Author: Liang Yu

Editor: Zhao Yidan

On November 24, 2025, Huaxia Bank, as the lead bookrunner, completed an operation defined by the market as "industry-first." It issued 4.5 billion yuan in financial bonds for its holding subsidiary, Huaxia Financial Leasing Co., Ltd., which deeply integrated "blockchain bookkeeping" and "digital RMB fundraising collection" for the first time.

In this model, the entire process information of the bond issuance is recorded on the blockchain in real-time, forming an immutable public record; at the same time, investors' subscription funds are transferred instantly and peer-to-peer through digital RMB wallets. Ultimately, this bond issuance not only achieved a coupon rate of 1.84% but also triggered the full 1.5 billion yuan oversubscription right, achieving a subscription multiple of up to 4.41 times.

This issuance transcends a mere demonstration of technical application. It essentially closed the loop by validating the "distributed trust" collaborative framework built by blockchain technology with the ultimate efficiency of "payment equals settlement" provided by digital RMB in key financial scenarios. Its true implication lies in suggesting a possibility: the trust mechanism and settlement track of the financial market may be entering a new evolutionary stage based on code consensus and legal digital currency as dual cornerstones.

1. Case Analysis: A Collaborative Experiment of Technology and System

The core innovation of this bond issuance led by Huaxia Bank lies in the combination of two "firsts."

In terms of information flow, the entire process information of bond bookkeeping has achieved real-time on-chain recording for the first time, creating a "transparent ledger" visible to all participants. In terms of fund flow, the raised funds are collected through digital RMB for the first time, theoretically eliminating many steps of traditional inter-institutional clearing.

From the results, this experiment received a positive response from the market. The initial plan for this bond was to issue 3 billion yuan, but due to enthusiastic subscriptions, the accompanying 1.5 billion yuan oversubscription right was fully triggered, ultimately issuing the full 4.5 billion yuan, with a coupon rate locked at 1.84%. The subscription multiple of up to 4.41 times demonstrates investors' dual recognition of the innovative model and the issuing entity.

However, viewing it merely as a successful "technical marketing" or efficiency improvement underestimates its deeper significance. Its true value lies in providing a systematic solution prototype based on national credit and new-generation internet technology for the long-standing issues of "inter-institutional data consistency" and "transaction settlement delays" that have plagued the financial industry for years.

2. Technical Deconstruction: Blockchain Reshaping the Trust Mechanism of Financial Collaboration

The role of blockchain in this issuance goes far beyond being a "transparent electronic bulletin board." Its core function is to reconstruct the trust generation mechanism in financial activities.

In traditional bond issuance, issuers, underwriters, custodians, and investors rely on repeated reconciliation, verification, and phone confirmations to ensure information consistency, which is a high-cost, low-efficiency "centralized coordination" process. However, permissioned consortium blockchain technology allows all parties to jointly maintain an immutable synchronized ledger under preset rules, shifting the reliance on a single party (such as a central registration agency) to reliance on technological rules and collective consensus.

According to the Bank for International Settlements, the core of distributed ledger technology lies in achieving decentralized ledger management through multi-party consensus mechanisms. What Huaxia Bank applied is a consortium chain that meets financial regulatory requirements, with its "immutable" characteristic built on the consensus of permissioned nodes, which is fundamentally different from public chains.

The profundity of this transformation lies in its resolution of the most fundamental "ledger consistency" problem in financial business. Once all transaction instructions, subscription records, and allocation results are confirmed on-chain, they become the "only truth" recognized by all participants, fundamentally eliminating the space for information asymmetry and subsequent disputes. This lays the most critical technological track for achieving more complex automated trading, compliance, and regulatory processes in the future.

3. Settlement Revolution: Digital RMB Reshaping the Underlying Track of Fund Flow

If blockchain reshapes the information flow, then the intervention of digital RMB aims to reconstruct the underlying track of fund flow. The term "digital RMB collection" in this issuance points to a grander goal: to build a new type of financial infrastructure that integrates payment and settlement.

The fund settlement in traditional bond issuance involves multiple links, including the investor's bank, clearing institutions (such as the Shanghai Clearing House), and the issuer's receiving bank. Funds need to be transferred, reconciled, and cleared through layers of account systems, usually requiring T+1 or even longer. However, as a central bank liability, digital RMB has the legal finality characteristic of "payment equals settlement." This means that when investors use digital RMB wallets to pay subscription fees, the process of transferring funds from the investor's wallet to the issuer's wallet simultaneously completes the transfer of ownership and final confirmation of settlement, achieving a leap from "relay" to "point-to-point direct reach."

The significance of this transformation is comparable to "laying tracks" for a financial highway. Digital RMB does not aim to completely replace the existing bank account system but provides a more fundamental, efficient, and programmable settlement asset option. When combined with smart contracts, future bond interest payments and redemptions may achieve fully automated execution, significantly reducing operational risks and costs.

4. Path Exploration: "Process On-Chain" with Chinese Characteristics Rather than "Asset Tokenization"

This practice provides a clear model for understanding the digitalization path of "real-world assets" in the Chinese context. It has subtle yet critical differences from the internationally popular "asset tokenization."

