Original | Odaily Planet Daily (@OdailyChina)

The "Bitcoin Asset Reserve Company" Twenty One Capital (NYSE: XXI), backed by stablecoin giant Tether and Japanese conglomerate SoftBank Group, officially debuted on the New York Stock Exchange on December 9. However, in stark contrast to its "heavy asset" and "strong endorsement" resource advantages, the stock price fell sharply after opening on the first day, with intraday losses approaching 20%, indicating an unfriendly first response from the capital market.

Founded in early 2025 and led by Strike founder and CEO Jack Mallers, Twenty One is positioned as a company focused on Bitcoin as its core asset allocation. It is strongly supported by stablecoin issuer Tether, Japan's SoftBank Group, and Wall Street investment bank Cantor Fitzgerald.

It is important to note that Twenty One did not adopt a traditional IPO but instead completed a reverse merger with Cantor Equity Partners (SPAC) to go public, officially listing on the NYSE on December 9. Cantor Equity Partners is an important platform under Cantor Fitzgerald, led by Brandon Lutnick, the son of the U.S. Secretary of Commerce. He personally led this merger and emphasized that Cantor's partnerships were key to facilitating the involvement of innovative players like Tether and SoftBank. This relationship adds "institutional prestige" to Twenty One Capital, especially in the crypto-friendly policy environment promised by the Trump administration.

However, the sentiment in the capital market is evidently more complex. Initially trading under the CEP code, the company's stock price surged from $10.2 to a high of $59.6 after the announcement, nearly a 6-fold increase, reflecting the market's initial enthusiasm for the "Bitcoin reserve company" narrative. But as speculative sentiment waned, the stock price quickly retreated and is now hovering around $11.4, nearly erasing most of the premium.

This stands in stark contrast to its substantial Bitcoin assets. As of its listing, Twenty One held 43,514 BTC, valued at approximately $4.03 billion, ranking third in the global corporate holdings leaderboard, only behind Strategy and MARA Holdings.

Valuation Puzzle: Causes Behind Extreme Discount

What truly confuses the market is its valuation structure. At the current stock price level, Twenty One's overall market capitalization is only about $186 million, with a market multiple (mNAV) as low as 0.046. This means the capital market is only willing to assign a valuation of about 4.6% of its Bitcoin asset's book value. Why is there such an extreme discount?

A deeper analysis of its asset acquisition method reveals that Twenty One's Bitcoin reserves were not primarily formed through long-term purchases in the open market but rather heavily rely on a "shareholder infusion" model: its initial reserve of about 42,000 BTC came from direct investment by Tether. Subsequently, on May 14, 2025, the company acquired an additional 4,812 BTC through Tether, costing approximately $458.7 million at an average cost of about $95,300 per coin; and before going public, it completed an additional acquisition plan of about 5,800 BTC through PIPE financing and convertible bonds.

The advantage of this model lies in its high efficiency, allowing for large-scale reserves to be completed in a short time without going through a lengthy secondary market accumulation process. However, the drawbacks are also evident: the assets are highly concentrated from a few related parties, making it difficult for investors to fully penetrate its internal trading structure, custody forms, and potential contractual constraints, leading to transparency and sustainability becoming significant discount factors in market pricing.

