Original Author: Li Dan

Original Source: Wall Street Journal

Key Points:

- The Federal Reserve lowered interest rates by 25 basis points for the third consecutive time as the market expected, but for the first time since 2019, there were three dissenting votes against the rate decision.

- Stephen Miran, a board member appointed by Trump, continued to advocate for a 50 basis point cut, while two regional Fed presidents and four non-voting members supported maintaining the current rates, resulting in a total of seven dissenters, reportedly the largest disagreement in 37 years.

- The meeting statement reiterated that inflation remains slightly elevated and that the risk of job losses has increased in recent months, removing the phrase "unemployment rate remains low" and stating it has slightly risen as of September.

- The statement added considerations for the "magnitude and timing" of further rate cuts, seen as an indication that the threshold for future cuts is higher.

- The statement noted that reserves have fallen to adequate levels, and to maintain sufficient reserves, the Fed will begin purchasing short-term debt starting this Friday. The New York Fed plans to buy $40 billion in short-term debt over the next 30 days, with expectations that reserve management purchases (RMP) will remain high in the first quarter of next year.

- The median value of interest rate expectations remained unchanged from the last meeting, suggesting one rate cut each in the next two years, with the dot plot's rate forecast for next year shifting slightly dovish, with one less person expecting no cuts, totaling seven.

- Economic outlooks were raised for GDP growth expectations for this year and the next three years, while inflation and unemployment rate expectations for this year and next were slightly lowered.

- The "New Federal Reserve News Agency" indicated that the Fed suggested it may not cut rates again for the time being due to a "rare" divergence within regarding the weight of concerns over inflation and employment.

The Federal Reserve lowered rates again as the market expected, but this revealed the largest internal disagreement among voting decision-makers in six years, suggesting a slowdown in actions next year and possibly no actions in the near term. The Fed also initiated reserve management as Wall Street anticipated, deciding to buy short-term government bonds by year-end to address pressures in the money market.

On Wednesday, December 10, Eastern Time, the Federal Reserve announced after the FOMC meeting that the target range for the federal funds rate was lowered from 3.75% to 4.00% to 3.50% to 3.75%. This marks the third consecutive FOMC meeting where the Fed has cut rates by 25 basis points each time, totaling a 75 basis point reduction this year, and a cumulative cut of 175 basis points since the easing cycle began last September.

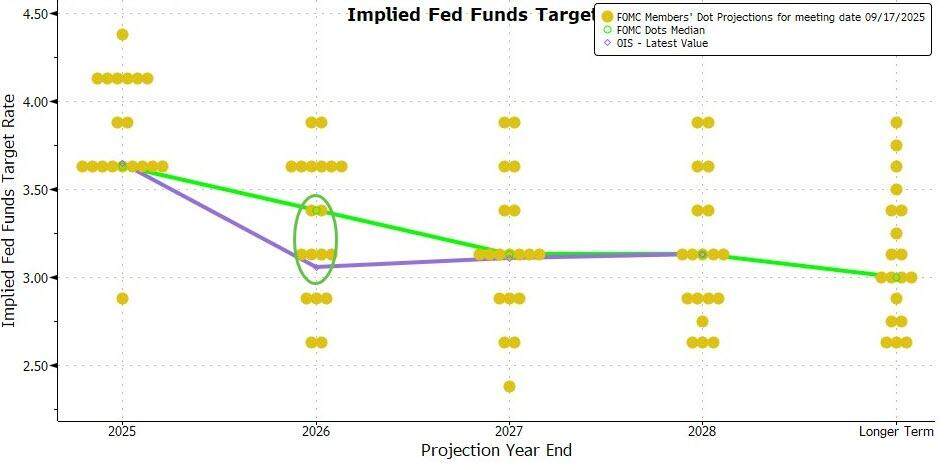

The dot plot released after the meeting showed that the Fed's rate path forecast remains consistent with the dot plot published three months ago, still expecting one 25 basis point cut next year. This indicates that the rate-cutting actions next year will be noticeably slower than this year.

This rate cut and the indication of a slowdown in actions next year were almost entirely anticipated by the market. By Tuesday's close, CME tools indicated that the futures market expected an 88% probability of a 25 basis point cut this week, while the probability of at least another 25 basis point cut by June next year reached 71%. The probabilities for similar cuts in January, March, and April meetings did not exceed 50%.

The predictions reflected by the CME tools can be summarized by the recently discussed term "hawkish rate cut." This refers to the Fed cutting rates this time but simultaneously suggesting a possible pause in actions, indicating that there will be no further cuts in the near term.

Nick Timiraos, a senior Fed reporter known as the "New Federal Reserve News Agency," stated after the Fed meeting that the Fed "implied it may not cut rates again for the time being" due to a "rare" divergence internally regarding which concerns—inflation or the job market—are more pressing.

