The world is bustling, all for profit; the world is bustling, all for profit to go! Hello everyone, I am your friend Lao Cui, focusing on digital currency market analysis, striving to convey the most valuable market information to the vast number of coin friends. I welcome everyone's attention and likes, and refuse any market smoke screens!

Yesterday, after discussing the exchange rate, many friends began to worry whether the little value in their hands would continue to depreciate; that is, the CNY exchange rate continues to rise, breaking previous highs. You can rest assured about this; currently, major investment banks predict that next year's exchange rate will fluctuate around 6.5. It is very difficult to return to previous levels, and this difficulty cannot be solved by macro-control. Of course, the top players definitely want to address this issue. Think about it, in the current economic environment, it is impossible to return to previous standards. This is true for both us and the Americans; continuous confrontation will not yield good results. Coupled with the number of unemployment claims in the U.S., the initial claims for unemployment benefits are 236,000, higher than the expected 220,000, which is enough to prove that their employment environment is also facing problems. Currently, the markets recognized to drive employment rates are nothing but finance and real estate, while we are in the process of phasing out traditional manufacturing, and the pain is only temporary.

The problems faced by the Americans are also simple: the outflow of high-end manufacturing and the challenges in the financial sector, now relying on the service industry to maintain employment rates. The entire trade surplus has reached a trillion level; unless they loosen up and complete free trade between both sides, this will obviously not happen again. Therefore, the exchange rate is actually not that important; what is important for us is the users holding U.S. dollars, who are more concerned. The depreciation of the dollar is a good signal for us, proving that dollar assets are appreciating. You can rest assured that the currencies in your hands will definitely outperform the depreciation rate of foreign exchange. As long as you don't hold onto the dollar, converting it into corresponding dollar assets won't be a big problem. Also, don't worry unnecessarily, thinking that the future of the coin circle is bleak. It is impossible; as long as the platforms continue to launch stablecoins, the current application scenarios are becoming more and more widespread. Putin once said that no one can restrict Bitcoin.