The international trend of RWA typically refers to fragmenting the rights of assets such as real estate and bonds into cryptocurrencies or tokens and circulating them on blockchain trading platforms. In contrast, Huaxia Bank's case demonstrates a different path: the legal ownership of the asset remains unchanged; what changes is the "management process" of asset issuance, trading, and settlement. The bonds themselves are still standard financial instruments regulated by the Securities Law, but their bookkeeping, rights confirmation, and fund settlement processes have been migrated to a digital environment constituted by blockchain and digital RMB.

This model of "process on-chain, ownership legalized" cleverly balances technological innovation and financial security. It absorbs the traceable and collaborative advantages of blockchain technology while fully operating within the existing legal and regulatory framework, avoiding complex issues such as the ambiguity of financial attributes and regulatory arbitrage that "tokens" may bring. It is foreseeable that this will become one of the mainstream paths for China to promote the deep application of financial technology and serve the real economy.

5. International Perspective: The Global Competition for On-Chain Financial Infrastructure

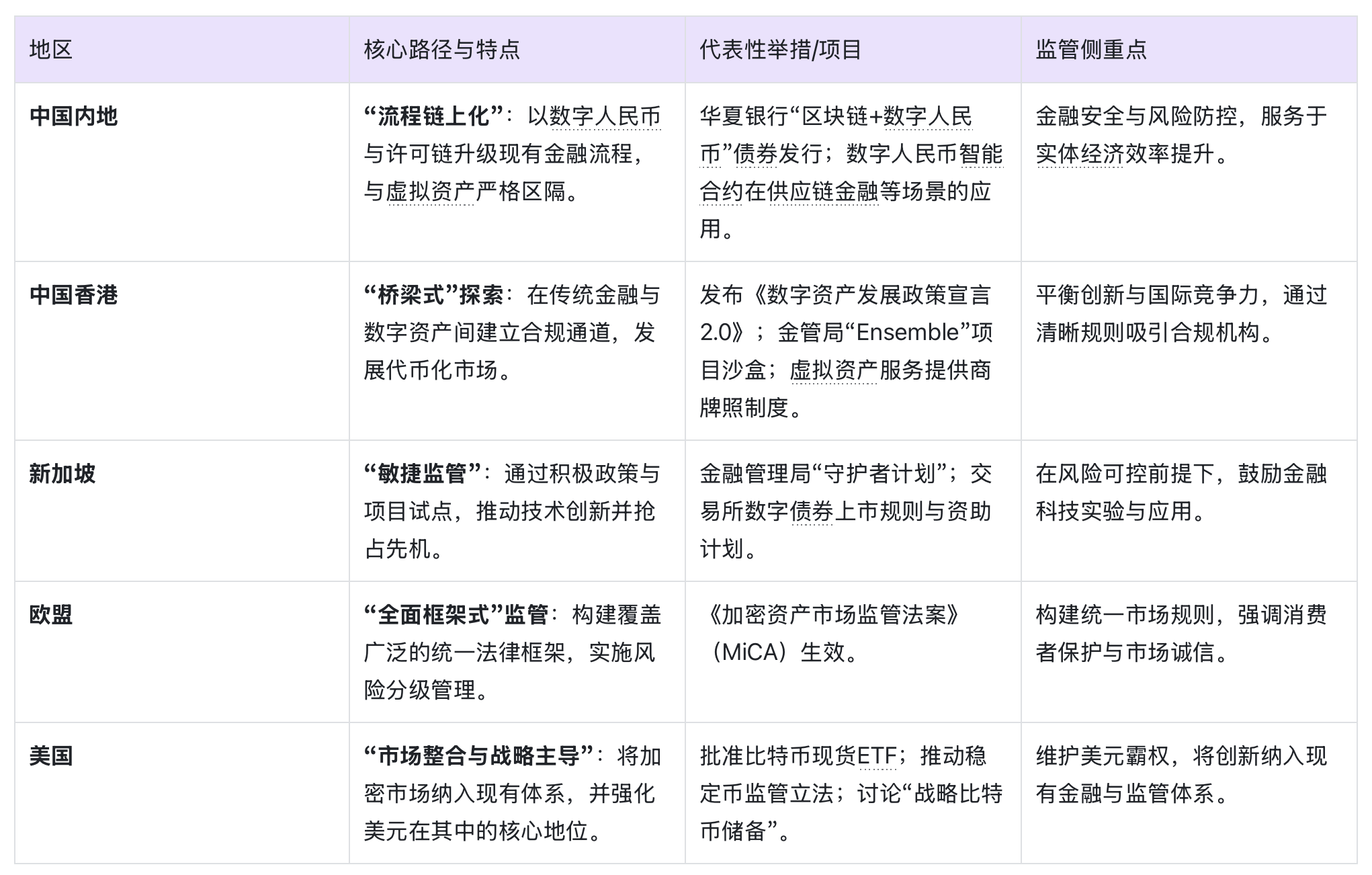

China's practice is not an isolated case but a microcosm of the global financial system's exploration of future infrastructure. Major financial centers are evolving in similar technological directions along different regulatory approaches.