Timiraos pointed out that three officials opposed the 25 basis point cut at this meeting, making it the largest disagreement in recent years due to stagnation in the downward progress of inflation and a cooling job market.

Other comments noted that the dot plot released this time showed that six people, including two voting FOMC members, expected no rate cut in December, meaning a total of seven opposed the 25 basis point cut, marking the largest disagreement in 37 years.

First Time Since 2019 with Three Dissenting Votes Against Rate Decision

Compared to the last meeting's decision at the end of October, the most significant difference in this meeting's statement is that among the 12 voting FOMC members, three voted against the 25 basis point cut, one more dissenting vote than at the end of October. This is the first time since 2019 that the Federal Reserve's rate decision faced opposition from three voting members.

The statement indicated that nine FOMC members, including Fed Chair Powell and Fed Governor Cook, who was publicly threatened with dismissal by President Trump, supported the continued 25 basis point cut. The three dissenters were Stephen Miran, the Fed governor appointed by Trump, Austan Goolsbee, president of the Chicago Fed, and Jeffrey Schmid, president of the Kansas City Fed.

Among them, Miran has consistently advocated for a 50 basis point cut since his appointment, just as he did in his first two meetings. Schmid opposed the cut this time because he supports keeping rates unchanged, similar to his stance in the last meeting. Goolsbee, who supported the 25 basis point cut last time, changed his position this time to align with Schmid.

This year, there have been dissenting votes in four FOMC meetings. In July and the last meeting, there were two dissenting votes, while in September, only Miran opposed.

These voting disagreements reflect that, in the context of government shutdowns leading to some official data being unavailable or permanently missing, the Fed decision-makers do not have a unified view on the risks of inflation and employment. Those opposing the rate cut are primarily concerned about stagnation in the downward progress of inflation, while those supporting the cut believe action should continue to prevent accelerated job losses and deterioration in the labor market.

New Considerations for Further Rate Cuts "Magnitude and Timing"

Another major change in this meeting's statement compared to the last is in the interest rate guidance. Although the decision was to cut rates, the statement no longer vaguely states that the FOMC will assess future data, evolving prospects, and risk balances when considering further rate cuts, but rather more explicitly considers the "magnitude and timing" of rate cuts. The statement was revised to:

"When considering the magnitude and timing of further adjustments to the federal funds rate target range, the (FOMC) committee will carefully evaluate the latest data, the evolving (economic) outlook, and the risk balance."

Following this statement, the Fed reiterated its commitment to supporting full employment and bringing inflation back to its target level of 2%.

This aligns with what Wall Street insiders had previously anticipated regarding the adjustment. They expected the statement to revert to the style used a year ago, reintroducing the phrasing "magnitude and timing of further adjustments." Goldman Sachs believes this adjustment reflects that "the threshold for any further rate cuts will be higher." Other comments noted that considering "magnitude and timing" was the phrasing used in last December's statement, seen as a signal to pause actions.

Removal of "Unemployment Rate Remains Low" and Stating It Has Slightly Risen as of September

Most of the other economic evaluations in the statement retained the wording from the last statement, reiterating that "available" indicators show that the pace of economic activity has slowed.

The statement reiterated that employment growth has slowed this year, with a slight adjustment in the description of the unemployment rate. The last statement said, "the unemployment rate has slightly risen but remains low as of August," while this time it changed to "the unemployment rate has slightly risen as of September," removing "remains low." Following these remarks, the statement noted that more recent indicators are consistent with these trends, reiterating that inflation rates have risen since the beginning of the year and remain slightly elevated.

As in the last statement, this time it also stated that the FOMC "is attentive to the risks facing its dual mandate and assesses that the risks of job losses have increased in recent months."

Plans to Buy $40 Billion in Short-Term Debt Over the Next 30 Days, Expecting High RMP Purchases in the First Quarter of Next Year

Another significant change in this meeting's statement compared to the last is the addition of a paragraph specifically mentioning the purchase of short-term debt to maintain adequate reserves in the banking system. The statement read:

"(FOMC) committee believes that reserve balances have fallen to adequate levels and will begin purchasing short-term government bonds as needed to continue maintaining adequate reserve supplies."

This effectively announces the initiation of what is known as reserve management, aimed at rebuilding liquidity buffers in the money market. This is often necessary as market disruptions can occur at year-end, with banks typically reducing their activities in the repurchase market to support their balance sheets in response to regulatory and tax settlements.

The following red text highlights the deletions and additions in this decision statement compared to the last.

The New York Fed, responsible for open market operations, also issued a notice on Wednesday, stating plans to buy $40 billion in short-term government bonds over the next 30 days.

