Author: Wenser (@wenser2010), Planet Daily

2025 is about to come to an end. Standing at the conclusion of the "Year of Cryptocurrency Mainstreaming," it is time to summarize this year's four quarters with some keywords and glimpse how the world is being gradually infiltrated and transformed by cryptocurrency.

The cryptocurrency world in 2025 has experienced many ups and downs: from Trump taking office as President of the United States in early January to the U.S. initiating a tariff trade war in April; from Strategy leading the DAT treasury company trend with a temporary profit of hundreds of billions of dollars, to ETH, SOL treasury-listed companies, and even altcoin treasury companies blooming and then falling silent; from stock tokenization platforms being seen as the "best combination of DeFi and TradFi," to the Nasdaq Stock Exchange undergoing self-revolution to join the stock tokenization craze; from the wealth creation frenzy sparked by on-chain Perp DEXs like Hyperliquid and Aster to the dual oligopoly of prediction markets Polymarket and Kalshi being valued at over $10 billion; from the GENIUS stablecoin regulatory bill to the stablecoin craze that always mentions PayFi; from cryptocurrency IPOs to the normalization of cryptocurrency ETFs… In the process of countless funds, attention, and regulatory forces clashing, fighting, and reconciling, amidst numerous wealth creation projects, meme spoofs, and hacking incidents, in the fervor of FOMO, new highs, and frantic buying, and in extreme fear, massive crashes, and black swans, the cryptocurrency industry's tree of maturity has added another ring.

Behind the sleepless money is the rise and fall of meme coin players, the losses of those trying to profit, the large-scale incorporation by Wall Street, and the lifting of restrictions by U.S. regulators. This year is somewhat complex—it is neither a complete bull market nor a cold bear market; compared to the past, where the cryptocurrency market had clear highs and lows and sector rotations, the cryptocurrency industry in 2025, influenced by Trump and many authoritarian governments, resembles a monkey jumping around; some have fallen from grace, while others have risen to prominence. As for the gains and losses, perhaps our upcoming “2025 Cryptocurrency Investment Memoir” will reveal more answers.

In this article, Odaily Planet Daily will use four quarterly keywords to review cryptocurrency in 2025.

Spring of Cryptocurrency: The Trump Effect Continues, TRUMP Creates Wealth, and Cryptocurrency Regulatory Framework Clarifies

In January, Trump officially took office as President of the United States.

Continuing the hot momentum from last year's election victory, the cryptocurrency market, after a brief consolidation, saw BTC prices once again approaching the $100,000 mark.

Just three days before Trump took office, the "Trump Official Meme Coin" known as TRUMP brought the first wave of wealth creation to many cryptocurrency participants this year.

I still clearly remember that morning when a colleague first shared the TRUMP token contract, its total market cap (FDV) was only around $4 billion, and amidst doubts like "Has Trump been hacked?", "Does the U.S. President dare to issue a coin?", and "Is Trump trying to make one last profit before becoming president?", TRUMP's total market cap surged, quickly breaking through $10 billion, then $30 billion, and finally reaching over $80 billion.

In this astonishing wealth creation frenzy, many meme players in the Chinese community made substantial profits, with some individuals earning as much as several million dollars, even exceeding $20 million. For a list of TRUMP wealth creation traders, I recommend reading “Who Made Over a Million Dollars from TRUMP? Winning KOLs and Disappointed ETH Maxis”_.

This was also the "second spring" for the cryptocurrency market, reignited by Trump's personal influence after he was elected President of the United States in November 2024.

Soon, the cryptocurrency market also offered its own "gift" for Trump's presidency—on January 20, a month later, BTC once again broke its historical high, with prices rising to $109,800.

At that time, everyone regarded Trump as the undisputed "First Cryptocurrency President." Perhaps many did not realize that "water can carry a boat, but it can also capsize it." What Trump brought to the cryptocurrency market was not only favorable macro policies and regulatory environments but also a series of controversies, harvesting, and repeated swings brought by his family's cryptocurrency projects.

On the other hand, the key point of the "Trump Effect" lies in whether he can directly improve the U.S. cryptocurrency regulatory environment after taking office—

Firstly, whether he can bring clearer boundaries and more friendly rules through legislation and executive orders for cryptocurrency regulation. Trump gradually fulfilled some of his promises, including replacing the SEC chairman with Paul Atkins, appointing David Sacks as the White House AI and cryptocurrency director, and promoting the passage of the GINUS stablecoin regulatory bill.

