Federal Reserve Cuts Interest Rates to Three-Year Low

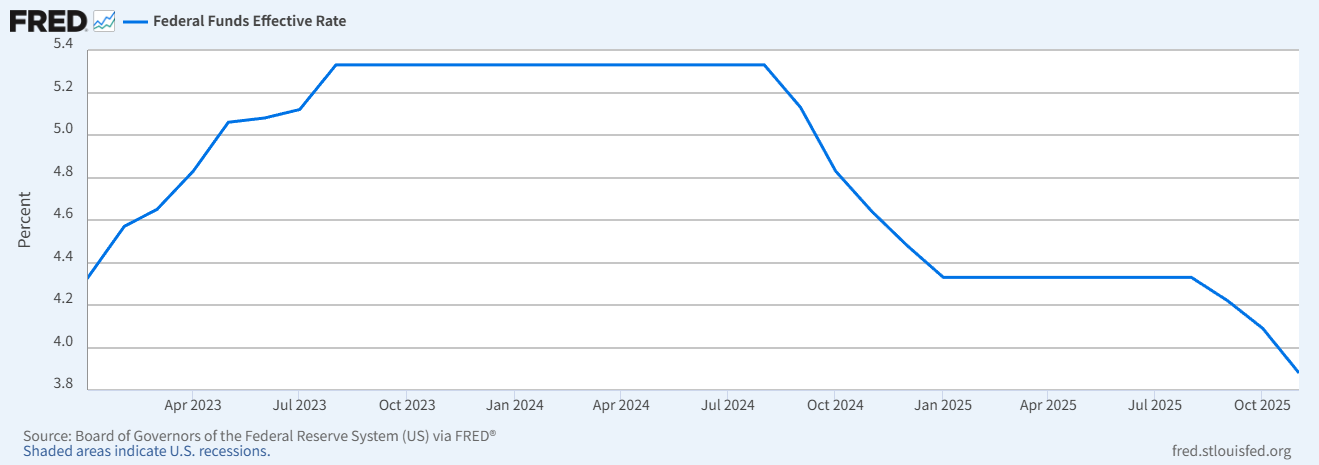

On December 10, 2025, the Federal Reserve announced a 25 basis point reduction in the target range for the federal funds rate to 3.50%–3.75%. This marks the third rate cut this year and the lowest level in the past three years. While the market has speculated about the timing of rate cuts over the past few months, the reasons for the policy shift have long been embedded in official language and economic data.

Figure 1: Federal Funds Rate Trends from 2023 to 2025 (Source: Federal Reserve FRED Database)

Official Language Slightly Adjusted, Inflation Moderates and Employment Concerns Rise

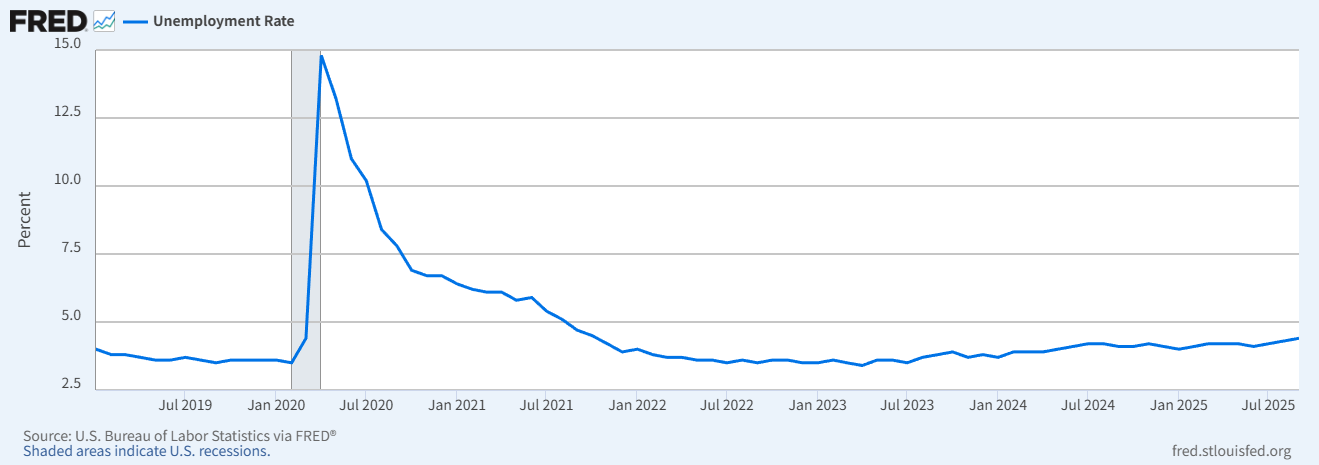

The Federal Reserve's policies have never been emotional but rather traceable. Since mid-year, the language in official documents has quietly changed: descriptions of inflation have become more moderate, and attention to the labor market has increased. Particularly entering the third quarter, employment data showed a noticeable slowdown — the U.S. Department of Labor reported that non-farm payrolls increased from 180,000 in July to 119,000 in September, with the unemployment rate rising to 4.4% as of September, causing the "risk balance" policy framework to begin to tilt.

