Tonight, the Federal Reserve will announce one of the most closely watched interest rate cuts of the year.

The market is generally betting that a rate cut is almost a done deal. However, what will truly determine the trajectory of risk assets in the coming months is not another 25 basis point cut, but a more critical variable: whether the Federal Reserve will re-inject liquidity into the market.

Therefore, this time, Wall Street is not focused on interest rates, but on the balance sheet.

According to expectations from institutions like Bank of America, Vanguard, and PineBridge, the Federal Reserve may announce this week the initiation of a $45 billion monthly short-term bond purchase program starting in January next year, as part of a new round of "reserve management operations." In other words, this means the Federal Reserve may be quietly restarting an era of "de facto balance sheet expansion," allowing the market to enter a phase of liquidity easing before the rate cut.

But what truly makes the market nervous is the backdrop of this scene—America is entering an unprecedented period of monetary power reconstruction.

Trump is taking over the Federal Reserve in a way that is much faster, deeper, and more thorough than anyone expected. It’s not just about replacing the chairperson, but redefining the power boundaries of the monetary system, reclaiming control over long-term interest rates, liquidity, and the balance sheet from the Federal Reserve back to the Treasury. The independence of central banks, which has been regarded as an "iron law of the system" for decades, is being quietly loosened.

This is also why, from the Federal Reserve's rate cut expectations to ETF fund movements, to MicroStrategy and Tom Lee's counter-cyclical accumulation, all seemingly disparate events are actually converging on the same underlying logic: the U.S. is entering a "fiscal-dominated monetary era."

And what impact will this have on the crypto market?

MicroStrategy is making moves

In the past two weeks, the entire market has been discussing the same question: will MicroStrategy be able to withstand this round of decline? If the mNAV approaches 1, will they be forced to sell coins, triggering a chain reaction? Bears have simulated various scenarios of this company "falling."

But Saylor clearly does not think so.

Last week, MicroStrategy increased its Bitcoin holdings by approximately $963 million, specifically, 10,624 BTC. This is his largest purchase in recent months, even exceeding the total of his purchases over the past three months.

It’s worth noting that the market had been speculating whether MicroStrategy would be forced to sell coins to avoid systemic risk when its mNAV approached 1. However, when the market nearly hit that level, he not only didn’t sell but also increased his holdings significantly.

Meanwhile, a similarly impressive counter-cyclical operation unfolded in the ETH camp. Tom Lee's BitMine managed to continuously cash out from ATMs, raising a large amount of cash, even as ETH prices plummeted and the company's market value adjusted by 60%. Last Monday, they made a single purchase of $429 million in ETH, pushing their holdings to a scale of $12 billion.

Even though BMNR's stock price has retraced more than 60% from its peak, the team can still continuously cash out (through a mechanism of issuing more shares) to raise funds and keep buying.

CoinDesk analyst James Van Straten commented more bluntly on X: "MSTR can raise $1 billion in a week, whereas in 2020, it took them four months to achieve the same scale. The exponential trend continues."

From the perspective of market capitalization influence, Tom Lee's actions are even "heavier" than Saylor's. BTC is five times the market cap of ETH, so Tom Lee's $429 million purchase is equivalent to Saylor buying $1 billion in BTC in terms of "double impact" on weight.