Secondly, there is the "BTC National Strategic Reserve" that the cryptocurrency market and many pro-crypto politicians are concerned about. In early March, Trump signed a presidential executive order to promote the establishment of a U.S. Bitcoin strategic reserve using previously confiscated BTC assets. He also emphasized: "It will not increase the taxpayer burden." For more details, I recommend reading “Trump Promises to Establish BTC Strategic Reserve, But Is Funding Solely from Confiscated Assets?”_.

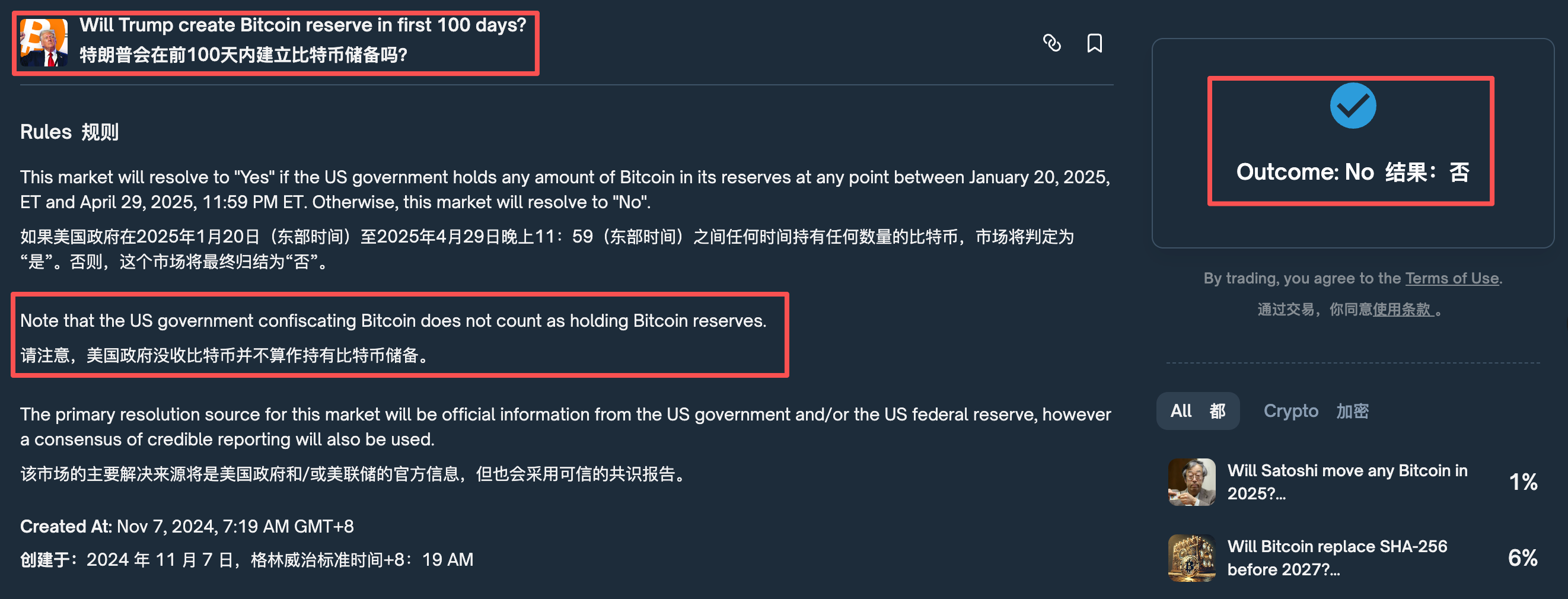

Despite this, the final determination on Polymarket regarding "Will Trump create a national Bitcoin reserve in his first 100 days?" was “No” (Odaily Planet Daily note: The reason is that the rules of this betting event mentioned that confiscated assets by the U.S. government do not belong to the BTC reserve), which left many people frustrated, with some even shouting "scam site" in the comments section of the event.

Polymarket betting event rules information

At that time, "insider whales" had already begun to emerge, with the "50x leverage insider" on Hyperliquid profiting millions of dollars from news about "Trump establishing a cryptocurrency reserve." For event details, refer to “Reviewing Hyperliquid Contract 'Insider' Operations, Precise Long and Short Openings and Closures”_.

