The impact of this policy measure goes far beyond a 25 basis point rate cut.

On December 10, the Federal Reserve lowered the benchmark interest rate by 25 basis points, marking the third consecutive rate cut and a total adjustment of 75 basis points since September. However, the implications of this decision are far more profound than the surface numbers suggest. Beneath the surface, this meeting exposed the growing divisions within the Federal Open Market Committee, escalating political pressures, and the rapid deterioration of consensus on monetary policy direction.

The meeting saw three dissenting votes, the highest number for a single meeting since 2019. One board member has voted against the decision for three consecutive times, while another has done so for two consecutive meetings, indicating that Powell's ability to maintain unity within the committee is weakening. As internal cohesion declines, the clarity of the Fed's policy direction is also affected. Investors rely on the committee's internal consensus to interpret future interest rate paths, and the December meeting suggests that this reliability is diminishing.

At the core of the disagreement is a tricky macroeconomic dilemma: inflation has stopped rising significantly, while employment indicators remain weak. In a typical economic cycle, data often points in one direction—either clearly favoring easing or tightening. But now, with price pressures remaining high and job growth slowing, policymakers find themselves in a stalemate. Insufficient tightening could lead to persistently high inflation; excessive easing could exacerbate unemployment issues. Historically, such intense internal divisions only arise during periods of extreme economic uncertainty.

