🧡 U.S. Treasuries don't like Mondays, U.S. stocks don't like Thursdays, but which day does Bitcoin dislike? You'd better take a look at the trading habits reflected in this chart!

Besides KFC's Crazy Thursday promotion!

There’s also a major pattern event—

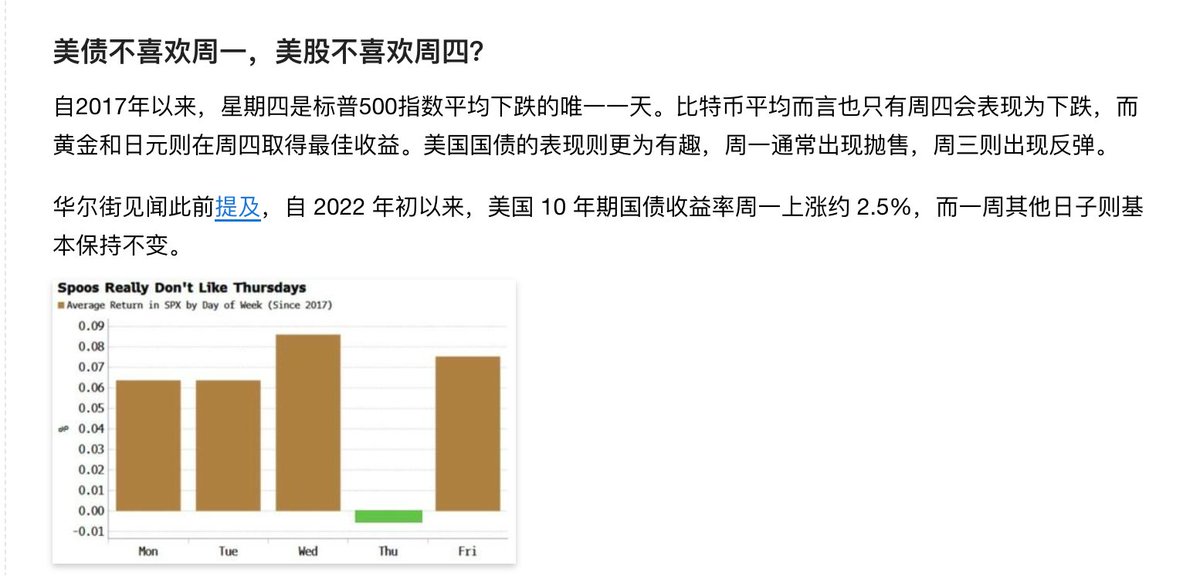

Since 2017, Thursday has been the only trading day when the S&P has averaged a decline;

Bitcoin shows the same trend, on average only performing poorly on Thursdays;

In contrast, gold and the yen tend to rise most steadily on Thursdays.

And U.S. Treasuries are even more interesting:

Sales usually occur on Mondays, while rebounds happen on Wednesdays.

I asked GPT,

and it broke down several real logical drivers—

Monday: Many macro news, geopolitical events, and policy announcements are released over the weekend, and large funds in the bond market have a high sensitivity to risk, so the first thing they do on Monday is to reduce positions and mitigate risks.

Wednesday: The Federal Reserve's overnight reverse repurchase settlement cycle usually occurs before Wednesday, making it often the day with the most liquidity throughout the week.

Thursday: Thursdays are often the days when key macro data such as initial jobless claims, PPI, and CPI are released, and they also serve as a repricing window for many weekly options or structured products.

Isn't it quite fascinating!

The behavior models of retail investors and quant funds solidify into these time preferences, essentially resulting from collective behavior reinforcing itself.

Then I looked up again, U.S. Treasuries don't like Mondays, U.S. stocks don't like Thursdays, but which day does Bitcoin dislike?

I found that Bitcoin currently dislikes weekends the most (especially Saturdays), so do you know why? Let me know in the comments!

免责声明:本文章仅代表作者个人观点,不代表本平台的立场和观点。本文章仅供信息分享,不构成对任何人的任何投资建议。用户与作者之间的任何争议,与本平台无关。如网页中刊载的文章或图片涉及侵权,请提供相关的权利证明和身份证明发送邮件到support@aicoin.com,本平台相关工作人员将会进行核查。