During this period, many events that put Trump in the spotlight also occurred, including the TRUMP-related “Melania Token Incident” and the political celebrity coin LIBRA incident triggered by Argentine President Milei, both considered "dark masterpieces" of Trump's coin issuance group. In addition, the first quarter of the cryptocurrency market also witnessed a series of "historic events," including:

- Hyperliquid's “Largest Airdrop of the Year” that made many on-chain players envious;

- Bybit suddenly attacked by North Korean hacker group Lazarus Group, losing $1.5 billion in assets;

- The controversial Ethereum Foundation underwent a major update, with former executive director Aya promoted to chair.

At that time, the industry did not anticipate that Trump's presence would soon lead the market to witness an American version of "success and failure both stem from the same source."

Summer of Cryptocurrency: DAT Treasury Companies, ETH Breaks New Highs, Stablecoins Take Center Stage

As the second quarter began, the cryptocurrency market was dealt a heavy blow—at the beginning of April, Trump initiated a global "tariff trade war," causing a sudden panic in the global economic situation, severely impacting both the U.S. stock market and the cryptocurrency market.

On April 7, during “Black Monday”, the U.S. stock market saw nearly $6 trillion evaporate in a week, including over $1.5 trillion in market cap lost by the "Big Seven" U.S. tech companies like Apple and Google. After nearly a month of turbulent market conditions, the cryptocurrency market finally experienced a significant drop—BTC once fell below the $80,000 mark, hitting a low of $77,000; ETH dropped to a low of $1,540, marking a new low since October 2023; the total cryptocurrency market cap fell to $2.6 trillion, with a single-day drop exceeding 9%. For further reading, refer to “Digging Deep into the 'Culprit' Behind the Tariff War, Over $6 Trillion Evaporated Overnight Because of Him?”

It was from that moment that, after months of market downturns and organizational reforms, ETH finally began to show some momentum and potential for a rebound. For further reading, refer to “New Officials Bring New Fire, Ethereum Foundation's New Executive Director Reveals EF's Future Direction”

At the same time, riding the wave of Circle's U.S. IPO, stablecoins and PayFi gradually entered the mainstream view of the cryptocurrency market, being seen by many as the only way for "mass adoption of cryptocurrency." _Recommended reading: _“The 10-Year Journey of Stablecoins: Finally Recognized as 'Peer-to-Peer Electronic Cash' by the U.S. Government”_ and “The Golden Age of Stablecoins Begins: USDT to the Left, USDC to the Right”_

In late May, with a command from Joseph Lubin, co-founder of Ethereum and founder of Consensys and MetaMask, U.S. listed company Sharplink transformed from a sports marketing company into the first "ETH treasury listed company." From then on, the DAT craze began to sweep the entire cryptocurrency market, and ETH's price finally emerged from its downward spiral, successfully breaking through the previous historical high of $4,800 a few months later, soaring to nearly $5,000.

Subsequently, "Wall Street's oracle" Tom Lee also joined the "DAT treasury craze" with his U.S. listed company Bitmine, making ETH treasury listed companies another "scenic spot in the cryptocurrency world" following the BTC treasury listed companies led by Strategy.

