1. Development History and Capability Overview of AA Accounts

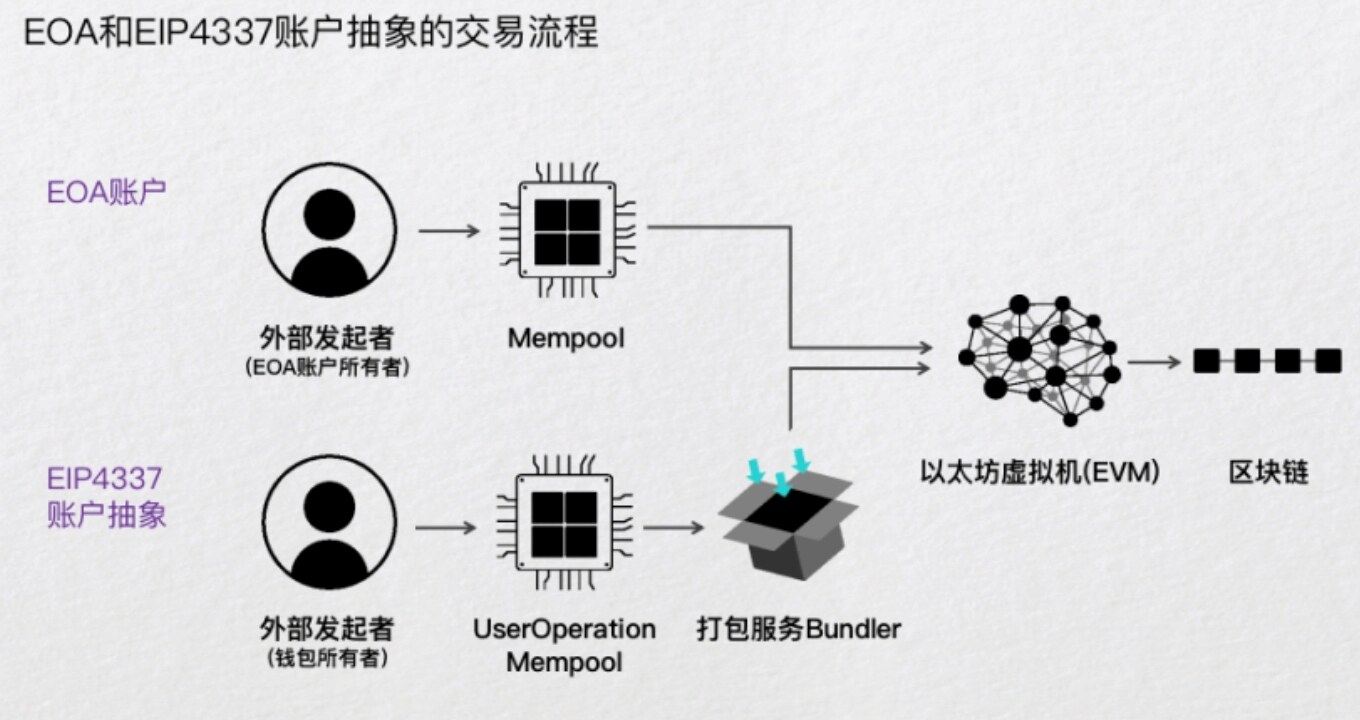

Ethereum underwent a significant upgrade named Fusaka on December 3, 2025. This marks the third milestone update since the Merge and the Dencun upgrade, aimed at significantly enhancing the network's scalability, reducing transaction costs, and optimizing node operation efficiency, with a particular focus on upgrading and optimizing features related to account abstraction. The evolution of account structures within Ethereum essentially forms the core logic of the entire on-chain user experience, asset security, and even industrial upgrades. The dual account system of EOA (Externally-Owned Account) and CA (Contract Account), which we are familiar with today, is a technical legacy from Ethereum's launch in 2015. However, as the user base surpassed ten million and Web3 gradually took on asset custody and user operation infrastructure during the 2023–2025 phase, this system has exposed increasingly severe structural bottlenecks.

