Author: Xiao Za Legal Team

On December 1, 2025, the Hong Kong licensed digital asset trading platform HashKey passed the Hong Kong Stock Exchange hearing and disclosed the post-hearing information package, just one step away from becoming the "first compliant cryptocurrency stock in Hong Kong." This IPO is co-sponsored by JPMorgan, Cathay Securities, and Guotai Junan International. Its prospectus not only showcases the growth trajectory of regional crypto platforms but also reflects the profound changes in the global crypto asset market — from rampant growth to compliance competition, from retail dominance to institutional entry, the industry stands at a new crossroads.

As the first crypto trading platform in Asia to hold a comprehensive license from the Hong Kong Securities and Futures Commission, HashKey's business data, financial performance, and equity structure are important samples for interpreting the current crypto market. This article will analyze the macro characteristics of the market based on the core information from the prospectus, predict the future direction of the industry, and reveal the hidden opportunities and risks behind it.

I. Three Macro Characteristics of the Crypto Market from HashKey Data

The HashKey prospectus covers the full scope of its business from 2022 to the first half of 2025. From trading volume, user structure to revenue composition, each set of data corresponds to deep changes in the crypto market.

1. Compliance as a Regional Competitive Barrier, Global Landscape Shows "Head Monopoly + Regional Fragmentation"

With the implementation of regulatory policies in various countries, compliance qualifications have become the core competitive barrier for platforms. As one of the first institutions in Hong Kong to obtain a Virtual Asset Trading Platform License (VDTA), HashKey quickly captured the regional market with its compliance advantages. The prospectus shows that in 2024, its market share in the Hong Kong crypto trading market exceeded 75%, making it the largest crypto asset platform in the region and also the largest regional onshore platform in Asia. Its digital asset exchange has facilitated a cumulative spot trading volume of 1.3 trillion HKD, with trading volume soaring from 4.2 billion HKD in 2022 to 638.4 billion HKD in 2024, a growth of over 150 times in three years, confirming the explosive potential of compliant platforms in the region under clear regulations.

