Today I finished reading a deep article about the evolution of consensus mechanisms. Although it felt a bit like a dry academic paper, understanding it can help better grasp the historical evolution of the 'trust mechanism' in the Web3 world, the civilizational leap regarding "how trust is reconstructed," and why the #SEI Giga architecture upgrade will mark the beginning of a new era for high-performance consensus mechanisms. 🧐

1️⃣ The essence of consensus mechanisms: it's not about technology, but the game of "trust cost"

Many people feel overwhelmed when they hear terms like "PBFT," "PoS," or "DAG," but the core question is simple: how do we reach a consensus result that everyone can trust among a group of people who do not trust each other?

It's like a group of people who are strangers to each other, have no way to contact one another, and may even include troublemakers, trying to decide together whether to have "hot pot or barbecue tonight," and once the decision is made, it cannot be reversed. What blockchain aims to solve is this kind of "collective decision-making in a remote, anonymous, and hostile environment."

The evolution of consensus mechanisms, in simple terms, is humanity's continuous attempt to lower the cost of "establishing trust": from early military-style discipline (classical era), to mining and electricity costs (#BTC era), and now to staking assets + mathematical rules (PoS + new models). Each generation redefines the blockchain's three difficult problems: "security, speed, and decentralization."

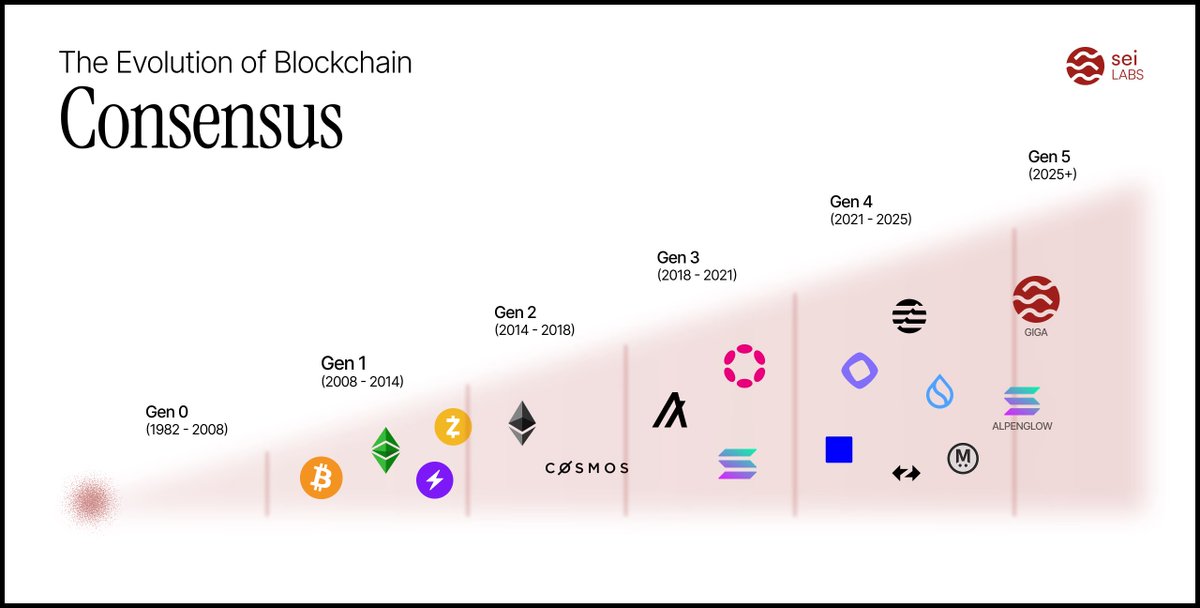

2️⃣ Five eras - five shifts in investment paradigms

🕰️ Classical Era (1982–2008): Trusting oneself

Characteristics: Only "insiders" can vote, such as in internal banking systems.

There were no investment opportunities during this phase; it was all closed systems. However, it is the "ancestor" of all current consensus mechanisms, much like the significance of the steam engine to automobiles. The security boundary of n=3f+1 (tolerating at most 1/3 bad actors) remains an industry rule today.

