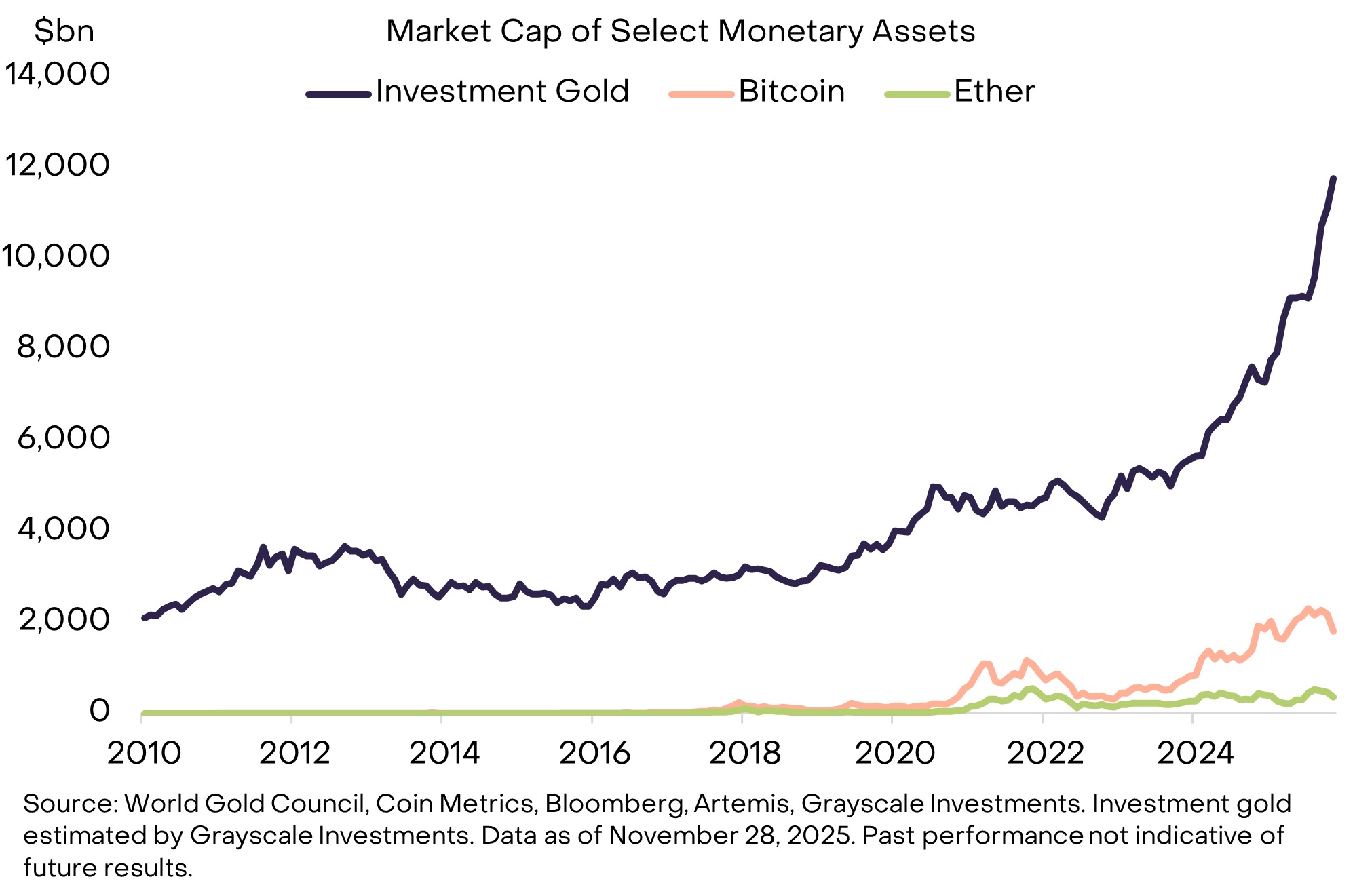

First, there will continue to be macro demand for alternative value storage means. The two largest cryptocurrencies by market cap—Bitcoin and Ethereum—can be viewed as scarce digital commodities and alternative currency assets. Fiat currencies (and assets priced in fiat) face additional risks due to high and rising public sector debt and their long-term potential impact on inflation (Chart 3). Scarce commodities, whether physical gold and silver or digital Bitcoin and Ethereum, may serve as ballast in portfolios to counter fiat currency risks. We believe that as long as the risk of fiat currency devaluation continues to rise, the demand for Bitcoin and Ethereum in portfolios may also continue to grow.

Chart 3: The U.S. debt issue raises questions about the credibility of low inflation

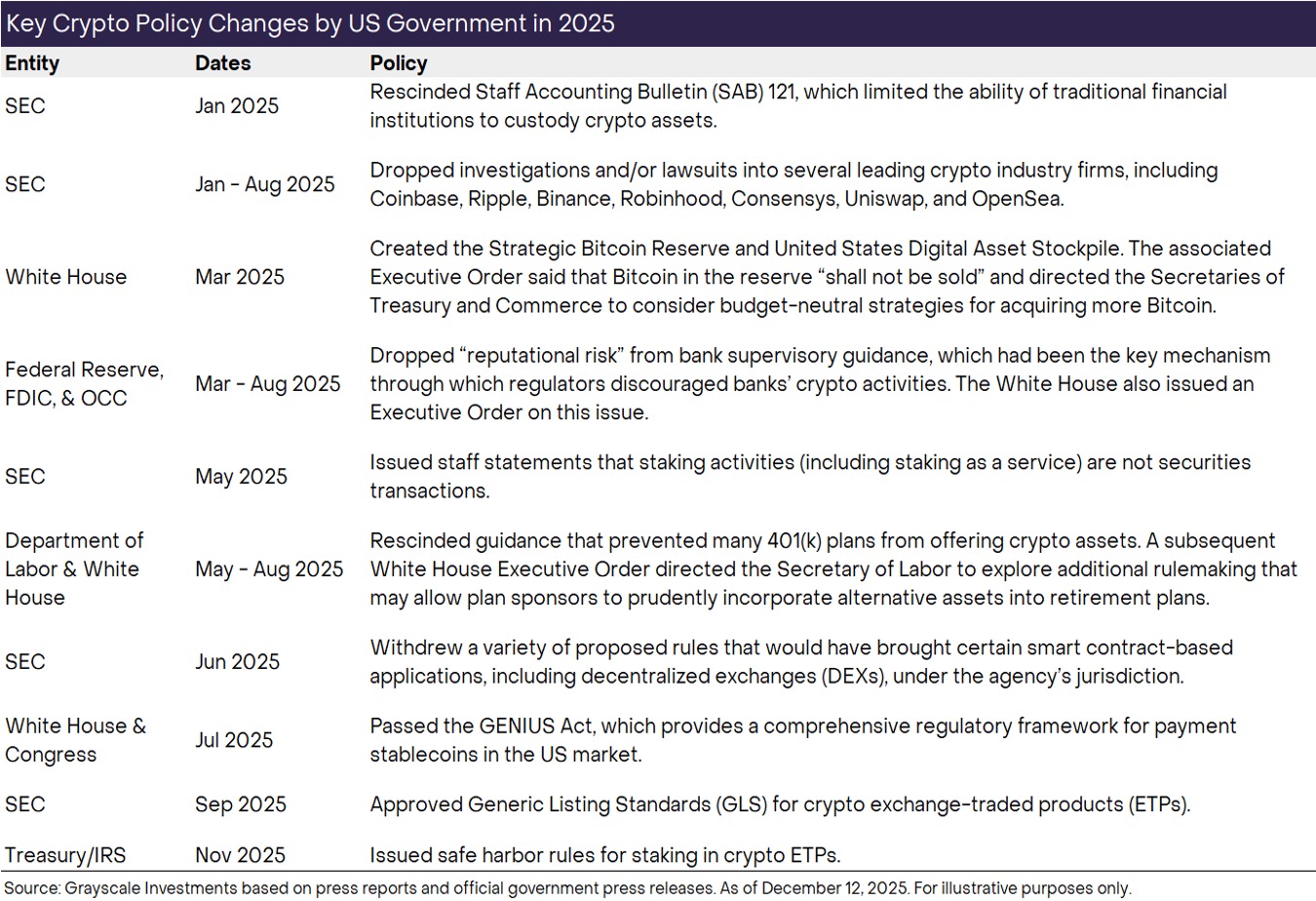

Second, regulatory clarity is driving institutional investment into the public blockchain technology space. This is easily overlooked, but before 2025, the U.S. government was still conducting pending investigations and/or lawsuits against many leading companies in the cryptocurrency industry, including Coinbase, Ripple, Binance, Robinhood, Consensys, Uniswap, and OpenSea. Even today, exchanges and other crypto intermediaries are still operating without clear spot market guidelines.

