Original | Odaily Planet Daily (@OdailyChina)

Author | Ethan (@ethanzhangweb3)_

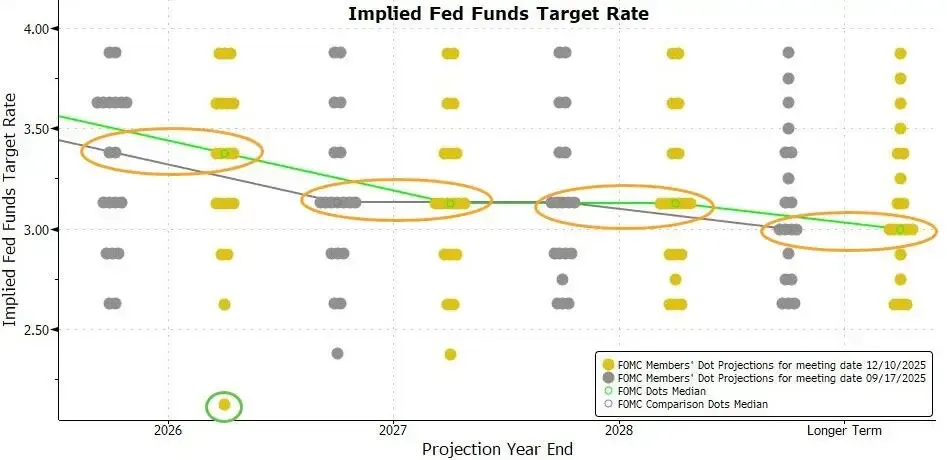

In the early hours of today, Powell announced as expected a 25 basis point cut in the benchmark interest rate to 3.50%-3.75%. This marks the third consecutive rate cut this year and the conclusion of the year, with a total reduction of 75 basis points. However, the signals revealed by the dot plot are not entirely optimistic, reflecting intense internal struggles within the Federal Reserve. Although the overall expectations are slightly more dovish than last time, the internal consensus is loosening: this time, as many as 7 officials disagreed with the decision, with 6 even leaning towards maintaining the status quo (keeping rates unchanged). Additionally, the median rate forecast is completely consistent with September, suggesting that after aggressive rate cuts this year, the pace of easing in the next two years will significantly slow down (most likely only one cut each). This complex signal of "hawkish-dovish intertwining" and extremely cautious expectations seem to have failed to instill enough confidence in the market, leading to a fear-dominated crypto market that is experiencing a continuous decline.