These bottlenecks not only limit the industry's expansion but also restrict user growth and the realization of genuine applications. The emergence of Account Abstraction (AA) is precisely aimed at addressing the inherent structural flaws of Ethereum's account system, enabling the on-chain world to possess "modern financial-grade" security, experience, and autonomy, ultimately becoming a reliable asset infrastructure for global users.

The current bottlenecks are primarily due to the EOA's security model, which rigidly ties "private key = asset" at the protocol level. While this model is simple from an engineering perspective, it poses the greatest resistance to large-scale adoption in practice.

The operational structure of EOA resembles a "mechanized assembly line," rather than the "one-click execution" familiar to modern internet users. Additionally, in terms of permission control, EOA cannot achieve any fine-grained settings: it cannot set daily limits, define multi-signature rules, create parent-child accounts, freeze partial permissions, or enable automated strategies. EOA acts like a universal key that contains all assets and permissions; if it is leaked once, all assets and permissions are exposed.

As a result, the Ethereum community began to rethink the question of "what accounts should be." The concept provided by AA is precisely the remedy: accounts should be "code," not "private keys." Under the AA paradigm, accounts can be programmed, verified, restored, and upgraded. In other words, the limitations that were previously hardcoded into the EOA structure can be abstracted away; wallets are no longer just signature containers but can become "smart accounts" with logic, strategies, and permission systems.

First, in terms of security, AA enables wallets to have a programmable permission system: users can enable social recovery mechanisms, alleviating concerns about losing mnemonic phrases; they can set multi-signature rules for families, institutions, or DAOs to manage funds more securely; they can create parent-child accounts, whitelists, and payment limits; they can even freeze certain permissions or use temporary keys to enhance the flexibility of use cases. The "single point of failure" model of EOA is completely flattened by AA, resulting in a significant increase in security. In terms of cost, after introducing Paymaster, users can pay gas fees with any ERC-20 token, or even have project parties cover the gas fees, achieving a truly "seamless fee" experience.

Moreover, AA supports batch execution and transaction aggregation, significantly reducing the number of signatures and failure costs, thereby lowering the overall cost of complex interactions. On the experience front, AA brings the interaction experience of Web3 closer to that of Web2 for the first time. Users can execute combined operations with one click, without needing to understand complex concepts like nonce, gas settings, or signature order; new users can even create wallets without mnemonic phrases, completing account initialization through biometrics, local recovery, or email verification; complex on-chain logic (such as strategy trading, automated liquidation, scheduled execution, etc.) can be embedded within account logic, making on-chain applications feasible as "smart products."

The ultimate vision of AA is to transform blockchain from an "experimental system for technical experts" to a "universal account infrastructure for global users." If the bottleneck of Web3 in the past decade stemmed from the primitive model of "keys as accounts," then the breakthroughs in the next decade will come from the new paradigm of "accounts as programs." AA is not merely an upgrade of wallets but a complete rewrite of the entire on-chain interaction logic; it not only enhances user experience but also lowers development barriers, allowing DApps to design processes and define permissions like Web2 products, and to build a trustless security assurance system at the account level.

As the ERC-4337 ecosystem fully explodes in 2024–2025, the industrial chain of Bundler, Paymaster, AA wallets, modular security plugins, etc., is gradually taking shape, and account abstraction is transitioning from "concept" to "infrastructure." Just as the evolution from Web1.0 to Web2.0 on mobile gave rise to super applications and trillion-dollar industries, the implementation of account abstraction is expected to become the underlying driving force for the next exponential growth of Web3. The limitations of the EOA era are being gradually dismantled, and AA is leading the entire industry toward a safer, more flexible, and more user-friendly on-chain world.