Fortunately, this situation is gradually changing. In 2023, Grayscale won its lawsuit against the SEC, paving the way for spot cryptocurrency exchange-traded products. In 2024, Bitcoin and Ethereum spot ETPs will be listed. In 2025, Congress passed the GENIUS Act regarding stablecoins, and regulators adjusted their attitudes toward cryptocurrencies, collaborating with the industry to provide clear guidance while continuing to focus on consumer protection and financial stability. We expect that in 2026, Congress will pass bipartisan-supported crypto market structure legislation, which is likely to solidify the blockchain-based financial system in U.S. capital markets and drive continued inflows of institutional investment (Chart 4).

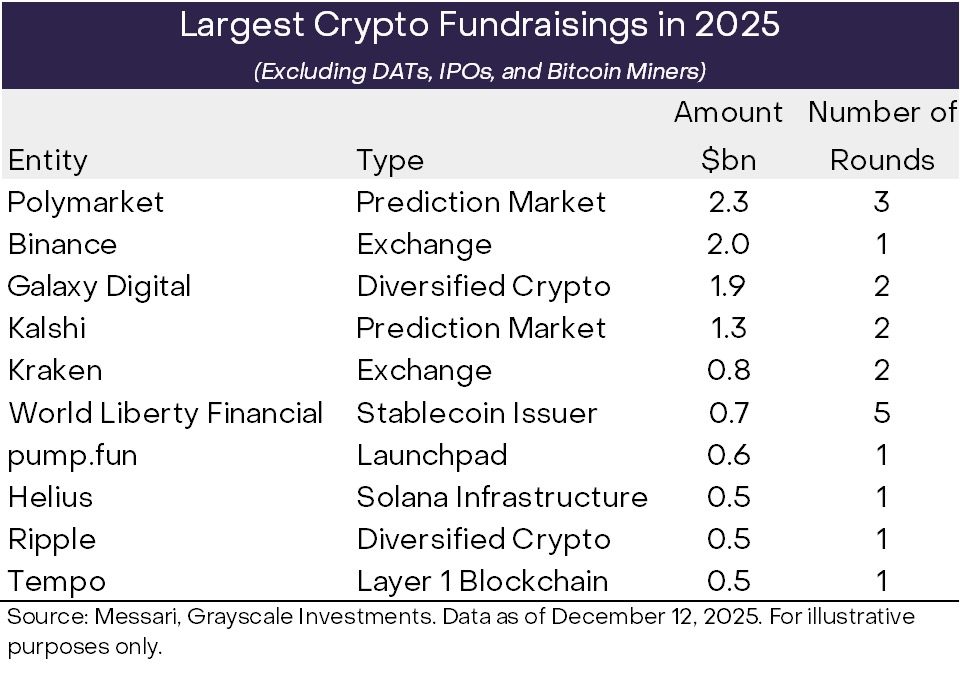

Chart 4: Higher financing amounts may be a sign of institutional confidence

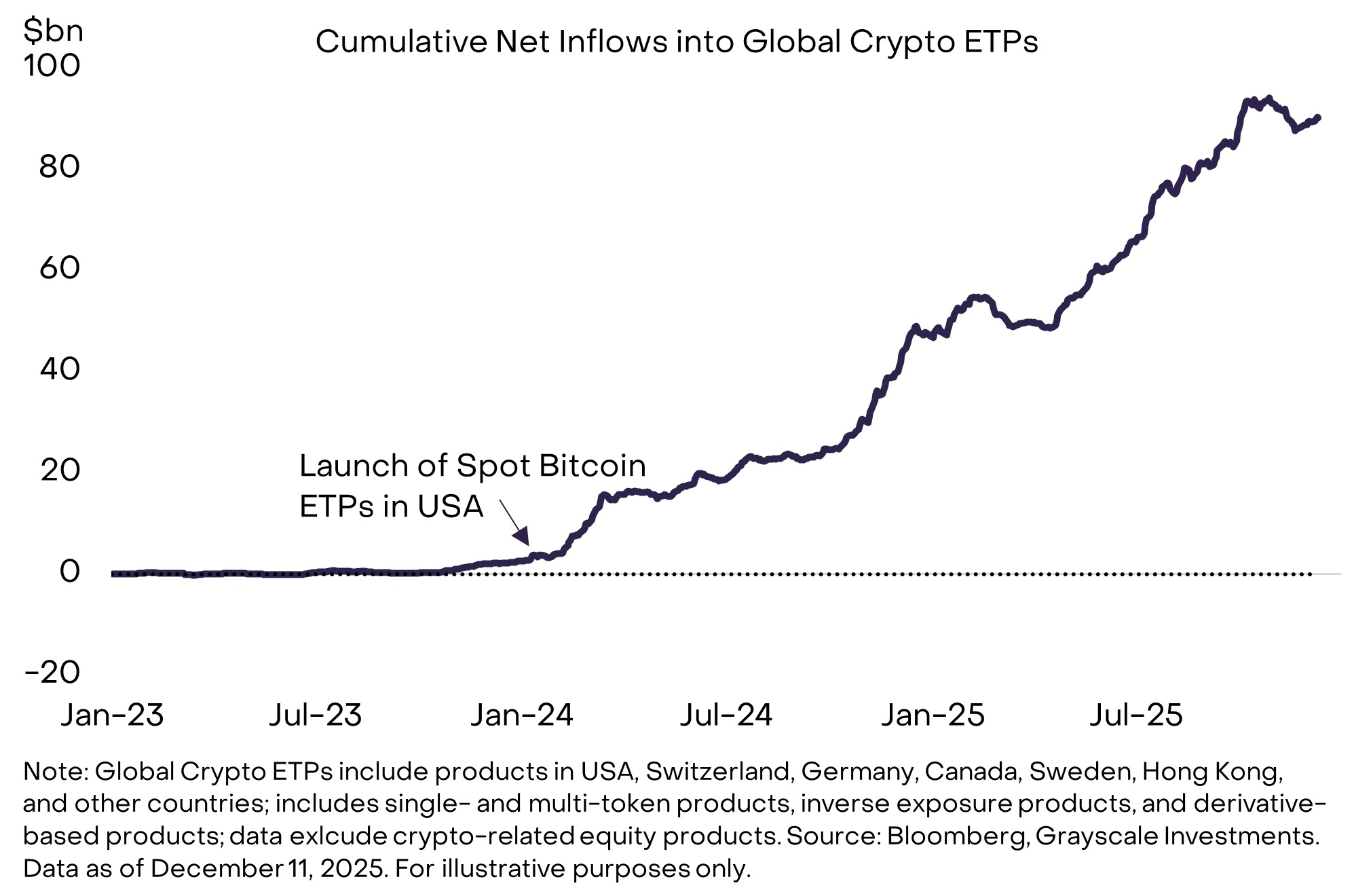

We believe that new capital entering the crypto ecosystem is likely to flow primarily through spot ETPs. Since the U.S. launched Bitcoin ETPs in January 2024, global crypto ETPs have achieved $87 billion in net inflows (Chart 5). Although these products have achieved initial success, the process of incorporating crypto assets into mainstream portfolios is still in its early stages. We estimate that the proportion of crypto asset allocation in U.S. advised wealth management is less than 0.5%. As more platforms complete due diligence, establish capital market assumptions, and incorporate crypto assets into model portfolios, this proportion is expected to grow. In addition to advised wealth, some pioneers have adopted crypto ETPs in institutional portfolios, including Harvard Management Company and one of Abu Dhabi's sovereign wealth funds, Mubadala. We expect this list to expand significantly in 2026.

Chart 5: Continued capital inflows into crypto spot ETPs

As the crypto market increasingly driven by institutional capital inflows, the nature of its price performance has changed. In each previous bull market, Bitcoin's price increased by at least 1000% within a year (Chart 6). In this cycle, the largest year-on-year increase was about 240% (as of March 2024). We believe this difference reflects that recent institutional buying is more stable, contrasting with the behavior of retail investors chasing momentum in past cycles. Although crypto investment involves significant risks, we believe that at the time of writing, the probability of a deep and prolonged cyclical pullback in prices is relatively low. Instead, we see a more likely scenario next year as a more stable price increase driven by institutional capital inflows.

