The regulatory landscape for cryptocurrency assets in the United States is undergoing a fundamental shift. On December 15, 2025, the U.S. Securities and Exchange Commission (SEC) cryptocurrency task force held a closed-door roundtable discussion on Financial Surveillance and Privacy.

This meeting, along with a series of new policies introduced by the SEC in the second half of 2025, clearly outlines a path from a stringent "enforcement regulation" to a focus on "dialogue regulation" and "compliance innovation." This is not just an adjustment in regulatory philosophy but could reshape the flow of global crypto capital and the landscape of innovation.

1. Core of the Roundtable: Walking a Tightrope Between Surveillance and Privacy

The roundtable directly addressed a core contradiction: how to protect individuals' legitimate financial privacy while utilizing the transparency of blockchain technology.

● SEC Chairman Paul Atkins issued a clear warning in his opening remarks. He pointed out that blockchain is essentially an unprecedented transparent ledger, and if regulators instinctively treat every wallet as a broker and every line of code as an exchange, then the government has the ability to turn the entire crypto ecosystem into a "financial panopticon." This statement rarely acknowledges the threat of excessive surveillance to personal freedom.

● Atkins also defended privacy-enhancing technologies (such as zero-knowledge proofs). He believes these technologies provide a balanced solution: for example, allowing regulated platforms to prove their users have been screened without submitting a complete mapping of every payment to the government. This provides a theoretical framework for "regulatable privacy"—privacy is not outside the law, but protecting legitimate privacy should be the norm, not an indicator of criminality.

2. Paradigm Shift: From "Enforcement is King" to "Innovation Exemption"

This roundtable is not an isolated event but a microcosm of the SEC's overall regulatory paradigm shift. In 2025, with the change in U.S. administration, the SEC's regulatory tone shifted from Gary Gensler's era of "regulation equals enforcement" to the "categorical regulation and encouragement of innovation" advocated by the new chairman, Paul Atkins.

The most emblematic policy is the "Innovation Exemption," expected to take effect in January 2026. This policy aims to provide a time-limited "safe harbor" for crypto projects, with key points including:

● Lowering Barriers: Allowing eligible projects to operate during a 12-24 month exemption period with simplified disclosures, without the need to immediately complete the full set of expensive and time-consuming registration procedures for traditional securities.

● Clear Pathways: The exemption policy works in conjunction with the "Token Classification Law" that the SEC is building. Under this framework, digital assets are categorized as commodity-type, functional-type, collectible-type, and security-type. When the networks of the current three asset types reach "sufficient decentralization," they can exit the securities regulatory framework. This provides projects with a clear path for compliant development.

● Setting Boundaries: The exemption is not without constraints; projects must meet basic investor protection measures, such as regular reporting, risk warnings, and implementing KYC (Know Your Customer) and AML (Anti-Money Laundering) procedures.

3. Multi-Dimensional Strategy: Coordination Among Administration, Legislation, and Institutions

The SEC's transformation is not a solo endeavor but is embedded within a larger, parallel new U.S. crypto regulatory system involving both administration and legislation.

- Coordination with Congressional Legislation: The SEC's "Innovation Exemption" complements the "CLARITY Act" being advanced by Congress, forming a synergy between "temporary exemptions" and "permanent standards."

● This act aims to clarify the regulatory responsibilities of the SEC and the Commodity Futures Trading Commission (CFTC) and will set legislative-level decentralization standards for "mature blockchains."

● At the same time, the GENIUS Act, which took effect in July 2025, has excluded payment stablecoins from the definition of securities, establishing an independent banking-style regulatory framework, allowing the SEC's innovation exemption to focus more on emerging areas like DeFi.

- Cooperation Among Regulatory Agencies: The SEC and CFTC have announced enhanced coordination to resolve jurisdictional ambiguities through joint statements and roundtable discussions. For example, both parties have clarified that exchanges registered with either agency can facilitate the trading of certain spot crypto products, encouraging free choice among market participants.

4. Investment Context: Seeking New Alpha Within a Compliance Framework

The clarification of the regulatory environment is redrawing the investment map in the crypto space. The long-standing policy uncertainty that has plagued the market is beginning to dissipate, revealing new opportunities.

1. Privacy Technology Track: From Marginal to Mainstream

The discussion of privacy technology at the roundtable resonates with market dynamics.

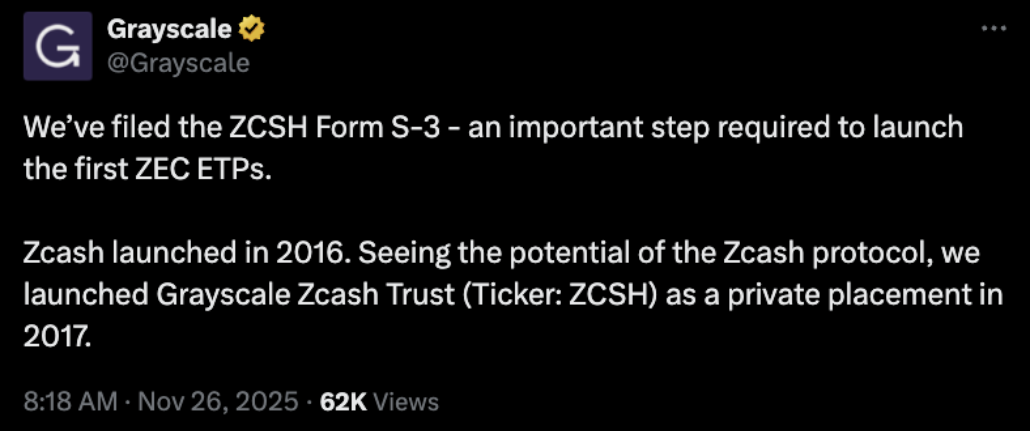

● In November 2025, the world's largest crypto asset management firm, Grayscale, submitted an application to the SEC to convert its Zcash trust into a spot ETF. If approved, this would become the first ETF linked to a privacy coin in the U.S., carrying significant symbolic weight.