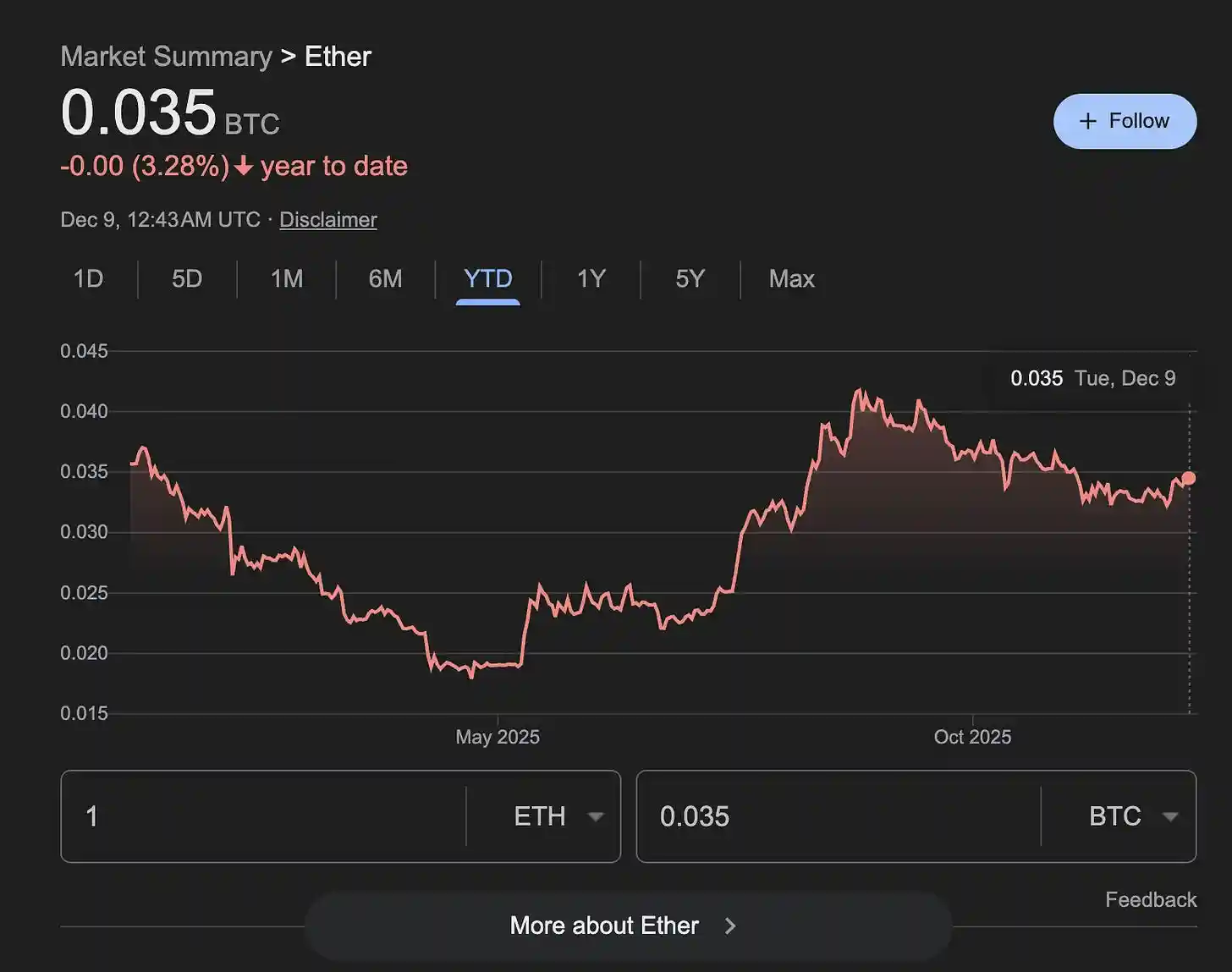

No wonder the ETH/BTC ratio has started to rebound, breaking free from a three-month downtrend. History has repeated itself countless times: whenever ETH leads in recovery, the market enters a brief but intense "altcoin rebound window."

BitMine now holds $1 billion in cash, and the ETH retracement range is just the best position for him to significantly lower costs. In a market where liquidity is generally tight, having institutions that can continuously fire is part of the price structure itself.

ETF outflows are not a retreat, but a temporary withdrawal of arbitrage funds

On the surface, Bitcoin ETFs have seen outflows of nearly $4 billion over the past two months, with prices dropping from $125,000 to $80,000, leading the market to quickly draw a crude conclusion: institutions have retreated, ETF investors are panicking, and the bull market structure has collapsed.

However, Amberdata provides a completely different explanation.

These outflows are not due to "value investors fleeing," but rather "leveraged arbitrage funds being forced to close positions." The main source of this is the collapse of a structured arbitrage strategy known as "basis trading." Funds originally profited from "buying spot/selling futures" to earn a stable interest spread, but starting in October, the annualized basis dropped from 6.6% to 4.4%, with 93% of the time below the breakeven point, turning arbitrage into losses and forcing the strategy to be dismantled.

This triggered a "dual action" of ETF selling and futures covering.

In traditional definitions, capitulation selling often occurs in an extreme emotional environment following continuous declines, where market panic reaches its peak, and investors stop trying to cut losses, completely abandoning all positions. Typical characteristics include: almost all issuers experiencing large-scale redemptions, soaring trading volumes, cost-ignoring sell-offs, accompanied by extreme emotional indicators. However, this ETF outflow clearly does not fit this pattern. Despite an overall net outflow, the directional flow of funds is inconsistent: for example, Fidelity's FBTC maintained continuous inflows throughout the period, while BlackRock's IBIT even absorbed some incremental funds during the most severe net outflow phase. This indicates that only a few issuers are truly withdrawing, not the entire institutional group.

