Master Discusses Hot Topics:

Tomorrow morning's Federal Reserve meeting, a 25bp rate cut is basically a routine matter. I haven't really paid much attention to that, what I care about is whether the dot plot dares to soften and whether old Powell dares to be lenient.

If these two continue to put on a hawkish face, then tomorrow's market will slap all the bulls back to reality. Following that, we have the Japanese monetary policy meeting and a bunch of data lined up to hit us.

The surge in the 2-year yield over the past week is the clearest signal; the market has not only priced in a rate cut ahead of time but has also pushed up the average rate, neutral rate, and risk premium for the next two years.

What can I say? The American market simply does not believe that a rate cut can save the economy, and is even hinting to the Fed that their rate cuts are useless. This is toxic for U.S. stocks and has an even greater impact on BTC bulls.

Looking at Nvidia, it has also been weak these past two weeks. If the tech leader in a central position can't rise, it indicates that the heat of AI is truly starting to fade. The market is draining liquidity, and with funds retreating, can you still expect the Fed's rate cut to help Bitcoin rise?

Back to the market, Bitcoin has only held up for 20 days since its recent bottom. Yesterday's false breakout has already crushed the triple divergence on the chart, and this trend clearly indicates a downward move. If the Fed gives any hint in the morning, Bitcoin will be thrown back to 93.5K to fill that 15-minute gap.

Although it has surged to 92.6K, which is the first step, if the bulls can't hold 89.5K, the entire structure will collapse into a puddle of mud. Only if it holds can it challenge 94.1K and 96K again, but when the price reaches the liquidity zone at 96K, it’s normal for the bulls to get washed out.

Not to mention it will inevitably try again at 94.2K to 94.5K; that range will eventually be tested again. The current long and short volume is also very weak, with both sides lacking strength but wanting to make a move.

A real breakout will definitely not happen today; it will surely occur tomorrow or the day after, and it is highly likely to catch people off guard with a spike. The key range above is 94K to 96K; only after breaking and stabilizing can we talk about 100K.

If the range of 88K to 90K is broken, the bulls will face a stampede, and the drop will be harsher than you think. The market sentiment is currently in this state: wanting to rise but not daring to, wanting to fall but not daring to. Funds are hesitant to exert force and can only wait for tomorrow to be forced into a direction.

Now, regarding my current judgment, am I bullish? That is based on Bitcoin being able to stabilize above 92K to 93K and the volume returning. If that condition is met, it can indeed push to 94K to 96K, or even break through strongly. But if you dare to let it drop to 90K for a test? That would be a strong bearish kill, directly rolling back to 88K to decide whether the mid-term trend will break.

On the Ethereum side, it is clearer than Bitcoin; the three-day moving average has already crossed bullish. 3420 is the first hurdle, and those with low long positions should exit here.

If it truly breaks through 3420, then a pullback to the two-day moving average can push it to 3626 without hesitation. If the support at 3170 holds, it will directly target 3400. Tonight, the high short position should be set a bit higher; in this kind of hanging market, you can't place orders at slightly lower positions.

Master Looks at Trends:

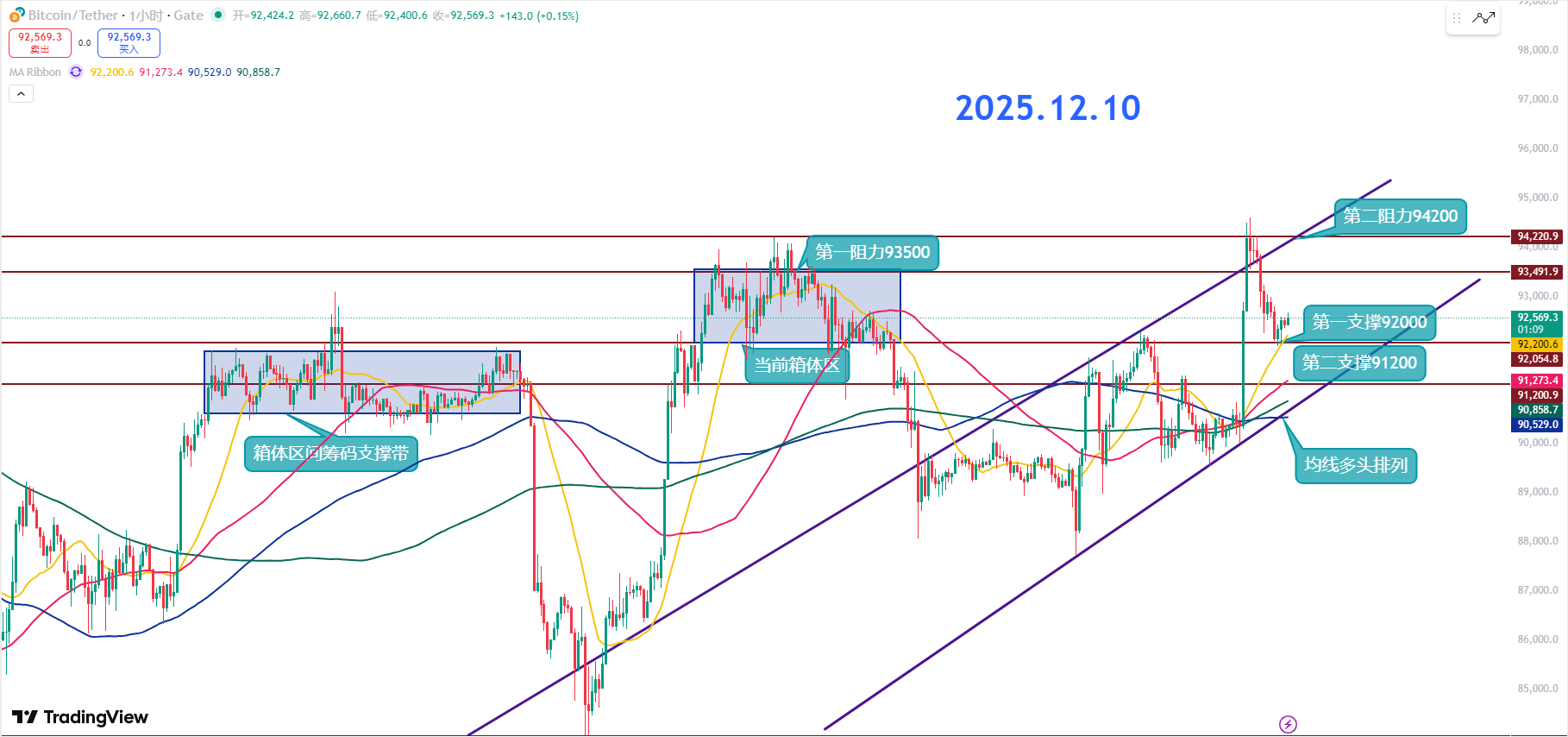

The current first support is at 92K, which also corresponds to the 20MA. If 92K is broken, the short-term downside will open directly to the second support at 91.2K, which is a range where you can buy in batches.

The price is currently consolidating in the range of 92K to 93.5K, with the lower range of 90.4K to 91.8K being the previous large support and trading dense area. The last rebound was too strong, so the pullback is naturally not light; this is a healthy trend.

92K is the best stop-loss and reversal point for the short term, and you can start by taking a small position here. If it drops to the second support, you can continue to add, which offers a suitable risk-reward ratio. The 91.2K and the long-term moving averages below are also golden zones for building low-cost positions.

The first resistance at 93.5K is the upper edge of the previous range, and it will be strong pressure before breaking through. But once it breaks, the short-term bulls will clearly strengthen.

The second resistance at 94.2K is the closing high before last night's sharp rise; to continue pushing up, it must break through here, and volume is key.

Last night's surge was too sudden, and the lower side basically didn't establish a base, leading to a pullback that is harder than expected today. However, this is a normal structure; after a sharp rise, there must be a deep correction. The next focus should be on the stop and the beginning of the consolidation range, which is the real opportunity.

12.10 Master’s Wave Strategy:

Long Entry Reference: Not currently referenced

Short Entry Reference: Short in the range of 94200-94700, Target: 93500-92000

If you truly want to learn something from a blogger, you need to keep following them, rather than making hasty conclusions after just a few market observations. This market is filled with performers; today they screenshot long positions, and tomorrow they summarize short positions, making it seem like they "catch every top and bottom," but in reality, it’s all hindsight. A truly worthy blogger will have a trading logic that is consistent, coherent, and withstands scrutiny, rather than jumping in only when the market moves. Don’t be blinded by exaggerated data and out-of-context screenshots; long-term observation and deep understanding are necessary to discern who is a thinker and who is a dreamer!

This content is exclusively planned and published by Master Chen (WeChat: Coin Master Chen). For more real-time investment strategies, solutions, spot trading, short, medium, and long-term contract trading techniques, operational skills, and knowledge about candlesticks, you can join Master Chen for learning and communication. A free experience group for fans has been opened, along with community live broadcasts and other quality experience projects!

Warm reminder: This article is only written by Master Chen on the official account (as shown above), and any other advertisements at the end of the article and in the comments are unrelated to the author!! Please be cautious in distinguishing authenticity, thank you for reading.

免责声明:本文章仅代表作者个人观点,不代表本平台的立场和观点。本文章仅供信息分享,不构成对任何人的任何投资建议。用户与作者之间的任何争议,与本平台无关。如网页中刊载的文章或图片涉及侵权,请提供相关的权利证明和身份证明发送邮件到support@aicoin.com,本平台相关工作人员将会进行核查。