Original / Odaily Planet Daily (@OdailyChina)

Recently, Alliance DAO founder qw (@QwQiao) made a shocking statement: "The blockchain moat is limited," and rated the moat of L1 public chains at only 3/10.

This statement quickly ignited discussions in the overseas crypto community, sparking heated debates among crypto VCs, public chain builders, and KOLs. Dragonfly partner Haseeb fired back that rating the "blockchain moat as 3/10" is utterly absurd, and even Aave founder Santi, who is critical of the gambling culture in the industry, has never believed that blockchain "has no moat."

The debate over the meaning, value, and business model of blockchain and cryptocurrency often resurfaces in cycles. The crypto industry oscillates between ideals and reality: people nostalgically remember the original decentralized vision while yearning for the status and recognition of traditional finance, all while deeply mired in self-doubt about whether it is merely a repackaged casino. The root of all these contradictions may lie in scale—the total market value of the crypto industry has been hovering around $3-4 trillion, which still seems small compared to traditional financial giants that often reach hundreds of billions or even trillions of dollars.

As practitioners, there is a contradictory psychology of being both arrogant and insecure—arrogant in the belief that blockchain was born from Satoshi Nakamoto's ideal of de-dollarization and decentralization, and that the crypto industry has indeed become an emerging financial sector that is gradually gaining attention, acceptance, and participation from mainstream forces; yet insecure, like a poor kid who feels that what he does is not particularly glorious, filled with the blood, tears, suffering, and pain of a zero-sum game. In summary, the limitations of the industry's scale have fostered this cyclical identity anxiety, self-doubt, and self-denial.

Today, we will use qw's proposed "moat business rating" topic to discuss the existing ailments and core advantages of the crypto industry.

Origin of the Debate: Is Liquidity the Moat of the Crypto Industry?

This major industry discussion about "whether there is a moat in the crypto industry" actually originated from a statement made by Paradigm team researcher frankie who said—"The greatest trick the devil ever pulled was convincing crypto people that liquidity is a moat."

It is clear that as a "purebred" VC, frankie is somewhat dismissive of the current industry trend that highly esteems "liquidity is everything." After all, for an investor or research expert who has advantages in capital and information, they often hope that the money they manage can be spent on projects and businesses that have real business support, can generate real cash flow, and continuously bring them financial returns.

This viewpoint has garnered support from many in the comments:

- Multicoin partner Kyle Samani directly stated "+1";

- Ethereum Foundation member binji believes "Trust is the real moat; even if trust may flow due to opportunities in the short term, liquidity will always be placed where it is trusted."

- Chris Reis from the Arc public chain team under Circle pointed out: "TVL always seems to be the wrong North Star metric (business guiding goal)."

- Justin Alick from the Aura Foundation jokingly remarked: "Liquidity is like a fickle woman; she can leave you at any time."

- DeFi researcher Defi peniel stated: "Relying solely on liquidity is not a moat; speculation can disappear overnight."

Of course, there were also many rebuttals—

- DFDV COO and CIO Parker commented: "What are you talking about? USDT is the worst stablecoin, yet it holds absolute dominance. Bitcoin is the (performance experience) worst blockchain, yet it absolutely dominates."

- Former Sequoia investor and current Folius Ventures investor KD posed a rhetorical question: "Isn't it?"

- Fabric VC investor Thomas Crow pointed out: "In exchanges, liquidity is a moat—deeper liquidity leads to better user experience; this is the most important feature in this vertical industry, without exception. This is why the main innovations in crypto asset trading focus on solving liquidity shortages (which lead to worse user experiences), such as Uniswap, which obtains long-tail asset liquidity through LPs, and Pump.Fun, which attracts pre-launch liquidity through standardized contracts and joint curves."

- Pantera investor Mason Nystrom retweeted and commented: "Liquidity is definitely a moat." He then provided different examples to illustrate: Ethereum's current lead in public chains is due to DeFi liquidity (and developers); CEXs like Binance and Coinbase; lending platforms like Aave and MakerDAO; stablecoins like USDT; DEXs like Uniswap and Pancakeswap.

