Hello everyone, today is December 10th, how should we view the market?

Bitcoin has risen by 3 points, while Ethereum has directly increased by 7 points. What is the reason for this rise?

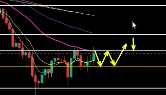

First, let's take a look at Bitcoin's movement last night, which surged directly to 94,500. Our resistance level is drawn here.

If it does not break above 94,000, it will continue to retrace. As a result, it is still weaker than Ethereum and has retraced.

Let's see, if it cannot break through and continues to oscillate in this range, between 88,000 and 94,000, it may eventually break through and retest this line.

It could potentially reach 98,000 or even 100,000. Looking at last night's rise, let's examine Bitcoin on a 4-hour level to see how we should operate. On the 4-hour level, we can see that it has broken through the life line, forming a W bottom without breaking the previous low, and has surged up to the retest of the Vegas channel line.

This position is at 92,500. If anyone wants to place an order today, you can set it at 92,300, with a stop loss at 91,900 and a take profit around 94,500.

From a broader perspective, if it cannot break 94,500, it will continue to retrace. If it breaks through, it will reach 98,000.

This is the intraday market trend.

Now let's look at the 15-minute retracement for a long position. If it can retrace to 91,000, everyone can confidently enter the market.

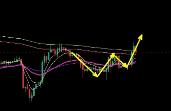

As for Ethereum, we saw a 7-point increase yesterday. Why did we witness such a shocking market rebound in such a short time?

From the market data, starting from 11 PM last night, the price quickly climbed from 3,114 USD to 3,397 USD, a direct increase of 7 points, which surprised many.

The reason lies in macro analysis and institutional capital injection. High-level signals from the Federal Reserve frequently indicate sufficient room for interest rate cuts. Yesterday, we also saw many signals for rate cuts, supported by the Trump administration's push for related policy easing measures, which improved market liquidity and boosted confidence. From the daily level, it broke through the resistance level I drew and accumulated up to 3,397. Additionally, institutional investment managers are gradually expanding their investment layout in crypto ETFs, leading to increased participation from large institutions. From the market's perspective, a large amount of capital has flowed into high-risk assets, providing strong bottom support for Ethereum.

From a technical perspective, many bullish trends have appeared near the daily level. Let's take a look at this position; it started to gain volume from here, and the three-layer bottom formation has already entered an upward trend.

Moreover, large orders and competitive buying from capital have driven Ethereum's price to break through significant resistance levels. From the technical analysis of KDJ, it has continuously formed golden crosses at the bottom, showing a clear bullish trend.

At the same time, the 5-day, 10-day, and 30-day moving averages have frequently shown golden crosses, and even the three-layer bottom formation has appeared, with overbought indicators reaching the overbought zone.

SRP has suddenly risen to the upper trend line, so we have also seen its breakthrough from a technical perspective. Looking ahead, we can see that the bullish sentiment for Ethereum's fundamentals will continue to rise.

From a technical perspective, investors should be cautious of the risk of retracement. In the medium to long term, supported by macro easing forecasts and institutional layouts, Ethereum is expected to maintain an upward trend.

Now let's look at the weekly level's upward trend. From the weekly level, last week's retracement was a healthy one.

To participate in this market process, we need to closely monitor changes in trading volume. Here, trading volume is continuously increasing.

At the weekly level, let's check the daily level's volume. The daily level has also started to increase in volume over the past few days, and capturing the movements of large orders, combined with our technical signals, will help us find quality entry points and exit opportunities in this market.

In summary, today's overall market for Bitcoin and Ethereum is still primarily bullish, with a cautious approach to short positions and proper stop-loss settings.

For more strategies, follow the public account BTC-ETH Crypto.

免责声明:本文章仅代表作者个人观点,不代表本平台的立场和观点。本文章仅供信息分享,不构成对任何人的任何投资建议。用户与作者之间的任何争议,与本平台无关。如网页中刊载的文章或图片涉及侵权,请提供相关的权利证明和身份证明发送邮件到support@aicoin.com,本平台相关工作人员将会进行核查。