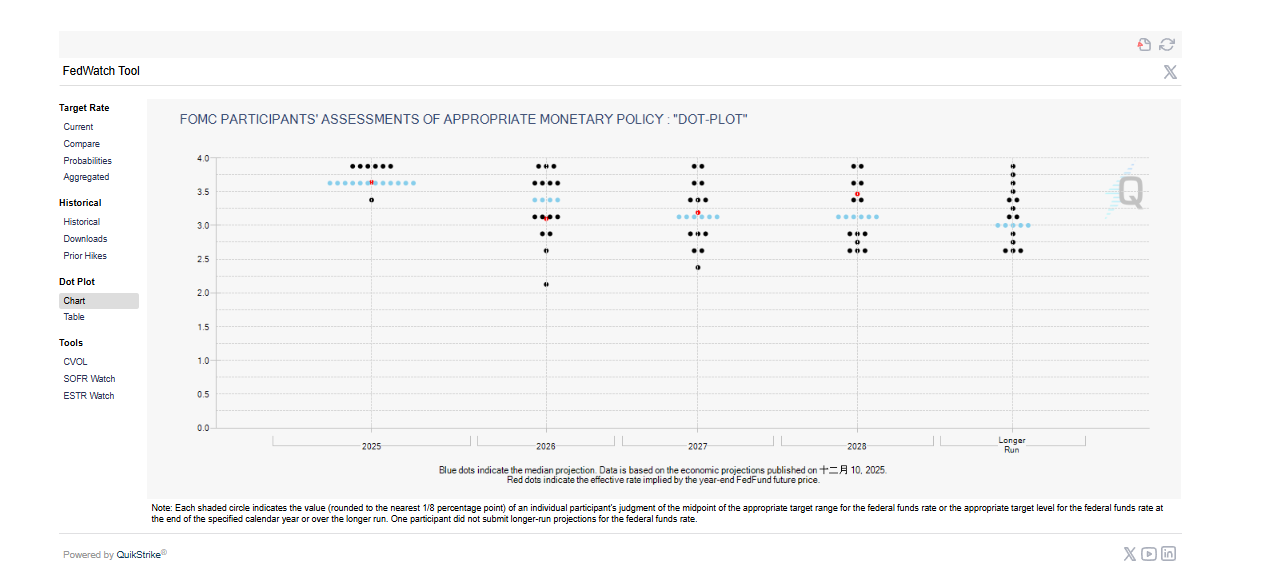

The dot plot conveys a clearer message

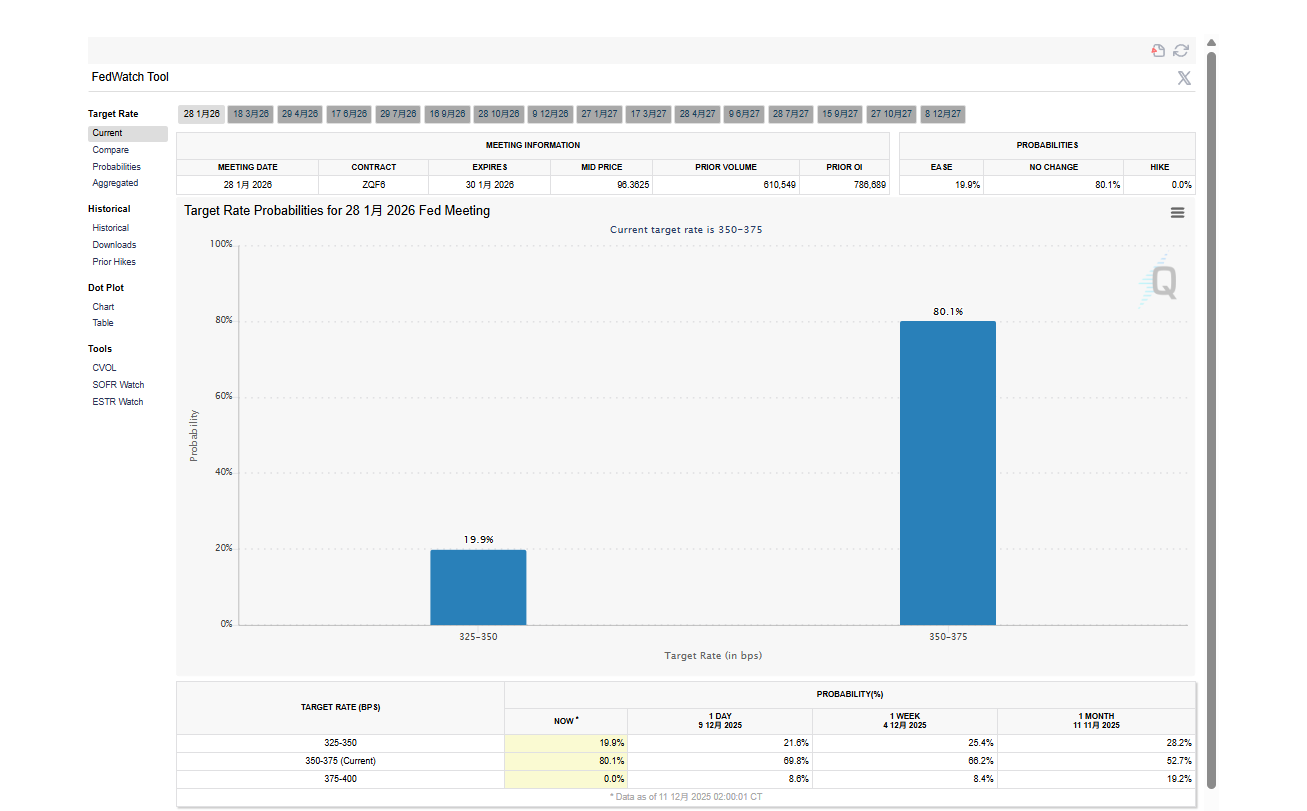

If the previous divisions were not enough, the updated dot plot has further intensified market caution. Current forecasts indicate that there will only be one rate cut in both 2026 and 2027, with the long-term policy rate remaining around 3%. This is clearly more conservative than what investors had anticipated. Despite weak labor market data, the forecast results show almost no change compared to the update in September, highlighting the significant divisions among committee members.

Slowing the pace of easing indicates that the Fed is unwilling to commit to a smooth or sustained reduction in interest rates. Instead, policymakers seem concerned that the economy may not withstand rapid easing, or that inflation remains too high to support such policies. Regardless of the reasons, the message is clear: future easing policies will not follow the predictable linear patterns of past cycles.

Powell shifts to a neutral, cautious framework

Jerome Powell's press conference heightened market uncertainty. Unlike previous meetings, he did not hint at further rate cuts. He described the current policy as "in good shape" and noted that interest rates are currently in a neutral range. This shift is significant. If the Fed views its policy as neutral, it means it believes there is no need for further easing at this time and intends to respond based on economic data rather than adhering to a pre-set direction.

