I. Interest Rate Decision: Rate Cut as Expected but Internal Divergence Highlighted

1. Benchmark Interest Rate Adjustment

● At midnight on December 11 in the Eastern Time Zone, the Federal Open Market Committee (FOMC) announced a reduction of the federal funds rate target range from 3.75%-4.00% to 3.50%-3.75%.

● This marks the third rate cut following those in September and October of this year, each by 25 basis points. Cumulatively, the total rate cut for 2024 reaches 75 basis points.

● Since the start of this easing cycle in September 2023, the Fed has cut rates by a total of 175 basis points.

2. Rare Internal Divergence Among Decision Makers

● This rate decision faced three dissenting votes, the first since 2019.

● Governor Milan (appointed by Trump) advocated for a 50 basis point cut; two regional Fed presidents and four non-voting members supported keeping rates unchanged.

● In total, seven officials opposed the decision, reportedly the largest divergence in 37 years.

3. Key Changes in Policy Statement

● Adjustment of Rate Guidance: The statement no longer vaguely states "will assess future data, outlook, and risk balance," but explicitly changes to "when considering the magnitude and timing of further adjustments to the federal funds rate target range, the committee will carefully evaluate the latest data, evolving outlook, and risk balance." This wording is interpreted as setting a higher threshold for rate cuts.

● Description of the Labor Market: The phrase "unemployment rate remains low" was removed, replaced with "slightly increased as of September," while acknowledging that "the risk of job losses has increased in recent months."

● Inflation Stance: The judgment that "inflation remains slightly elevated" is maintained, with no substantial softening observed.

II. Economic Forecasts and Dot Plot Signals: Slowing the Pace of Action

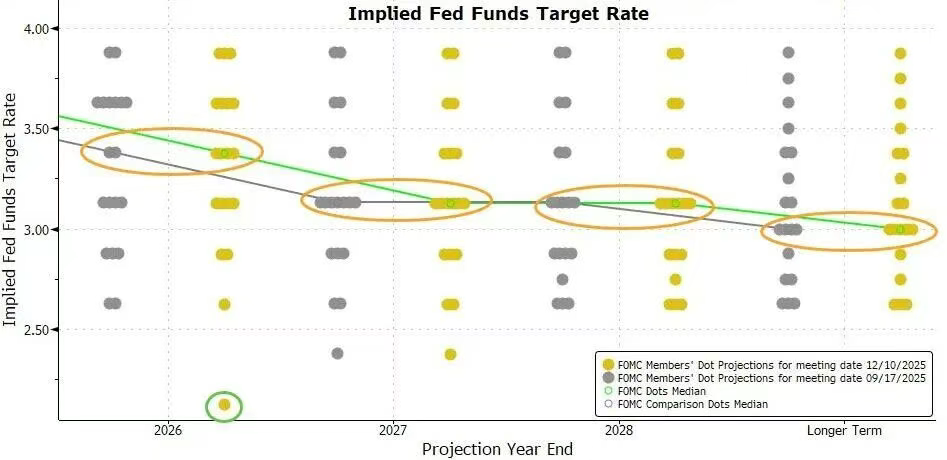

1. Interest Rate Path Forecast (Dot Plot)

● The latest dot plot shows that the median interest rate forecast by Fed officials for 2025-2027 is completely consistent with the September forecast.

● Specifically:

○ End of 2025: The median interest rate forecast is 3.4%, implying only one 25 basis point rate cut next year.

○ End of 2026: The median interest rate forecast is 3.1%.

○ End of 2027: The median interest rate forecast is 2.9%.

● Among the 19 officials providing forecasts, 7 expect the rate to remain in the 3.5%-4.0% range in 2025 (i.e., no rate cut), a decrease of one from September.

2. Adjustments to Economic Outlook

● Economic Growth: Upward revisions to GDP growth expectations for 2024 and the following three years reflect recognition of economic resilience.

● Unemployment Rate: A slight downward adjustment of 0.1 percentage points to the unemployment rate forecast for 2026, with other years unchanged, indicating a more resilient labor market than expected.

● Inflation Expectations: A slight downward adjustment of 0.1 percentage points to the PCE inflation and core PCE inflation expectations for 2024 and 2025, indicating a slight increase in confidence regarding inflation moderation.

3. Comparison of Market Expectations

● Before the meeting, the Chicago Mercantile Exchange (CME) FedWatch tool indicated:

○ The probability of a 25 basis point rate cut at this meeting was nearly 88%.

○ The market expects a probability of 71% for another rate cut of at least 25 basis points by June 2025.

○ The probability of rate cuts in the January, March, and April 2025 meetings did not exceed 50%.

● This decision aligns with the characteristics of a "hawkish rate cut": executing a rate cut while suggesting a possible pause in future actions.

III. Reserve Management Plan: Purchasing Short-Term Bonds to Maintain Liquidity

1. Operation Initiation and Purpose

● The Fed added a new paragraph in the statement, announcing that "reserve balances have fallen to adequate levels and will begin purchasing short-term Treasury securities as needed to maintain sufficient reserve supply."