Chart 6: No dramatic surge in Bitcoin prices in this cycle

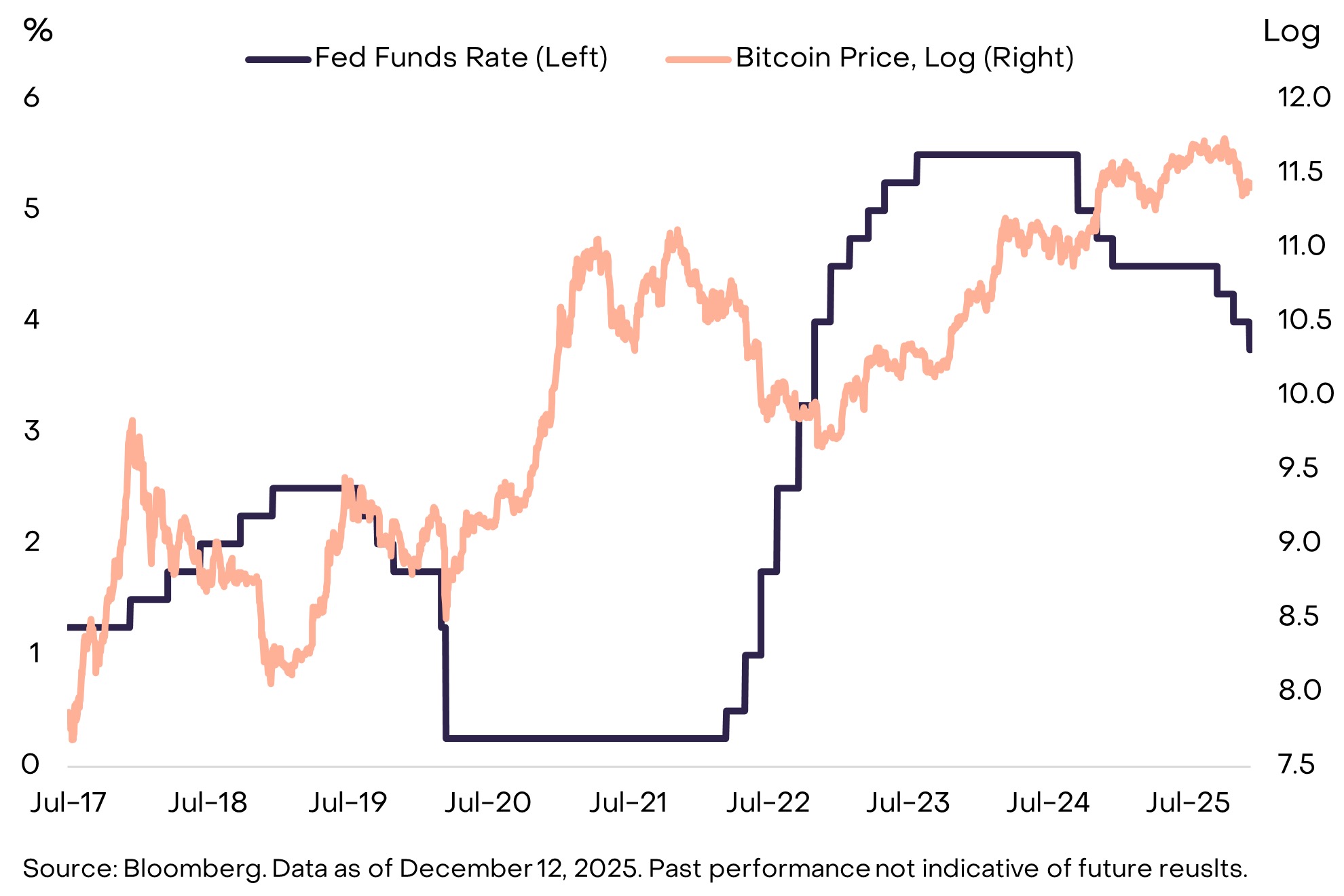

A supportive macro market backdrop may also limit some downside risks for token prices in 2026. The previous two cycle peaks occurred during periods of Federal Reserve interest rate hikes (Chart 7). In contrast, the Federal Reserve has cut rates three times in 2025 and is expected to continue lowering rates next year. Kevin Hassett, who may succeed Powell as Fed Chair, recently stated in an interview with Face the Nation: "The American people can expect President Trump to choose someone who can help them get cheaper auto loans and more easily obtain mortgages at lower rates." Overall, economic growth and the Fed's generally supportive policies should favor investor risk appetite and potentially drive up risk assets, including cryptocurrencies.

Chart 7: Previous cycle peaks associated with Federal Reserve rate hikes

Like all other asset classes, the drivers of the crypto market also stem from a combination of fundamentals and capital flows. The commodities market is cyclical, and future crypto assets may also experience long-term cyclical pullbacks at certain stages. However, we believe this will not occur in 2026. The fundamentals appear solid, and we expect macro demand for alternative value storage means to persist, while regulatory clarity will drive institutional funds toward public blockchain technology. Additionally, new capital continues to flow into the market, and by the end of next year, crypto ETPs are likely to enter more portfolios. In this cycle, there has not been a massive wave of retail demand; instead, there is stable allocation demand for crypto ETPs from various portfolios. Under a generally supportive macro backdrop, we believe these factors will create conditions for the crypto asset class to reach new highs in 2026.

Top Ten Crypto Investment Themes for 2026

Crypto assets are a diverse asset class that reflects numerous use cases of public blockchain technology. The following section outlines our views on the ten most important crypto investment themes for 2026—plus two "disruptors." For each theme, we list the most relevant tokens from our perspective. For more background information on investable digital assets, please refer to our Crypto Sector Framework.

Theme 1: Dollar Devaluation Risk Drives Demand for Currency Alternatives

Relevant Crypto Assets: BTC, ETH, ZEC

The U.S. economy faces a debt problem (see Chart 3), which may ultimately pressure the dollar's status as a store of value. Other countries face similar issues, but the dollar is the dominant international currency today, making the credibility of U.S. policy more critical for potential capital flows. We believe a small portion of digital assets can be viewed as viable stores of value due to their sufficiently broad adoption, high decentralization, and limited supply growth. This includes the two largest cryptocurrencies by market cap—Bitcoin and Ethereum. Like physical gold, their utility partly derives from their scarcity and autonomy.

Bitcoin has a supply cap of 21 million coins, fully controlled by algorithms. For example, we can confidently predict that the 20 millionth Bitcoin will be mined in March 2026. A transparent, predictable, and ultimately scarce digital currency system is a simple concept, but its appeal in today's economy is increasing due to the tail risks associated with fiat currencies. As long as the macro imbalances causing fiat currency risks continue to worsen, the demand for alternative value storage means in portfolios may also continue to rise (Chart 8). Zcash, a small decentralized digital currency with privacy features, may also be suitable for allocation in response to dollar devaluation (see Theme 5).

Chart 8: Macro imbalances may drive demand for alternative value storage means

Theme 2: Regulatory Clarity Supports the Adoption of Digital Assets

Relevant Crypto Assets: Almost All

In 2025, the U.S. made significant strides toward regulatory clarity for cryptocurrencies, including the passage of the GENIUS Act (regarding stablecoins), the rescission of SEC Staff Accounting Bulletin No. 121 (regarding custody), the introduction of universal listing standards for crypto ETPs, and addressing the issue of the crypto industry accessing traditional banking services (Chart 9). We expect another key step forward next year with the passage of bipartisan market structure legislation. The House passed its version of the Clarity Act in July, and the Senate has initiated its own legislative process. While many details are still to be finalized, overall, the bill provides a traditional financial rulebook for the crypto capital markets, including registration and disclosure requirements, crypto asset classification, and insider rules.

In practice, establishing a more comprehensive regulatory framework for crypto assets in the U.S. and other major economies may mean that regulated financial services companies will incorporate digital assets into their balance sheets and begin trading on blockchains. This may also allow for on-chain capital formation, enabling both startups and established companies to issue regulated tokens. By further unlocking the full potential of blockchain technology, regulatory clarity should help elevate the entire crypto asset class. Given the potential importance of regulatory clarity in driving the crypto asset class in 2026, we believe that a breakdown in the bipartisan legislative process should be viewed as a downside risk.

