Author: Ye Kai

Preface

Recently, Musk threw out a vivid statement in an interview—"Energy is the true currency." His meaning is simple yet harsh: fiat currency can be printed, but energy cannot be created out of thin air. The extraction, transmission, and efficient utilization of energy and electricity are the true "value foundation" of this era.

Around the same time, at the BBW in Dubai, Peter Schiff and CZ staged a live debate on "Gold vs. Bitcoin." On one side was Schiff, a long-time "gold bull," who insisted that only physical gold is the true store of value; on the other side was CZ, who emphasized Bitcoin's verifiability, scarcity, and efficiency in cross-border payments, even using a "live gold verification" episode to highlight the costs and inconveniences of verifying gold authenticity. This scene is reminiscent of the ideological battle between two monetary civilizations over the past half-century: one represented by gold as "static storage," and the other by Bitcoin as "on-chain energy."

In the East, the digitalization and internationalization of the Renminbi are carving out a third path. On one hand, in the mainland, the People's Bank of China has established a digital Renminbi international operation center in Shanghai, while building three major infrastructures: "cross-border payment platform + blockchain service platform + digital asset platform," clearly placing DCEP within a digital financial framework led by the central bank that is regulatory and scalable. Meanwhile, thirteen ministries jointly issued a document reiterating that virtual currencies and related businesses are illegal financial activities, with stablecoins clearly categorized as "a form of virtual currency" that does not enjoy legal tender status and monetary functions within the territory.

On the other hand, Hong Kong is bringing "fiat currency-pegged stablecoins" into compliance through stablecoin legislation and licensing frameworks: the new system implemented on August 1 requires that fiat-pegged stablecoins issued in Hong Kong or offered to the public must obtain a license from the Monetary Authority, meeting a full set of high standards including adequate reserves, strict KYC and AML risk management, and audit disclosures, with plans to issue only a limited number of initial licenses, preferring quality over quantity.

In this "one country, two systems" financial landscape, Hong Kong is intentionally being developed into an international hub for digital assets and stablecoins, while the mainland provides an "official version" of a digital currency platform with the digital Renminbi.

Putting these three threads together:

- On one end, Musk reminds us that "energy is the ultimate currency";

- On another end, there is the ideological debate of "gold vs. Bitcoin";

- On the third end, there is the division of labor and interaction between the mainland and Hong Kong regarding stablecoins and the digital Renminbi.

This sets the stage for the discussion of "golden Renminbi"—we do not have to choose between "gold or Bitcoin" or "fiat currency or stablecoins," but can start from the combination of "gold tokenization + energy power corridor + digital infrastructure of the Renminbi" to think about a new monetary narrative: the Renminbi neither returns to a rigid gold standard nor follows the crypto world to adopt pure algorithmic credit, but instead integrates the millennia-old consensus of gold, the physical constraints of energy, and China's manufacturing and infrastructure capabilities into a programmable, regulatory, and cross-border transferable digital system.

1. Not Returning to the Gold Standard, but Moving Towards "Golden Renminbi"

We need to clarify a recent misconception: the Renminbi cannot and does not need to return to the traditional "gold standard," nor will it be solely anchored to gold in the future.

The logic of the gold standard is to tie currency to gold one-to-one, locking the central bank's balance sheet in a "vault," leaving extremely limited monetary policy space, which is completely unsuitable for a super-large economy that is still undergoing rapid transformation and upgrading. What China needs to do today is high-quality development, technological and industrial upgrading, not to revert to the monetary frameworks of the 19th and 20th centuries.

However, this does not mean that gold is "retiring." In the digital age, gold can return to the Renminbi system in a different way—not as a "gold standard that locks everything," but as a "digital anchor that enhances Renminbi credit."