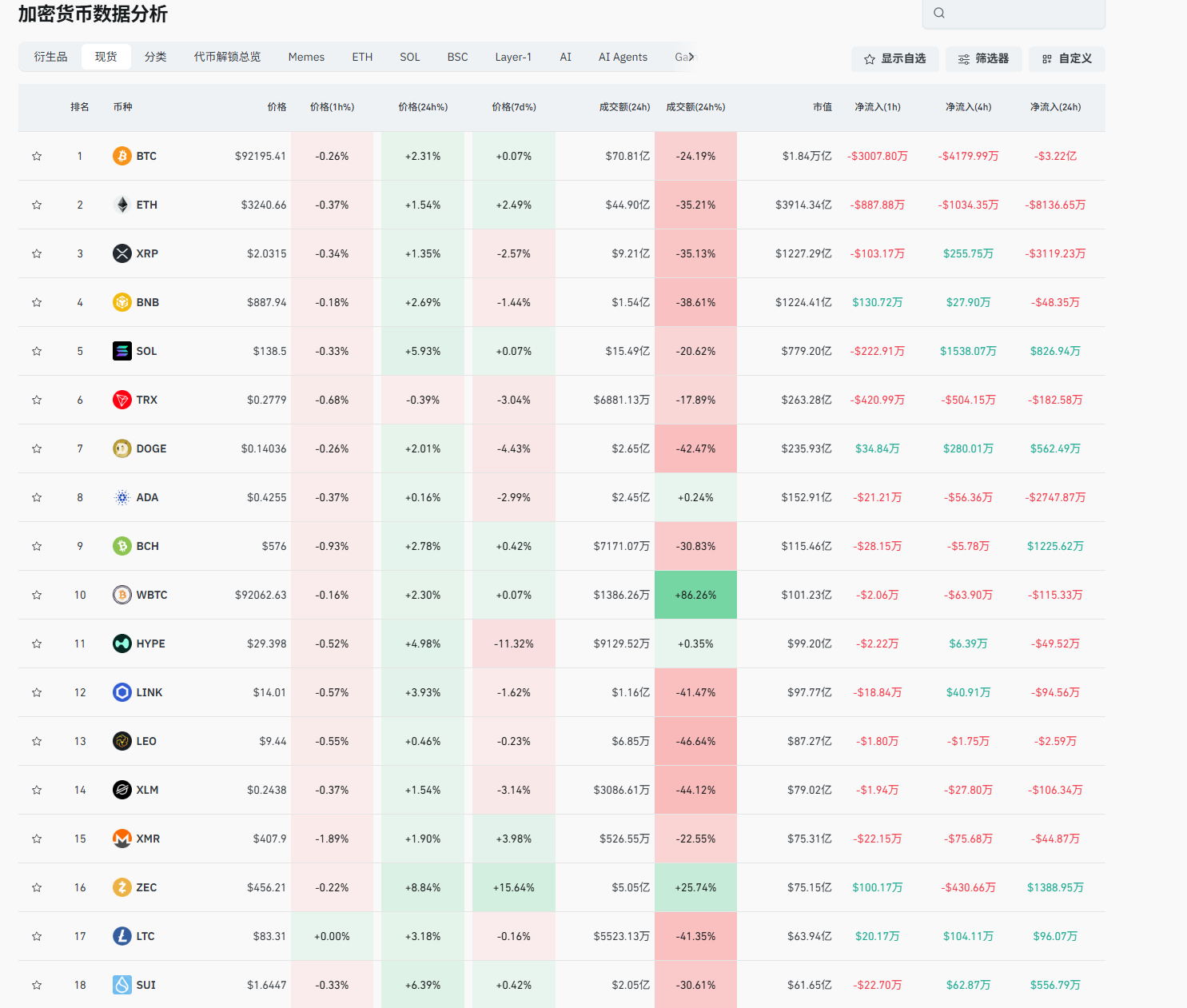

You can observe that leading trading platforms like Yingwei Finance have already seen a large number of coin circle assets, directly purchasing U.S. Treasury bonds and U.S. stocks. The formation of such channels will only create higher value in the coin circle, and the future will definitely be better. At this stage, the funds being absorbed by the Americans are not enough for them to close the net; the overall market in the coin circle still has the potential to double. From Lao Cui's perspective, this possibility is extremely high. This is not to encourage you to invest; think independently and discern right from wrong. There isn't much to discuss about the spot market; what needs to be said has already been emphasized many times, so let's talk about contract users. For contract users, the core issue still lies in playing expectations, not events, which is completely contrary to spot users. In other words, contract users do not chase hot spots but layout expectations in advance. For example, a rate cut event is a positive signal, and the time to buy is before it happens.

For institutions, when the expectation of a rate cut appears in December, they will buy in advance, perhaps around 88 or 90, and at this position, Lao Cui has also reminded everyone to buy, but the reminder was around 87. After the event is confirmed, institutions will definitely enter the selling phase. This is what they follow: buy expectations, sell facts to form a closed loop. Taking this practical case as an example, since December 7, it has been in the buy expectation phase. After the rate cut was confirmed on the 10th, the rally only lasted until around 4 a.m., followed by a wave of selling. This is a typical case of short-term harvesting; many friends were trapped around this area, and the reason for being trapped is very simple: they made profits but did not exit. The announcement of the rate cut at three o'clock pushed from 92 all the way to 94, which is the key point. If you entered with contracts, Lao Cui has previously mentioned that you cannot view market trends from a spot perspective; if you profit around 1000 points, you must consider exiting.