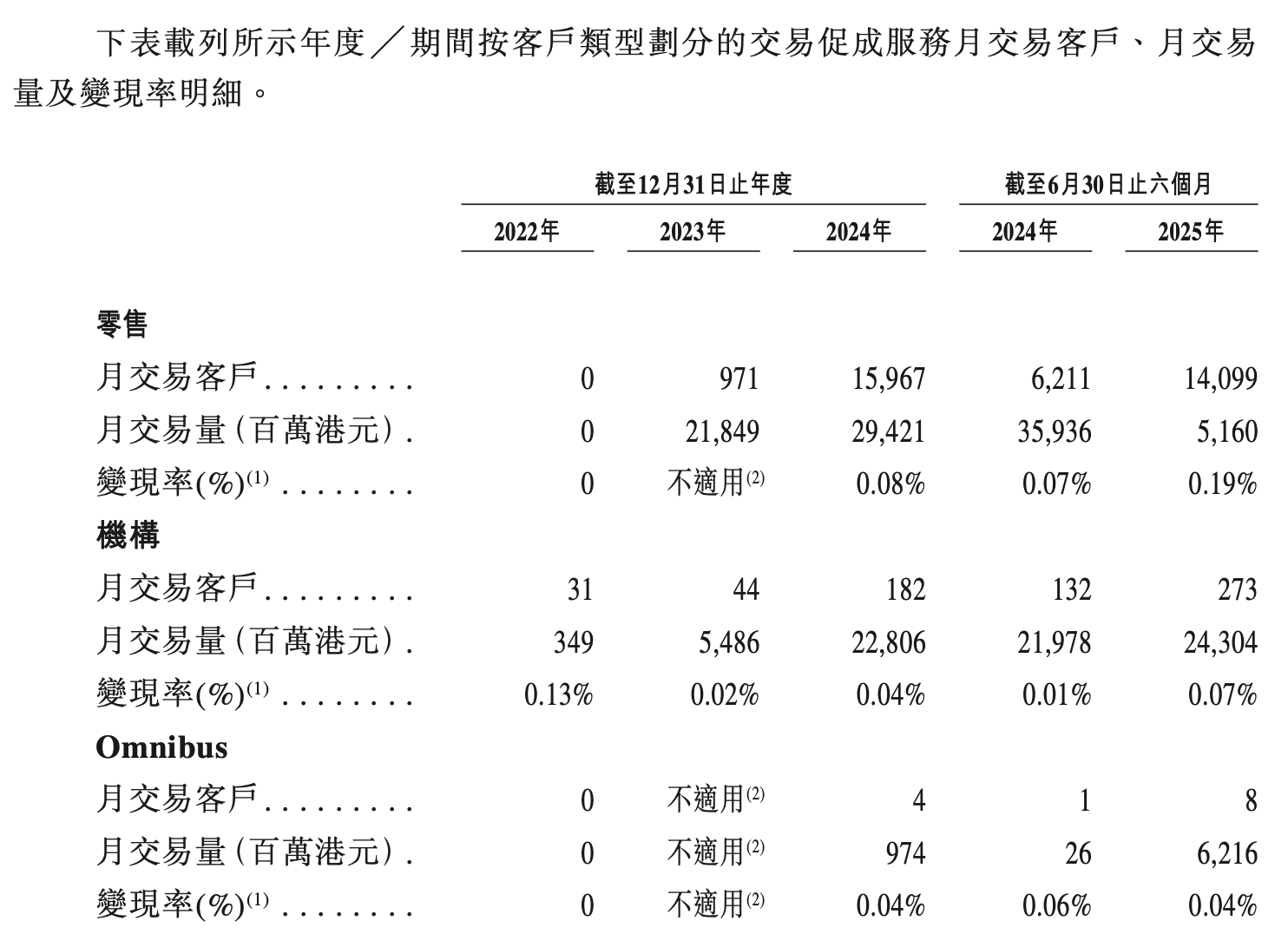

However, from a global perspective, there is a significant gap between regional compliant platforms and traditional leading exchanges. In the first half of 2025, HashKey's institutional clients had an average monthly trading volume of 24.304 billion HKD, while retail clients had an average monthly trading volume of 5.16 billion HKD, still showing a magnitude gap compared to global leading platforms like Binance and OKX. This "regional monopoly, global weakness" pattern reflects that the crypto market has entered the "compliance fragmentation era," where regional compliant platforms hold advantages locally, but still struggle to shake the status of traditional leading platforms in terms of global capital attraction and user base. This "regional monopoly, global weakness" pattern confirms that the crypto market has entered the "compliance fragmentation era."

2. Revenue Reliance on Trading Business, Market Cycle Volatility Risks Highlighted

Although HashKey has built three major business segments: "trading facilitation + on-chain services + asset management," its revenue structure is highly dependent on trading business. In the first half of 2025, trading facilitation service revenue accounted for 68%, and this business has turned from loss to profit — from a loss of 14.915 million HKD in 2022 to a profit of 518 million HKD in 2024.

However, this reliance also deeply binds its performance to market cycles. During the bull market in 2024, its revenue surged by 247% year-on-year; in the first half of 2025, the market was sluggish, with trading volume plummeting from 347.6 billion HKD in the same period last year to 214.1 billion HKD, leading to a 26% year-on-year decline in revenue. More concerning is the high sensitivity of retail clients: in the first half of 2025, the monthly trading volume of retail clients dropped from 35.936 billion HKD to 5.16 billion HKD compared to the same period last year, a decline of over 85%, while the monthly trading volume of institutional clients grew from 21.978 billion HKD to 24.304 billion HKD, becoming a "stabilizer" amid market fluctuations. This reveals that retail investors act as "amplifiers" of market sentiment, flooding in during bull markets and quickly exiting during bear markets, which also exposes the platform to the risk of "living off the weather."

3. Deepening Institutional Trend, Staking and RWA Become New Growth Engines

The crypto market is accelerating its shift from "retail-driven" to "institution-driven," and HashKey's user data clearly presents this transition: the number of institutional trading clients increased from 31 in 2022 to 273 in the first half of 2025, while the number of omnibus clients (accessing through partners) expanded from 1 in the first half of 2024 to 8, with the proportion of institutional client trading volume rising to 68% in the first half of 2025.

At the same time, institutional demand is also driving the market's transformation from "trading-driven" to "service-driven," with staking and real-world asset (RWA) tokenization becoming new growth engines. As of September 2025, HashKey's staking asset scale reached 29 billion HKD, ranking first in Asia and eighth globally among staking service providers; its self-developed HashKey Chain has achieved RWA tokenization issuance of 1.7 billion HKD, covering areas such as real estate and supply chain finance. Staking services provide stable passive income, which is crucial for attracting funds during bear markets; RWA connects traditional finance with the crypto ecosystem, opening up new market space.

