Why is $BTC continuing to decline under the "positive outlook" consensus? How can we operate to better protect ourselves!

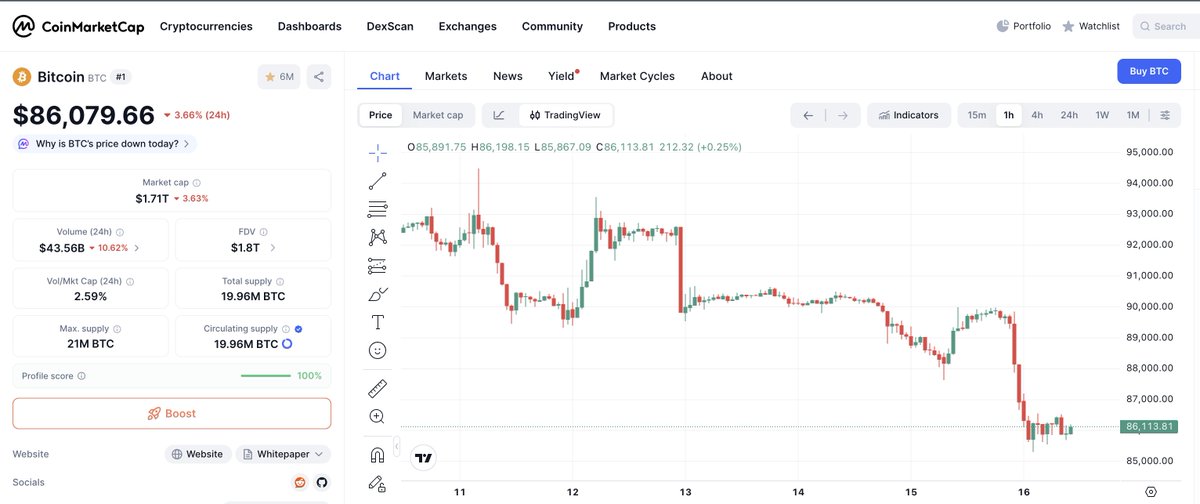

Today, the market continues to decline, with a sharp drop bringing $BTC to the edge of 85,000!

This is a typical market misalignment period: the long-term narrative still holds, but short-term pricing is deteriorating.

1️⃣ What is the reason?

Currently, it is a typical positive outlook, but the short-term situation is indeed not optimistic.

We can understand this round of BTC decline as: "deteriorating liquidity expectations + weak demand side + ETF outflows + deleveraging + low liquidity environment" overlapping at the same time.

If there are two good factors here, I believe December should be an explosive month. However, unfortunately, the market is like this, ever-changing. What we need to do is accept and understand, rather than remain stagnant!

Against the backdrop of the BOJ meeting, U.S. employment/inflation data, and ETF fund flows still wavering, the market direction should lean towards a "high volatility, weak range oscillation" baseline scenario; unless there is a continuous improvement on the demand side (sustained net inflows into ETFs, sudden information favorable for interest rate cuts, overall warming of risk assets), it will be difficult to quickly return to a unilateral upward trend.

2️⃣ How to operate?

The following is purely my personal opinion, as everyone has different tolerances for positions and investment structures, so it is only for reference and not investment advice!

1) I suggest everyone do one thing first: write down the "maximum acceptable drawdown for the next month";

If the account drawdown reaches -20% in the next month, will I be unable to sleep?

If it drops to -30%, will I be forced to cut losses?

Can I withstand the process of "falling first and then rising"?

This number determines whether you should reduce your position and by how much;

Otherwise, any operation may turn into emotional trading.

2) "Reduce one level of risk" before the event window, but do not go all in to clear out.

Under the premise of not using leverage and taking "controlling drawdown for the next month" as the primary goal, observe your position. I believe that a stablecoin position of 30-40% and a mainstream coin position of around 50%, plus a little other positions, is relatively reasonable. Therefore, I suggest everyone:

Reduce the position from 80% Crypto to 60%-70% (first reduce other token positions, then slightly reduce BTC), increase stablecoins to 30%-40%, and then use ETF fund flows turning positive + price stabilization as conditions for replenishment;

If it continues to weaken after the event, then reduce one more level.

In short, under the premise of not being anxious, reduce positions, and then patiently wait and observe.

免责声明:本文章仅代表作者个人观点,不代表本平台的立场和观点。本文章仅供信息分享,不构成对任何人的任何投资建议。用户与作者之间的任何争议,与本平台无关。如网页中刊载的文章或图片涉及侵权,请提供相关的权利证明和身份证明发送邮件到support@aicoin.com,本平台相关工作人员将会进行核查。