CoinW Research Institute

Key Points

The total market capitalization of cryptocurrencies globally is $3.14 trillion, up from $3.03 trillion last week, representing an increase of approximately 3.6% this week. As of the time of writing, the cumulative net inflow of the U.S. Bitcoin spot ETF is approximately $57.71 billion, with a net inflow of $70.05 million this week; the cumulative net inflow of the U.S. Ethereum spot ETF is approximately $12.94 billion, with a net inflow of $312 million this week.

The total market capitalization of stablecoins is $305 billion, with USDT having a market cap of $184.6 billion, accounting for 60.52% of the total stablecoin market cap; followed by USDC with a market cap of $76.6 billion, accounting for 25.11%; and DAI with a market cap of $5.36 billion, accounting for 1.75%.

According to DeFiLlama, the total TVL of DeFi this week is $119.9 billion, up from $114.4 billion last week, an increase of approximately 4.8%. By public chain, the top three chains by TVL are Ethereum at 67.57%; Solana at 8.79%; and BNB Chain at 6.95%.

This week, multiple public chains showed divergent performance in key metrics: Aptos, Ton, and Solana saw daily trading volumes increase by 68.33%, 20.33%, and 18.34%, respectively; while Sui, Ethereum, and BNB Chain saw declines of 40.38%, 33.95%, and 7.22%, respectively. In terms of transaction fees, Solana and Sui's fees increased by 49.02% and 28.31%, respectively; Aptos decreased by 6.07%; while other chains remained stable. In terms of on-chain activity, all public chains recorded growth except for Ton, which saw a 22.05% drop in daily active addresses, with Sui leading at 54.08%, and Ethereum, Aptos, and BNB Chain seeing increases between 17% and 23%, while Solana saw a slight increase of 8.29%. The overall TVL performance remained robust, with only Sui declining by 8.25%, Aptos remaining flat, and other chains maintaining moderate growth of 0.96% to 4.33%.

New Project Focus: LootGO is a Web3 "walk-to-earn + treasure hunt" application that converts real-life daily activities, especially walking, into cryptocurrency rewards. CreatorFi is a financing platform launched by Insomnia Labs, focusing on providing "future income-based" financing support for digital content creators, musicians, and UGC game studios. Pruv Finance is an infrastructure platform focused on bringing real-world assets (RWAs) on-chain and integrating them with the DeFi ecosystem.

Table of Contents

Key Points

I. Market Overview

Total cryptocurrency market cap/Bitcoin market cap share

Fear Index

ETF inflow and outflow data

ETH/BTC and ETH/USD exchange rates

Decentralized Finance (DeFi)