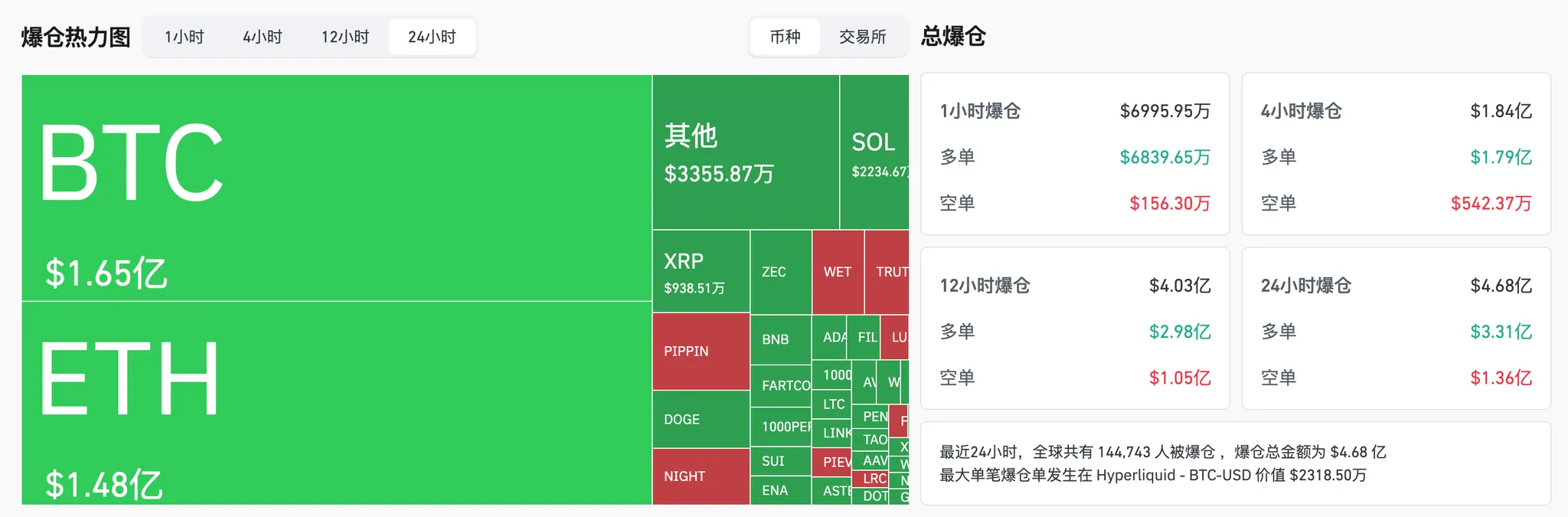

Real-time data from OKX shows that as of 11:40 today (all subsequent references are based on this time), BTC fell below $90,000, currently reported at $89,790.5, with a 24-hour decline of 2.45%, breaking the $90,000 mark; ETH fell below $3,200, currently reported at $3,181.24, with a 24-hour decline of 4.47%; SOL fell below $130, currently reported at $129.5, with a 24-hour decline of 4.88%.

According to SoSoValue, various sectors of the crypto market are generally retreating, with the DePIN sector leading the decline at 4.28% over 24 hours, where Filecoin (FIL) dropped 7.50% and Render (RENDER) fell 5.52%. In other sectors, the CeFi sector declined 1.00% over 24 hours, with Cronos (CRO) down 3.39%; the Layer2 sector fell 2.15%, but Mantle (MNT) remained relatively strong, rising 1.12%; the DeFi sector dropped 2.35%, while Hyperliquid (HYPE) rose against the trend by 2.95%; the Layer1 sector fell 2.54%, with Zcash (ZEC), which had previously seen significant gains, down 10.78%.

In the U.S. stock market, according to msx.com data, at the close of the day, the Dow Jones rose 1.05%, the S&P 500 index rose 0.67%, and the Nasdaq rose 0.33%. Crypto-related stocks generally fell, with ETHZ down over 8.1%, HODL down over 6.39%, and ABTC down over 5.37%.

In terms of derivatives trading, Coinglass data shows that in the past 24 hours, the entire network saw liquidations of $468 million, including $331 million in long liquidations and $136 million in short liquidations. In terms of cryptocurrencies, BTC saw liquidations of $165 million, and ETH saw liquidations of $148 million.

Market sentiment is releasing, and the market continues to decline. Discussions about whether "expectations have been fully realized and whether the market is weak" are also heating up.

Below, Odaily Planet Daily will summarize the views and arguments of institutions and analysts regarding the future market trends.

What will be the future trend of Bitcoin?

Greeks.live: Year-end liquidity exhaustion, limited momentum to restart the bull market

Adam, a researcher at Greeks.Live, pointed out on social media that the Federal Reserve's recent meeting cut rates by 25 basis points as expected and announced the restart of a $40 billion short-term U.S. Treasury (T-bills) purchase plan; its dovish statements will effectively supplement liquidity in the financial system, providing a clear benefit to the market.

However, mentioning "restarting quantitative easing (QE) to drive the bull market" is still premature: with Christmas and annual settlements approaching, the same period in previous years has been the time of lowest liquidity in the crypto market, with low market activity and very limited momentum to restart the bull market.

From the cryptocurrency options data, over 50% of the options positions are accumulated by the end of December, with BTC's maximum pain point at the $100,000 round number, and ETH's maximum pain point at $3,200; the implied volatility (IV) for major maturities has declined across the board this month, with market expectations for volatility this month continuing to fall.

Overall, the current performance of the crypto market is weak, with year-end liquidity under pressure and low market sentiment; "slow decline" is the mainstream expectation in the options market; however, one must also be wary of sudden positive news that could trigger a market reversal.

