In the first half of 2025, the artificial intelligence capital invested by major American tech companies contributed approximately 1 percentage point to GDP growth, a figure that coincidentally matches the overall growth rate of the U.S. GDP during the same period.

Opening the report card of the U.S. economy for the first half of 2025 reveals a dramatic phenomenon: against a backdrop of weak consumption and traditional investment, a AI investment boom led by tech giants has almost single-handedly supported the economic growth data.

Microsoft, Google, Amazon, and Meta are expected to reach a record capital expenditure of $364 billion in 2025.

This is not merely an industrial upgrade, but a profound transformation that changes the structure and inherent resilience of the U.S. economy. As the market cheers the slogan "computing power is the future," a fragile closed loop based on rising asset prices rather than widespread income growth is quietly forming.

1. Economic Dependence: AI as the Sole Engine of Macro Growth

● The growth story of the U.S. economy is being rewritten by artificial intelligence. Economic data from the first half of 2025 reveals an unprecedented phenomenon: once regarded as a stabilizer for economic growth, personal consumption has been overshadowed by a new emerging force.

● According to Barclays analysis, in the first half of 2025, capital expenditures related to artificial intelligence contributed approximately 1 percentage point to U.S. GDP growth. The significance of this figure lies in its near-perfect alignment with the overall growth rate of the U.S. economy during the same period.

● More in-depth calculations reveal structural dependence. Data from Renaissance Macro Research shows that, as of 2025, spending on AI data centers has historically surpassed the total contribution of all consumer spending in the U.S. for the first time.

Specifically, the AI investment boom is primarily focused on computer equipment, software, and data center construction. Investment in computers and related equipment alone has recently surged by 41% year-on-year.

2. Illusion of Growth: Layoffs, Stock Prices, and the Fragile Closed Loop of Consumption

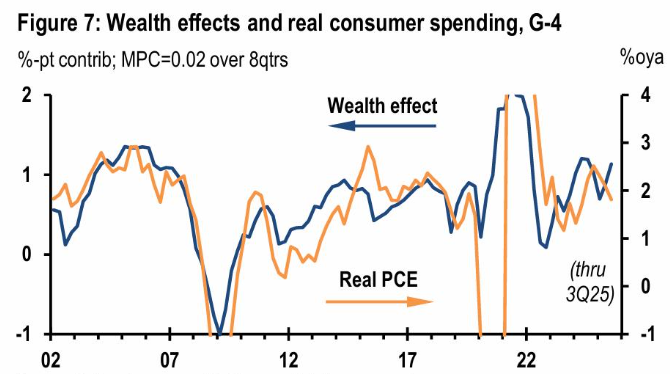

● The apparent prosperity of the current U.S. economy is driven by a delicate and fragile chain, whose starting point is not a productivity explosion brought about by technological innovation, but rather cost compression on the corporate side. According to research from JPMorgan, the U.S. is in a state where "labor income growth is slowing, but asset prices have boosted household wealth, allowing consumption to be maintained."

● The operation of this closed loop follows a clear four-step logic: companies optimize their profit statements by controlling hiring, consolidating positions, and even laying off employees, thereby gaining favor in the capital markets and driving up stock prices.

● Rising stock prices directly increase the paper wealth of American households, with recent annualized growth nearing 15%, primarily driven by rising asset prices rather than wage growth. Subsequently, the wealth effect stimulates consumption, maintaining corporate revenue, ultimately completing an economy cycle driven by stock prices.

● This prosperity has been categorized by economists under the framework of "reflexivity," meaning the economy "appears" good because asset prices have risen first, inducing consumption, rather than being fundamentally solid. Its fragility is rooted in the household sector: the U.S. personal savings rate remains persistently low, with much consumption relying on the depletion of existing savings.

● At the same time, households have a very pessimistic outlook on future income. A University of Michigan survey shows that as many as 68% of surveyed households believe that income growth in the coming year will not keep pace with rising prices, the most pessimistic level since 1975.

3. Intensifying Divergence: The K-shaped Reality and Dual Consumption Behind Prosperity

The bull market in artificial intelligence has not brought about inclusive wealth growth; rather, it acts like a magnifying glass, exposing and exacerbating the deep-rooted wealth gap in American society.

● Research by a New York University professor shows that the wealthiest 20% of households in the U.S. hold 93% of all stocks, while the bottom 50% of households collectively own only 1% of stock wealth. This asset appreciation feast driven by AI is almost unrelated to ordinary families. Consequently, wealth at the top has surged dramatically, with Federal Reserve statistics indicating that the average net worth of the wealthiest 1% of households has approached $37 million.