Powell repeatedly emphasized that the Fed would not follow a predetermined policy path but would make decisions based on the specifics of each meeting. This is in stark contrast to market expectations of a smooth, sustained easing cycle over multiple quarters. In fact, Powell suggested that the trajectory of interest rates could become uneven: there may be a period of unchanged rates followed by cuts, or even a pause in rate hikes, depending on changes in inflation and employment conditions.

This approach reflects the overall chaotic situation at the time. With severe divisions among committee members, persistently high inflation, slowing job growth, and increased political scrutiny, Powell is treading carefully. He has avoided triggering panic while providing no roadmap. Now, the lack of forward guidance itself has become a source of market volatility.

Political front: Trump pushes for accelerated easing

Political pressure adds another layer of complexity. President Donald Trump has publicly criticized the magnitude of the rate cuts, arguing that they should be at least doubled. Since the president cannot directly instruct the Fed, public statements have become his channel for influence. His dissatisfaction with the pace of easing has become increasingly apparent.

More importantly, Trump announced that he would expedite the selection process for a new Fed chair. Powell's term ends in May 2026, meaning he has only three meetings left to set policy. Kevin Warsh has emerged as a frontrunner, but Christopher Waller, Michelle Bowman, and BlackRock's Rick Rieder are still in the running. Given Trump's unpredictability in personnel decisions, the market cannot remain stable until a formal nomination is announced.

The impending leadership transition exacerbates policy uncertainty. The market must simultaneously interpret Powell's remaining decisions and predict the policy framework of his successor. If Trump ultimately chooses someone who aligns more closely with his aggressive easing preferences, the entire interest rate path post-2026 could undergo significant changes.

Why is the market calm in the short term but facing higher risks in the future?

Despite deeper concerns, the market initially welcomed the rate cut. Powell assured that no one on the committee was considering rate hikes, which boosted market sentiment and triggered a rally. Stock prices rose, and volatility eased. However, this optimism is likely to be temporary.

The mid-term outlook is now more complex. With divisions within the Fed and Powell avoiding clear commitments, the path of easing policy is more difficult to predict than at any time during this cycle. This uncertainty often translates into broader market volatility. Additionally, the upcoming leadership change introduces a political variable that investors cannot accurately price in.

For Bitcoin and other digital assets, the predictability of liquidity conditions is crucial. While the confirmed rate cut may boost short-term market sentiment, the ambiguity surrounding the next steps in monetary policy could prolong the current consolidation phase. The cryptocurrency market may not experience a clear upward trend but could face a longer period of sideways trading as market participants await clearer signals.

Investors now need to closely monitor two parallel forces: Powell's remaining decisions and the political evolution surrounding the next Fed chair. Both forces will influence market expectations, especially as monthly economic data continues to reshape relevant discussions.

A period filled with uncertainty

The December meeting was not just a routine policy adjustment. It exposed the dilemmas faced by the monetary policy institution in addressing conflicting economic forces, growing political influence, and diminishing internal coordination. This meeting also set the stage for a potentially tumultuous transformation that could reshape the future of U.S. monetary policy.

The short-term economic situation remains stable, but structural uncertainty is rising. The Fed is shifting from a predictable easing cycle to a phase characterized by greater volatility and reliance on economic data. With inflation still high, unemployment rates declining, and leadership changes on the horizon, the future path is more uncertain than at any time in recent years.

Until the situation clarifies—whether through improved data, internal consensus, or a change in chair—markets, including Bitcoin, may continue to trade in a turbulent and uncertain environment.

免责声明:本文章仅代表作者个人观点,不代表本平台的立场和观点。本文章仅供信息分享,不构成对任何人的任何投资建议。用户与作者之间的任何争议,与本平台无关。如网页中刊载的文章或图片涉及侵权,请提供相关的权利证明和身份证明发送邮件到support@aicoin.com,本平台相关工作人员将会进行核查。