On-chain data

Stablecoin market cap and issuance status

II. This Week's Hot Money Trends

Top five VC coins and Meme coins by increase this week

New project insights

III. Industry News

Major industry events this week

Major upcoming events next week

Important financing activities from last week

IV. Reference Links

I. Market Overview

1. Total Cryptocurrency Market Cap/Bitcoin Market Cap Share

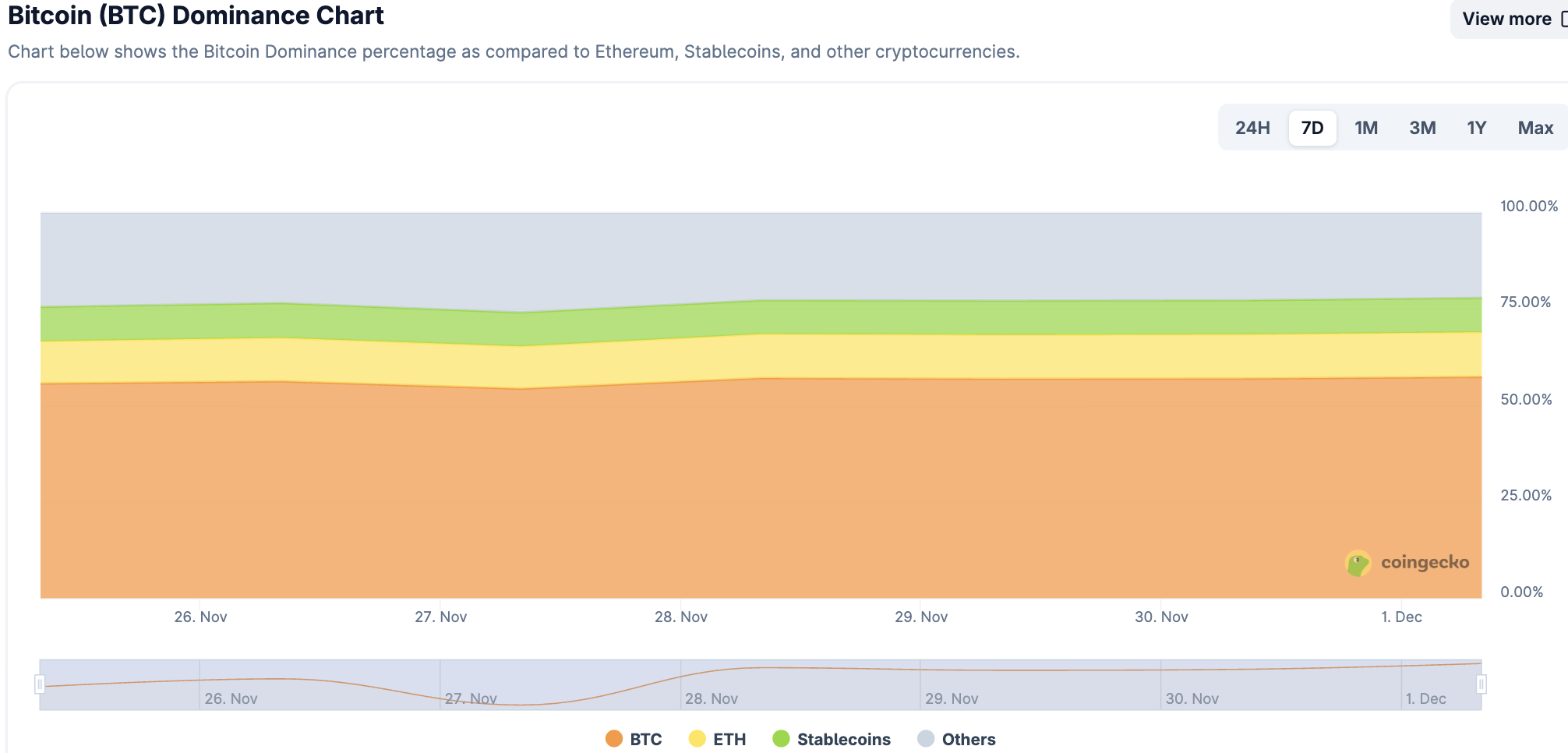

The global total cryptocurrency market cap is $3.14 trillion, up from $3.03 trillion last week, representing a 3.6% increase this week.

Data Source: cryptorank, https://cryptorank.io/charts/btc-dominance

Data as of November 30, 2025

As of the time of writing, the market cap of Bitcoin is $1.74 trillion, accounting for 55.4% of the total cryptocurrency market cap. Meanwhile, the market cap of stablecoins is $305 billion, accounting for 9.71% of the total cryptocurrency market cap.

Data Source: coingeck, https://www.coingecko.com/en/charts

Data as of November 30, 2025

2. Fear Index

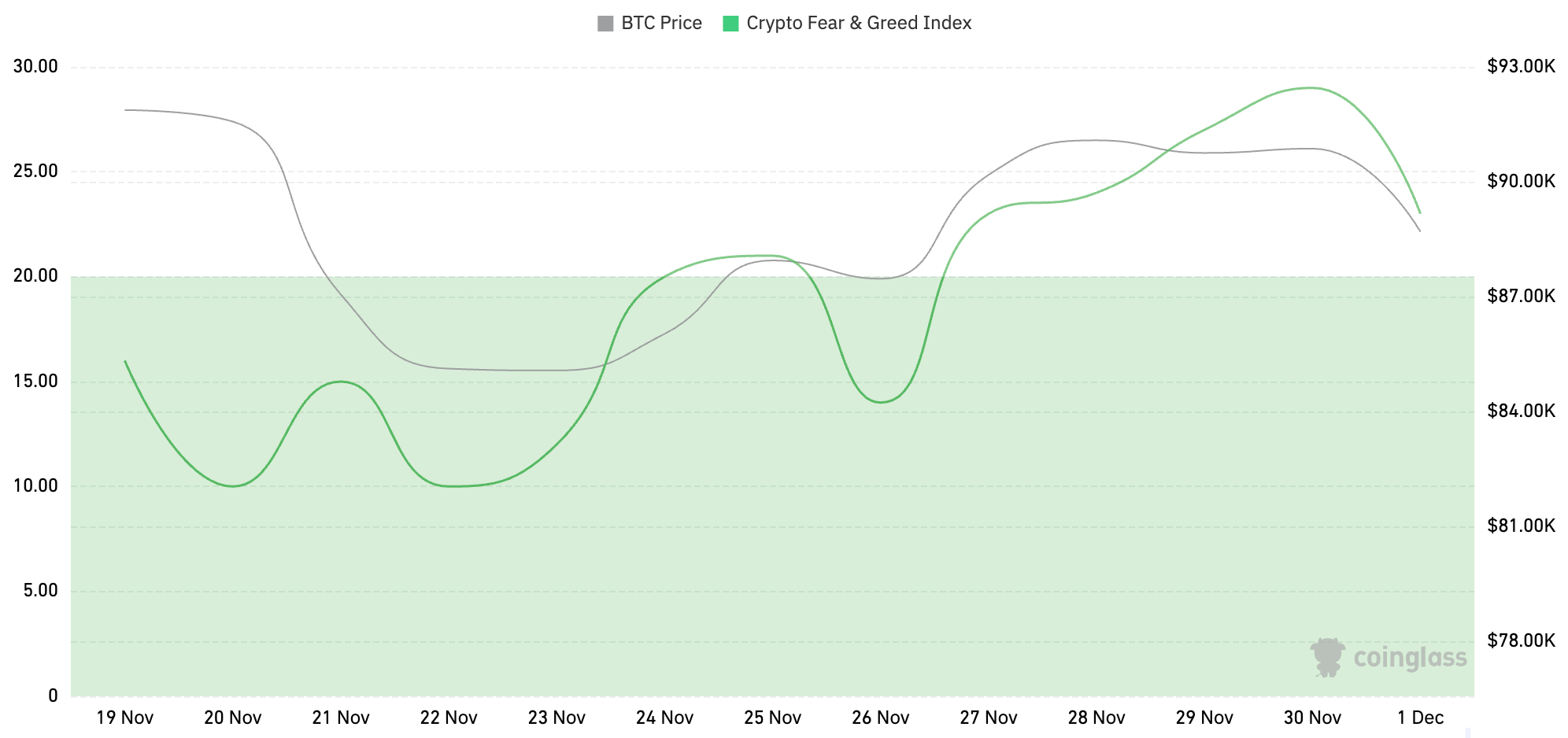

The cryptocurrency fear index is at 23, indicating fear.

Data Source: coinglass, https://www.coinglass.com/pro/i/FearGreedIndex

Data as of November 30, 2025

3. ETF Inflow and Outflow Data

As of the time of writing, the cumulative net inflow of the U.S. Bitcoin spot ETF is approximately $57.71 billion, with a net inflow of $70.05 million this week; the cumulative net inflow of the U.S. Ethereum spot ETF is approximately $12.94 billion, with a net inflow of $312 million this week.