More crucial evidence comes from the distribution of outflows. From October 1 to November 26, over 53 days, funds under Grayscale contributed more than $900 million in redemptions, accounting for 53% of total outflows; 21Shares and Grayscale Mini followed closely, together accounting for nearly 90% of the redemption scale. In contrast, BlackRock and Fidelity—the most typical institutional allocation channels in the market—overall saw net inflows. This is completely inconsistent with a true "panic institutional retreat," and instead resembles a kind of "localized event."

So, which type of institution is selling? The answer is: large funds engaged in basis arbitrage.

Basis trading is essentially a direction-neutral arbitrage structure: funds buy spot Bitcoin (or ETF shares) while shorting futures to earn the contango yield. This is a low-risk, low-volatility strategy that attracts a large amount of institutional capital when futures are reasonably priced above spot and funding costs are controllable. However, this model relies on one premise: futures prices must consistently be higher than spot prices, and the interest spread must be stable. Starting in October, this premise suddenly disappeared.

According to Amberdata's statistics, the 30-day annualized basis compressed from 6.63% all the way down to 4.46%, with 93% of trading days below the 5% breakeven point required for arbitrage. This means that these trades are no longer profitable and even start to incur losses, forcing funds to exit. The rapid collapse of the basis led to a "systematic liquidation" of arbitrage positions: they had to sell ETF holdings while buying back previously shorted futures to close this arbitrage trade.

Market data clearly shows this process. The open interest of Bitcoin perpetual contracts decreased by 37.7% during the same period, with a cumulative reduction of over $4.2 billion, and the correlation coefficient with basis changes reached 0.878, indicating almost synchronous action. This combination of "ETF selling + short covering" is a typical path for the exit of basis trading; the sudden expansion of ETF outflows is not driven by price panic, but rather a necessary result of the collapse of the arbitrage mechanism.

In other words, the ETF outflows over the past two months resemble more of a "liquidation of leveraged arbitrage positions" rather than a "long-term institutional retreat." This is a highly specialized, structured trading disintegration, rather than panic selling pressure caused by a market sentiment collapse.

What’s even more noteworthy is that when these arbitrage positions are cleared, the remaining fund structure becomes healthier. Currently, ETF holdings still maintain a high level of about 1.43 million Bitcoins, with most shares coming from allocation-type institutions rather than short-term funds chasing interest spreads. As the leverage hedging of arbitrage positions is removed, the overall leverage in the market decreases, leading to less volatility, and price behavior will be driven more by "real buying and selling power" rather than being hijacked by forced technical operations.

Amberdata's research director Marshall describes this as a "market reset": after the exit of arbitrage positions, the new funds entering ETFs are more directional and long-term, reducing structural noise in the market, and future trends will reflect real demand more. This means that although it appears to be a $4 billion outflow, it may not be a bad thing for the market itself. On the contrary, it could lay the foundation for the next healthier upward trend.

If Saylor, Tom Lee, and ETF funds demonstrate the attitudes of micro-level funds, then the changes occurring at the macro level are deeper and more intense. Will the upcoming Christmas rally come? If we are to find an answer, we may need to look further at the macro level.

Trump "takes control" of the monetary system

For decades, the independence of the Federal Reserve has been regarded as an "iron law of the system." Monetary power belongs to the central bank, not the White House.

But Trump clearly disagrees with this.

An increasing number of signs indicate that the Trump team is taking over the Federal Reserve in a way that is much faster and more thorough than the market expects. It’s not just about symbolically "replacing with a hawkish chairperson," but about completely rewriting the power distribution between the Federal Reserve and the Treasury, changing the balance sheet mechanism, and redefining the pricing of the interest rate curve.

Trump is attempting to reconstruct the entire monetary system.

Former New York Fed trading desk chief Joseph Wang (who has long studied the Federal Reserve's operational system) has also clearly warned: "The market is clearly underestimating Trump's determination to control the Federal Reserve, and this change could push the market into a higher risk, higher volatility phase."

From personnel arrangements, policy directions to technical details, we can see very clear traces.

The most direct evidence comes from personnel arrangements. The Trump camp has placed several key figures in core positions, including Kevin Hassett (former White House economic advisor), James Bessent (important decision-maker at the Treasury), Dino Miran (fiscal policy think tank), and Kevin Warsh (former Federal Reserve governor). These individuals share a common characteristic: they are not traditional "central bank factions" and do not insist on central bank independence. Their goal is very clear: to weaken the Federal Reserve's monopoly over interest rates, long-term funding costs, and systemic liquidity, and to return more monetary power to the Treasury.