2. Prospects and Challenges of AA Accounts

Account Abstraction (AA) has once again become the narrative core of the Ethereum ecosystem from 2023 to 2025, but after experiencing enthusiasm and expectations, its structural dilemmas have gradually come to light. The long-term prospects of AA are still highly anticipated—it promises a generational leap in security, usability, and automation experience, replacing the primitive model of "private key as account" from the EOA era; however, in reality, the implementation of ERC-4337 has faced repeated skepticism, being described as "loud thunder but little rain." From the perspectives of industrial structure, cost model, ecological collaboration, and competitive protocols, the prospects and dilemmas of AA are intertwined, representing both the future of blockchain account systems and exposing the complexity of its protocol upgrade path.

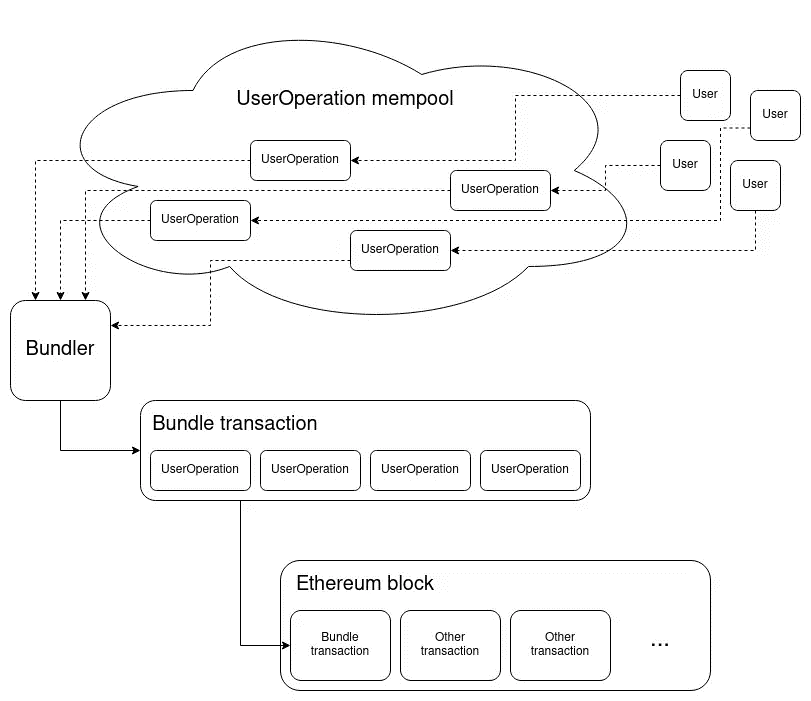

From the cost perspective, the primary resistance to AA comes from gas fees. Compared to the 21,000 gas of EOA, the average gas for AA's UserOperation on the mainnet is about 42,000 gas, nearly doubling. This is not due to waste but is structural: the validation calls of 4337 include validateUserOp, state access of EntryPoint, reading wallet contract bytecode, logging, initCode deployment, and data encoding overhead. Each step entails additional on-chain computation. Most wallets or DApps initially rely on subsidies to attract users, but once the subsidies disappear, the cost of user migration is extremely low, making it difficult to form network effects.

More realistically, the Web3 ecosystem lacks the "advertising, retention, and traffic closed loop" industrial chain seen in Web2, making it difficult for Paymaster's expenditures to yield returns and develop a sustainable business loop. Therefore, the slow promotion of AA is fundamentally not a technical issue but a matter of "lack of commercial traction." Due to the complexity of AA's structure, a user's UserOperation is not directly processed by the chain but must go through Bundler's simulation and aggregation, meaning that slight implementation differences between ecosystems can lead to "incompatibility." Incompatibility between wallets, high integration costs for DApps, and complex on-chain testing all force project parties to reassess the cost-benefit ratio when facing AA. While EOA is primitive, it is extremely simple; AA, while advanced, faces the challenge of "ecological fragmentation" in its early promotion. For the vast majority of small and medium DApps, supporting 4337 does not bring significant benefits but incurs additional technical costs, resulting in the outcome of "if it can be avoided, it will be avoided."