Chart 9: The U.S. made significant strides toward regulatory clarity in 2025

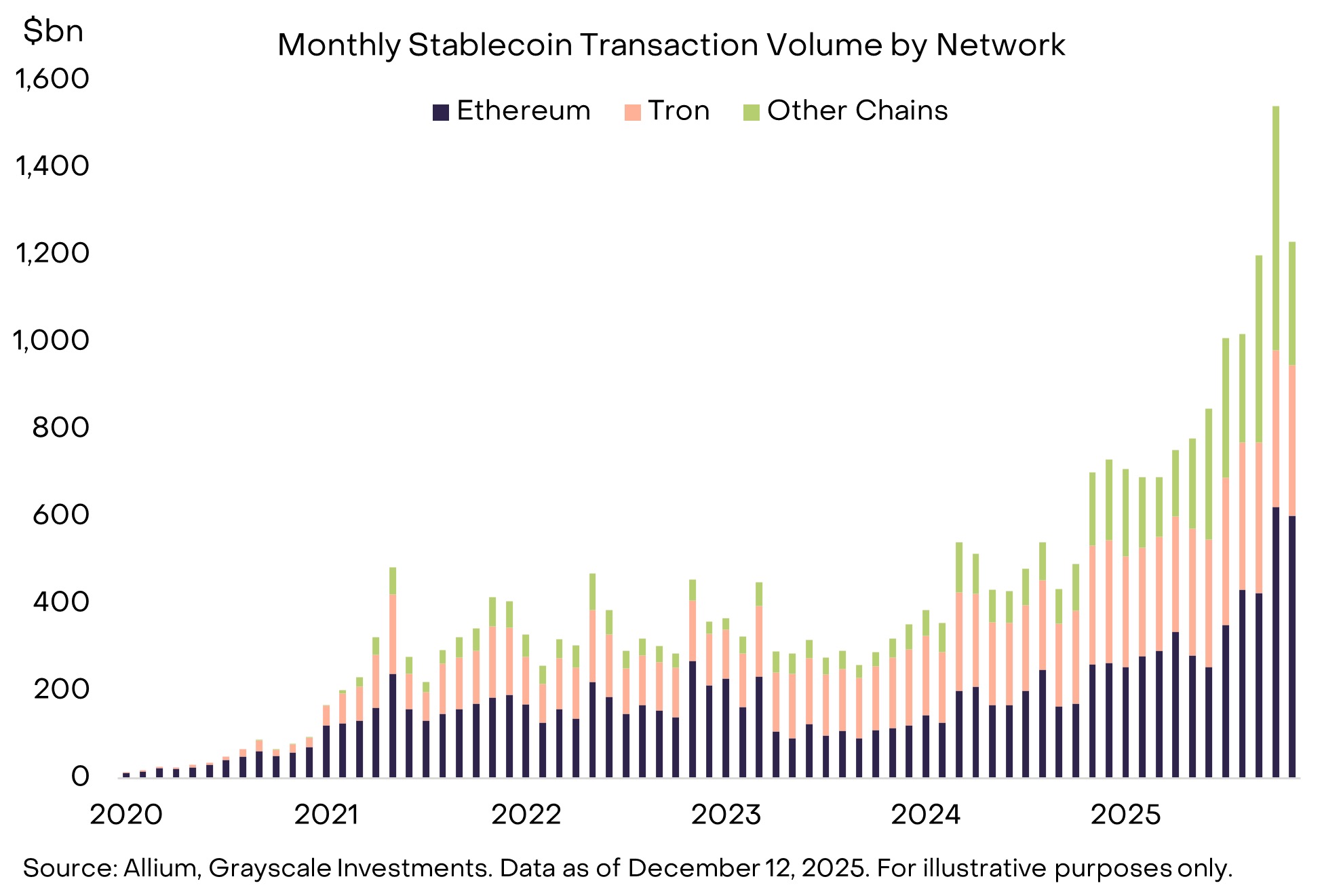

Theme 3: The Scope of Stablecoins Will Expand Post-GENIUS Act

Relevant Crypto Assets: ETH, TRX, BNB, SOL, XPL, LINK

Stablecoins experienced a breakout moment in 2025: their circulating supply reached $300 billion, with an average monthly trading volume of $1.1 trillion over the six months ending in November, the U.S. Congress passed the GENIUS Act, and a wave of institutional capital is flowing into this space (Chart 10). We expect to see tangible results in 2026: stablecoins integrated into cross-border payment services, used as collateral in derivatives exchanges, appearing on corporate balance sheets, and serving as alternatives for online consumer payment via credit cards. The growing popularity of the prediction market may also generate new demand for stablecoins. Higher stablecoin trading volumes will benefit the blockchains that record these transactions (such as ETH, TRX, BNB, and SOL) as well as various supporting infrastructures (such as LINK) and DeFi applications (see Theme 7).

Chart 10: Stablecoins experience a breakout moment

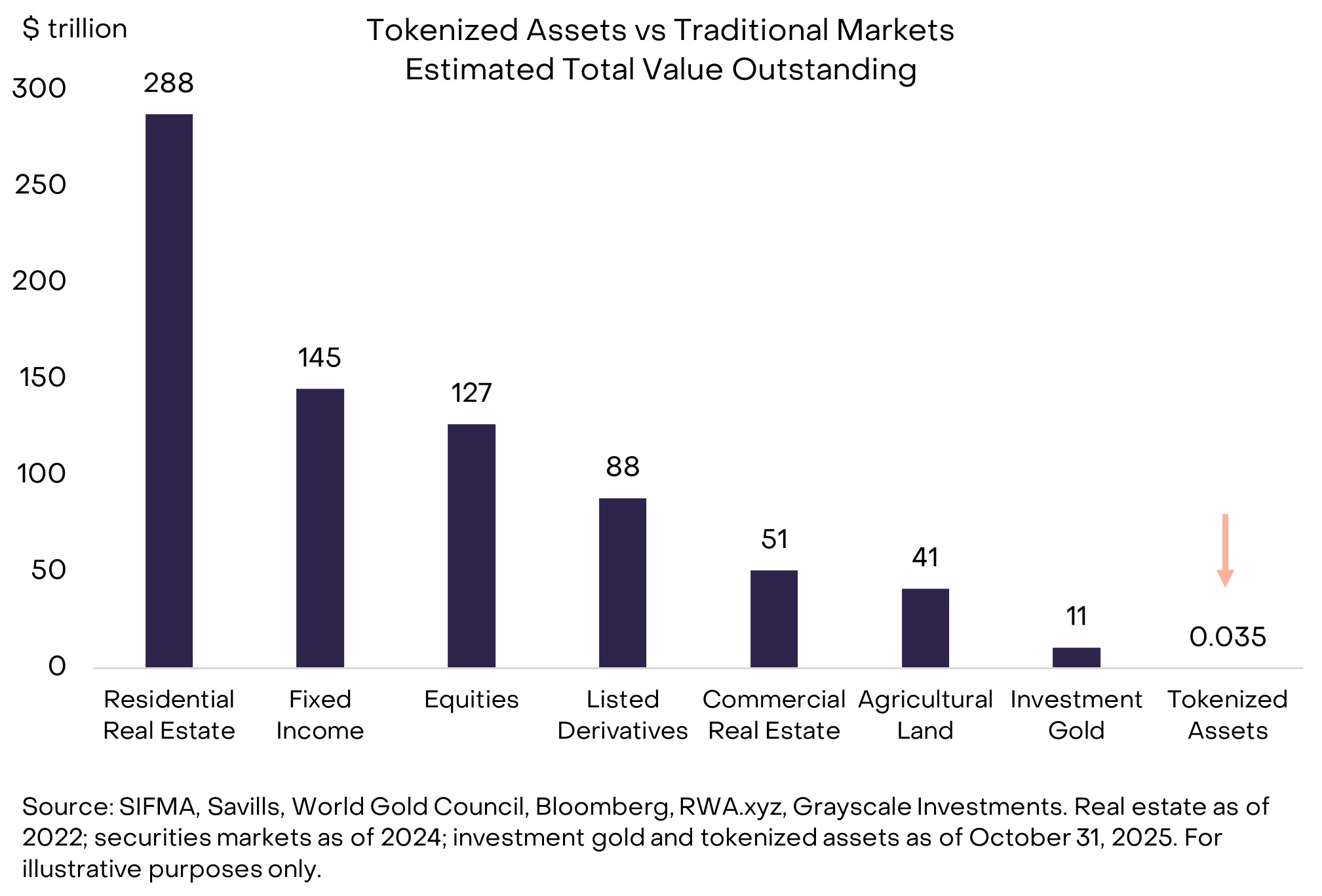

Theme 4: Asset Tokenization is at a Turning Point

Relevant Crypto Assets: LINK, ETH, SOL, AVAX, BNB, CC

Currently, the scale of tokenized assets is very small: accounting for only 0.01% of the global stock and bond market value (Chart 11). We expect that with more mature blockchain technology and a clearer regulatory environment, asset tokenization will grow rapidly in the coming years. We believe that by 2030, a growth of approximately 1000 times in tokenized assets would not be surprising. This growth may bring value to the blockchains that handle tokenized asset transactions and various supporting applications. Currently, asset tokenization mainly occurs on Ethereum (ETH), BNB Chain (BNB), and Solana (SOL), although this list may change over time. In terms of supporting applications, Chainlink (LINK) appears particularly well-positioned due to its unique software technology suite.