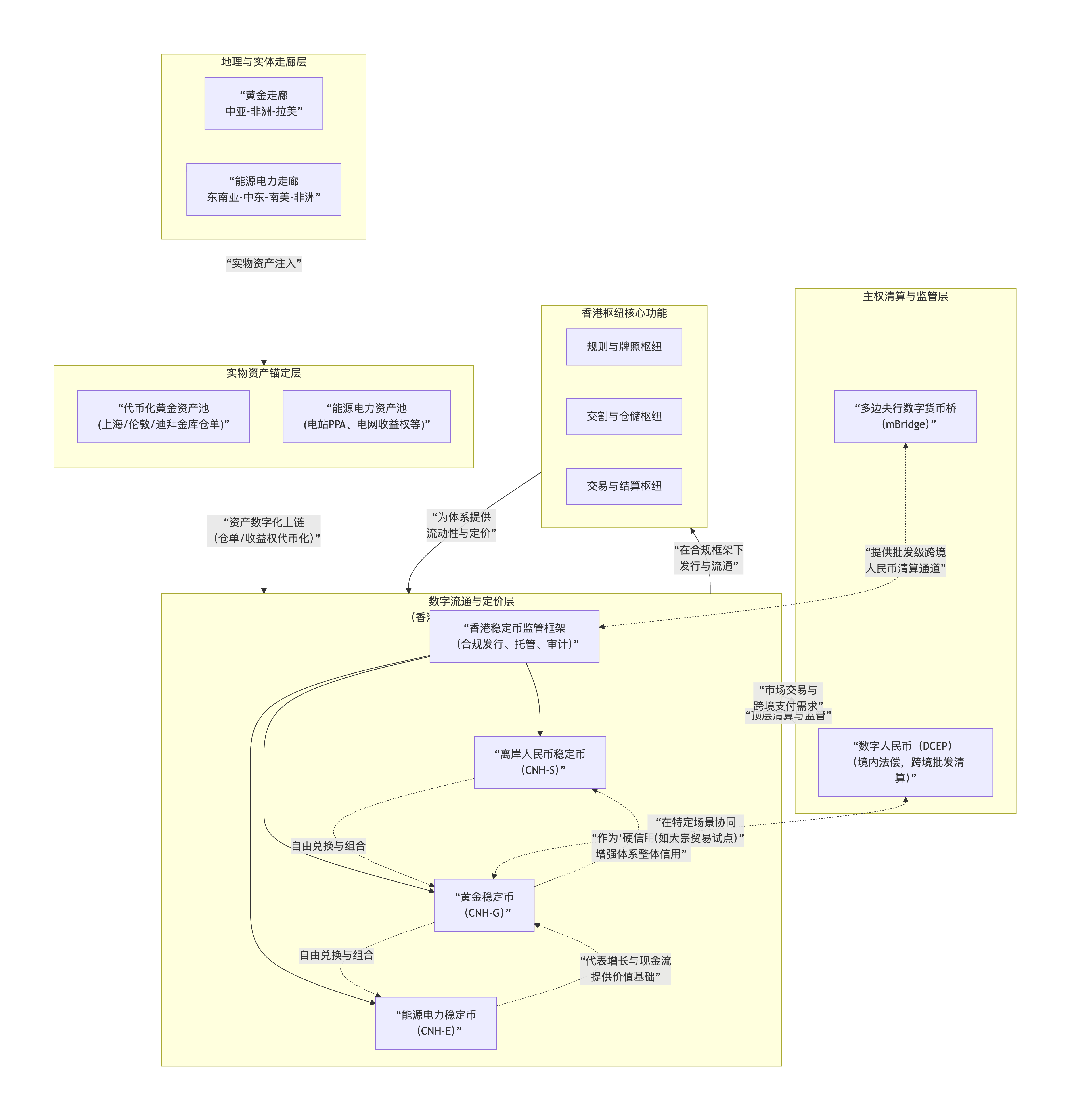

The so-called "golden Renminbi" refers to this set of combinations:

- The underlying layer uses tokenized gold as an on-chain super-sovereign value anchor;

- The middle layer uses gold stablecoins, energy power stablecoins, and offshore Renminbi stablecoins issued in Hong Kong as circulating tools in the market;

- The top layer uses digital Renminbi (DCEP), mBridge, etc., as the backbone of sovereign clearing and regulatory frameworks.

Adding two physical "corridors"—the gold corridor and the energy power corridor—connects resources, production capacity, and digital finance into a closed loop.

This is the basic picture of "golden Renminbi."