● This indicates that under a clear compliance framework (such as a regulated ETF structure), previously suppressed privacy technologies are gaining packaging as mainstream financial products, with their value expected to be reassessed. The prices of tokens like Zcash have recently seen significant increases.

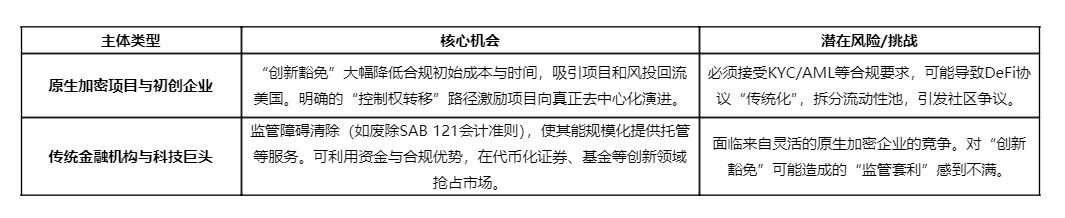

2. Core Beneficiaries of Compliance Innovation: Two Main Types

Under the new regulatory framework, two types of entities will seize development opportunities:

3. Infrastructure and "Compliance as a Service"

For both native and traditional participants, compliance itself has become a rigid demand. This creates a huge market for infrastructure projects or companies that can provide the following services:

● Compliance Tools: On-chain identity verification, transaction monitoring, automated audit reporting solutions.

● Middleware: Oracles or data protocols that help projects meet regulatory reporting requirements.

● Professional Services: Law firms and consulting agencies will see a surge in business related to "Innovation Exemption" applications and compliance framework design.

A typical case is Coinbase, which, in response to the SEC lawsuit, transformed its developed KYC/AML technology into a "compliance as a service" product for external sales, achieving significant revenue growth.

5. Global Competition: The Struggle Between the U.S. Model and the European Model

The shift in U.S. regulation is also part of a global regulatory competition. The flexible, categorical regulatory model represented by its "Innovation Exemption" stands in stark contrast to the unified, pre-authorization model represented by the EU's Markets in Crypto-Assets (MiCA) regulation.

● U.S. Model: Tolerates higher initial uncertainty and risk in exchange for speed and flexibility in innovation, making it attractive to startups and venture capital.

● EU Model: Provides stability and predictability through unified rules, favored by large traditional financial institutions looking for steady expansion.

This strategic divergence means that global crypto companies may need to prepare two sets of compliance strategies. In the short term, the more lenient and flexible U.S. regulatory environment may attract global crypto talent and capital back, reshaping the geography of innovation. The EU and other regions (such as the UK, Singapore, and Hong Kong) may need to assess and adjust their policies to maintain competitiveness.

6. Pragmatic Outlook and Risk Warnings

In 2026, with the formal implementation of the "Innovation Exemption" and the advancement of the "CLARITY Act," the U.S. is expected to usher in a wave of "compliance innovation." However, challenges remain:

● The Art of Balance: Achieving a lasting balance between privacy and surveillance, the ideals of decentralization and necessary compliance, and encouraging innovation while protecting investors remains a significant test.

● Political Stability: The direction of regulation is closely tied to the administration, and the long-term stability of policies remains to be seen.

● Market Volatility: Expectations of regulatory benefits have already partially reflected in asset prices (such as privacy coins), and the introduction of specific rule details may still trigger volatility.

For market participants, a pragmatic strategy is to deeply study the specifics of rules like the "Innovation Exemption," assess the compliance fit of their projects; focus on projects with technological advantages and first-mover advantages in clear tracks like privacy technology and compliance infrastructure; and incorporate compliance costs and requirements into core business models rather than as an afterthought.

The SEC's roundtable and new policies mark a turning point in an era. The crypto industry is transitioning from a "wild west" of regulation to a new continent where rules are gradually clarifying, but competition remains fierce. In this new continent, innovation and compliance are no longer a choice but a necessary question that must be addressed. The correctness of the answer will determine the winners of the next cycle.

Join our community to discuss and grow stronger together!

Official Telegram community: https://t.me/aicoincn

AiCoin Chinese Twitter: https://x.com/AiCoinzh

OKX benefits group: https://aicoin.com/link/chat?cid=l61eM4owQ

Binance benefits group: https://aicoin.com/link/chat?cid=ynr7d1P6Z

免责声明:本文章仅代表作者个人观点,不代表本平台的立场和观点。本文章仅供信息分享,不构成对任何人的任何投资建议。用户与作者之间的任何争议,与本平台无关。如网页中刊载的文章或图片涉及侵权,请提供相关的权利证明和身份证明发送邮件到support@aicoin.com,本平台相关工作人员将会进行核查。