Chart 11: Tokenized assets have significant growth potential

Theme 5: Blockchain Technology Goes Mainstream, Privacy Solutions Become Essential

Relevant Crypto Assets: ZEC, AZTEC, RAIL

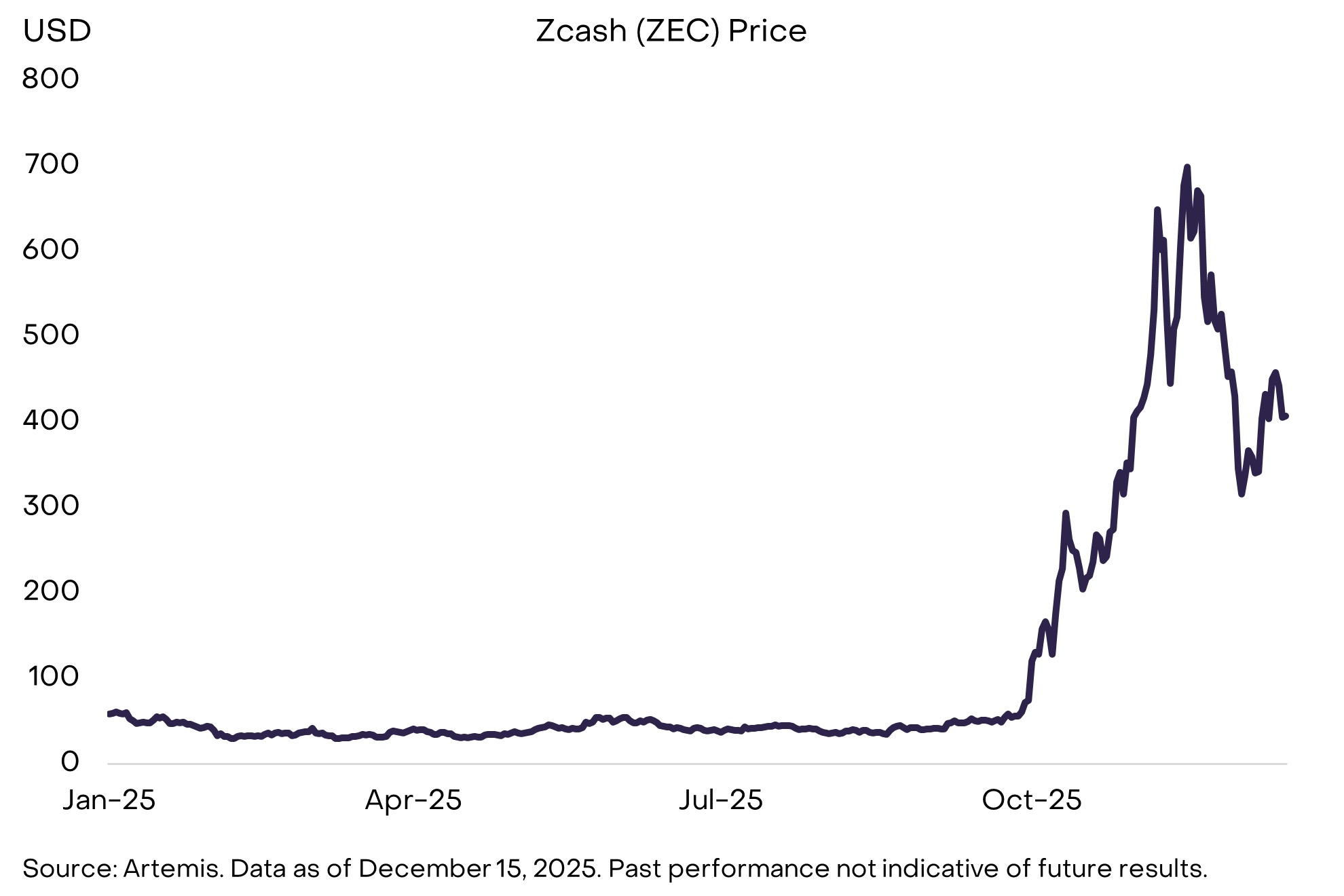

Privacy is a normal component of the financial system: almost everyone expects their salaries, taxes, net worth, and spending habits to remain unseen on public ledgers. However, most blockchains are inherently transparent. If public blockchains are to integrate more deeply into the financial system, they will need stronger privacy infrastructure. This is becoming increasingly evident as regulation drives this integration.

Investor focus on privacy may benefit some projects, including Zcash (ZEC)—a decentralized digital currency similar to Bitcoin but with privacy features; Zcash saw significant appreciation in Q4 2025 (Chart 12). Other major projects include the privacy-focused Ethereum Layer 2 solution Aztec and the DeFi privacy middleware Railgun. We may also see increased adoption of confidential transactions on leading smart contract platforms like Ethereum (via ERC-7984) and Solana (via Confidential Transfers token extension). Improvements in privacy tools may also necessitate better identity verification and compliance infrastructure in the DeFi space.

Chart 12: Crypto investors are increasingly focused on privacy features

Theme 6: Centralized AI Calls for Blockchain Solutions

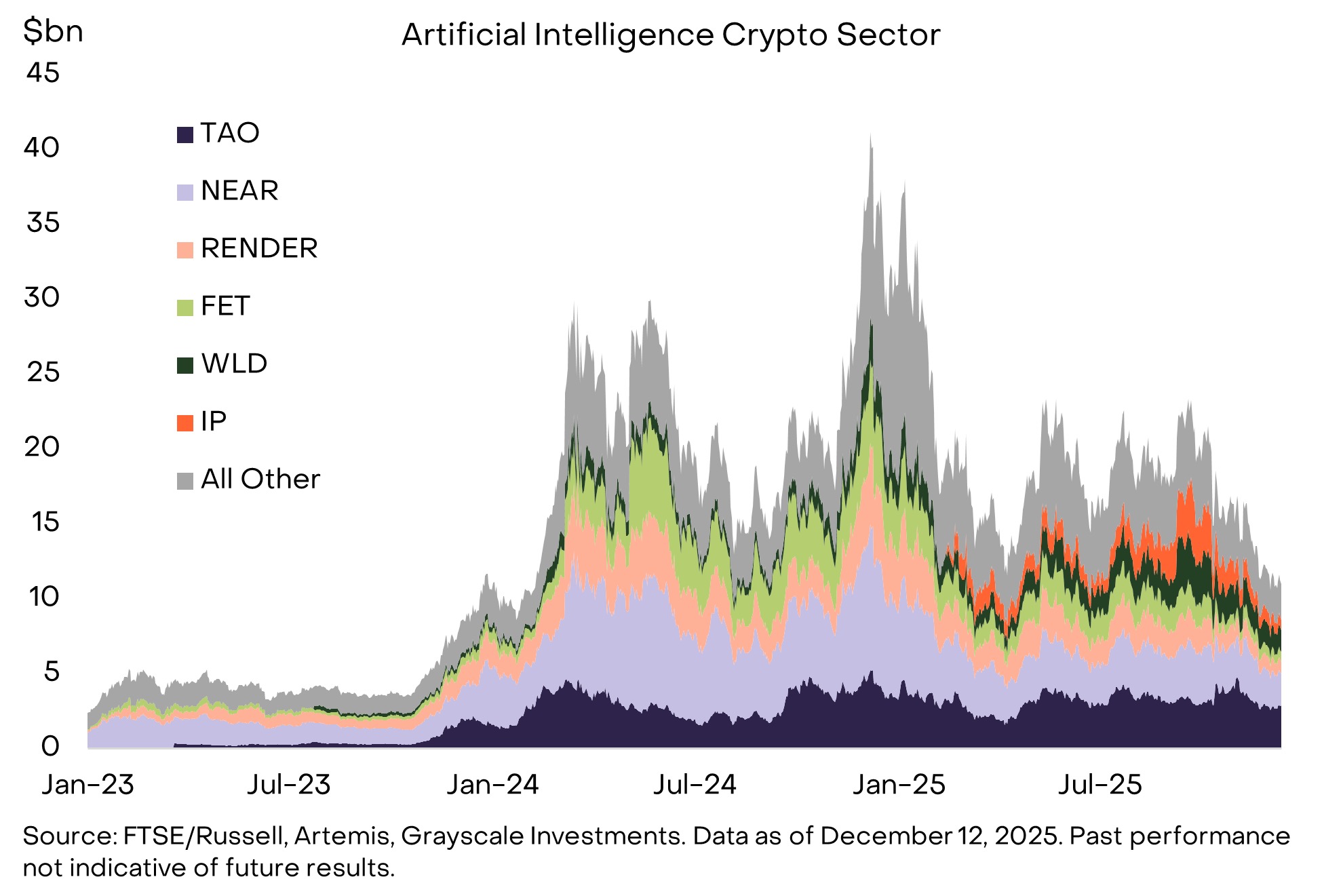

Relevant Crypto Assets: TAO, IP, NEAR, WORLD

The underlying compatibility between cryptocurrencies and artificial intelligence is tighter and clearer than ever. AI systems are becoming centralized around a few dominant companies, raising concerns about trust, bias, and ownership, while cryptocurrencies provide foundational components to directly address these risks. Decentralized AI development platforms like Bittensor aim to reduce reliance on centralized AI technologies; verifiable personality proof systems like World can distinguish between humans and agents in a world of synthetic activities; and networks like Story Protocol offer transparent, traceable intellectual property solutions in an era where digital content provenance is increasingly difficult. Meanwhile, tools such as X402 (an open, zero-fee payment layer supporting stablecoins on Base and Solana) enable low-cost, instant micropayments necessary for economic interactions between agents or between machines and humans.