The Collective Dilemma of the "Digital Asset Reserve Company" Model

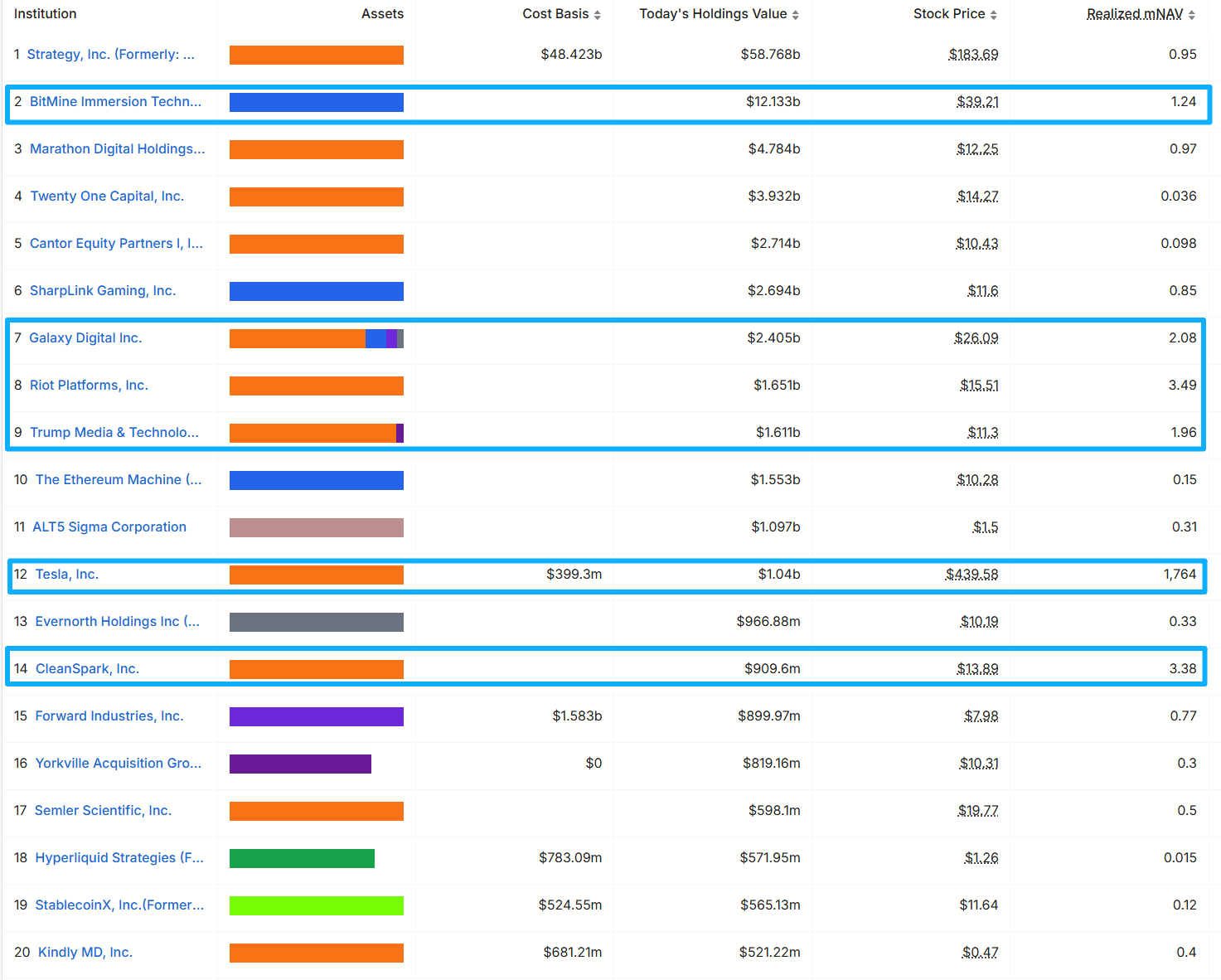

From an industry perspective, Twenty One's issues are not isolated cases. According to defillama.com, there are currently over 70 "coin stock companies" (i.e., publicly traded companies holding crypto assets) globally. Among the top 20 holders, most companies have seen their mNAV drop below 1, including Strategy, which pioneered this model.

As the overall crypto market retracts, these "coin stock companies" have gradually shifted from being the narrative's core to becoming marginal assets in risk control models, with the current market generally adopting a cautious approach to valuing these crypto asset reserve companies.

However, there is a significant difference in scale between Strategy and Twenty One. Strategy currently holds about 660,600 Bitcoins, accounting for approximately 3% of the total Bitcoin supply, which is more than 15 times that of Twenty One. This scale not only grants it stronger market influence but also symbolizes a certain "systemic anchoring." When Strategy's mNAV falls below 1, deeper questions naturally arise in the market: Will it be forced to sell coins? Will its debt structure lead to a cascading effect? Has the DAT model lost its logical foundation in the face of macro cycles?

In fact, with the significant retraction of the crypto market in 2025, the DAT model faces severe tests. The core of this model is to accumulate Bitcoin through debt and equity financing, viewing it as the "ultimate asset" to hedge against inflation and currency devaluation. However, when Bitcoin's price volatility significantly amplifies, the stability of this model begins to waver. Some companies, despite holding large amounts of BTC, face valuation pressure due to operational costs and market sentiment. The extreme discount of Twenty One, while related to its asset acquisition method, also reflects the market's concentrated pricing of risks associated with the entire DAT model.

Conclusion: The Narrative Continues, but the Market Needs Time

At the Binance Blockchain Week on December 4, Michael Saylor provided a broader perspective. In his talk titled "Why Bitcoin is Still the Ultimate Asset: The Next Chapter of Bitcoin," he reiterated his core judgment on Bitcoin's future over the next decade: Bitcoin is transitioning from an investment asset to the "foundational capital" of the global digital economy, and the rise of the digital credit system will reshape the traditional $300 trillion credit market. From policy shifts and changes in bank attitudes to the institutional adoption of ETFs and explosive growth in digital credit tools, Saylor paints a picture of a new financial order that is accelerating: digital capital provides energy, digital credit provides structure, and Bitcoin will become the underlying asset supporting all of this.

From this perspective, companies like Twenty One indeed possess a kind of "long-term correctness" potential—if Bitcoin ultimately completes its transition from a high-risk asset to "digital gold," these enterprises may become core vehicles in this migration process.

However, the issue is that "long-term correctness" does not automatically equate to "currently reasonable pricing." The market still needs time to verify Bitcoin's true role in the macro system and to reassess the DAT model's resilience under different cyclical environments.

Related Reading: “Full Text of Saylor's Dubai Speech: Why Bitcoin Will Become the Underlying Asset of Global Digital Capital”

免责声明:本文章仅代表作者个人观点,不代表本平台的立场和观点。本文章仅供信息分享,不构成对任何人的任何投资建议。用户与作者之间的任何争议,与本平台无关。如网页中刊载的文章或图片涉及侵权,请提供相关的权利证明和身份证明发送邮件到support@aicoin.com,本平台相关工作人员将会进行核查。