Release Date: December 11, 2025

Author: BlockBeats Editorial Team

In the past 24 hours, the cryptocurrency market has witnessed a multifaceted dynamic ranging from macroeconomic discussions to specific ecosystem developments. Mainstream topics have focused on the long-term moat of Web3 projects and the value of token buybacks, sparking intense debates among industry leaders. Meanwhile, the sentiment of "no regrets in the crypto space" has resonated widely. In terms of ecosystem development, major public chains such as Solana, Ethereum, Hyperliquid, and the emerging MegaETH have released significant updates, showcasing the rapid pace of innovation and expansion in the industry. This report will summarize and analyze these hot topics.

I. Mainstream Topics

1. The Debate on the "Moat" and Value Capture of Web3 Projects

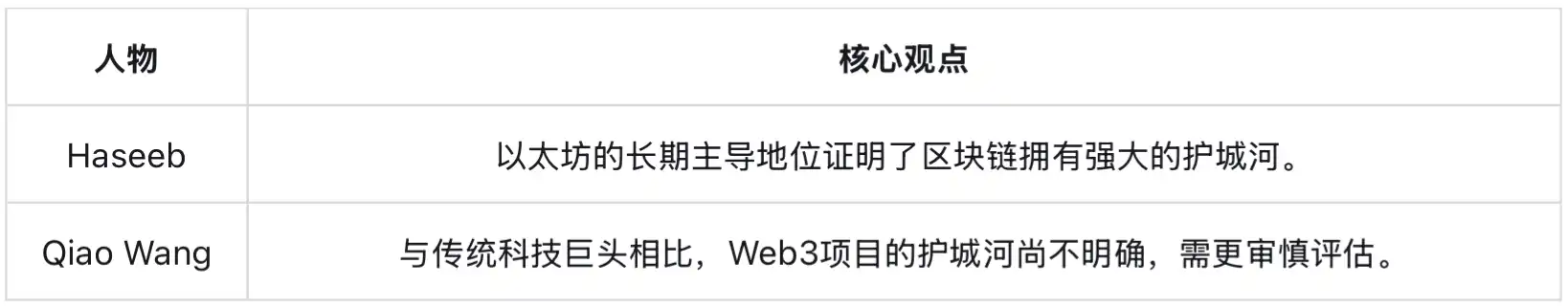

Recently, discussions about whether Web3 projects, especially public chains, possess a true "moat" have intensified. Haseeb Qureshi, a partner at Dragonfly, questioned the rating of "blockchain moats only being 3/10," using Ethereum as an example to point out that despite facing hundreds of competitors over the past decade, it has maintained its dominant position, which itself proves its strong network effects and first-mover advantage.

In contrast, Qiao Wang, co-founder of Alliance DAO, provided a more comparative moat ranking from a traditional business analysis perspective. He believes that companies like Microsoft (critical task SaaS) and Apple (brand + developer ecosystem) have a top moat rating of 10/10, while Google and Amazon also enjoy strong competitive barriers. Although he did not directly rate blockchain, his framework implies a cautious attitude towards the current value capture capabilities of Web3 projects. This debate reflects the core divergence in the market regarding how to assess the long-term value of decentralized networks.

2. Eight Years in the Crypto Industry: "No Regrets" Becomes the Community's Voice

Nic Carter, co-founder of Castle Island Ventures, stated on social media that he has "no regrets" about spending eight years in the crypto industry. This statement quickly resonated widely within the community. After experiencing multiple cycles of bull and bear markets and significant market volatility, this expression of persistence and belief not only affirms personal career choices but also reflects the steadfast faith of many long-term practitioners in the potential of cryptocurrency and blockchain technology to change the world.

II. Mainstream Ecosystem Dynamics

1. Solana: Meteora Protocol Welcomes Major Upgrade

The liquidity infrastructure protocol Meteora in the Solana ecosystem announced a significant upgrade. Key features of this upgrade include the introduction of "Auto Vaults" and improvements to dynamic AMM v2 (DAMM v2). These new features are expected to provide liquidity providers (LPs) with better yield strategies and more flexible capital management tools, solidifying Meteora's position as a core DeFi hub on Solana.

2. Ethereum: Parallel Innovations in Technology and Application Expansion

Aave Expands into Latin America: DeFi lending giant Aave announced partnerships with several leading fintech companies in Argentina (including Lemon, Ripio, Buenbit, and Belo) to jointly provide stablecoin-based DeFi solutions in the Latin American region. This move marks an important step for Aave in its global inclusive finance strategy, aiming to bring decentralized financial services to millions of emerging market users.

RWA Sector Continues to Heat Up: Projects like Ondo Finance and Superstate remain market focal points. Ondo, as a leading platform for the tokenization of RWA (real-world assets), saw its native token rise after the SEC concluded its related investigation. Meanwhile, Superstate, founded by Aave's creator Robert Leshner, focuses on issuing and trading traditional financial assets like stocks on-chain, further promoting the integration of DeFi with traditional finance.

3. Hyperliquid Ecosystem: HIP-3 Sparks In-Depth Discussion

The governance proposal HIP-3 from decentralized derivatives exchange Hyperliquid has become the focus of community discussions. This proposal aims to establish a more open and permissionless perpetual contract market creation mechanism. In response, ether.fi Ventures released a research report analyzing the potential business models and ecosystem impacts of HIP-3. Additionally, Paradigm researcher Dan Robinson participated in related discussions, debating the pros and cons of the mechanism with other industry experts, highlighting the market's high interest in the future development path of decentralized derivatives protocols.

4. MegaETH Ecosystem: Aave Announces Initial Deployment

As a highly anticipated high-performance Ethereum L2 solution, the MegaETH ecosystem welcomes significant partners. A proposal has emerged within the Aave community suggesting the simultaneous deployment of the Aave V3 protocol upon the launch of the MegaETH mainnet. This deployment will support various assets, including the native stablecoins USDm, cUSD, and stcUSD. This collaboration not only injects strong liquidity and a user base into MegaETH's cold start but also indicates Aave's proactive layout in the multi-chain deployment strategy for emerging high-performance public chains.

免责声明:本文章仅代表作者个人观点,不代表本平台的立场和观点。本文章仅供信息分享,不构成对任何人的任何投资建议。用户与作者之间的任何争议,与本平台无关。如网页中刊载的文章或图片涉及侵权,请提供相关的权利证明和身份证明发送邮件到support@aicoin.com,本平台相关工作人员将会进行核查。