These components together form the early infrastructure of the "agent economy," where identity, computation, data, and payments must all possess verifiability, programmability, and censorship resistance. Although still in its early and uneven development, the intersection of cryptocurrencies and artificial intelligence continues to spawn some of the most attractive long-term use cases in the field. As AI becomes increasingly decentralized, autonomous, and involved in economic activities, protocols that build real infrastructure are expected to benefit from this trend (Chart 13).

Chart 13: Blockchain provides solutions to some risks of AI

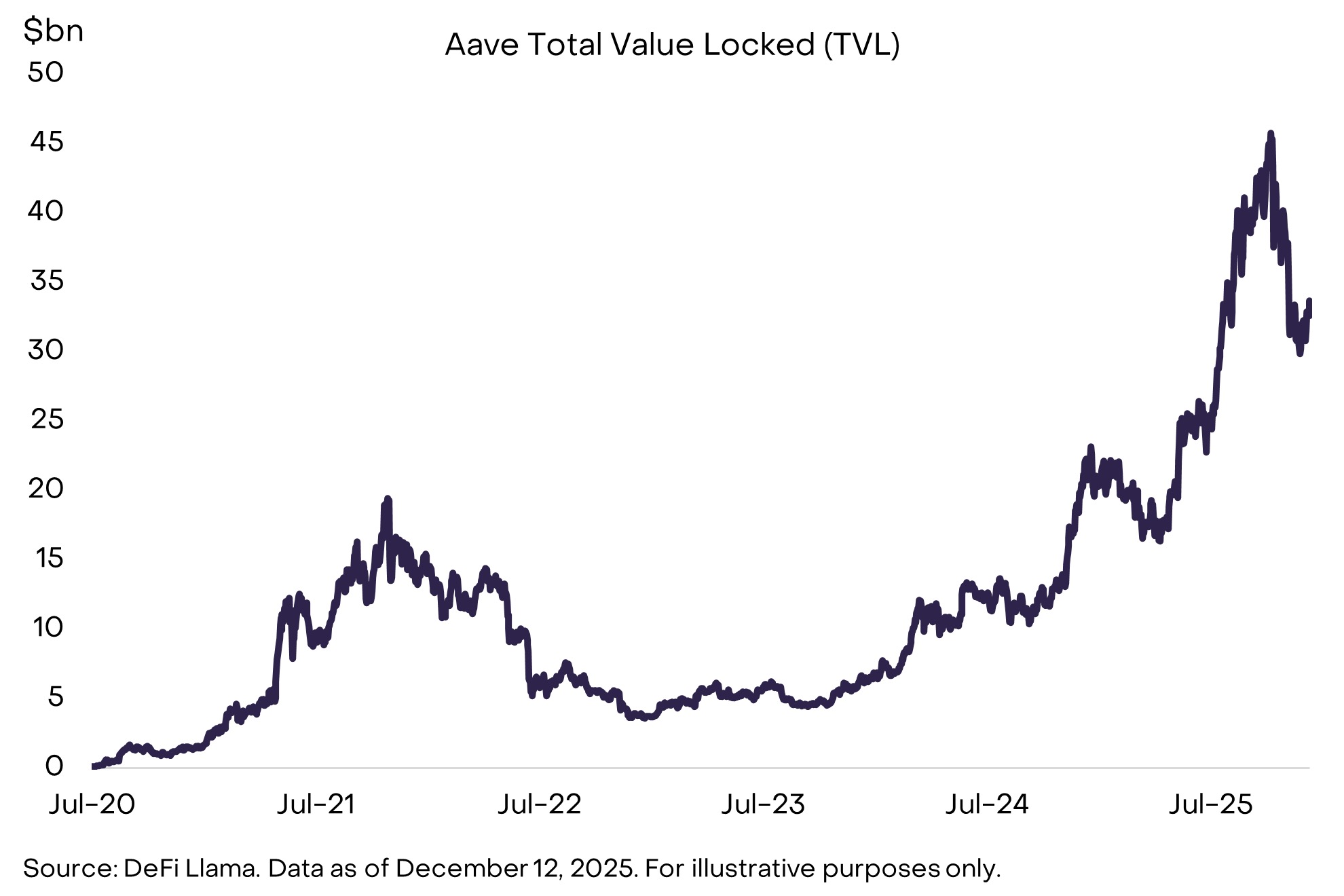

Theme 7: Lending Leads to Accelerated Development of DeFi

Relevant Crypto Assets: AAVE, MORPHO, MAPLE, KMNO, UNI, AERO, RAY, JUP, HYPE, LINK

Driven by technological improvements and favorable regulatory winds, DeFi applications showed strong development momentum in 2025. Stablecoins and tokenized assets are important success stories, but DeFi lending led by Aave, Morpho, and Maple Finance also achieved significant growth (Chart 14). Meanwhile, the open interest and daily trading volume of decentralized perpetual contract exchanges like Hyperliquid continue to rival some of the largest centralized derivatives exchanges.

Looking ahead, the growing liquidity, interoperability, and real-world price connections of these platforms will make DeFi a reliable choice for users hoping to conduct financial activities directly on-chain. More DeFi protocols are expected to integrate with traditional fintech companies to leverage their infrastructure and existing user bases. We anticipate that core DeFi protocols will benefit from this, including lending platforms like AAVE, decentralized exchanges like UNI and HYPE, as well as related infrastructure like LINK, while blockchains that support most DeFi activities (e.g., ETH, SOL, BASE) will also benefit.

Chart 14: The scale and diversity of DeFi continue to grow

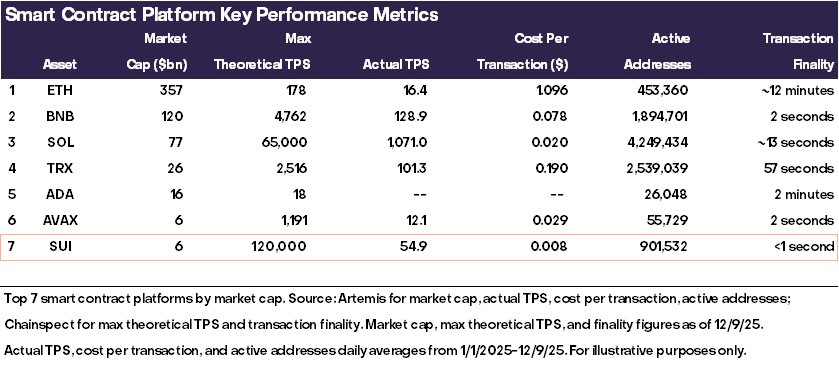

Theme 8: Mainstream Adoption Will Require Next-Generation Infrastructure

Relevant Crypto Assets: SUI, MON, NEAR, MEGA

New blockchains continue to push the technological frontier. However, some investors believe that more block space is not needed, as the demand for existing chains is already insufficient. Solana is a typical example of this viewpoint: a high-speed but underutilized chain that was once criticized for being "excess block space" until a wave of adoption made it one of the most successful cases in the industry.

However, not all current high-performance chains will follow a similar trajectory, but we expect some of them will. Superior technology does not guarantee adoption, but the architecture of these next-generation networks makes them particularly suitable for emerging application areas such as AI micropayments, real-time gaming loops, high-frequency on-chain trading, and intent-based systems. Among this group, we expect Sui to stand out due to its technological advantages and integrated development strategy (Chart 15). Other promising projects include Monad (parallelized EVM), MegaETH (ultra-fast Ethereum Layer 2 network), and Near (a blockchain focused on AI, whose intent products have achieved success).