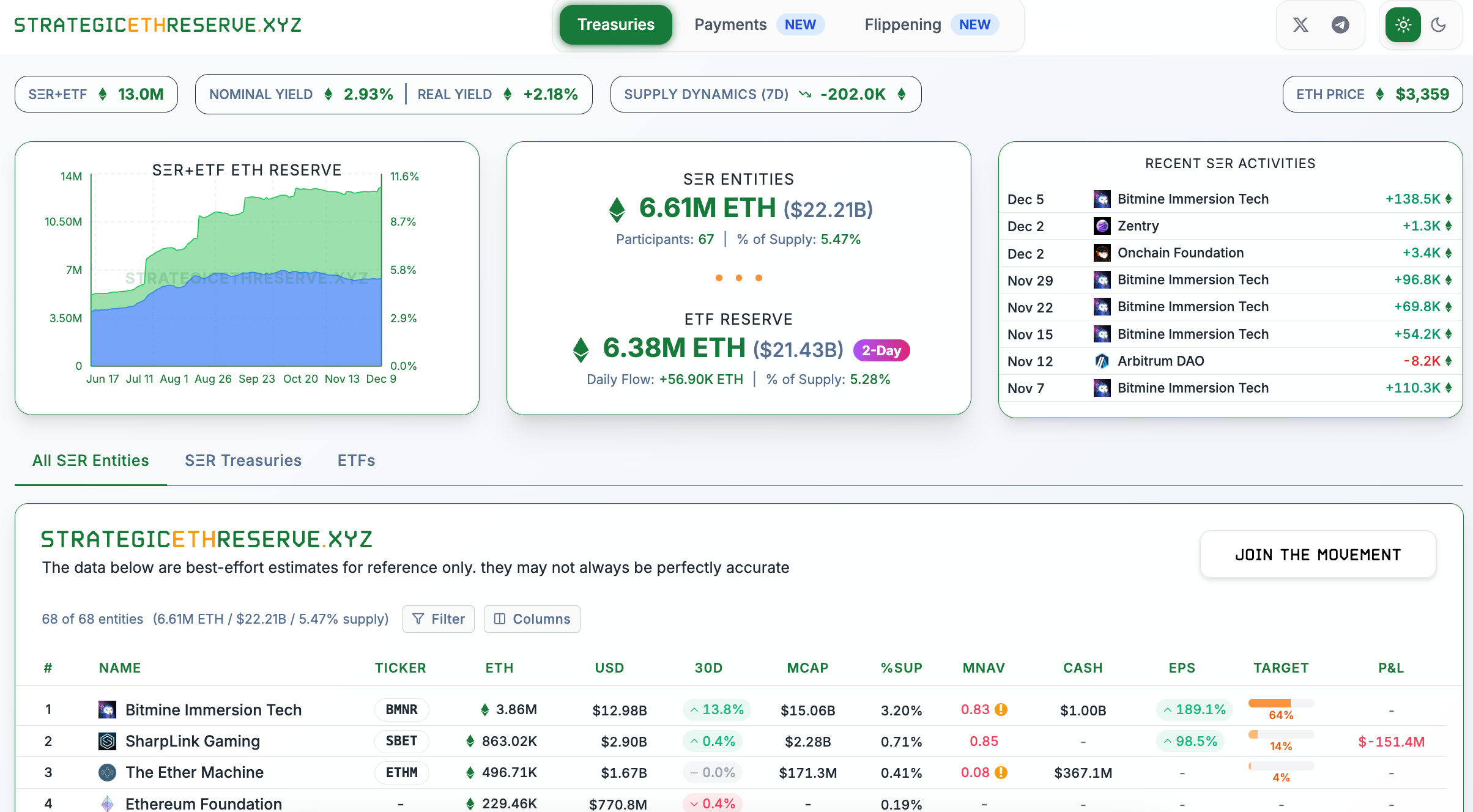

A Glimpse of ETH Treasury Companies

As of the time of writing, according to data from strategicethreserve website, the total number of ETH treasury companies has increased to nearly 70, among which:

- Bitmine (BMNR) ranks first with a holding of 3.86 million ETH;

- Sharplink (SBET) holds over 860,000 ETH, firmly in second place;

- ETH Machine (ETHM) ranks third with over 490,000 ETH.

It is worth mentioning that the ETH holdings of these three DAT companies significantly exceed the Ethereum Foundation's holdings (less than 230,000 ETH).

With ETH treasury companies leading the way, SOL DAT companies , BNB DAT companies, and a series of altcoin DAT companies also sprang up like mushrooms after rain, with their stock prices experiencing sudden rises and falls amidst the clamor of not wanting to be outdone.

Having passed through the initial frenzy of transformation and entering a period of calm in the cryptocurrency market, ETH DAT companies like Bitmine now face billions of dollars in paper losses, while DAT treasury companies, including many BTC reserve companies, have seen their market values and crypto assets even inverted, with dozens of DAT companies' mNAV (i.e., crypto assets/company market value) falling below the level of 1.

In the summer of cryptocurrency, DAT companies were jubilant, still not fully understanding what Zweig meant when he said, "All gifts in fate come with a hidden price," and that price is the plummeting stock price.

Of course, just as death often gives birth to new life, amidst the rapid advance of DAT like fire and oil, the wind of stock tokenization gradually blew into the cryptocurrency market, becoming an unstoppable trend, even the Nasdaq stock exchange could not ignore it and had to join this "capital feast" through self-revolution.

Autumn of Cryptocurrency: Stock Tokenization, On-Chain Perp DEX, and the "Dual Kings" of Stablecoin Public Chains

After Circle (CRCL) made a strong debut on the U.S. stock market at the end of June, achieving a "10-fold surge in stock price," the enthusiasm for stablecoins and crypto concept stocks in both the cryptocurrency and traditional financial markets reached unprecedented heights.