Data Source: sosovalue, https://sosovalue.com/zh/assets/etf

Data as of November 30, 2025

4. ETH/BTC and ETH/USD Exchange Rates

ETHUSD: Current price $2,863.27, all-time high $4,878.26, down approximately 42.32% from the all-time high.

ETHBTC: Currently at 0.032822, all-time high 0.1238.

Data Source: ratiogang, https://ratiogang.com/

Data as of November 30, 2025

5. Decentralized Finance (DeFi)

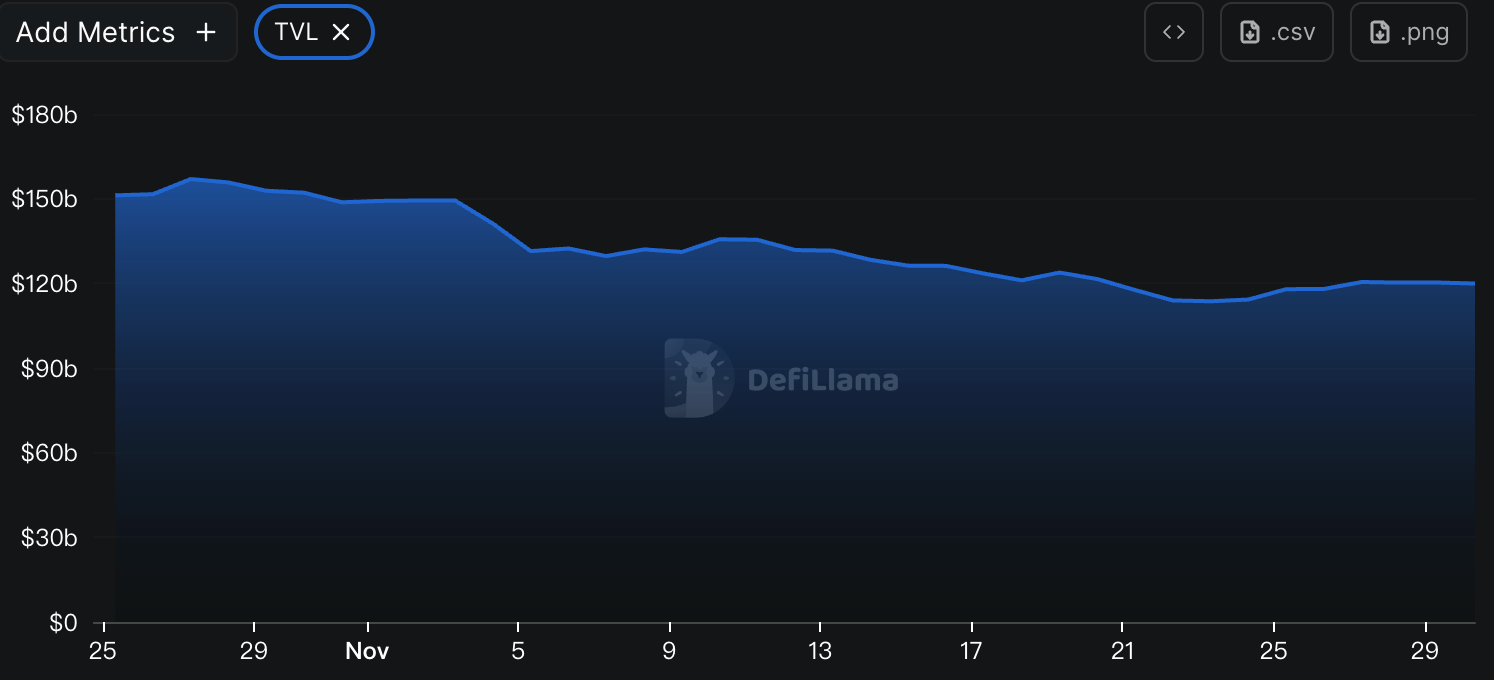

According to DeFiLlama, the total TVL of DeFi this week is $119.9 billion, up from $114.4 billion last week, an increase of approximately 4.8%.

