Selected News

Trending Topics

Source: Overheard on CT (tg: @overheardonct), Kaito

The following is a translation of the original content into English:

【COINBASE】

Coinbase is in the spotlight today due to its partnership with PNC Bank. This collaboration allows PNC's private clients to trade Bitcoin directly through their existing accounts, marking an important milestone in institutional cryptocurrency adoption. This is the first such partnership among major banks in the U.S., highlighting Coinbase's role in bridging cryptocurrency with the traditional banking system. Additionally, discussions about Coinbase's strategic moves (such as re-entering the Indian market and participating in various crypto initiatives) have also increased its visibility.

【THEORIQ】

Today's main discussion around THEORIQ focuses on the launch of the $THQ airdrop claim portal. This portal allows testnet users, Kaito Yappers, community ambassadors, and members to verify their eligibility and claim the airdrop. The process includes anti-witch attack measures and requires testnet users to mint a "proof of humanity" NFT. The airdrop registration period is from December 9 to December 14. Furthermore, THEORIQ has been included in Coinbase's roadmap, generating significant market attention and anticipation for its TGE.

【HYPERLIQUID】

HYPERLIQUID is receiving widespread attention today due to the launch of HyENA. HyENA is a new trading platform built on Hyperliquid's HIP-3 standard, offering innovative features such as earning yields through margin collateral. Discussions also center on a recent automatic liquidation event on Hyperliquid, which resulted in significant losses and sparked debates about improving the ADL mechanism. Additionally, the platform's potential in redefining perpetual contract trading and its market impact has been highlighted.

【USDE】

Today's main discussion around USDE focuses on the launch of HyENA. HyENA is a USDe margin perpetual contract DEX based on the Hyperliquid HIP-3 standard. It allows traders to earn rewards on USDe margin collateral, turning idle margin into an efficient savings account. The platform is built by BasedOneX and supported by Ethena Labs, with USDe as the core collateral. HyENA introduces a new standard for on-chain trading, enabling users to trade any asset 24/7 while simultaneously earning yields. Its innovative capital efficiency model and incentives (such as enhanced USDe margin APY and HyENA points) have garnered widespread attention. Discussions emphasize HyENA's potential in redefining perpetual contract trading and attracting market share.

【KRAKEN】

Today's discussions around KRAKEN focus on its involvement in several significant crypto events. KRAKEN is co-hosting the $FUN token sale with Legion, while Sport.Fun is expanding its fantasy sports platform. Meanwhile, the launch of the ADI Chain mainnet and the listing of the $ADI token on KRAKEN, KuCoin, and Crypto.com have also drawn attention, highlighting its role in the UAE's digital payment ecosystem. Additionally, KRAKEN's strategic moves (such as $500 million in pre-IPO financing and collaboration with Deutsche Börse) have been mentioned, showcasing its influence in connecting traditional finance with digital assets.

Featured Articles

Tonight, the Federal Reserve will announce one of the most anticipated interest rate decisions of the year. The market widely bets that a rate cut is almost a done deal. However, what truly determines the trajectory of risk assets in the coming months is not just a 25 basis point cut, but a more critical variable: whether the Federal Reserve will re-inject liquidity into the market. Therefore, this time, Wall Street is focused not on interest rates, but on the balance sheet.

Over the past year, breakthroughs in AI have shifted from model capabilities to system capabilities: understanding long sequences, maintaining consistency, executing complex tasks, and collaborating with other intelligent agents. Consequently, the focus of industrial upgrades has shifted from single-point innovations to redefining infrastructure, workflows, and user interactions. In the annual "Big Ideas 2026," a16z's four investment teams provided key insights for 2026 from the perspectives of infrastructure, growth, healthcare, and interactive worlds. Essentially, they collectively depict a trend: AI is no longer just a tool, but an environment, a system, and an agent acting in parallel with humans.

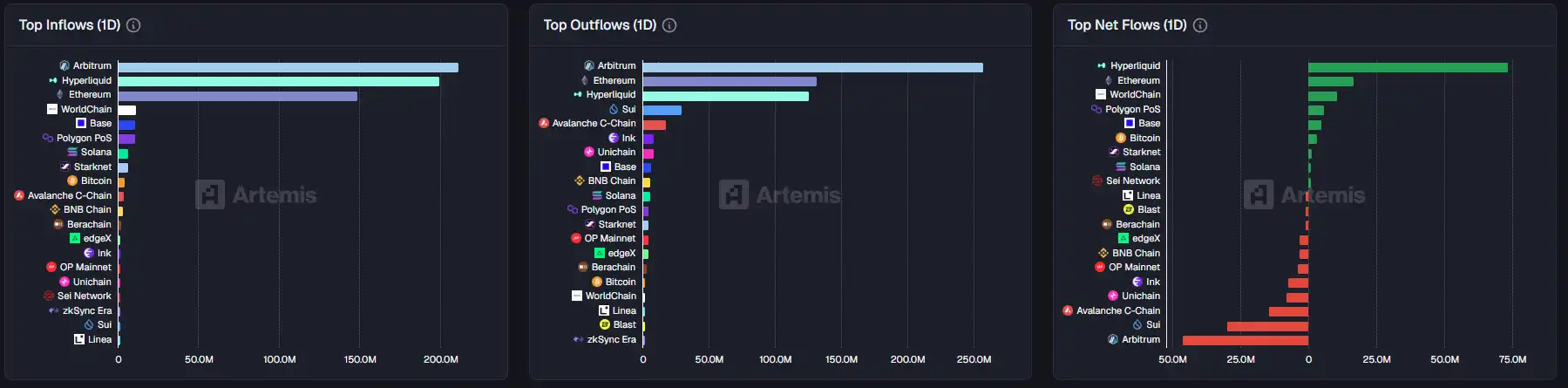

On-Chain Data

On-chain capital flow situation for the week of December 10

免责声明:本文章仅代表作者个人观点,不代表本平台的立场和观点。本文章仅供信息分享,不构成对任何人的任何投资建议。用户与作者之间的任何争议,与本平台无关。如网页中刊载的文章或图片涉及侵权,请提供相关的权利证明和身份证明发送邮件到support@aicoin.com,本平台相关工作人员将会进行核查。