Chart 15: Next-generation blockchains like Sui offer faster and cheaper transactions

Theme 9: Focus on Sustainable Revenue

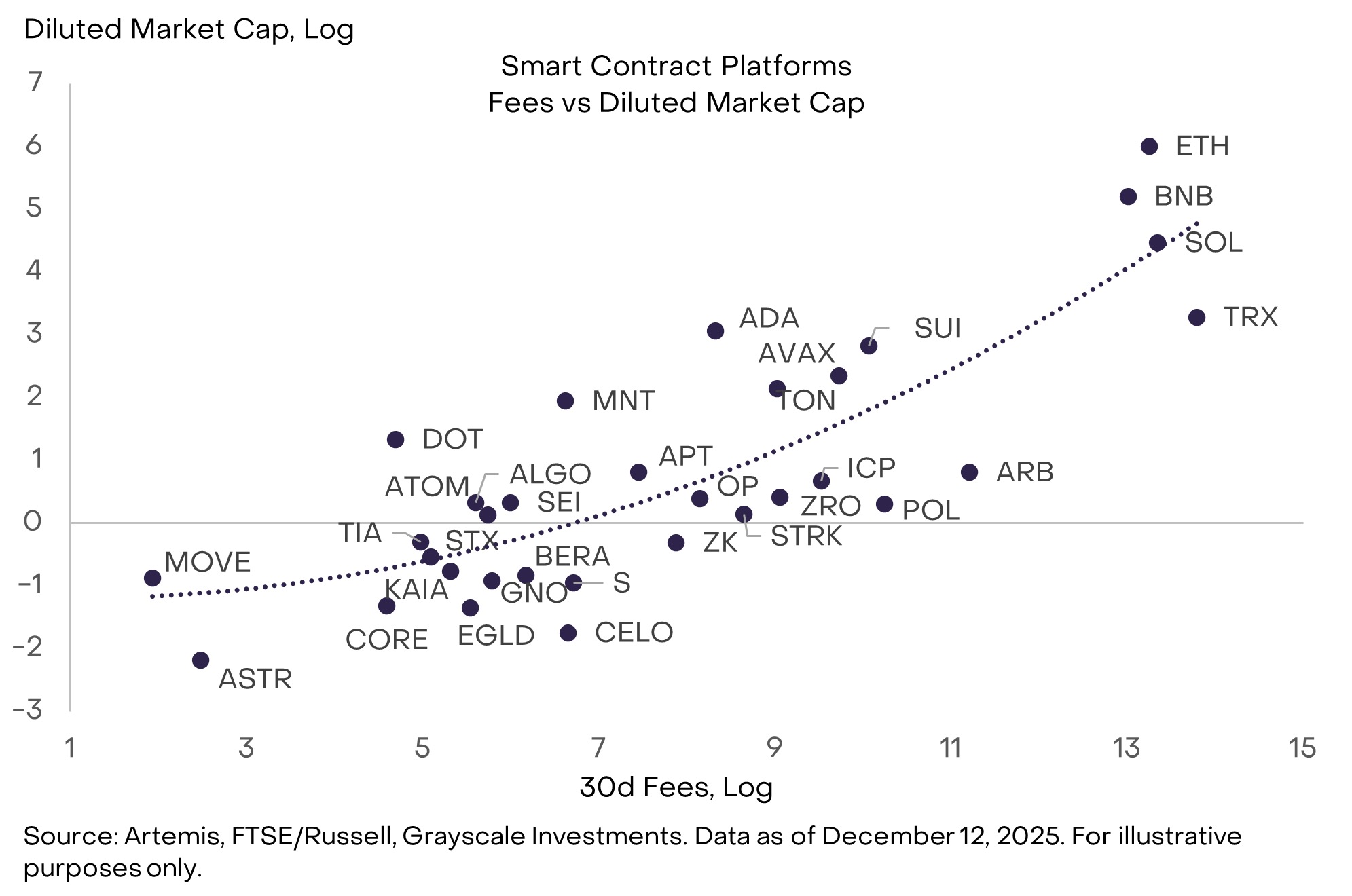

Relevant Crypto Assets: SOL, ETH, BNB, HYPE, PUMP, TRX

Blockchains are not enterprises, but they do have measurable fundamental indicators, including users, transaction volume, fees, capital/TVL (total value locked), developers, and applications. Among these indicators, we believe transaction fees are the most valuable fundamental metric because they are the hardest to manipulate and are the most comparable across different blockchains (they also provide the best empirical fit).

Transaction fees are akin to "revenue" in traditional corporate finance. For blockchain applications, it may also be important to distinguish between protocol fees/revenue and "supply-side" fees/revenue. As institutional investors begin to allocate funds to the crypto space, we expect them to focus on blockchains and applications with high and/or growing fee revenues (excluding Bitcoin). Smart contract platforms with relatively high revenues include TRX, SOL, ETH, and BNB (Chart 16). Revenue-rich application layer assets include HYPE and PUMP, among others.

Chart 16: Institutional investors may closely examine fundamentals

Theme 10: Investors Seek Default Staking Yields

Relevant Crypto Assets: LDO, JTO

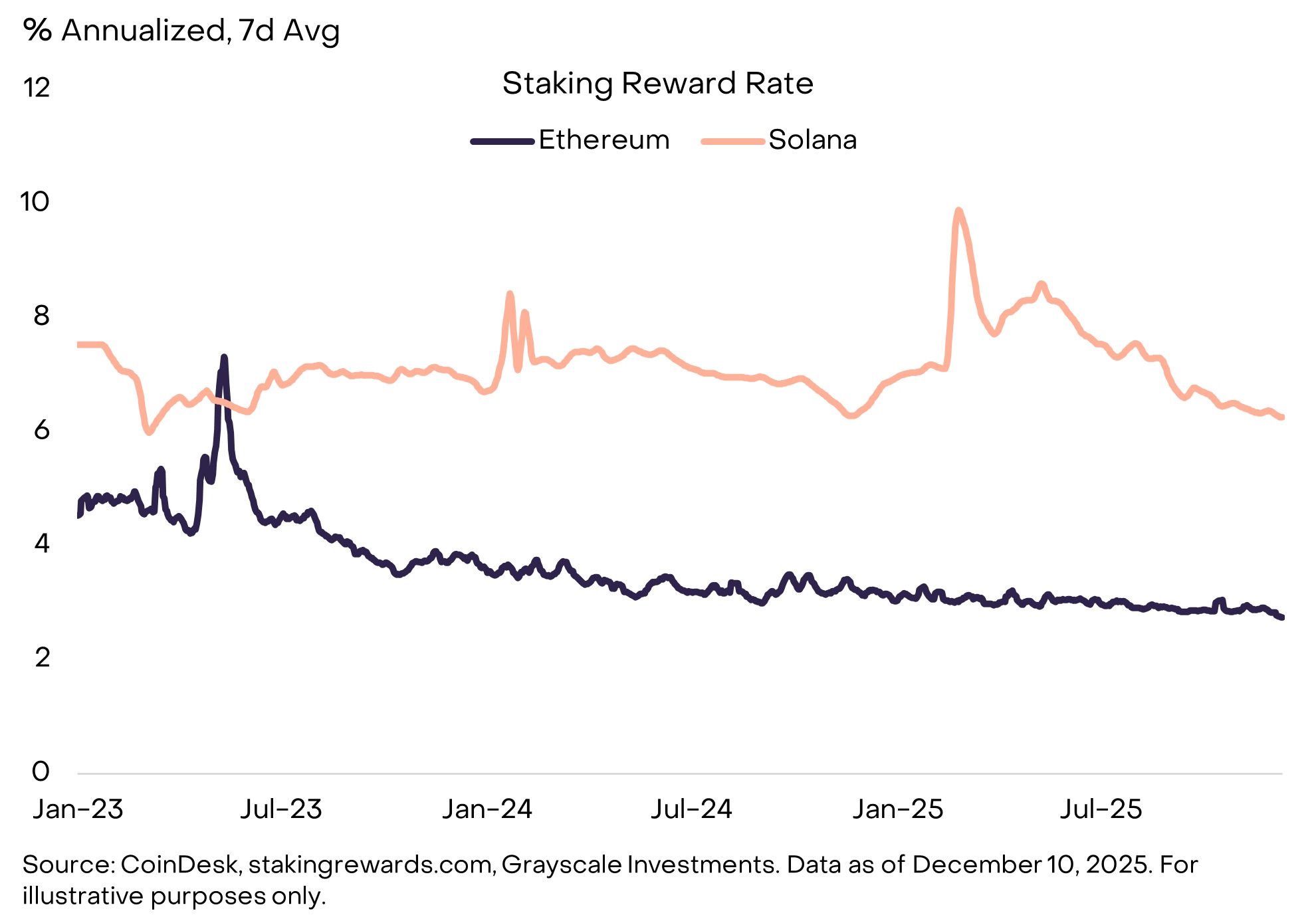

U.S. policymakers made two adjustments related to staking in 2025, which will enable more token holders to participate in this activity: (i) The SEC clarified that liquid staking activities do not constitute securities trading; (ii) The IRS and Treasury stated that investment trusts/ETPs can engage in digital asset staking. Guidance around liquid staking services may benefit Lido and Jito, which are leading liquid staking protocols based on Ethereum and Solana, respectively. More broadly, the fact that crypto ETPs can engage in staking is likely to make them the default structure for holding Proof of Stake token investment positions, leading to increased staking rates and pressure on reward rates (Chart 17). In an environment where staking is more widely adopted, custodial staking through ETPs will provide a convenient structure for obtaining rewards, while on-chain non-custodial liquid staking will have the advantage of composability within DeFi. We expect this dual structure to persist for some time.