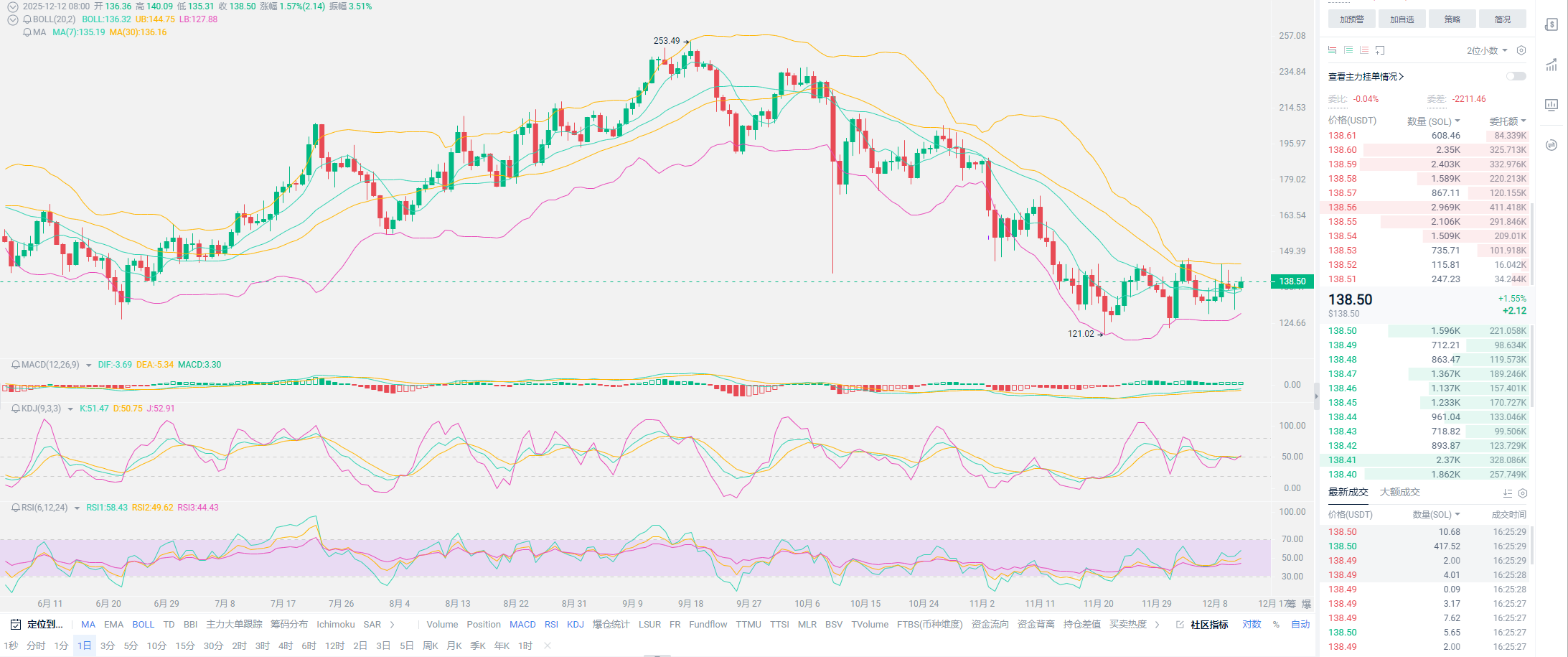

Many friends may think that after a rate cut, a bull market will form. Remember, no bull market starts with a strong rally on the day of a major event. There will definitely be a wave of short-term washing to let you relax your vigilance before the rally occurs. This is also why Lao Cui did not advise trapped users to stop-loss and exit; at this stage, you can lock in positions or even short, but long positions cannot be held. The only concern is the potential short-term sell-off near Japan's interest rate hike, but Japan's economic scale cannot lead the coin circle's trend. At most, the negative impact will be completely eliminated within a week to half a month. Near this key point, you can short to offset the losses from long positions; these issues can be resolved through your own operations. Because the trend is indeed on the bullish side, your lack of confidence is merely a problem with trend control.

The U.S. Financial Stability Oversight Council no longer lists digital assets as potential risks; this definition is the trend. With this definition from the Americans, you should no longer hype about risk assets or speculative behavior; they do not exist in the coin circle. Because next, the Americans will begin to promote the legalization and compliance of the coin circle. If the process is not delayed by major events, it is estimated that by 2026, the results you want will appear. The current stage is a trial run, the integration of digital assets with the real financial industry, that is, the digitization of U.S. stocks. Once formed, all funds will be siphoned into the U.S. market, and the coin circle will inevitably experience a new round of growth. Regarding the trend, you do not need to doubt too much; this is a concern for Trump. You just need to choose a side and not be on the opposite side of him. Binance has launched spot gold XAU perpetual contract trading, which is a concrete example of financial digitization.