Hong Kong is attempting to bridge traditional finance and digital assets. The "Digital Asset Development Policy Declaration 2.0" released in 2025 proposes regular issuance of government digital bonds and provides clear support for tokenized assets. The "Ensemble" project sandbox launched by the Hong Kong Monetary Authority aims to explore innovations such as tokenized deposit settlements. Its policy logic is to accept compliant innovations through a clear licensing system (such as implementing a licensing system for virtual asset service providers) while ensuring financial stability, thereby consolidating its position as an international financial center.

Singapore showcases the characteristic of "agile regulation." The Monetary Authority of Singapore's "Guardian Program" actively promotes the application of blockchain in areas such as asset management. Its exchange has also established clear listing rules and funding plans for digital bonds, such as providing subsidies of up to 2.5 million Hong Kong dollars for eligible issuances to reduce innovation costs.

The European Union and the United States focus on building comprehensive regulatory frameworks. The EU's "Regulation on Markets in Crypto-Assets" came into effect in 2024, being the world's first comprehensive regulatory framework for crypto assets, imposing strict regulations on stablecoins. Meanwhile, the U.S. is approving Bitcoin spot ETFs and exploring stablecoin regulations while attempting to integrate the crypto market into its financial system, strengthening the dollar's influence in the digital age.

Compared to the aforementioned paths, mainland China's exploration appears more cautious and focused. Its core feature is to prioritize the efficiency and security of traditional financial markets, supported by central bank digital currency and permissioned blockchain, while maintaining a strict separation from virtual asset trading. The choice of different paths reflects their respective legal traditions, financial structures, and strategic considerations.

6. Regulatory Framework: Innovation Space Under Clear Boundaries

In promoting such financial technology innovations in China, understanding the boundaries set by regulations and the space provided is crucial. The current regulatory framework presents a distinct "dual structure."

On one hand, China maintains a strict prohibition on virtual currencies such as Bitcoin and Ethereum and their related trading speculation activities. The regulatory logic is to prevent financial risks, combat money laundering and other illegal activities, and maintain monetary sovereignty and financial stability.

On the other hand, for central bank digital currency and compliant blockchain technology applications, regulatory authorities adopt a proactive promotion and support attitude. The research and pilot of digital RMB have been listed as a national strategy, with its application scenarios rapidly expanding from daily consumption and government distribution to supply chain finance and cross-border trade in the corporate sector. For blockchain, its application is encouraged to improve the processes of the real economy and enhance financial efficiency, provided it does not involve token issuance and trading.

The case of Huaxia Bank precisely falls within the latter encouraged zone. It uses regulated consortium blockchain technology, and settlement is conducted using legal digital currency, with the entire business loop operating completely within the existing financial laws and regulations. This innovation not only does not touch the regulatory red line but also aligns closely with the direction of regulatory technology by enhancing transparency, efficiency, and regulatory compliance.

The success of this bond issuance is just a starting point. The "trustworthy information flow + efficient fund flow" paradigm it validates has the potential to migrate to broader financial scenarios. In the short term, the most direct expansion will be the issuance of similar financial products. More financial institutions, especially banks, leasing companies, and factoring companies, may follow this model to issue financial bonds, asset-backed securities, etc., thus creating a wave of efficiency improvement in the direct financing market.

In the medium term, supply chain finance may be the next explosion point. Blockchain can ensure the authenticity and immutability of trade backgrounds, while digital RMB smart contracts can achieve targeted payments and automatic clearing of loan funds, fundamentally solving the core problem of information asymmetry in financing for small and micro enterprises, with relevant practices already piloted in institutions like Agricultural Bank.

In the long term, this will promote a systematic upgrade of China's financial infrastructure. As more asset issuance, trading, and settlement processes migrate to this new paradigm, a more efficient, lower-cost, and more resilient financial ecosystem based on distributed ledgers and legal digital currency will gradually emerge. This is not only about technology but also a profound institutional project that requires the synchronized evolution of regulatory rules, industry standards, and legal interpretations.

The endpoint of this silent revolution is not that all assets will be "on-chain" one day. The trading hall remains busy, and the bank account system remains solid, but the trust mechanism of the market and the track of fund flow have quietly been restructured. When blockchain becomes the default language of financial collaboration, and when the settlement tracks of digital RMB crisscross, the capillaries of the financial system will flow with unprecedented certainty and efficiency.

Some sources of information:

· "Huaxia Bank Leads the Bookrunning of the Industry's First 'Blockchain + Digital RMB' Bond"

· "4.5 Billion! Industry's First! Huaxia Bank Leads the Bookrunning of 'Blockchain + Digital RMB' Bond"

· "From 'Scene Expansion' to 'Scene Deepening' Highlights of Digital RMB Innovative Applications"

免责声明:本文章仅代表作者个人观点,不代表本平台的立场和观点。本文章仅供信息分享,不构成对任何人的任何投资建议。用户与作者之间的任何争议,与本平台无关。如网页中刊载的文章或图片涉及侵权,请提供相关的权利证明和身份证明发送邮件到support@aicoin.com,本平台相关工作人员将会进行核查。