Data Source: defillama, https://defillama.com

Data as of November 30, 2025

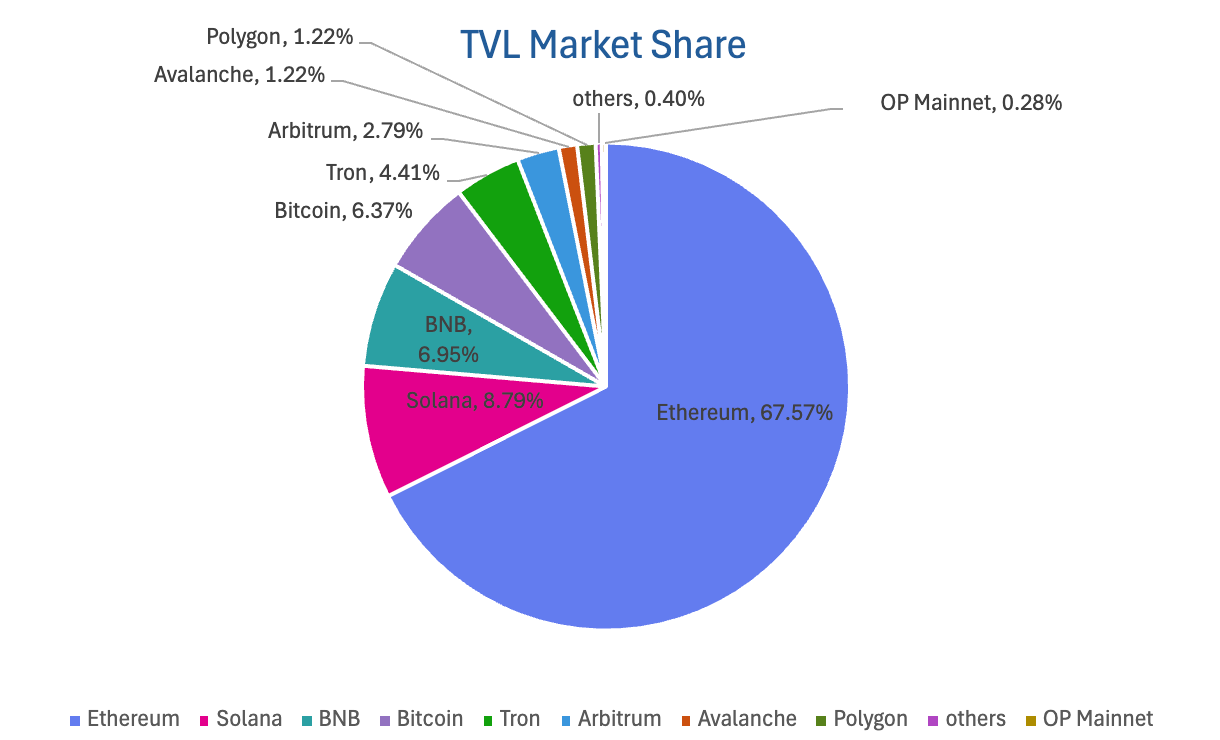

By public chain, the top three chains by TVL are Ethereum at 67.57%; Solana at 8.79%; and BNB Chain at 6.95%.

Data Source: CoinW Research Institute, defillama, https://defillama.com

Data as of November 30, 2025

6. On-chain Data

Layer 1 Related Data

Mainly analyzing the current data of major Layer 1 chains including ETH, SOL, BNB, TON, SUI, and APTOS based on daily trading volume, daily active addresses, and transaction fees.

Data Source: CoinW Research Institute, defillama, https://defillama.com

Data as of November 30, 2025

Daily Trading Volume and Transaction Fees: Daily trading volume and transaction fees are core indicators of public chain activity and user experience. In terms of daily trading volume, this week Aptos, Ton, and Solana increased by 68.33%, 20.33%, and 18.34%, respectively; while the other chains saw declines, with Sui down by 40.38%, Ethereum down by 33.95%, and BNB Chain down by 7.22%. Regarding transaction fees, this week Ethereum, BNB Chain, and Ton Chain remained stable compared to last week; Solana and Sui increased by 49.02% and 28.31%, respectively; Aptos decreased by 6.07%.

Daily Active Addresses and TVL: Daily active addresses reflect the ecological participation and user stickiness of public chains, while TVL reflects user trust in the platform. In terms of daily active addresses, only Ton Chain saw a decline of 22.05% this week, while the other chains recorded increases. Sui Chain had the largest increase at 54.08%; Ethereum, Aptos, and BNB Chain increased by 22.87%, 20.27%, and 17.04%, respectively; Solana Chain saw a relatively minor increase of 8.29%. In terms of TVL, only Sui Chain declined by 8.25% this week; Aptos remained nearly flat compared to last week; the other public chains achieved moderate growth, with Solana at +4.33%, Ethereum at +4.06%, Ton at +2.73%, and BNB Chain at +0.96%.

Layer 2 Related Data

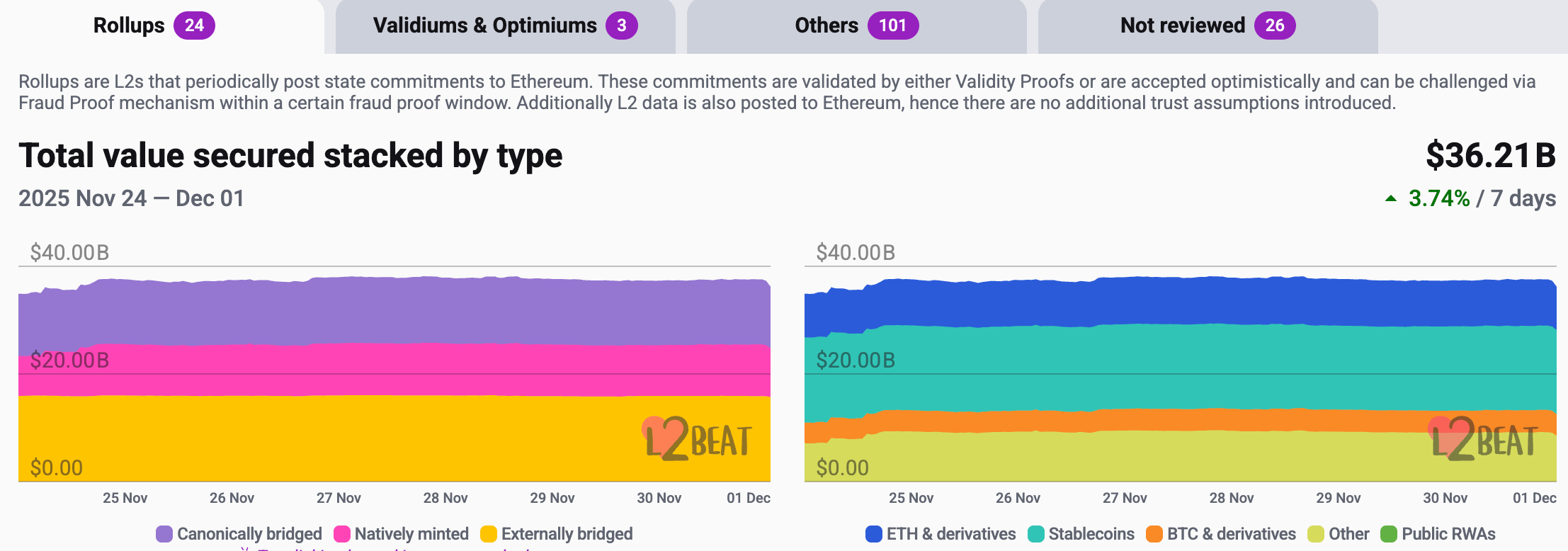

According to L2Beat data, the total TVL of Ethereum Layer 2 is $36.21 billion, an overall increase of 3.8% from last week ($34.86 billion).