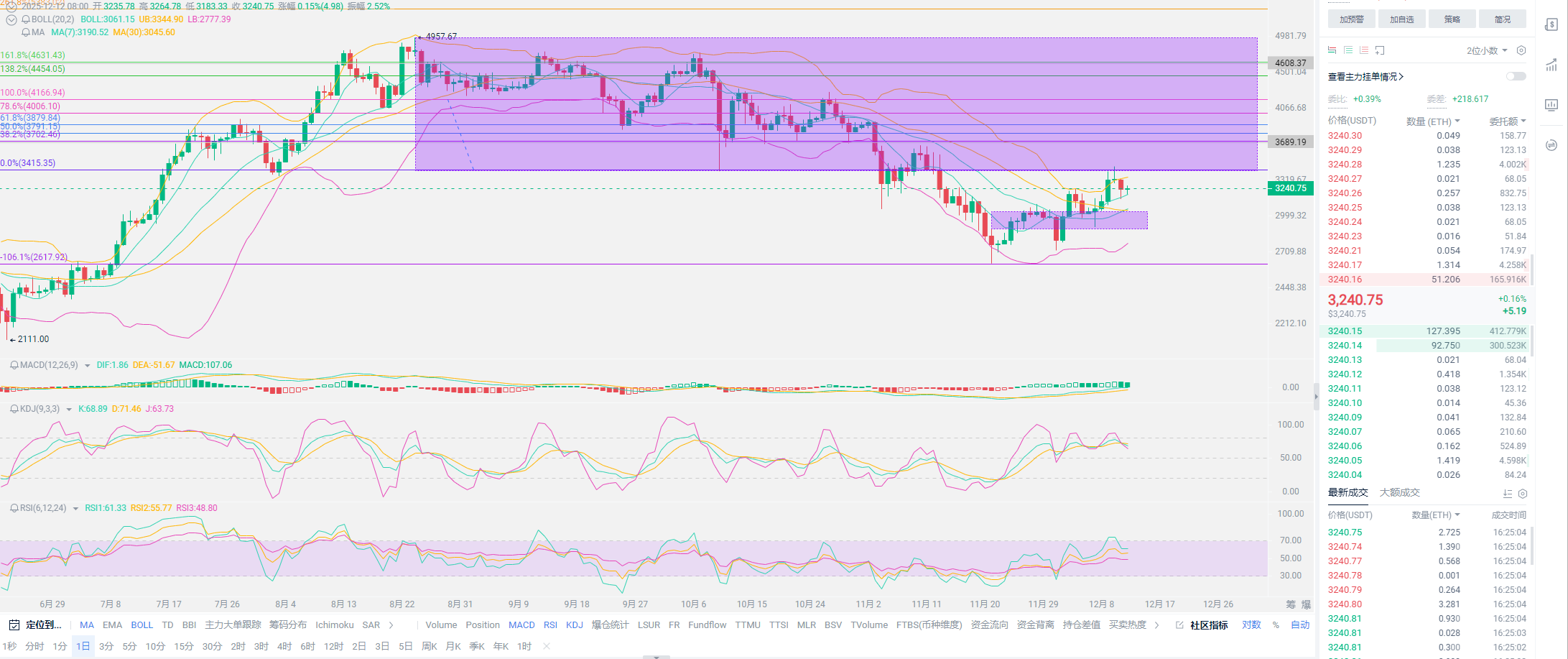

Lao Cui's summary: If we discuss trends on an annual basis, the fluctuations around 90,000 will continue for a while; at the same time, there will be no new lows, so you can rest assured. If compared to next year's new highs, the current points this year are still considered low. Spot users can take action, and the best timing for contract users is after Japan's interest rate hike. Also, pay attention to Hassett's appointment time; once these two achieve a transition, it will be the starting point of the bull market. His appointment power is no less than Trump's competence. Once this is achieved, it will form Trump's ultimate completeness, basically able to point and shoot. All of Trump's financial ideas lean towards hawkishness; large-scale rate cuts and even expanding the balance sheet to print money are possible. This kind of liquidity will definitely flow towards the coin circle above all else, even higher than U.S. stocks. This is the trend and the goal Trump wants to achieve during his term. You need to be patient; if you are trapped in positions or have contract issues, please consult Lao Cui primarily, as contract fluctuations are too fast, and perhaps by night to the next day, another set of operational thinking will form.

Original creation by WeChat public account: Lao Cui Talks About Coins. For assistance, you can contact directly.

Lao Cui's message: Investing is like playing chess; a master can see five, seven, or even ten steps ahead, while a novice can only see two or three steps. The master considers the overall situation and the big trend, not focusing on one piece or one territory, aiming for the final victory. The novice, on the other hand, fights for every inch, frequently switching between long and short positions, only competing for short-term gains, resulting in frequent entrapment.

This material is for learning reference only and does not constitute trading advice. Trading based on this is at your own risk!

免责声明:本文章仅代表作者个人观点,不代表本平台的立场和观点。本文章仅供信息分享,不构成对任何人的任何投资建议。用户与作者之间的任何争议,与本平台无关。如网页中刊载的文章或图片涉及侵权,请提供相关的权利证明和身份证明发送邮件到support@aicoin.com,本平台相关工作人员将会进行核查。