Dutch International: Improved inflation environment, maintaining prediction of two rate cuts in 2026

Dutch International Bank stated that the market currently expects the Federal Reserve to cut rates by another 50 basis points in 2026.

However, considering the current situation, the economy is still growing, the unemployment rate is low, and the stock market is close to historical highs, while the inflation rate is closer to 3% rather than the Fed's target of 2%, providing insufficient justification for the Fed to further ease policy. However, the bank suspects that the inflation environment in the coming months will be more conducive to rate cuts, providing support for further dovish actions: although tariff threats still exist, their impact is slower and weaker than expected, which buys more time for inflation-relieving factors such as falling energy prices, slowing rental growth, and weakening wage growth; the bank believes this will drive inflation to approach 2% faster than the Fed expects.

Additionally, with rising uncertainty in the "employment" dimension of the Fed's dual mandate, Powell mentioned that the Fed believes recent employment growth data has been overestimated by about 60,000 jobs. Dutch International Bank maintains its original prediction that the Fed will cut rates twice in 2026, with cuts of 25 basis points each in March and June.

Goldman Sachs: Soothing the hawkish camp, significantly raising the threshold for future easing

Goldman Sachs analyst Kay Haigh stated that the Federal Reserve has completed this round of "preventive rate cuts." She pointed out: "To justify any additional recent easing policies, the core premise is that labor market data must weaken further."

The "hard dissent" from voting members and the "soft dissent" in the dot plot both highlight the hawkish camp within the Federal Reserve; the reintroduction of wording regarding the "degree and timing" of future policy decisions in the statement is likely aimed at soothing this camp. While this adjustment retains the possibility of future rate cuts, the labor market must show a high degree of weakness to trigger a new round of easing.

Analyst: Policy statement "clearly dovish but subtly hawkish," expects 100 basis points of rate cuts next year

Analyst Anna Wong stated: "My assessment is that the overall tone of this policy statement and the updated forecast leans dovish, although it contains some implicit hawkish signals. On the dovish side, the committee significantly upgraded the economic growth path, lowered the inflation outlook, while maintaining the 'dot plot' forecast unchanged; the Federal Open Market Committee (FOMC) also announced the initiation of reserve management purchase operations."

"On the other hand, a signal in the policy statement indicates that the committee tends to pause the rate-cutting cycle for a long time." She further added: "Although the 'dot plot' shows only one rate cut in 2026—differing from the market's expectation of two—we believe the Fed will ultimately cut rates by a total of 100 basis points next year. The core basis is that we expect wage growth to remain weak, and we currently do not see clear signs of inflation reigniting in the first half of 2026."

Summary

This morning, although the Federal Reserve cut rates as expected, the internal divisions and slowing easing expectations revealed by the dot plot have led the market to encounter a complex signal of "hawkish-dovish intertwining." BTC fell below the $90,000 mark, with over $300 million in long liquidations, indicating that in the absence of incremental funds, the mere "implementation of rate cuts" can no longer mask the reality of year-end liquidity exhaustion.

Institutions generally believe that in the short term, due to the Christmas holiday and annual settlements, market activity will significantly decline, and "slow decline" and "defensive" may become the main tone for the end of the year, with very limited momentum to restart the bull market. However, looking further ahead, the focus of the game has shifted from simple inflation data to the performance of the labor market. Although institutions like Goldman Sachs indicate that the threshold for future easing has been raised, if wage growth remains weak or employment data deteriorates further next year, the market may still welcome a more aggressive rate-cutting path than expected. For investors, blindly bottom-fishing is not the optimal strategy before liquidity returns and macro signals become clearer.

免责声明:本文章仅代表作者个人观点,不代表本平台的立场和观点。本文章仅供信息分享,不构成对任何人的任何投资建议。用户与作者之间的任何争议,与本平台无关。如网页中刊载的文章或图片涉及侵权,请提供相关的权利证明和身份证明发送邮件到support@aicoin.com,本平台相关工作人员将会进行核查。