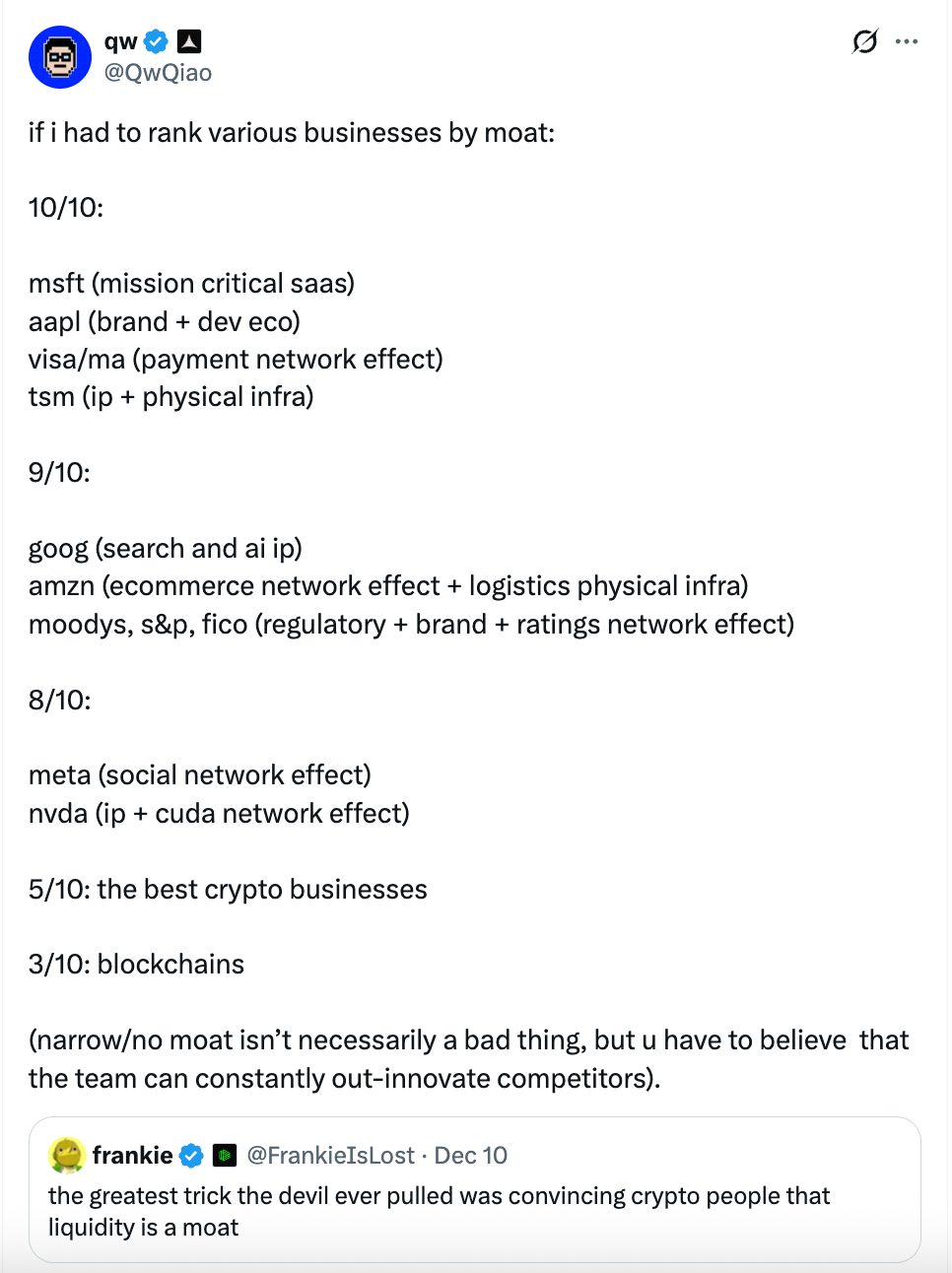

Then came the tweet from Alliance DAO founder qw about the moat rating:

In his view, the moat of blockchain (public chains) itself is very limited, rated at only 3/10.