2. Tokenized Gold: The Global Consensus Foundation of the Renminbi on the Chain

The advantage of gold is simple: thousands of years of civilizational consensus, super-sovereign, anti-inflation, and high liquidity make it one of humanity's few "global consensus assets." The problem is that traditional gold is too "heavy"—storage, transportation, division, and delivery are all expensive and slow, making it difficult to naturally embed into digital finance. Tokenization flips this problem on its head.

Tokenized gold refers to taking standard gold bars stored in certified delivery warehouses like the Shanghai Gold Exchange, London Bullion Market Association, and Dubai DMCC, and "putting them on the chain," corresponding to the issuance of programmable gold tokens.

Each token is backed by: verifiable physical gold warehouse receipts, quality inspection and custody from authoritative exchanges or vaults, and a traceable link "from mine to vault" connected through the Internet of Things and blockchain. Thus, gold transforms from "stored assets lying in the vault" to "on-chain assets that can circulate globally 24/7." It can be transferred between exchanges and embedded in DeFi, RWA funds, cross-border payments, and collateral lending scenarios.

In this process, China can form a clear structure:

- Shanghai: The onshore pricing center for Renminbi-denominated gold, with "Shanghai Gold" providing the Renminbi gold price benchmark;

- Hong Kong: The innovation, issuance, and trading center for offshore tokenized gold products and gold stablecoins, driven by "onshore pricing + offshore circulation."

In other words, the "price anchor" of gold is primarily in Shanghai, while the "liquidity anchor" can be in Hong Kong. This is the first layer of "golden Renminbi": tokenized gold as the on-chain value cornerstone.

3. Gold Corridor: Turning Gold Resources from the Belt and Road into a Renminbi Asset Pool

With the on-chain gold "foundation" established, the next question is: where does this gold come from? How can it continuously and stably enter the Renminbi system?

The answer is the "gold corridor." Along the "Belt and Road," in regions like Central Asia, Africa, and Latin America, Chinese enterprises have already deeply engaged in mineral development, infrastructure construction, and trade exchanges. The gold corridor aims to upgrade these scattered collaborations into an integrated arrangement of "resources + infrastructure + finance."

A typical path is as follows: on one hand, China provides funding and technology for local projects such as mines, electricity, and roads through digital Renminbi loans, offshore Renminbi stablecoins, and engineering general contracting; on the other hand, through long-term purchase agreements, a certain proportion of future gold production is locked in and standardized storage and settlement are completed through warehouses in Shanghai, Hong Kong, and Dubai.

Once the produced gold is warehouse-receipted and tokenized, it enters the asset pool of "golden Renminbi." Part of it can serve as reserve certificates for the central bank and sovereign funds; another part can be structured in Hong Kong as gold-backed stablecoins or various RWA products.

Thus, the gold corridor is not just about "transporting gold from resource countries to China," but rather:

- Resource countries receive infrastructure and long-term capital;

- China obtains a sustainable flow of gold and project returns;

- Both parties share the "gold asset pool" on the chain in places like Hong Kong and Shanghai.

The gold corridor essentially binds the credit of the Renminbi to an entire industrial chain and a resource belt, making it no longer a castle in the air.

4. Gold Stablecoin: The "Neutral Bridge" Between Digital Renminbi and Offshore Renminbi

With tokenized gold, there is also a need for a form that can "be held by the market"—this is the gold stablecoin.

Gold stablecoins are not "another virtual currency," but a digital certificate of gold: one end is anchored to physical gold in compliant vaults, while the other end circulates in offshore markets like Hong Kong in token form.

It has several key features:

- Transparent reserves, compliant custody, and regular audits, in line with Hong Kong's future stablecoin licensing framework;

- Not purely "algorithmic credit," but a dual support of "gold + rules";

- From a regulatory perspective, it is closer to "commodity certificates" rather than "high-leverage speculative tools."

In the design of "golden Renminbi," the role of gold stablecoins is very clear:

Internally, it can collaborate with digital Renminbi (DCEP) in specific scenarios. For example, in pilot cross-border bulk commodity trades, both parties can settle part with DCEP and another part with gold stablecoins, achieving diversification and hedging of price, exchange rate, and political risks.