Chart 17: PoS tokens provide native rewards

Disruptors in 2026

We expect each of the investment themes mentioned above to drive the development of the crypto market in 2026. However, there are two hot issues that we do not expect to have a substantial impact on the crypto market next year, including the cryptographic vulnerabilities posed by quantum computing and the evolution of Digital Asset Trusts (DATs). There will be much discussion around these topics, but we believe they are not central to the market outlook.

If quantum computing technology continues to advance, most blockchains will eventually need to update their cryptographic systems. Theoretically, a sufficiently powerful quantum computer could derive a private key from a public key, allowing it to create valid digital signatures to spend users' coins. Therefore, Bitcoin and most other blockchains, as well as nearly all other areas of the economy that use cryptography, will ultimately need to transition to post-quantum tools. However, experts estimate that the likelihood of a quantum computer powerful enough to break Bitcoin's cryptography appearing before 2030 is low. Research on quantum risks and community preparedness may accelerate in 2026, but we believe this theme is unlikely to impact prices.

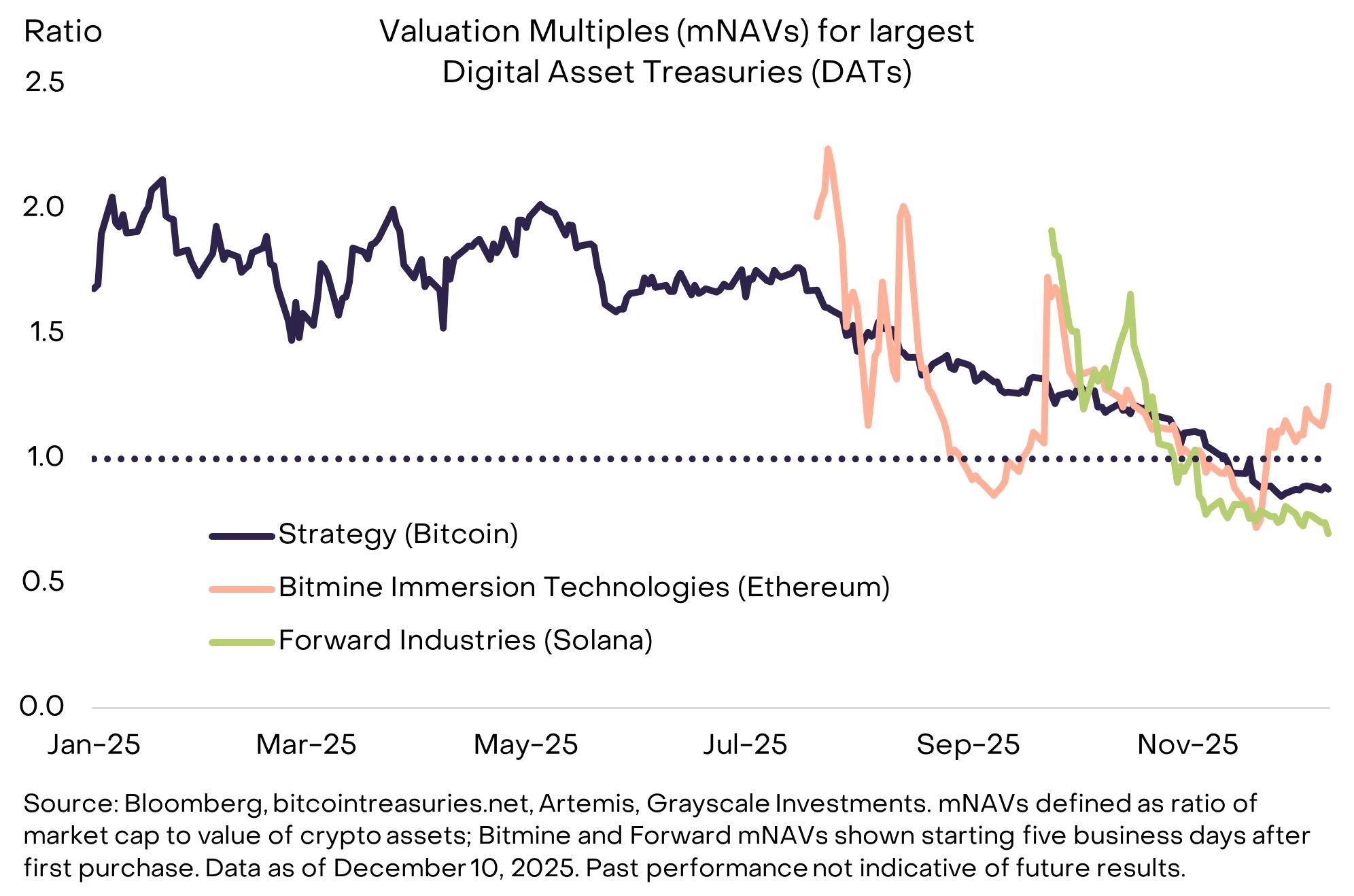

The situation with DATs is similar. The strategy pioneered by Michael Saylor to incorporate digital assets into corporate balance sheets gave rise to dozens of imitators in 2025. According to our estimates, DATs hold 3.7% of the total Bitcoin supply, 4.6% of ETH, and 2.5% of SOL. Demand for these tools has retreated from its mid-2025 peak: the largest DAT is currently trading at an adjusted net asset value (mNAV) close to 1.0 (Chart 18). However, most DATs are not over-leveraged (or are completely unleveraged), so they may not face forced liquidation of assets during market downturns. The largest DAT Strategy by market capitalization recently raised a dollar reserve fund to continue paying preferred stock dividends even if Bitcoin prices fall. We expect most DATs to behave like closed-end funds, trading at a premium or discount relative to net asset value, with few asset liquidations. These tools may become a permanent feature in the crypto investment space, but we believe they are unlikely to be a major source of new token demand or significant selling pressure in 2026.

Chart 18: DAT premiums have narrowed, but the likelihood of asset liquidation is low

Summary

We believe the outlook for digital assets in 2026 is bright, supported by the dual backing of macro demand for alternative stores of value and an increasingly clear regulatory environment. Next year is likely to focus on deepening the connections between blockchain-based finance and traditional finance, as well as the inflow of institutional capital. Tokens that gain institutional adoption are likely to be those with clear use cases, sustainable revenue, and the ability to enter regulated trading venues and applications. Investors can expect the range of crypto assets available through ETPs to expand, with support for staking functionality where possible.

At the same time, the clarity of regulation and institutional adoption may raise the bar for success in mainstream circles. For example, crypto projects may need to meet new registration and disclosure requirements to enter regulated exchanges. Institutional investors are also likely to overlook those crypto assets with relatively high market capitalizations but no clear use cases. The "GENIUS Act" clearly distinguishes between regulated payment stablecoins (which will enjoy specific rights and bear corresponding responsibilities under U.S. law) and other stablecoins (which do not enjoy the same rights). Similarly, we expect the institutional era of cryptocurrencies to draw a clearer line between assets that can access regulated venues and attract institutional capital and those that cannot access the same channels.

Crypto assets are entering a new era, but not all tokens will successfully transition from the old era to the new one.

免责声明:本文章仅代表作者个人观点,不代表本平台的立场和观点。本文章仅供信息分享,不构成对任何人的任何投资建议。用户与作者之间的任何争议,与本平台无关。如网页中刊载的文章或图片涉及侵权,请提供相关的权利证明和身份证明发送邮件到support@aicoin.com,本平台相关工作人员将会进行核查。