- He believes that Microsoft (key SaaS), Apple (brand + development ecosystem), Visa/Mastercard (payment network effects), and TSMC (IP + physical infrastructure) can score 10/10 (strongest moat);

- Google (search and AI IP), Amazon (e-commerce network effects + logistics infrastructure), Moody's, S&P, FICO, and other rating agencies (regulatory-driven + brand + rating network effects), and large cloud computing (AWS/Azure/GCP, etc.) can score 9/10;

- Meta (social network effects) and Nvidia (IP + CUDA network effects) score 8/10;

- The best crypto businesses in the crypto industry score 5/10;

- Public chains score only 3/10 (narrow moat).

qw further stated that a low moat rating is not necessarily a bad thing, but it means that the team must be able to continuously lead in innovation, or they will be quickly replaced. Subsequently, perhaps feeling that the previous rating was too hasty, he provided some supplementary ratings in the comments:

- The three major cloud service providers score 9/10;

- BTC's moat rating is 9/10 (Odaily Planet Daily note: qw pointed out that no one can replicate BTC's founding story and "Lindy effect," but he deducted 1 point because it is unclear whether it can cope with security budgets and quantum threats);

- Tesla 7/10 (Odaily Planet Daily note: qw believes that automated IP like smart driving is very crazy, but the automotive industry is commoditized, and humanoid robots may be similar);

- Lithography machine manufacturer ASML 10/10.

- AAVE's moat rating may be higher than 5 (out of 10), with qw reasoning: "As a user, you must believe that their smart contract security testing is sufficient and will not lose your funds."

Of course, seeing qw take on the role of a "sharp critic" so grandly, the comments section not only debated the "moat system" but also included some irrelevant mockery of qw's statements, with some even mentioning: "What about those terrible launch platforms you invested in?" (Odaily Planet Daily note: After investing in pump.fun, the one-click token issuance platforms that Alliance DAO subsequently invested in, such as Believe, performed poorly, and even he himself did not want to rate them).

With such a contentious focal topic, Dragonfly partner Haseeb's subsequent outburst was triggered.

Dragonfly Partner's Inner Thoughts: Nonsense, I've Never Seen Such a Shameless Person

In response to qw's "moat rating system," Dragonfly partner Haseeb wrote angrily: "What? 'Blockchain moat: 3/10'? This is a bit absurd. Even Santi doesn't think public chains 'have no moat.'

Ethereum has dominated for 10 years, with hundreds of challengers raising over $10 billion trying to capture market share. After a decade of competitors attempting to dethrone it, Ethereum has successfully defended its throne every time. If this doesn't indicate that Ethereum has a moat, I really don't know what a moat is?"

In the comments section of this tweet, qw also expressed his views: "What you are saying is a retrospective ('the past ten years') and factually incorrect (Ethereum no longer holds the throne on multiple metrics)."

Subsequently, the two engaged in several rounds of discussion on "what exactly is a moat?" and "does Ethereum have a moat?" qw even referenced a post he made in November, pointing out that his concept of a "moat" is actually revenue/profit. But Haseeb immediately provided counterexamples—while projects like OpenSea, Axie, and BitMEX once had high revenues, they actually have no moat, and the real moat should focus on—"Can it be replaced by competitors?".

Marissa, the asset management director at Abra Global, also joined the discussion: "I agree (with Haseeb's viewpoint). qw's statement is a bit strange—switching costs and network effects can create a solid moat—both Solana and Ethereum have these, and I believe over time, they will become stronger than other public chains. They both have strong brands and development ecosystems, which are clearly part of the moat. Perhaps he is referring to other public chains that lack these advantages."

Haseeb continued to mock: "qw is just arguing in bad faith, digging his own grave."

Based on the above discussion, perhaps we should break down what the "real moat" of public chains in the cryptocurrency industry actually includes.

The 7 Major Components of Public Chain Moats: From People to Business, From Origin to Network

In my view, the reason qw's "moat rating system" is somewhat self-contradictory is mainly due to:

First, its rating criteria only look at the current industry position and revenue while ignoring multi-dimensional assessments. Whether it’s infrastructure like Microsoft, Apple, and Amazon Web Services, or payment giants like Visa and Mastercard, the main reason qw gives high scores is due to their strong revenue models, which clearly simplifies and superficializes the business moats of giant companies. Moreover, it is worth noting that Apple's global market share is not at a dominating level, and payment giants like Visa also face challenges such as market contraction and regional business decline.

Second, it overlooks the complexity and uniqueness of public chains and crypto projects compared to traditional internet businesses. As challengers to the fiat currency system, cryptocurrencies and blockchain technology, as well as the subsequent emergence of public chains and crypto projects, are rooted in the inherent "anonymity" and "node-based" nature of decentralized networks, which traditional revenue-driven businesses often cannot achieve.