The New York Fed's announcement stated that it received instructions from the FOMC to increase the securities holdings in the System Open Market Account (SOMA) by purchasing short-term government bonds in the secondary market and, if necessary, buying government bonds with a remaining maturity of up to three years to maintain adequate reserve levels. The scale of these reserve management purchases (RMP) will be adjusted based on expected trends in the demand for Fed liabilities and seasonal fluctuations, such as those caused by tax day impacts.

The announcement stated:

"The monthly RMP amount will be announced around the ninth working day of each month, along with a tentative purchase plan for the following approximately 30 days. The trading desk plans to announce the first plan on December 11, 2025, at which point the total amount of RMP short-term government bonds will be approximately $40 billion, with purchases starting on December 12, 2025.

The trading desk expects that to offset the anticipated significant increase in non-reserve liabilities in April (next year), the RMP (purchases) will remain at a high level in the coming months. Subsequently, the total purchase pace may significantly slow based on expected seasonal changes in Fed liabilities. The purchase amounts will be appropriately adjusted based on the outlook for reserve supplies and market conditions."

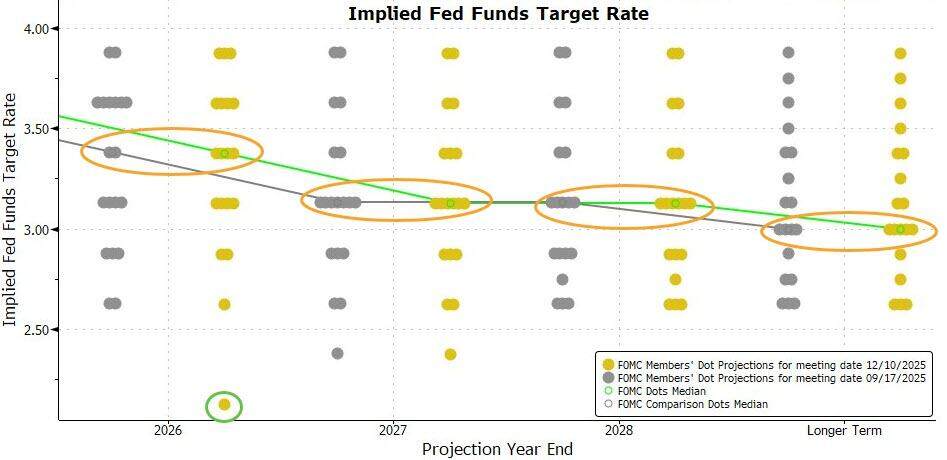

Dot Plot Shows Seven Opponents to This Decision, Rate Forecast for Next Year Shifts Slightly Dovish Compared to Last Time

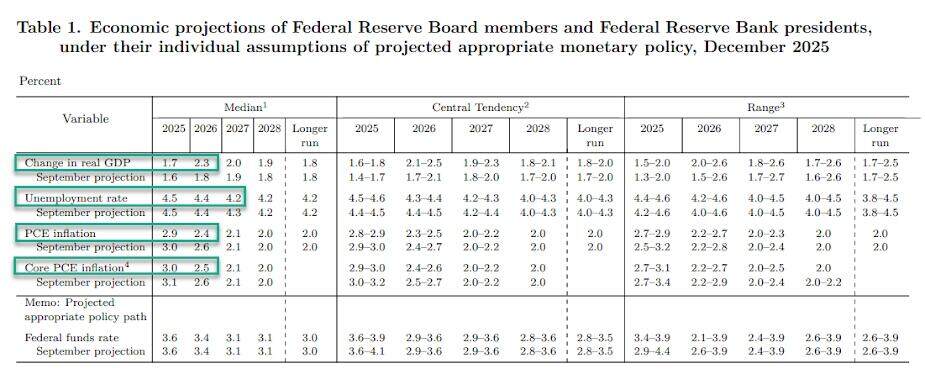

The median values of the interest rate forecasts from Fed officials released after the meeting on Wednesday show that the officials' expectations this time are identical to those from the last forecast published in September. The specific median values are as follows:

The federal funds rate at the end of 2026 is 3.4%, at the end of 2027 is 3.1%, at the end of 2028 is 3.1%, and the longer-term federal funds rate is 3.0%, all unchanged from the September expectations.

Based on these median interest rates, similar to last time, Fed officials currently also expect that after three rate cuts this year, there will likely be one 25 basis point cut each in the next two years.