II. Four Major Trend Predictions for the Future of the Crypto Market

Based on the characteristics revealed in HashKey's prospectus, combined with global regulatory and technological trends, four major predictions can be made for the future of the crypto market.

1. Compliance is Irreversible, Regulatory Differences Intensify Market Fragmentation

HashKey's rise proves that compliance is the "moat" for the long-term development of the industry. The global process of compliance in the crypto market will accelerate, with more countries and regions likely to adopt Hong Kong's regulatory model and establish clear frameworks. Small platforms without compliance qualifications will gradually be eliminated, while regions with clear regulations, such as Hong Kong and Singapore, are expected to become regional crypto asset hubs.

However, regulatory policy differences will exacerbate market fragmentation. The People's Bank of China recently reiterated its ban on virtual currency speculation and trading, restricting mainland clients' participation; the U.S. SEC continues to strengthen its regulation of crypto platforms; and the EU's MiCA regulations have come into effect. These differences may increase operational risks for cross-regional businesses.

2. Business Diversification is Key to Breaking the Deadlock, RWA and Staking Lead New Growth

Currently, crypto platforms generally face the issue of a single revenue structure, with HashKey's trading commissions still accounting for a large proportion of its revenue. This model yields high returns in bull markets but has weak risk resistance in bear markets. In the future, the focus of industry competition will shift from "trading volume competition" to "business diversification competition."

From HashKey's layout, RWA and staking are the two most promising directions. RWA will tokenize traditional assets, lowering investment thresholds and increasing liquidity. It is predicted that by 2028, the global RWA market size may exceed 10 trillion USD, becoming the largest incremental market. Staking services act as a "stabilizer" during bear markets; in the first half of 2025, while HashKey's trading volume declined, the scale of staking assets continued to grow. In the future, platforms that can provide high-security, high-yield staking products will have an advantage in competition.

3. Institutionalization Continues to Deepen, Retail Market Needs Ecological Innovation to Activate

Institutional clients have become the dominant force in the market, and this trend will continue to deepen. In the future, platforms will launch more customized custody, block trading algorithms, and other services for institutions, and crypto derivatives will become richer to meet institutional risk management needs.

In contrast, the retail market faces prominent conversion challenges. HashKey had 1.4469 million registered users by June 2025, but only 138,500 were asset clients, with the proportion of actual trading users being less than 10%. The core reason is the high product threshold and single application scenario; breakthroughs in the retail market require ecological innovation.

4. Threefold Risks Need Attention: Price, Regulation, and Platform Operations

Despite the positive trends in the market, multiple risks still exist. First is the price volatility risk; crypto assets still have speculative attributes, and investors need to rationally view the risk of returns. Second is the regulatory policy risk; regulatory rules in various countries are still changing rapidly, and tightening policies may lead to restrictions on platform operations and sharp declines in asset prices. Third is the platform operation risk; as a regional leader, HashKey has not yet achieved profitability, and during market downturns, if the capital chain breaks, it may face operational crises. Investors need to consider both compliance qualifications and financial conditions when choosing a platform.

In Conclusion

HashKey's prospectus is a microcosm of the crypto industry transitioning from "rampant growth" to "regulated development." The crypto market is no longer a playground for retail speculation but is gradually becoming a new battleground for institutional layouts. Compliance, institutionalization, and diversification are reshaping the underlying logic of the industry. For investors, participating in the market requires more rational judgment, recognizing both the growth potential of new directions and the various risks; for practitioners, compliance qualifications and business innovation are core competitive advantages. The crypto market is still in its early stages of development, with challenges and opportunities coexisting. Only participants who respect regulations, pay attention to risks, and continue to innovate can seize the dividends of industry development.

免责声明:本文章仅代表作者个人观点,不代表本平台的立场和观点。本文章仅供信息分享,不构成对任何人的任何投资建议。用户与作者之间的任何争议,与本平台无关。如网页中刊载的文章或图片涉及侵权,请提供相关的权利证明和身份证明发送邮件到support@aicoin.com,本平台相关工作人员将会进行核查。