The most symbolic point is that Bessent, widely considered the most suitable candidate to succeed the Federal Reserve chair, ultimately chose to remain at the Treasury. The reason is simple: in the new power structure, the position at the Treasury is more capable of determining the rules of the game than the chair of the Federal Reserve.

Another important clue comes from the change in term premium.

For ordinary investors, this indicator may be somewhat unfamiliar, but it is actually the most direct signal of the market's judgment on "who is controlling long-term interest rates." Recently, the spread between 12-month U.S. Treasury bills and 10-year Treasury bonds has approached a phase high again, and this round of increase is not due to an improving economy or rising inflation, but rather the market reassessing: the future determination of long-term interest rates may not be the Federal Reserve, but the Treasury.

The yields on 10-year and 12-month Treasury bonds are continuing to decline, indicating a strong market bet that the Federal Reserve will cut rates, and that the pace will be faster and more significant than previously expected.

The SOFR (Secured Overnight Financing Rate) experienced a cliff-like drop in September, indicating a sudden collapse in U.S. money market rates and a significant loosening signal in the Federal Reserve's policy rate system.

The initial rise in the spread was due to the market's belief that Trump would "overheat" the economy after taking office; later, when tariffs and large-scale fiscal stimulus were absorbed by the market, the spread quickly fell back. Now that the spread is rising again, it reflects not growth expectations, but uncertainty regarding the Hassett-Bessent system: if the Treasury controls the yield curve by adjusting debt duration, increasing short-term debt issuance, and compressing long-term debt, then traditional methods of judging long-term rates will become completely ineffective.

More covert but crucial evidence lies in the balance sheet system. The Trump team frequently criticizes the current "ample reserves system" (where the Federal Reserve expands its balance sheet and provides reserves to the banking system, making the financial system highly dependent on the central bank). However, they also clearly understand that the current reserves are already significantly tight, and the system actually needs balance sheet expansion to maintain stability.

This contradiction of "opposing balance sheet expansion while having to expand the balance sheet" is, in fact, a strategy. They use this as a reason to question the Federal Reserve's institutional framework and push for a transfer of more monetary power back to the Treasury. In other words, they are not looking to immediately shrink the balance sheet, but rather to use the "balance sheet controversy" as a breakthrough to weaken the Federal Reserve's institutional position.

If we piece these actions together, we will see a very clear direction: term premiums are compressed, the duration of U.S. Treasuries is shortened, long-term rates gradually lose their independence; banks may be required to hold more U.S. Treasuries; government-sponsored entities may be encouraged to leverage up to purchase mortgage bonds; the Treasury may influence the entire yield structure by increasing short-term debt issuance. Key prices previously determined by the Federal Reserve will gradually be replaced by fiscal tools.

The result of this may be: gold entering a long-term upward trend, stocks maintaining a slow push structure after fluctuations, and liquidity gradually improving due to fiscal expansion and repurchase mechanisms. The market may appear chaotic in the short term, but this is merely because the boundaries of power in the monetary system are being redrawn.

As for Bitcoin, which the crypto market is most concerned about, it is on the edge of this structural change, not the most direct beneficiary, nor will it become the main battlefield. The positive side is that improved liquidity will provide a floor for Bitcoin prices; however, looking at the longer-term trend over the next 1-2 years, it still needs to go through a period of re-accumulation, waiting for the framework of the new monetary system to become truly clear.

The U.S. is transitioning from an "era dominated by central banks" to an "era dominated by fiscal policy."

In this new framework, long-term interest rates may no longer be determined by the Federal Reserve, liquidity will come more from the Treasury, the independence of the central bank will be weakened, market volatility will increase, and risk assets will face a completely different pricing system.

When the underlying system is being rewritten, all prices will behave more "illogically" than usual. But this is a necessary phase in the loosening of the old order and the arrival of a new one.

The market trends in the coming months are likely to emerge from this chaos.

免责声明:本文章仅代表作者个人观点,不代表本平台的立场和观点。本文章仅供信息分享,不构成对任何人的任何投资建议。用户与作者之间的任何争议,与本平台无关。如网页中刊载的文章或图片涉及侵权,请提供相关的权利证明和身份证明发送邮件到support@aicoin.com,本平台相关工作人员将会进行核查。