Based on this, I believe the moat of public chain businesses mainly lies in the following 7 aspects:

1. Technical Philosophy. This is also the greatest advantage and differentiating feature of Bitcoin, Ethereum, Solana, and countless public chain projects. As long as humanity remains vigilant against centralized systems, authoritarian governments, and fiat currency systems, and accepts the concepts of sovereign individuals and related viewpoints, the real demand for decentralized networks will always exist;

2. Founder Charisma. Satoshi Nakamoto disappeared after inventing Bitcoin and ensuring the smooth operation of the Bitcoin network, sitting on hundreds of billions of dollars without being swayed; from a gamer who was obsessed with World of Warcraft but suffered "abuse" from the game company to a co-founder of Ethereum, Vitalik resolutely embarked on his journey of decentralized spirit; Solana founders like Toly were originally elites from major American companies but were unwilling to stop there, thus starting their own "capital internet" construction path. Not to mention the various public chains built on the Move language, which inherits the legacy of the Meta Libra network. The personal charisma and appeal of founders are particularly important in the crypto industry. This is why countless crypto projects are favored by VCs, embraced by communities, and flooded with funds, but also why they can fade into obscurity when founders step down or face unexpected events. A good founder is the true soul of a public chain or a crypto project;

3. Developer and User Network. In this regard, as emphasized by Metcalfe's Law and the Lindy Effect, the stronger the network effect of a thing and the longer it exists, the more likely it is to continue to exist. The developer and user network is the cornerstone of public chains and many crypto projects, as developers can be considered the first batch of users and the most enduring users of a crypto public chain or project;

4. Application Ecosystem. A tree can hardly survive if it has roots but no branches and leaves; the same goes for crypto projects. Therefore, a rich application ecosystem that can self-loop and generate synergistic effects is crucial. The reason why public chains like Ethereum and Solana can survive the winter is due to the various application projects that continue to be built. Moreover, the richer the application ecosystem, the more it can continuously generate value and feed back into the public chain;

5. Token Market Value. If the aforementioned aspects are the internal structure and foundation of a "moat," then the token market value is the external form and brand image of a public chain and a crypto project. Only when you "look expensive" will more people believe that you "have a lot of money," and that you are a "gold mine"; this applies to individuals as well as projects;

6. Openness to the Outside World. Public chains and other crypto projects, in addition to building their own internal circular ecosystems, also need to maintain openness and operability with the external environment and exchange value. Therefore, openness to the outside world is also crucial. Taking public chains like Ethereum and Solana as examples, their convenience and scalability in bridging with traditional finance, user fund inflows and outflows, and various industries through payment, lending, and other channels are key;

7. Long-term Roadmap. A truly solid moat must not only provide support in the short term but also require continuous updates, iterations, and innovations to maintain its vitality and longevity in the long term. For public chains, a long-term roadmap serves as both a North Star metric and a powerful tool to incentivize continuous development and innovation within and outside the ecosystem. The success of Ethereum is closely related to its long-term roadmap planning.

Based on these elements, a public chain can evolve from zero to one, from nothing to something, gradually passing through the barbaric growth phase and entering the mature iteration phase. Correspondingly, liquidity and user stickiness will naturally follow.

Conclusion: The Crypto Industry Has Not Yet Reached the "Talent Competition" Stage

Recently, the company known as the "Chinese version of Nvidia," Moore Threads, successfully listed on the Hong Kong stock market, achieving a milestone of 300 billion yuan on its first day of trading; shortly thereafter, within just a few days, its stock price skyrocketed, reaching over 400 billion yuan in market value in another astonishing breakthrough today.

In contrast to Ethereum, which took 10 years to finally reach a market value of 300 billion dollars, Moore Threads has traversed 1/7 of that journey in just a few days. Compared to the American stock giants with market values often in the trillions, the crypto industry seems even smaller.

This inevitably leads us to reflect again that, in an era where the scale of funds and user involvement is far smaller than that of traditional finance and the internet, we are far from the time of "talent competition." The only pain point in the crypto industry right now is that we don't have enough people, the funds we attract are not large enough, and the industries involved are not broad enough. Rather than worrying about those macro, large-scale "moats," perhaps we should think more about how cryptocurrencies can more quickly, cost-effectively, and conveniently meet the real needs of more market users.

免责声明:本文章仅代表作者个人观点,不代表本平台的立场和观点。本文章仅供信息分享,不构成对任何人的任何投资建议。用户与作者之间的任何争议,与本平台无关。如网页中刊载的文章或图片涉及侵权,请提供相关的权利证明和身份证明发送邮件到support@aicoin.com,本平台相关工作人员将会进行核查。