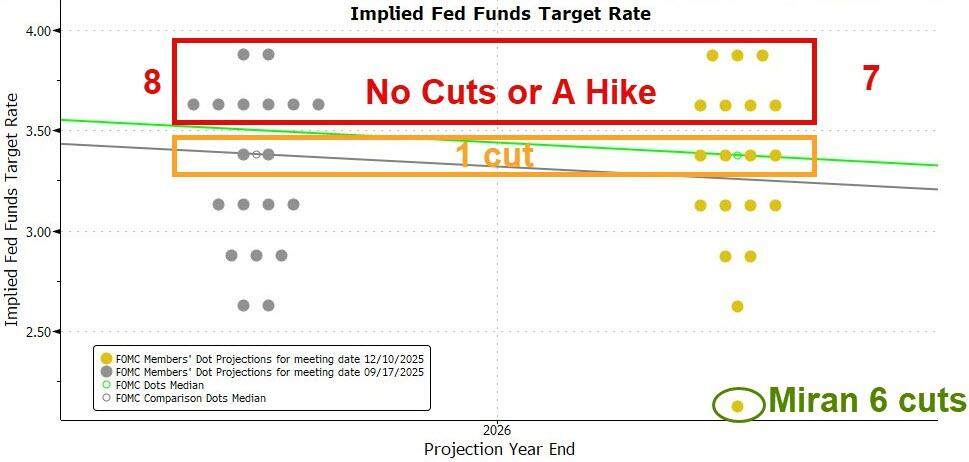

The dot plot shows that six people expect the interest rate to be between 3.75% and 4.0% by the end of this year, accounting for over 30% of the total number of forecasts provided. This means that six people believe the rate should remain unchanged at this meeting, including two dissenting voting members of the FOMC and four Federal Reserve officials without voting rights at this meeting. Including Miran, who advocates for a larger rate cut, the total number opposing the 25 basis point cut at this meeting reaches seven.

Previously, many expected that the dot plot reflecting future rate changes would show a more hawkish stance from Fed officials. However, this dot plot did not exhibit such a tendency and was instead slightly dovish compared to the last one.

Among the 19 Federal Reserve officials providing forecasts, seven expect next year's rate to be between 3.5% and 4.0%, down from eight in the last forecast. This indicates that the number of people expecting no rate cuts next year is one less than last time.

The dot plot also shows that eight people expect rates to be between 3.0% and 3.5%, which is two more than the last forecast. Three people predict next year's rate to be between 2.5% and 3.0%, which is two fewer than last time, and one person predicts a rate below 2.25%, with no one making such a prediction last time.

Upward Revision of GDP Growth Expectations for Four Years, Slight Downward Revision of Inflation and Unemployment Rate Expectations for This Year and Next

The economic outlook released after the meeting shows that Federal Reserve officials have upwardly revised GDP growth expectations for this year and the next three years, with the largest increase for next year's growth rate, raised by 0.5 percentage points. Other years were only slightly increased by 0.1 percentage points, while the unemployment rate expectation for 2027, or the year after next, was slightly revised down by 0.1 percentage points, with expectations for other years remaining unchanged. This adjustment indicates that the Federal Reserve believes the labor market is more resilient.

At the same time, Federal Reserve officials slightly revised down the PCE inflation and core PCE inflation expectations for this year and next by 0.1 percentage points each. This reflects a slight increase in the Fed's confidence regarding a slowdown in inflation in the near future.

As in the last meeting, Fed officials still expect that by 2028, inflation will return to the Fed's long-term target level of 2%, which would mark the first time the U.S. inflation rate meets the target after being above it for seven consecutive years.

Specific forecasts are as follows:

- The GDP growth expectation for 2025 is 1.7%, up from the September expectation of 1.6%. The expected growth rate for 2026 is 2.3%, up from the September expectation of 1.8%. The expected growth rate for 2027 is 2.0%, up from the September expectation of 1.9%. The expected growth rate for 2028 is 1.9%, up from the September expectation of 1.8%. The long-term expected growth rate remains at 1.8%, unchanged from the September expectation.

- The unemployment rate expectation for 2025 is 4.5%, unchanged from the September expectation of 4.4%. The expectation for 2027 is 4.2%, down from the September expectation of 4.3%. The unemployment rate expectations for 2028 and the long term are both 4.2%, unchanged from the September expectation.

- The PCE inflation rate expectation for 2025 is 2.9%, down from the September expectation of 3.0%. The expectation for 2026 is 2.4%, down from the September expectation of 2.6%. The expected growth rate for 2027 is 2.1%, while the expectations for 2028 and the long term are both 2.0%, unchanged from the September expectation.

- The core PCE expectation for 2025 is 3.0%, down from the September expectation of 3.1%. The expectation for 2026 is 2.5%, down from the September expectation of 2.6%. The expectation for 2027 is 2.1%, while the expectation for 2028 is 2.0%, both unchanged from the September expectation.

免责声明:本文章仅代表作者个人观点,不代表本平台的立场和观点。本文章仅供信息分享,不构成对任何人的任何投资建议。用户与作者之间的任何争议,与本平台无关。如网页中刊载的文章或图片涉及侵权,请提供相关的权利证明和身份证明发送邮件到support@aicoin.com,本平台相关工作人员将会进行核查。