The lack of cross-chain capabilities also undermines the system-level value of AA. ERC-4337 is essentially an upgrade of the account system for the EVM Layer, relying on EntryPoint, UserOp mode, and EVM's validation logic, making it inherently difficult to extend to non-EVM chains. If a unified multi-chain experience is desired, more intermediate layers, multiple EntryPoints, multiple validations, and cross-chain message transmissions must be introduced, significantly increasing costs and complexity. The Web3 world is already fragmented across multiple chains, and AA's inability to form a unified account system across chains prevents it from fulfilling the vision of "a unified account standard for Web3." Users' smart accounts on one chain cannot seamlessly map to another chain, greatly diminishing the scalable value of AA.

However, despite the evident structural dilemmas, AA remains a highly promising direction for the future. This is because the evolution trend of next-generation blockchain infrastructure is naturally aligning with AA rather than diverging from it. In particular, the large-scale rise of L2 (Rollup) has structurally alleviated the cost pain points of AA. The data compression capabilities of mainstream ZK Rollup and Optimistic Rollup can reduce the gas costs of 4337 by 70%–90%, while batch UserOperations can further lower the on-chain overhead of single operations. Therefore, "Rollup + AA" is likely to become the mainstream combination in the next 35 years, relieving the Ethereum mainnet of the cost pressure of high-frequency AA operations. With the compression capabilities of Rollup, the core bottlenecks of AA in terms of performance costs are being unlocked, and the industry is beginning to see its commercial viability.

However, the greatest challenge to AA's future comes from the suddenly emerging competitor in 2024–2025—the x402 protocol. Compared to AA, x402 resembles a "unified payment protocol at the internet level," using HTTP 402 as an entry point to unify the payment interface logic between Web2 and Web3. AA aims to solve "on-chain account abstraction"; x402 aims to solve "internet payment abstraction." AA's target audience is Web3 users; x402's potential audience is the entire internet. More importantly, x402 has a natural business loop: Providers and Facilitators can directly charge from the payment process, providing clear market traction. ERC-8004 under the x402 framework becomes a "tool protocol," rather than a foundational infrastructure requiring a full network migration, making its promotion much easier than that of AA. AA needs to persuade the ecosystem to migrate to its defined system, while x402 chooses to adapt to existing internet behaviors, giving it a clear advantage in commercial adoption.

Therefore, the prospects for AA are clear, but the path is rugged. There exists a profound tension between the elegance of technology and the realities of the industry: the future defined by AA is indeed better, but it must overcome multiple challenges such as costs, commercial incentives, ecological fragmentation, and competitive protocols before realization. As the Rollup era arrives, signature aggregation technology matures, and EIP-7702 opens compatibility paths, the cost and compatibility issues of AA will gradually ease, while breakthroughs in business models and cross-chain capabilities are still needed.

3. Investment Value and Future Outlook of AA Accounts

Account Abstraction (AA) is transitioning from a "revolutionary technological concept" to a "structural infrastructure upgrade" in the blockchain industry, and its investment value has evolved from early narrative dividends to a comprehensive judgment based on engineering implementation, ecological collaboration, and commercial sustainability. In the next five years, AA will not become the unified entry point for the entire Web3, nor will it replace EOA as the standard account system, but it will firmly exist at the high-end level of wallets and account systems, becoming the core representative of "smart accounts" and deeply embedded in on-chain interaction experiences and transaction execution capabilities in the Rollup era. Therefore, for investors, the value of AA lies not in short-term user explosions but in a "classic internet-style long-term infrastructure investment opportunity."