Data Source: L2Beat, https://l2beat.com/scaling/tvs

Data as of November 30, 2025

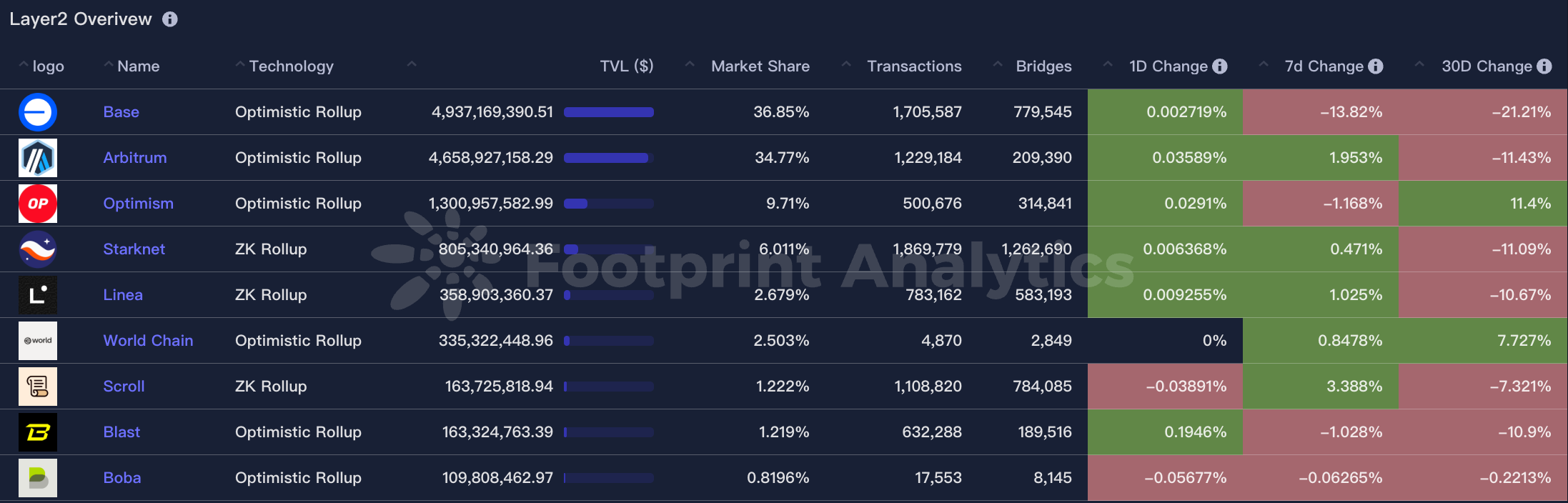

Base and Arbitrum occupy the top positions with market shares of 36.85% and 34.77%, respectively. Base Chain's market share decreased by 13.82% over the past week, while Arbitrum saw a slight increase of 1.95%.

Data Source: footprint, https://www.footprint.network/public/research/chain/chain-ecosystem/layer-2-overview