Externally, it can form a "combined punch" with offshore Renminbi stablecoins. Offshore Renminbi stablecoins are responsible for carrying Renminbi pricing, serving daily transactions and financial scenarios; gold stablecoins act as high-credit collateral, safe-haven assets, and long-term value storage tools, attracting conservative institutional capital into the entire offshore Renminbi asset pool.

This creates an interesting structure:

- Digital Renminbi: Sovereign level, legal tender and wholesale clearing;

- Offshore Renminbi Stablecoin: Market level, carrying daily use of Renminbi and on-chain innovation;

- Gold Stablecoin: Credit level, serving as the "hard asset ballast" of the entire Renminbi digital system.

Gold stablecoins do not "compete" with the monetary function of the Renminbi but add a layer of "gold insurance" to the digital form of the Renminbi.

5. From Gold Standard to "Dual Anchor System": Overlapping Gold Corridor and Energy Power Corridor

It is important to emphasize: gold is not, and should not be, the only anchor of the Renminbi. If we only talk about gold, it can easily be misinterpreted as a "disguised gold standard." The truly competitive and suitable solution for China's national conditions is a dual anchor or multi-anchor system of "gold corridor + energy power corridor."

The logic of the energy power corridor is that China's industrial chain advantages in power grids, power stations, photovoltaics, energy storage, and transmission and distribution equipment have already formed various "power corridors" in Southeast Asia, the Middle East, Africa, and South America. When countries along the route use Renminbi, offshore Renminbi stablecoins, or energy power stablecoins to:

- Pay for power station EPC general contracting projects;

- Pay for long-term electricity and capacity prices;

- Purchase operation, maintenance, and technical services;

The Renminbi gains a "fundamental demand from electricity prices and fees"—this is real cash flow, not merely "financial asset pricing."

If we further package assets like power purchase agreements (PPAs), electricity revenue rights, and grid usage fees into energy power stablecoins or RWA products, and place them in the same asset pool as gold stablecoins, it creates a very interesting combination:

- Gold, representing "hard value" and deflationary attributes of human consensus, is the "ballast";

- Energy power, representing future growth and industrialization "cash flow," is the "engine."

With both combined, the digital system of the Renminbi is no longer a "gold standard," but a multi-anchor structure of "gold + energy + manufacturing capability." This is why we prefer to call it "carbon-based Renminbi" or "physical asset Renminbi," rather than simply saying "the Renminbi is re-anchored to gold."

6. Hong Kong: The Institutional Hub and Offshore Engine of Golden Renminbi

To turn all of this from blueprint into reality, Hong Kong is an indispensable institutional hub. In the framework of "golden Renminbi," Hong Kong plays three key roles:

First, it is the hub of rules and licenses.

Under the stablecoin regulatory framework of the Hong Kong Monetary Authority, licensed institutions can be established for issuing gold stablecoins, energy power stablecoins, and offshore Renminbi stablecoins, locking products into the iron cage of the system with "1:1 full reserves + third-party custody + strict auditing."

As a result, global institutions will be more willing to place large funds into this system, as it is backed by physical assets and has highly transparent and verifiable regulatory rules.

Second, it is the hub of gold delivery and storage.

Hong Kong itself is an important node connecting the London Bullion Market Association, Shanghai Gold Exchange, Dubai, etc. After improving the delivery warehouse and clearing system, it can achieve:

- Efficient transfer and delivery of standard gold bars between Shanghai, London, Hong Kong, and Dubai;

- Digitalization of gold warehouse receipts on the chain with one click;

- Rapid transfer of gold tokens and gold stablecoins globally.

Third, it is the hub of trading and settlement.

Hong Kong can facilitate the trading of gold tokens, gold stablecoins, energy power stablecoins, and related derivatives, connecting the Hong Kong Stock Exchange, over-the-counter trading platforms, compliant exchanges, and the future mBridge clearing network.

In short: Hong Kong is the intermediary agreement layer between the "onshore Renminbi system" and the "global capital market," as well as the operational platform for the true implementation of "golden Renminbi."