● The wealth growth of the middle class primarily relies on real estate, but real estate is illiquid and grows steadily, preventing them from sharing in the explosive dividends of tech stocks.

● Lower-income families have seen a slight increase in stock participation due to conveniences like zero-commission trading apps, but their participation amounts are small and short-lived, having minimal impact on long-term wealth accumulation. The result is that under the AI-driven growth model, the U.S. economy is increasingly reliant on consumption from top-tier households.

● A market strategist at JPMorgan pointed out that about 75% of the returns from the S&P 500 index over the past three years have come from AI-related companies. This shift from "broad participation-driven" economic growth to a "top-driven" model has been termed by researchers as a "dual consumption structure."

● The K-shaped divergence in the consumption market is equally striking. While tech stocks soar, retailers like Dollar Tree and Dollar General, which primarily sell cheap goods, have seen their stock prices perform astonishingly, with annual increases of 60% and 75%, even surpassing AI chip giant Nvidia.

Among the new customers of Dollar Tree, about 60% come from high-income households earning over $100,000, indicating that consumption downgrading has spread to the middle and upper-income groups.

4. Debt Abyss: When Investment Frenzy Meets Financial Risk

● Supporting this trillion-dollar computing power race is an ever-increasing debt leverage. Mark Zandi, chief economist at Moody's, has issued a warning: tech companies are taking on massive debt through record bond issuances, the scale of which has already surpassed the years leading up to the burst of the internet bubble.

● Oracle recently issued $18 billion in bonds, pushing its total debt over $100 billion. Even more astonishingly, reports suggest that OpenAI's debt may have exceeded $1 trillion.

● Morgan Stanley predicts that global companies will spend $3 trillion on data centers, with one-third being debt. Zandi emphasizes that companies are not merely refinancing existing debt but are significantly increasing borrowing to compete for AI market share.

● Even excluding inflation factors, borrowing in the tech industry is at record levels. This debt-driven growth model brings unprecedented systemic risks.

● Unlike the internet bubble of 2000, where losses were primarily borne by stock investors, the rising debt levels today mean that once the AI boom fades, the impact will ripple through broader financial markets and the real economy, greatly enhancing risk transmission capabilities.

5. Future Puzzle: Uncertainty in Productivity Transformation and Long-term Growth

The core of the issue ultimately returns to: can this costly computing power arms race be transformed into tangible, widespread, and sustainable productivity improvements? Currently, the answer is fraught with uncertainty.

● The macro-level driving effect may be overestimated. One analysis points out that if the offsetting effect of imported equipment (such as imported servers) used for AI investment on GDP is excluded, the real driving rate of AI-related investment on GDP in the first half of 2025 may drop from the superficial 1% to 0.2%.

● Barclays expects that the contribution of AI capital expenditures to GDP growth will peak in 2025 and then decline rapidly, potentially falling to 0.2 percentage points by 2027, with limited sustained potential for long-term GDP growth or productivity improvement.

● At the corporate level, the imbalance between input and output is becoming increasingly evident. Data shows that nearly 80% of companies deploying AI have failed to achieve net profit increases, and 95% of generative AI pilot projects have not yielded direct financial returns.

● The iteration of technology itself also constitutes the "curse of Moore's Law." The reality that the computing power of the next generation of AI chips doubles every 18 months means that expensive hardware may become obsolete before generating sufficient returns, laying landmines of asset impairment on corporate balance sheets.

When Dollar Tree announces that 60% of its new customers come from households earning over $100,000, the signal light for consumption downgrading has already been lit.

In contrast, the capital expenditures of tech giants are soaring in a "parabolic" trajectory towards the sky. The prosperity of the stock market and the careful budgeting on supermarket shelves form the most authentic AB side of the current U.S. economy.

This economic carriage, relying on a single wheel of AI investment, faces a bumpy road ahead. Ultimately, what will determine whether this technological revolution is a bubble or a dawn is not the height of capital accumulation, but whether it can solidly reach and enhance the efficiency of every economic cell.

Join our community to discuss and grow stronger together!

Official Telegram community: https://t.me/aicoincn

AiCoin Chinese Twitter: https://x.com/AiCoinzh

OKX benefits group: https://aicoin.com/link/chat?cid=l61eM4owQ

Binance benefits group: https://aicoin.com/link/chat?cid=ynr7d1P6Z

免责声明:本文章仅代表作者个人观点,不代表本平台的立场和观点。本文章仅供信息分享,不构成对任何人的任何投资建议。用户与作者之间的任何争议,与本平台无关。如网页中刊载的文章或图片涉及侵权,请提供相关的权利证明和身份证明发送邮件到support@aicoin.com,本平台相关工作人员将会进行核查。