Data as of November 30, 2025

7. Stablecoin Market Cap and Issuance Status

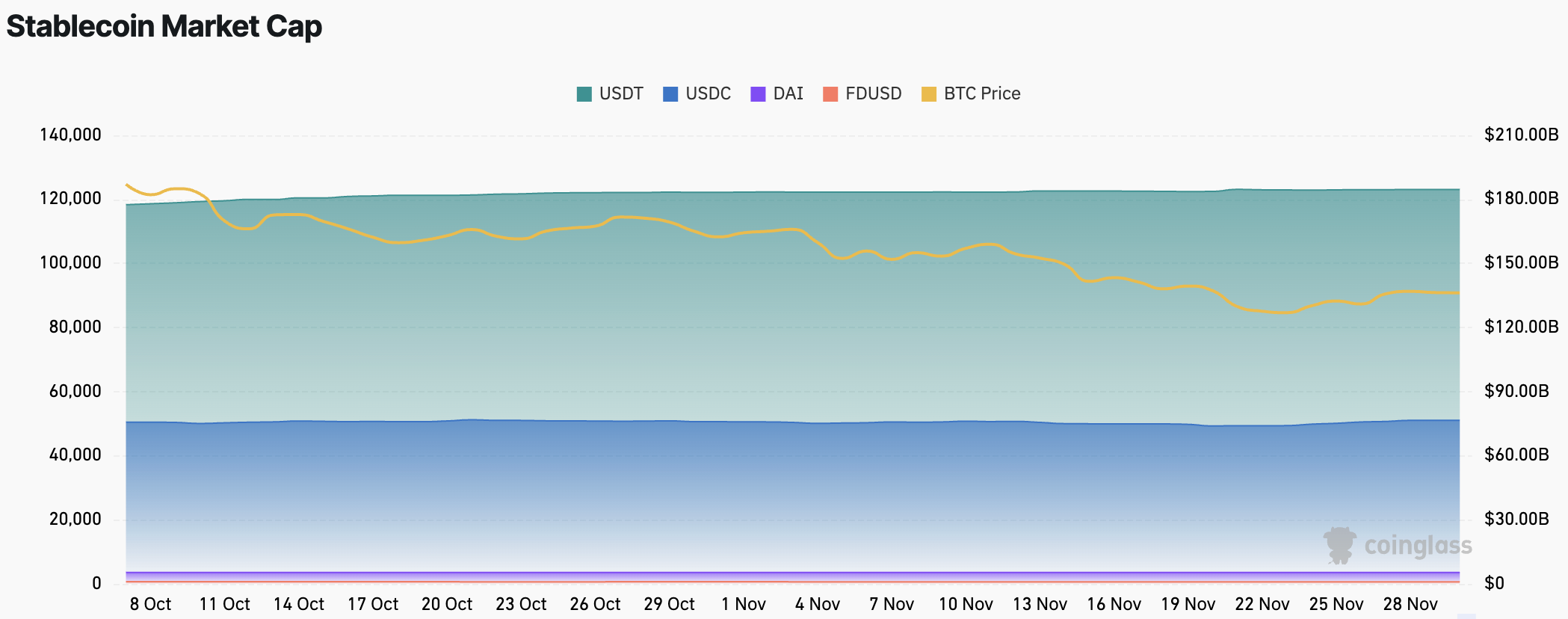

According to Coinglass data, the total market cap of stablecoins is $305 billion, with USDT having a market cap of $184.6 billion, accounting for 60.52% of the total stablecoin market cap; followed by USDC with a market cap of $76.6 billion, accounting for 25.11%; and DAI with a market cap of $5.36 billion, accounting for 1.75%.

Data Source: CoinW Research Institute, Coinglass, https://www.coinglass.com/pro/stablecoin

Data as of November 30, 2025

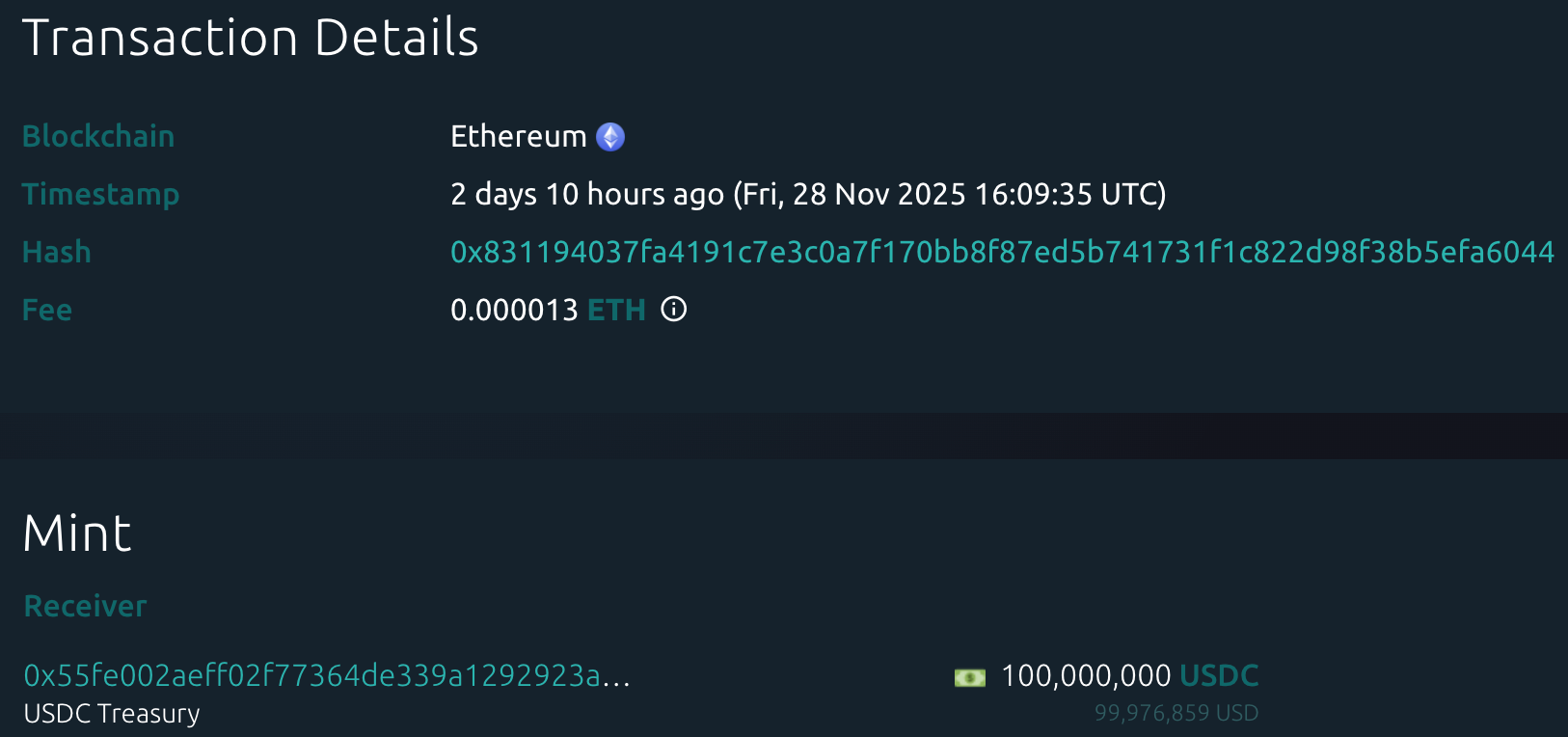

According to Whale Alert data, this week USDC Treasury issued a total of 4.493 billion USDC, while Tether Treasury had no issuance of USDT this week. The total issuance of stablecoins this week was 4.493 billion, an increase of 21.11% compared to last week's total issuance of 3.71 billion.