Affected by related positive news, the Hong Kong stock market's stablecoin sector and brokerage sector rose, with many internet giants, including JD.com and Ant Group, publicly announcing their imminent entry into the stablecoin arena, attracting countless eyes. _Recommended reading: _“The Arrival of the Altcoin Season in the Hong Kong Stock Market: Can Crypto Concept Stocks Support the Bull Market?”

Taking advantage of this momentum, the RWA sector finally welcomed a significant turning point—stock tokenization is timely.

In early July, exchanges Kraken and Bybit announced the opening of stock tokenization trading through the xStocks platform, supporting trading of dozens of tokenized U.S. stocks, including popular ones like AAPL, TSLA, and NVDA. From then on, the xStocks platform, which focuses on "on-chain U.S. stock tokenization trading," became the sole focus under the market spotlight, and MyStonks (now renamed MSX.com) also attracted a large number of users and investors.

If the launch of BTC spot ETFs in early 2024 and the ETH spot ETF in July of that year gave cryptocurrency traders the title of "noble U.S. stock traders," then the emergence of stock tokenization platforms this year truly bridged the "last mile of on-chain trading of U.S. stocks," allowing even someone like me, who is "bad at trading coins," to have the possibility of diversifying asset allocation through on-chain tokenization platforms.

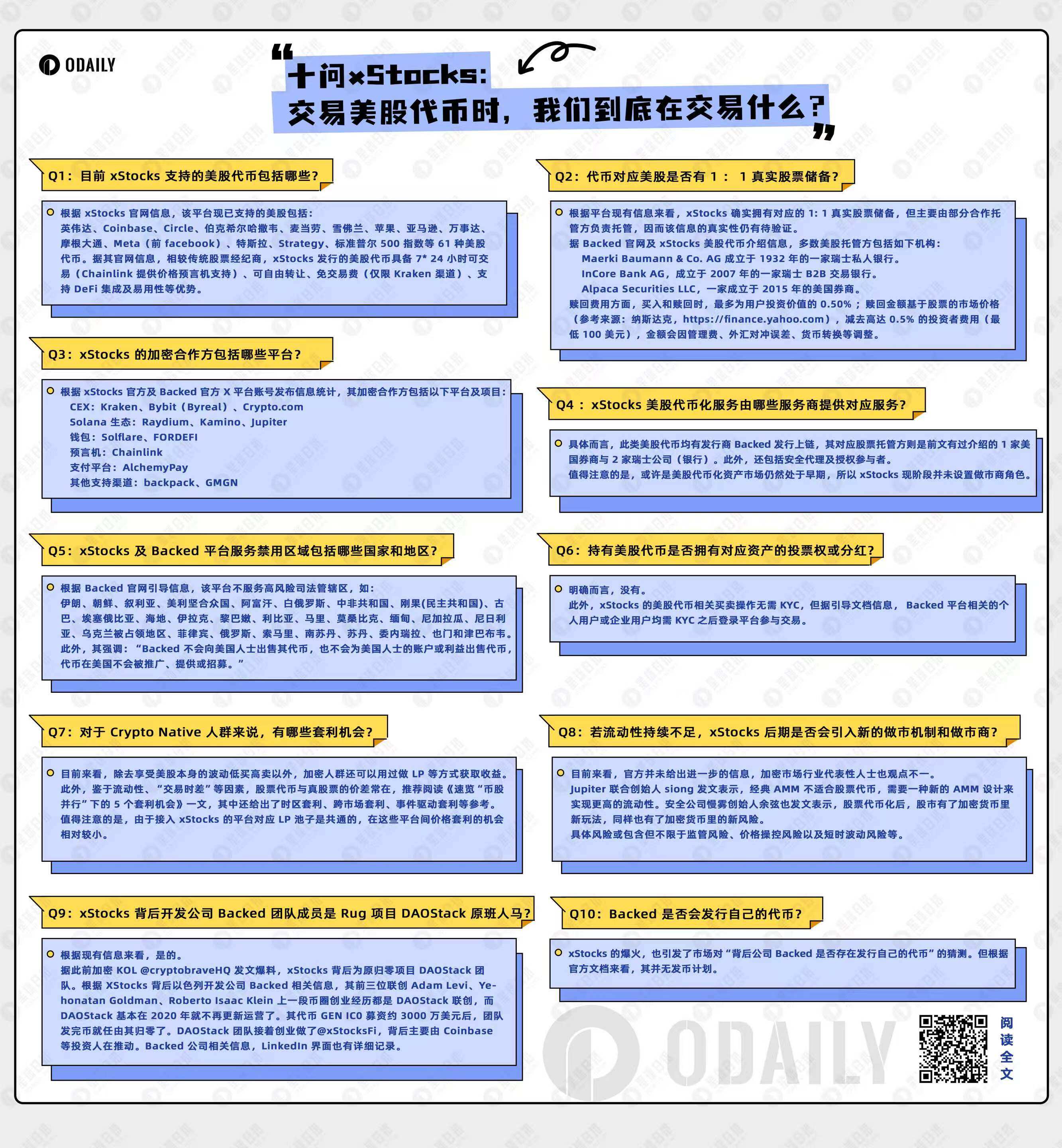

Odaily Planet Daily previously provided a detailed introduction to the mechanisms behind xStocks and tokenized U.S. stock trading platforms in the article “10 Questions for xStocks: What Are We Really Trading When We Trade Tokenized U.S. Stocks?”. Looking back now, the fundamental principles and asset management models remain largely unchanged; the difference is that after many U.S. stock tokenization platforms, traditional giants have also begun their awakening journey.

Summary of 10 Questions for xStocks

Previously, crypto asset management giant Galaxy actively issued stock tokenization; later, the U.S. stock exchange Nasdaq, with quarterly trading volumes reaching trillions, proactively submitted a "tokenized stock trading application" to the SEC, demonstrating that traditional giants have a keen sense of the vast track of asset issuance and trading.

At the same time, the native crypto market feast belongs to two major sectors:

Firstly, the " On-Chain Perp DEX War" following Hyperliquid—Aster from the BNB Chain ecosystem contributed another wealth creation miracle to the crypto market with an extremely violent "pump," with many saying they "sold out millions of dollars";

Secondly, the two wealth creation spectacles in the stablecoin sector: one is the Plasma initiated "savings activity" backed by "a stablecoin public chain supported by Tether's CEO," providing generous airdrops to many participants, with some even earning airdrops of XPL tokens worth over $9,000 from a $1 deposit, yielding over 900 times; the other is the official launch of the Trump family's crypto project WLFI, which, leveraging the previous momentum of its stablecoin USD1, allowed people to earn returns of over 6 times at public offering prices of $0.05 and $0.15.

Looking back at the prices of XPL and WLFI now is inevitably disheartening. According to Coingecko data, the XPL price is currently reported at $0.17, having dropped nearly 90% from its peak of $1.67; the WLFI price is currently reported at $0.15, having dropped nearly 50% from its peak of $0.33.

At a time when countless people lamented the infinite opportunities, little did they know that what awaited the crypto industry would be an "epic liquidation" far exceeding any previous crash in history.

Winter of Cryptocurrency: After the October 11 Crash, TACO Trading Faces Validation Again, and the Prediction Market Welcomes Dual $10 Billion Valuation Giants

After BTC prices reached a new high of $126,000 in early October, people were hopeful that the cryptocurrency market could continue the "Uptober" trend of previous years. However, the "epic liquidation" on October 11 shattered dreams and hopes.

This time, the trigger pointed back to Trump—on the evening of October 10, Trump announced a 100% tariff increase, causing the fear index to soar. The three major U.S. stock indices all experienced varying degrees of decline: the Nasdaq index fell nearly 3.5%, the S&P 500 dropped 2.7%, and the Dow Jones index fell 1.9%.

The cryptocurrency market faced exchange system issues, compounded by a fragile psychological state akin to a startled bird, with BTC hitting a low of $101,516, a 24-hour drop of 16%; ETH fell to a low of $3,400, a 24-hour drop of 22%; and SOL saw a 24-hour drop of 31.83%. In an instant, altcoins were in a bloodbath.

The losses from this epic liquidation far exceeded those from past crashes such as 3.12, 5.19, and 9.4, with the real liquidation scale in the cryptocurrency market estimated to be at least $30 billion to $40 billion.