● This operation is defined as Reserve Management Purchases (RMP), aimed at rebuilding liquidity buffers in the money market to address potential market pressures at year-end.

● Powell emphasized that this operation is separate from monetary policy stance and "does not represent a change in policy direction," with the sole purpose of ensuring the Fed can effectively control policy rates.

2. Specific Implementation Arrangements

● Start Date: To begin this Friday (December 13).

● Initial Scale: The New York Fed plans to purchase $40 billion in short-term Treasury securities over the next 30 days.

● Subsequent Arrangements: Purchase scale may remain high in the coming months to alleviate seasonal money market tensions; it will then gradually decrease based on market conditions.

● Background Considerations: Banks typically reduce repo market activities at year-end to meet regulatory and tax settlement demands, which can lead to liquidity tightening.

IV. Key Points from Chairman Powell's Press Conference

1. Policy Stance Definition

● Patience in Observation: "Our current position allows us to wait patiently and observe how the economy evolves next."

● Denial of Rate Hike Bias: Clearly stated, "I do not believe that 'the next move will be a rate hike' is anyone's baseline assumption," emphasizing he has not heard such views.

● Risk Balance Judgment: "Inflation risks are tilted upward, while employment risks are tilted downward; this is a challenging situation."

2. Explanation of Internal Divergence

● There are three main views within the committee:

○ Some members believe the current policy stance is appropriate, advocating for maintaining the status quo and further observation.

○ Some members believe that another rate cut may be needed in 2024 or 2025, possibly more than once.

○ Expectations mainly focus on scenarios of "maintaining the status quo, slight rate cuts, or slightly larger rate cuts."

3. Interpretation of Inflation and Employment

● Tariff Impact: Believes the impact of tariffs on inflation is "relatively short-lived," essentially a one-time price level increase; the Fed's responsibility is to prevent it from evolving into a persistent inflation issue.

● Labor Market: Pointed out that while official employment data for October and November have not been released, existing evidence shows that layoffs and hiring activities are both at low levels; households and businesses' views on the labor market continue to cool.

4. Clarification on Asset Purchases

● Reiterated that the purchase of short-term Treasury securities is an independent decision and not quantitative easing (QE), and does not change the monetary policy stance.

● Stated that the tightness in the money market "came a bit faster than expected," but is not strictly a "concern."

V. Market Analysis and Forward Outlook

1. Policy Path Assessment

● This meeting conveyed a clear signal: the Fed is about to enter an observation period after three consecutive rate cuts.

● The dot plot shows only one expected rate cut in 2025, contrasting sharply with three cuts in 2024, indicating a consensus to slow the pace of action.

● The new wording of "considering the magnitude and timing" sets a higher threshold for future policy adjustments, likely requiring clearer evidence of labor market weakening.

2. Economic Environment Judgment

● The Fed faces a balancing challenge between inflation and employment:

○ The process of inflation retreat has stalled, limiting further easing space.

○ Signs of cooling in the labor market necessitate caution against downside risks.

● Upward revisions to growth and downward revisions to inflation reflect an increased possibility of a "soft landing," but uncertainty remains.

3. Initial Market Impact

● After the decision announcement, the short end of the U.S. Treasury yield curve reacted mildly, while the long end saw a slight decline, reflecting the market's digestion of the slowed rate cut expectations.

● The U.S. dollar index remained relatively strong, and stock market volatility was limited, indicating overall market acceptance of the "hawkish rate cut" narrative.

● The reserve management operation is expected to alleviate year-end liquidity pressures, avoiding a repeat of the turmoil in the repo market in 2019.

4. Future Focus Areas

● Data Dependence: Future policies will heavily rely on inflation (especially core PCE) and employment data performance.

● Internal Coordination: How to bridge internal divergences among decision-makers to form a more unified forward guidance.

● External Risks: The impact of global economic growth trends, geopolitical developments, and changes in financial conditions.

● Technical Operations: The actual scale and pace adjustments of reserve management purchases, and their effects on stabilizing money market rates.

This Federal Reserve meeting completed the third rate cut as expected, but through dot plot forecasts, adjustments in policy statement wording, and the chairman's remarks, it clearly conveyed a signal of slowing the pace of easing.

The rare internal divergence among decision-makers highlights the difficulty of balancing inflation resilience with cooling employment. Meanwhile, the initiation of short-term Treasury purchases to manage reserves indicates the Fed is taking preventive measures to address structural pressures in the money market.

Join our community to discuss and grow stronger together!

Official Telegram community: https://t.me/aicoincn

AiCoin Chinese Twitter: https://x.com/AiCoinzh

OKX benefits group: https://aicoin.com/link/chat?cid=l61eM4owQ

Binance benefits group: https://aicoin.com/link/chat?cid=ynr7d1P6Z

免责声明:本文章仅代表作者个人观点,不代表本平台的立场和观点。本文章仅供信息分享,不构成对任何人的任何投资建议。用户与作者之间的任何争议,与本平台无关。如网页中刊载的文章或图片涉及侵权,请提供相关的权利证明和身份证明发送邮件到support@aicoin.com,本平台相关工作人员将会进行核查。