Data Source: Whale Alert, https://x.com/whale_alert

Data as of November 30, 2025

II. This Week's Hot Money Trends

1. Top Five VC Coins and Meme Coins by Increase This Week

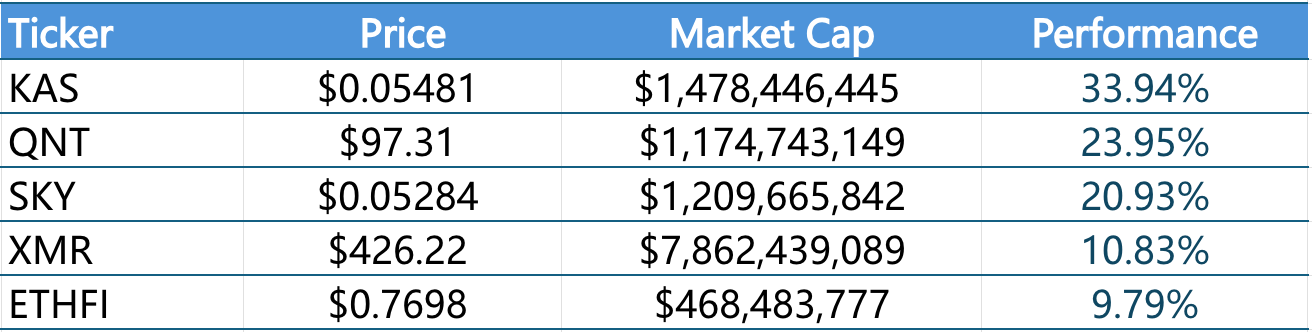

Top Five VC Coins by Increase in the Past Week

Data Source: CoinW Research Institute, coinmarketcap, https://coinmarketcap.com/

Data as of November 30, 2025

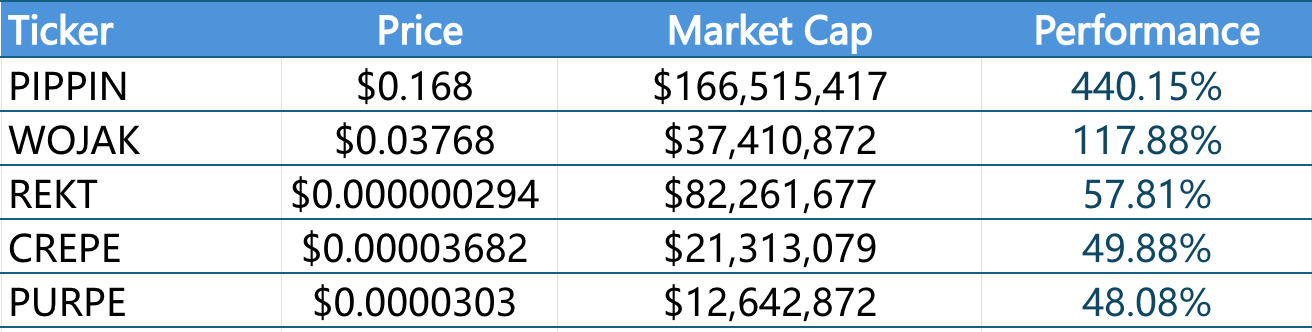

Top Five Meme Coins by Increase in the Past Week

Data Source: CoinW Research Institute, coinmarketcap, https://coinmarketcap.com/

Data as of November 30, 2025

2. New Project Insights

LootGO is a Web3 "walk-to-earn + treasure hunt" application that converts real-life daily activities, especially walking, into cryptocurrency rewards. Users can earn "loot boxes" by walking, reaching step goals, or going to specific locations; opening these boxes gives them a chance to receive various rewards such as meme coins, tokens, NFTs, whitelist vouchers, and merchant discount coupons. LootGO lowers the participation threshold for new users in Web3 cryptocurrency by combining daily walking, real-world actions, and on-chain incentives, merging "fitness/walking," "gamified experience," and "token economic incentives" into a lightweight and entertaining way—users do not need complex operations, just a phone and walking to potentially earn crypto rewards.

CreatorFi is a financing platform launched by Insomnia Labs, focusing on providing "future income-based" financing support for digital content creators, musicians, and UGC game studios. On CreatorFi, creators can use expected earnings from YouTube ad revenue, music copyrights, game development, or other digital IP as collateral to receive upfront funding in stablecoins (like USDC) or fiat currency, without giving up ownership of their works. The platform has built over $100 million in institutional financing channels through its credit risk engine and on-chain infrastructure, providing transparent, flexible, and scalable financing and monetization solutions for creators and the content industry.

Pruv Finance is an infrastructure platform focused on bringing real-world assets (RWAs) on-chain and integrating them with the DeFi ecosystem. It tokenizes real assets such as real estate, private equity, private credit, and public market securities through a compliant asset tokenization process; and supports multichain cross-chain distribution, allowing these assets to be freely traded, lent, and earn yields in the DeFi market like crypto assets.

III. Industry News

1. Major Industry Events This Week

On November 25, Irys (IRYS) completed its TGE, having opened airdrop registration for early testnet users, Genesis NFT holders, Kaito leaderboard users, and community contributors from November 20 to 24, with a snapshot taken on November 11, and a claim window lasting until December 25. This distribution comes from its 8% airdrop and ecological incentive allocation. Irys is a programmable data chain that integrates low-cost on-chain storage, data availability, and EVM execution layers, providing high-performance data infrastructure for AI, data-intensive applications, and DePIN projects, with IRYS used for network incentives, governance, and ecological development.

On November 27, SUPERFORTUNE (GUA) completed its TGE (total supply of 1 billion), and simultaneously distributed airdrops to community users. SUPERFORTUNE is a Web3 application that combines Chinese metaphysics (BaZi, Five Elements, I Ching) with AI and on-chain interaction, offering daily fortune, token "wealth" analysis, virtual talismans, junk coin cleaning, and on-chain rituals, creating a unique product experience of "metaphysics + psychology + InfoFi."