💥 Breakthrough Era (2008–2014): #BTC opens a new world

Characteristics: Trust in an open environment is achieved through "computing power equals power," allowing anyone to participate, but malicious actions require upfront investment. The pain points were significant: slow, expensive, and energy-consuming.

This marks the starting point of the "decentralized faith." Although the performance was lacking, it proved that "permissionless trust" could exist. Early adopters of Bitcoin did not profit from technical dividends but from the fundamental change in the model.

🎨 Renaissance Era (2014–2018): PoS revives classical protocols

Characteristics: The competition shifted from computing power to staking, replacing electricity costs with economic penalties. Efficiency improved significantly, with transaction confirmations reduced from an hour to a few seconds, and TPS increased from single digits to thousands.

This wave produced the visions of Cosmos, Cardano, and early Ethereum 2.0. Smart money began to shift from "investing in faith" to "paying for efficiency." Those who could make chains fast and cheap had ecological opportunities.

⚙️ Arms Race Era (2018–2021): Performance competition intensifies

Two major routes emerged:

Solana faction: Sacrificing a bit of decentralization for near-internet speeds (50,000 TPS, 400 ms confirmation).

ETH faction: Preferring to be slow while firmly maintaining security and decentralization.

This was the phase with the greatest investment divergence. Solana attracted high-frequency trading, gaming, and social applications; Ethereum stabilized the financial base. The two are actually moving in different directions: speed versus trust.

💡 Modular Era (2021–2024): Breaking down blockchains to specialize

Characteristics: Consensus, ordering, and execution are all separated, each performing its role!

- Data availability (DA) is handled separately (e.g., Celestia, EigenDA).

- Execution is delegated to Rollups (e.g., Arbitrum, zkSync).

- The consensus layer is only responsible for final confirmation.

The results are significant, with each focusing on their strengths and collaborating to achieve optimal solutions, leading to increased efficiency, with TPS potentially exceeding 100,000. However, the bottleneck has shifted to "execution speed." This era no longer focuses on a single chain but on a modular ecosystem—whoever controls DA, leads ordering, and optimizes execution will have the voice.

3️⃣ Now: Entering the "Extreme Era" (2025+) - Challenging the physical ceiling

This year's developments excite me, but there are also certain security risks. The consensus mechanism has already broken the "1/3 security boundary." Previously, it was believed that bad actors could not exceed 1/3. Now, new models (e.g., #SolanaAlpenglow, #Monad) propose n=5f+1—tolerating only 20% bad actors.

The benefits are evident, with consensus achieved in two steps (proposal + pre-vote), pushing delays to the limit. However, the risks cannot be ignored; the security boundary is thinner, and if breached, the system could collapse instantly. This is akin to changing the design of a nuclear power plant from "earthquake-resistant" to "microquake-resistant"—highly efficient, but a single incident could lead to a major disaster.

4️⃣ Finally, let's discuss the consensus solution based on the future intelligent era—hybrid intelligence.

