Ethereum # Bitcoin # Ethereum Real-Time Analysis # Bitcoin Real-Time Analysis

Hello everyone, I am Lao Lv. Overall, the strong trend is still Ethereum, which we emphasized in the previous article. Currently, unless there is significant news to stimulate the market, it is difficult to make moves because we are following trends and need to be very precise with our timing. Judging extreme trends must be spot on, as the stop-loss is limited. However, for short-term trading, it is quite manageable. The required profit margin is relatively small, and with a small position, it is easier to maneuver. Recently, our internal short-term trading group has been performing quite well. Today, we aggressively went long between 3280-3300, perfectly taking profit at 3375. If we continue to trade based on the trend, it could be troublesome. Now, it has dropped back to the starting point near 3375. So, you see, short-term trading is flexible. At the same time, we are also following up in real-time, which we can manage. However, sometimes the trend does not work out; there are times when it drops more than 80 or even 100, and you cannot make reminders for those trades. You just have to wait, and if the market is not moving much, it can be torturous! Therefore, we have adjusted our overall strategy. We will continue to open short-term trades normally and analyze trend trades normally, ensuring we do not miss out on either side.

For Ethereum, today’s strength actually hinges on whether it can break the high point of 3398, which we clarified in the last article. The entry point for a strong upward trend is at 3283, with a defensive point at the hourly chart bottom of 3240. If it breaks the high, it will strengthen; if it does not break the high and continues to retrace to 3283, there is a high probability it will test the 3240 support. This is the basic analysis of today’s market. The price is moving as expected. According to normal reasoning, a continued retracement to 3240 should lead to a long position since the support here is very strong. Even if it oscillates, it should bounce back in the short term. However, tonight there is data, so technically, it could easily become distorted! Therefore, tonight we will analyze the data again before discussing the market.

Let’s first look at interest rates: previous value 4%, forecast: 3.75%. The entire market expects a rate cut. Last night, both major figures spoke, further reinforcing the expectation of interest rate hikes, leading to a significant market surge, pushing silver to its historical highest point! However, tonight’s main speaker is not the major figures but rather Old Powell. This person is a bit eccentric; he has almost no political stance and consistently implements his monetary policy, only speaking based on data! He firmly believes that the current U.S. economy is good enough that it does not warrant a significant rate cut. Therefore, I suspect Old Powell will maintain the interest rate unchanged, not offending anyone, which would result in smaller fluctuations.

If Old Powell chooses to cut rates, the probability of a surge increases, which would mean another rate hike next year! The price would first surge and then drop.

If he chooses to raise rates, it would not only offend people but also create a major blunder, with the price first dropping and then surging.

Choosing to cut rates, bulls will take the opportunity to push prices higher; choosing to raise rates, when power returns to Old Trump next year, it will eventually revert to the starting point, so it will also drop first and then rise.

Therefore, unless he maintains the status quo, if either of the other two options is chosen, we need to find technical points to pinpoint the tops and bottoms of the upward or downward movements.

This is just one of the technical points, but it should be sufficient. Using 3283 as 0.618, we can predict the high points for upward movements and the low points for downward movements in advance. This is a reverse prediction technique, anticipating where 0.618 will appear. If we take 3398 as the top, predicting a downward movement, then the bottom would be 3100. If we take 3100 as the bottom and continue to break the top of 3398, then the upper major top would be 3585. Thus, we can establish the range for the tops and bottoms as 3100 and 3585. Once the price approaches either side, we cancel the other side because before the data is released, we cannot be certain whether the price will rise or fall first. Of course, we also need an extreme position, a long position at 3010. This technical point has been repeated multiple times, and I can see at least two points. Therefore, in the face of complex data, it is better to consider comprehensively.

Currently, around 3320, if the price goes up to near 3585, we will short and cancel the long. If the price goes down close to 3100, we will go long and cancel the short above.

At any time, if it reaches 3010, we will go long.

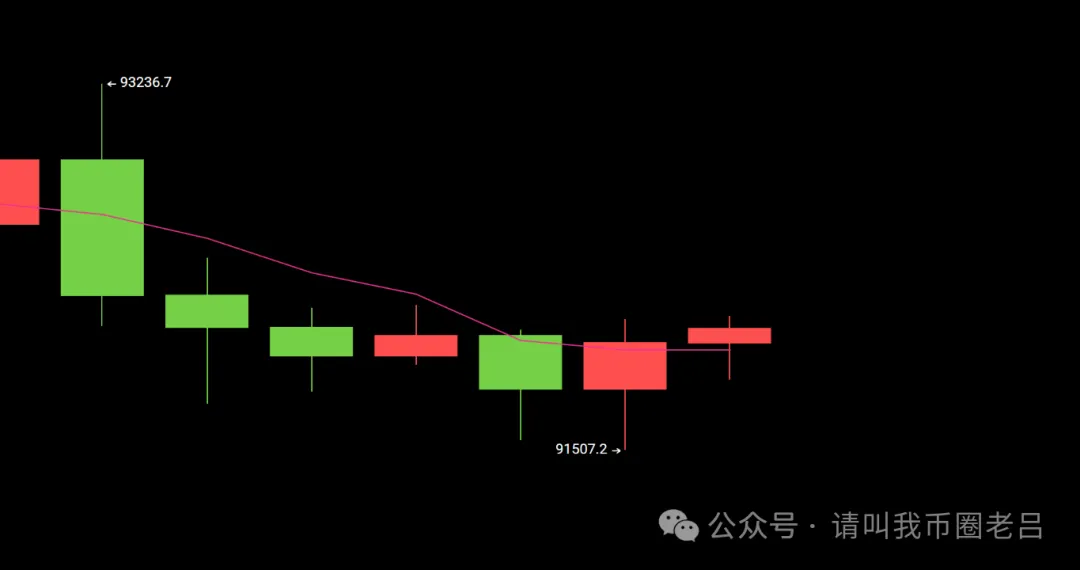

For Bitcoin, it is only emphasized that it is weaker than Ethereum, so there is no rush to open long positions. Now it seems that the support at 91500 is holding perfectly, not a penny off. Therefore, short-term trading is simple; the difficulty still lies in the trend. If we do not accurately judge the tops and bottoms of the larger cycle, it can be risky. Coupled with the recent frequent news, sometimes a good trade can turn into a loss because we cannot exit in time. Trend trades require not only technical support but also control over entry and exit points. Because of the data, do not ask whether 91500 can hold; if we could know the actual results of the data in advance, neither of us would be here. Therefore, this is a false proposition. In summary, a small win on the long at 91500; you can set a small stop-loss and continue to bet on the data. Above, we still have a limit order at the extreme position: short at 97500.

We will not analyze technically for now; we will wait for the price movement to clarify. All these prices appearing in the article are certainly not based on guesses. These six-digit number combinations, no matter how you guess, are similar to the probability of a lottery.

Today: Written by Lao Lv on December 11, 2025, at 12:10 AM. Note that all strategies are effective once and cannot be reused! Please refer to the text version and specific entry prices in the image or the bottom right corner of the video.

免责声明:本文章仅代表作者个人观点,不代表本平台的立场和观点。本文章仅供信息分享,不构成对任何人的任何投资建议。用户与作者之间的任何争议,与本平台无关。如网页中刊载的文章或图片涉及侵权,请提供相关的权利证明和身份证明发送邮件到support@aicoin.com,本平台相关工作人员将会进行核查。