7. System Integration: The Golden Renminbi Backbone Network of "mBridge + Digital Renminbi + Stablecoins"

Putting the previous elements together can be summarized in one sentence: "mBridge backbone network + digital Renminbi (DCEP) + offshore Renminbi stablecoins + gold stablecoins + energy power stablecoins."

You can imagine it as a three-layer network.

The bottom layer is the asset anchoring layer: physical gold warehouse receipts brought by the gold corridor, power purchase agreements (PPAs) and revenue rights from the energy power corridor, along with a portion of highly liquid offshore Renminbi assets, together form an asset pool.

The middle layer is the circulation and pricing layer: in Hong Kong, offshore Renminbi stablecoins are responsible for carrying the pricing and circulation needs of the Renminbi; gold stablecoins provide hedging and collateral value; energy power stablecoins bring in future electricity prices, electricity fees, and green assets, achieving a mapping of industry and finance.

The top layer is the clearing and sovereign layer: the central bank provides wholesale digital Renminbi to the central banks of countries along the route through mBridge for cross-border settlement of bulk commodities, infrastructure, gold, and energy power; the digital Renminbi remains the only legal digital currency domestically, responsible for "large, wholesale, and penetrable" clearing in cross-border scenarios; this multi-stablecoin system in Hong Kong provides flexible financial tools and liquidity for actual business parties in the offshore market.

In this network, the position of gold stablecoins is crucial:

- On one hand, it directly connects tokenized gold to the entire Renminbi payment, clearing, and investment chain, enhancing the "hard credit" of the entire system;

- On the other hand, it acts as a "credit converter" between digital Renminbi and offshore Renminbi stablecoins, as well as energy power stablecoins, allowing different entities with varying risk preferences to find suitable forms of Renminbi assets.

This is no longer the traditional "gold standard," but a "golden Renminbi parallel universe" with the Renminbi as the pricing core, gold and energy power as the physical foundation, and interconnected through blockchain and mBridge.

(AI Diagram of Golden Renminbi)

8. Conclusion: From Grand Narrative to Usage Habits, the Feasible Path of Golden Renminbi

What "golden Renminbi" truly aims to solve is not a promotional slogan, but a real issue: in today's world where the dollar network is highly developed and global risk differentiation is intensifying, how can the Renminbi provide a more credible, transparent, and physically supported "non-dollar" option to global partners without sacrificing its own monetary policy space?

The answer is likely:

- Not to retrace steps, not to adopt a rigid gold standard;

- To utilize tokenized gold to add a super-sovereign "hard anchor" to the digital system of the Renminbi;

- To leverage the gold corridor and energy power corridor to connect resources, production capacity, and finance into circular value chains;

- To use Hong Kong to connect rules, markets, and technology;

- To utilize mBridge and digital Renminbi to piece together a truly operational, clearable, and regulatory backbone network.

When a payment from an African gold mine and a payment settlement from a Middle Eastern photovoltaic power station can achieve second-level delivery and full traceability in the combination of "gold stablecoins + energy power stablecoins + offshore Renminbi stablecoins + digital Renminbi";

When more and more project financing, trade settlements, and asset allocations habitually choose this path instead of taking the long route through SWIFT and dollar agents;

The internationalization of the Renminbi will no longer be just a "narrative" in reports, but will become the "habit" of enterprises, banks, and sovereign institutions every day.

At that time, what we refer to as "golden Renminbi" will not just be a concept, but a set of digital infrastructure truly operating on the gold corridor and energy power corridor, priced in Renminbi.

The credit of the Renminbi is etched not only in China's manufacturing and infrastructure capabilities but also embedded in the gold bars stored in vaults, and flows through the cross-continental power lines and photovoltaic power stations that illuminate countless homes.

This may be another answer from China to the global challenge of "monetary value" in the digital age.

免责声明:本文章仅代表作者个人观点,不代表本平台的立场和观点。本文章仅供信息分享,不构成对任何人的任何投资建议。用户与作者之间的任何争议,与本平台无关。如网页中刊载的文章或图片涉及侵权,请提供相关的权利证明和身份证明发送邮件到support@aicoin.com,本平台相关工作人员将会进行核查。