Figure 2: U.S. Unemployment Rate Trends from 2019 to 2025 (Source: U.S. Department of Labor / FRED)

Rising Employment Risks Prompt Policy Rebalancing

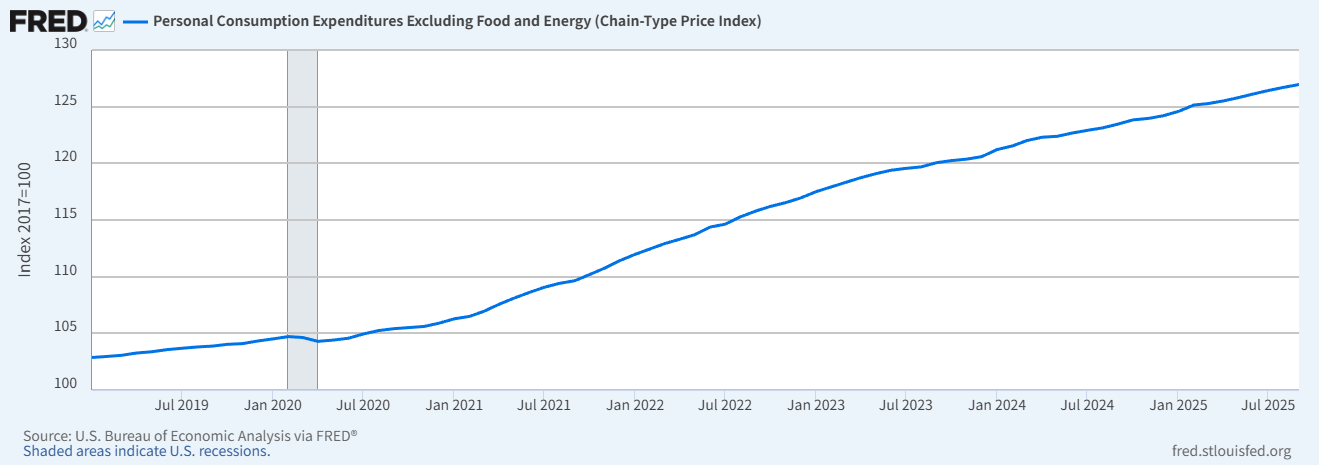

In the latest decision, the Federal Reserve explicitly stated, "Recent employment growth has slowed, and the unemployment rate has risen slightly." This judgment is rare and indicates that the previously "very strong" labor market is now recognized in official statements as facing downward pressure. In contrast, while inflation remains above the long-term target of 2%, the 3.1% year-on-year growth of core PCE in November (according to Federal Reserve data) led to the official language being described as "still elevated," rather than more intense terms like "stubborn" or "persistently excessive." This difference in wording is sufficient to indicate that decision-makers' priorities regarding risks have changed.

In a sense, this rate cut is a form of "rebalancing." After two years of tightening, high policy rates began to exert pressure on the economy — particularly on businesses and consumers facing high financing costs. The Federal Reserve is not easing policy due to a complete disappearance of inflation but is compelled to adjust its pace in light of subtle changes in employment (with the September unemployment rate reaching 4.4%). This is not the "comprehensive easing cycle" that the outside world anticipated, but rather an action to find space between data and risks.

Figure 3: Core PCE Inflation Trends from 2019 to 2025 (Source: Bureau of Economic Analysis / FRED)

Interest Rate Adjustment Pace Remains Flexible, Future Depends on Economic Data

On the policy path, the Federal Reserve has maintained restraint. The statement repeatedly emphasizes that future interest rate adjustments "will depend on the latest data and risk assessments," rather than proceeding along a predetermined path. This open-ended expression preserves space for flexible responses in the future while also dampening market expectations for continuous rate cuts and aggressive easing. In other words, the Federal Reserve has not committed to lower rates but hopes that each step of policy will follow actual economic changes.

Voting Discrepancies Reveal Different Judgments on Economic Outlook

Additionally, the voting results of this FOMC meeting also signal a message: 9 votes in favor, 3 votes against, indicating a rare divergence in recent years. The dissenting opinions do not question the policy direction but reflect a lack of consensus among decision-makers regarding the economic outlook — Federal Reserve Governor Milan favored a 50 basis point cut, while Chicago Fed President Goolsbee and Kansas City Fed President Schmidt advocated for maintaining rates. This internal difference itself serves as a reminder: the Federal Reserve does not believe the current situation is clear enough to establish a single path, and future policies may adjust direction without presenting a coherent one-sided trend.

Market Focus on Risk Signals Behind the Timing of Rate Cuts

Overall, this rate cut is a response to economic realities rather than a reassurance to the market. Although inflation has not returned to target, the 3.1% growth of core PCE in November has shown a sustained downward trend; the labor market remains robust but lacks the strength of the previous two years; economic growth remains resilient, but uncertainties persist. Under multiple constraints, the Federal Reserve's choice is a balanced adjustment: neither allowing the economy to be long-term pressured by high rates nor overly loosening policy to re-stimulate inflation.

For the market, the key information is not "the rate cut has occurred," but rather "why the rate cut happened at this time." The increased weight of the term "risk" in official documents indicates that future decision-makers will rely more on data rather than expectations or verbal commitments, and the pace of policy will be more cautious.

Data-Driven Future Direction of Monetary Policy

This adjustment is both a cyclical milestone and an important signal, reflecting policymakers' detailed judgment of the economy and demonstrating efforts to maintain balance amid uncertainty. The future direction of U.S. monetary policy lies at the intersection of employment, inflation, and growth: for instance, if the unemployment rate rises to 4.5% in the first quarter of next year (close to the Federal Reserve's median forecast for the end of 2025), the pace of rate cuts may accelerate; if core PCE rebounds above 3.5%, policy may even pause easing. Each change in data will become crucial in determining the next steps in interest rate trends.

免责声明:本文章仅代表作者个人观点,不代表本平台的立场和观点。本文章仅供信息分享,不构成对任何人的任何投资建议。用户与作者之间的任何争议,与本平台无关。如网页中刊载的文章或图片涉及侵权,请提供相关的权利证明和身份证明发送邮件到support@aicoin.com,本平台相关工作人员将会进行核查。