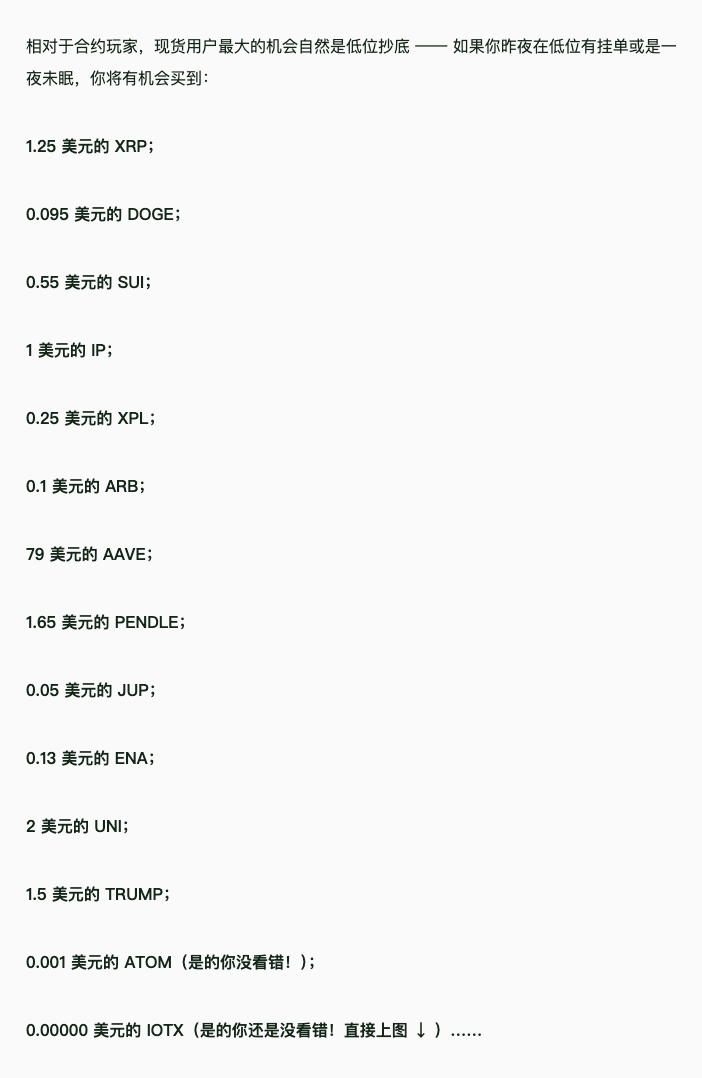

Of course, risks hide opportunities. As mentioned in various articles by Odaily Planet Daily, such as “In the Great Crash, Who Made Hundreds of Millions by 'Licking Blood Off the Blade'? What Wealth Opportunities Are Within Reach?” and “The Whale Stabbing Battle Behind the Largest Liquidation Day in Crypto History: The Bears Sated, Leaving with Their Knives”, there are various "wealth opportunities"—whether through high-leverage shorting or bottom-fishing, many have made a fortune amidst the chaos.

Risks Also Represent Opportunities

As the "TACO" trading style (Trump Always Chicken Out) is once again validated, the cryptocurrency market has finally begun a slow self-repair. Unlike before, many traders have lost most of their assets in that "Black Friday," leaving them in a slump and exiting the market in silence.

In such a dire market environment, prediction market platforms represented by Polymarket and Kalshi have gradually become one of the few hotspots and trading stages in the cryptocurrency market. Their valuations have risen significantly in just a few months. After completing the latest round of $1 billion financing led by Paradigm, Kalshi's valuation soared to $11 billion; Polymarket, after completing a previous $2 billion financing led by the parent company of the New York Stock Exchange, ICE Group, is seeking a new round of financing with a valuation between $12 billion and $15 billion.

After going in circles, the cryptocurrency market has returned to Polymarket, the prediction market platform that successfully predicted Trump's election in the "2024 U.S. Presidential Election" event. As the seasons change, the mainstreaming and popularization process of the cryptocurrency industry continues.

Where is the future headed? U.S. regulation and traditional finance still largely determine the direction of the tide and the duration of spring and winter. As crypto prospectors, we can only follow the waves and assess the situation to perhaps find our own treasure of wealth. Original / Odaily Planet Daily

免责声明:本文章仅代表作者个人观点,不代表本平台的立场和观点。本文章仅供信息分享,不构成对任何人的任何投资建议。用户与作者之间的任何争议,与本平台无关。如网页中刊载的文章或图片涉及侵权,请提供相关的权利证明和身份证明发送邮件到support@aicoin.com,本平台相关工作人员将会进行核查。