The true landing ground for AA will be within the Rollup system. As zkSync, Scroll, StarkNet, and Base become mainstream execution environments, the cost pain points of AA will be naturally absorbed by the data compression capabilities of Rollup, with gas costs potentially decreasing by 70%–90% compared to L1. At the same time, BLS signature aggregation and batch UserOperations will further reduce on-chain data size, transforming account operations under the AA model from "expensive but advanced" to "advanced and affordable." This means that the investment value lies not in L1 AA but in deeply embracing Rollup's AA wallets, Paymaster, and Bundler infrastructure. This direction corresponds to visible engineering value—it is not just a concept but a real adoption driving force brought about by the reduction of on-chain costs. From the perspective of the industrial chain, the investment value of AA mainly concentrates in four types of infrastructure areas: smart contract wallets, Paymaster service providers, Bundler infrastructure, and L2s that directly support AA.

Paymaster is one of the segments with the most potential commercial value in the AA system, serving as a bridge between fuel subsidies and user growth. Although the current business model of Paymaster is not yet fully mature, it is expected to become a "growth engine on-chain" as the Rollup environment and on-chain business scenarios become richer: project parties can cover gas fees for high-value users, implement subsidy strategies, and create whitelist strategies, thereby generating marketing effects similar to Web2 "advertising exposure." Projects like Stackup and Pimlico are worth paying attention to.

Bundler, as the execution layer of AA, is also a foundational infrastructure with latent value, akin to the "transaction packaging logistics layer" in the blockchain world. Biconomy, Alchemy's AA Infra, and others will benefit as the ERC-4337 ecosystem grows. Bundler does not have direct opportunities to face users but possesses a scalable and certain revenue model, potentially becoming a "low-volatility, scalable" infrastructure investment direction on-chain in the future.

At the same time, AA must face the competition and complementary relationship brought by the x402 protocol in the next five years. x402 does not replace AA but becomes a unified payment entry point for the internet in the model of HTTP 402, covering both Web2 and Web3, possessing inherent cross-chain capabilities, and having a clear business loop (Provider + Facilitator charging model). ERC-8004 becomes a plugin within the x402 framework rather than a foundational protocol, thus having stronger promotional power. From an investment perspective, the value of AA lies in the intelligence of on-chain accounts, while the value of x402 lies in unifying the payment experience across the entire internet. The two will coexist and complement each other in the future, rather than having a single winner.

In summary, AA will constitute the "mid-level infrastructure" of the Ethereum and Rollup ecosystems in the next five years: the underlying layer will still be EOA (weakened but existing), the mid-layer will be smart accounts (AA), and the top layer will be the unified interoperable network of x402. The user base of AA will not experience explosive growth, but its value will steadily increase with the rise in on-chain transaction volume, demand for strategy automation, specialization in asset custody, and loss prevention needs. In a world that is gradually migrating on-chain, AA represents a high-certainty structural investment direction; in a world where Rollup costs are decreasing, it is a "realizable future"; in an internet that coexists with x402, it is a cornerstone force shaping the on-chain account system.

4. Conclusion

The core value of AA lies in completing the transition of the Ethereum account system from the primitive model of "private key = account" to the modern paradigm of "account = program." It fills a critical gap in the migration from Web2 to Web3, making secure, recoverable, and programmable wallet systems possible. Although AA still faces structural bottlenecks such as high costs, weak commercial loops, and cross-chain limitations, it has become a direction for upgrading on-chain experiences. In the future, AA will exist as a high-end account layer for the long term, rather than being the only standard; x402 will complement cross-chain and payment interconnectivity. Together, they will drive Web3 from the geek era to the mass era, laying a crucial foundation for a "unified internet account."

免责声明:本文章仅代表作者个人观点,不代表本平台的立场和观点。本文章仅供信息分享,不构成对任何人的任何投资建议。用户与作者之间的任何争议,与本平台无关。如网页中刊载的文章或图片涉及侵权,请提供相关的权利证明和身份证明发送邮件到support@aicoin.com,本平台相关工作人员将会进行核查。