On November 29, GaiAI (GAIX) completed its TGE, having launched multiple rounds of "contribution rewards" airdrops during the previous testnet phase, rewarding early users who submitted prompts, uploaded models, and participated in image optimization. As a decentralized AI platform for generative content creation, GaiAI allows users to create, train, and share AI Agents independently, while using GAIX as the network incentive and governance token, providing ongoing rewards for creators, model contributors, and ecosystem participants.

On November 24, Sparkle (SSS) completed its TGE and simultaneously launched two types of community distributions: one for early participants as a points airdrop; the other for specific token holders as a HODLer airdrop, distributing a total of 187,500 SSS. Sparkle is a Web3 AI entertainment platform that integrates AI characters, virtual identities, and social interaction, aiming to create an immersive content ecosystem where users can create, train, and use AI characters across platforms.

2. Major Upcoming Events Next Week

Aztec, as an Ethereum privacy Layer-2 network, has announced that it will conduct a token issuance (TGE/IDO) through a public auction from December 2 to 6, 2025, with this sale accounting for approximately 15% of the total supply. The tokens will be used for governance, staking, and transaction fee payments. Aztec is committed to building a programmable privacy environment that supports users in conducting on-chain interactions and asset management while ensuring privacy.

Talisman (SEEK) plans to conduct a token sale on the ChainGPT platform from December 1 to 3, 2025, issuing approximately 666,000 SEEK tokens. Previously, it completed its first IDO from October 17 to 19, 2025, issuing about 500,000 tokens at a price of $0.30 each. Users can also participate in the "Talisman Quests" community incentive system, earning rewards and NFTs by completing tasks, holding tokens, and performing cross-chain operations. Talisman (SEEK) is a multi-chain self-custody wallet that supports major networks such as Ethereum, Solana, and Polkadot, providing asset management, cross-chain operations, and basic DeFi functionalities, while gradually incorporating AI-assisted tools to enhance the user experience.

SecantX AI will conduct its initial public IDO on the Spores Network Launchpad from December 3 to 5, 2025, issuing approximately 4.28 million SECA tokens at a price of $0.07 each, with a total supply of 1 billion. The SECA token is primarily used to unlock premium features and API access on the platform, utilizing a burn-on-use mechanism. The project currently has no public airdrop activities, and the token is more focused on being a utility tool token for platform service payments.

3. Important Financing Events Last Week

SpaceComputer announced the completion of a $10 million seed round financing, led by Maven11 and Lattice, with participation from Superscrypt, Arbitrum Foundation, Nascent, Offchain Labs, HashKey, and others. Previously, it had received a Pre-Seed round led by Primitive Ventures. The funding will be used to launch the first batch of "SpaceTEE" satellites equipped with secure computing hardware, build network software, and offer privacy computing and secure record services, aiming to create a secure computing network capable of executing cryptographic and blockchain tasks in orbit. SpaceComputer is committed to building an "orbital root of trust" through satellite infrastructure, providing safer and more reliable blockchain verification and threat protection for interstellar finance. (November 27, 2025)

Paxos acquired institutional-grade MPC wallet company Fordefi for $100 million, further strengthening its compliance custody and on-chain infrastructure capabilities. Founded in 2021, Fordefi provides multi-party computation (MPC) security architecture, fine-grained permission control, and native interaction capabilities with multi-chain and DeFi, serving nearly 300 institutions and supporting monthly transaction volumes in the tens of billions. This acquisition will deeply integrate Paxos's compliance custody, stablecoin, and asset tokenization capabilities with Fordefi's advanced wallet and cross-chain interaction technology, providing institutions with an integrated solution from custody to on-chain operations, accelerating their scaling into the on-chain economy. (November 25, 2025)

South Korea's largest internet company Naver plans to invest approximately $7 billion in artificial intelligence and blockchain after acquiring Upbit's parent company Dunamu for about $10.3 billion in an all-stock deal. Dunamu is a leading blockchain and fintech company in South Korea, operating the country's largest cryptocurrency exchange, Upbit, with Kakao currently holding a 10.88% stake. Naver stated that this move aims to seize the critical juncture of blockchain adoption and the transition to intelligent AI, positioning itself for the future fintech landscape. (November 26, 2025)

Cryptocurrency mining company Bitfury recently made a strategic investment of $12 million in the decentralized AI computing network Gonka.ai, subscribing to 20 million GNK tokens at $0.60 each. This marks Bitfury's first public move after announcing the establishment of a $1 billion ethical AI fund. As a decentralized AI inference and training network, Gonka allows nodes contributing GPU computing power to earn incentives through GNK, enabling developers to run AI applications in an environment without cloud restrictions, while users drive network demand through usage and inference. (November 28, 2025)

IV. Reference Links

Coingeck: https://www.coingecko.com/en/charts

Sosovalue: https://sosovalue.com/zh/assets/etf

Ratiogang: https://ratiogang.com/

Defillama: https://defillama.com

L2Beat: https://l2beat.com/scaling/tvs

Footprint: https://www.footprint.network/public/research/chain/chain-ecosystem/layer-2-overview

Coinglass: https://www.coinglass.com/pro/stablecoin

Whale Alert: https://x.com/whale_alert

Coinmarketcap: https://coinmarketcap.com/

Fordefi: https://fordefi.com/

Gonka: https://www.gonka.ai/

SpaceComputer: https://www.spacecomputer.io/

Dunamu: https://www.dunamu.com/

CreatorFi: https://creatorfi.finance/

Pruv Finance: https://pruv.finance/

免责声明:本文章仅代表作者个人观点,不代表本平台的立场和观点。本文章仅供信息分享,不构成对任何人的任何投资建议。用户与作者之间的任何争议,与本平台无关。如网页中刊载的文章或图片涉及侵权,请提供相关的权利证明和身份证明发送邮件到support@aicoin.com,本平台相关工作人员将会进行核查。