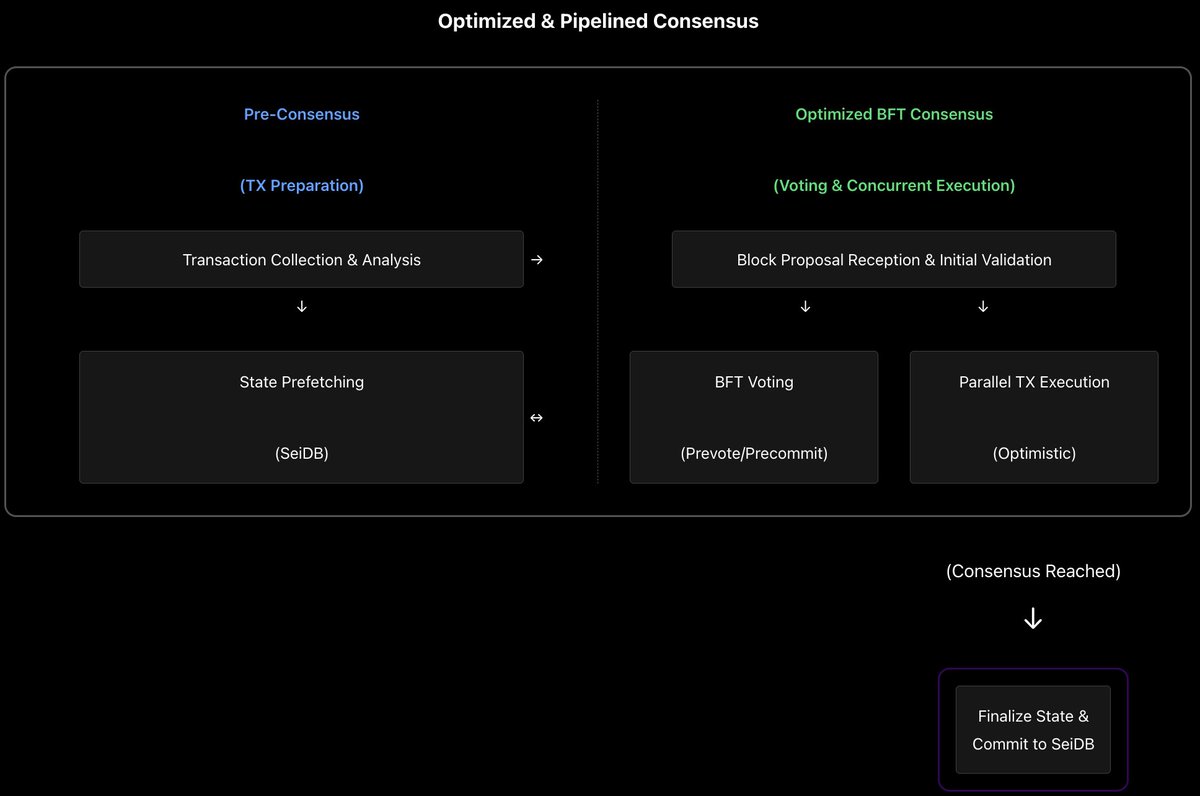

A representative example is the #SEI Twin Turbo consensus solution. In the future, the market may no longer blindly trust "the fastest" or "the most decentralized," but rather adopt optimal solutions. The future winners will likely be those who can switch between different modes based on the scenario. The default is to run fast in "leader mode," and once anomalies are detected, it switches to "leaderless mode" for safety. This achieves "intelligent trust," balancing speed and security dynamically rather than forcing one over the other.

The key is "tail latency." High-frequency trading is not afraid of high average latency but fears occasional 10-second delays—this can lead to failed arbitrage and liquidation. Therefore, stability is more important than speed.

"Hidden attributes" are the moat of public chains. These include privacy protection, resistance to MEV, censorship resistance, and fair ordering… These "invisible capabilities" will determine whether a public chain can attract high-quality users and funds.

The execution layer is even more critical than the consensus layer. Consensus is already sufficient; the next bottleneck lies in parallel execution engines (e.g., Monad's parallel EVM) and state validation optimization—this is where the main battlefield for performance breakthroughs lies.

In conclusion: The endpoint of consensus is "unconscious trust." We are approaching a future where users do not even feel the existence of "blockchain"—transfers arrive instantly, fees are close to zero, and there is never a disconnection, all backed by a precise trust machine composed of mathematics, economic incentives, and distributed protocols.

In the face of every trend in consensus evolution, there will always be significant investment opportunities, driven by the overarching trend of "decreasing trust costs." Whoever can achieve consensus in this world at a lower cost will hold the key to the next generation of financial infrastructure. It can be said that #SEI is currently doing quite well. 🧐

免责声明:本文章仅代表作者个人观点,不代表本平台的立场和观点。本文章仅供信息分享,不构成对任何人的任何投资建议。用户与作者之间的任何争议,与本平台无关。如网页中刊载的文章或图片涉及侵权,请提供相关的权利证明和身份证明发送邮件到support@aicoin.com,本平台相关工作人员将会进行核查。