Despite holding a floating loss of over $3 billion, cryptocurrency investment company BitMine accelerated its purchase of 138,000 Ethereum last week, with the buying speed surging by 156% compared to four weeks ago.

As Ethereum's price hovers around $3,100, the 3.86 million ETH held by BitMine Immersion Technologies is currently in a floating loss, with an average cost as high as $3,925.

However, the company not only did not reduce its holdings but instead increased its position by 138,452 ETH in the past week, bringing its total Ethereum holdings to 3,864,951 ETH, accounting for approximately 3.2% of the total Ethereum supply.

1. Contrarian Accumulation

Against the backdrop of a generally sluggish cryptocurrency market, BitMine's accumulation behavior is particularly noteworthy. As of December 9, the total value of the company's portfolio has reached $13.2 billion.

● BitMine's asset composition includes approximately $12.1 billion worth of 3.86 million ETH, 193 Bitcoins, $36 million in Eightco Holdings equity, and $1 billion in cash.

● The company's accumulation last week was approximately $435 million, with the buying speed significantly increasing by 156% compared to the weekly average four weeks ago. This accelerated buying behavior stands in stark contrast to the general risk-averse sentiment in the market.

2. Strategic Confidence

● BitMine Chairman Thomas "Tom" Lee explained the company's accelerated accumulation strategy. He stated that this move reflects the company's confidence in Ethereum's strength in the coming months, a confidence stemming from multiple catalysts. Lee specifically mentioned: "The Fusaka upgrade was activated on December 3, bringing a series of improvements in scalability, security, and usability."

● He also pointed out that the Federal Reserve is taking several key actions in December, including ending quantitative tightening and is expected to cut interest rates again on December 10. These factors collectively form the basis for BitMine's optimistic outlook on Ethereum's future performance.

3. Technical Upgrade

The Fusaka upgrade has indeed brought substantial improvements to the Ethereum network. This upgrade was successfully activated on December 3, marking the second hard fork following the Pectra upgrade in May of this year.

● A key highlight of the Fusaka upgrade is the introduction of "PeerDAS" technology, a peer-to-peer data availability sampling mechanism. This innovation is expected to reduce transaction delays from minutes to milliseconds, providing a more immediate user experience for decentralized applications and payment systems.

● According to predictions from the Ethereum Foundation, this upgrade will unlock up to 8 times the on-chain data throughput. For Layer 2 scaling solutions like Optimism and Arbitrum, this means being able to submit more data at a lower cost, thereby reducing transaction fees for end users.

4. Macroeconomic Tailwinds

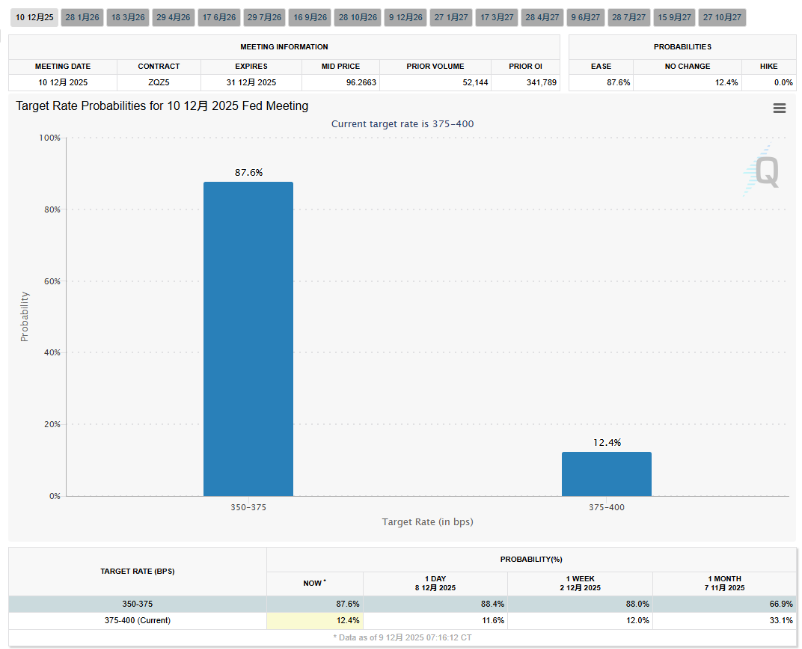

● In addition to positive technical factors, changes in macro monetary policy also provide potential support for the cryptocurrency market. Market expectations for a Federal Reserve rate cut in December are growing, with CME data showing that as of December 8, the probability of a 25 basis point cut at this meeting has soared to 88%.

● The impact of rate cuts on crypto assets is typically realized through liquidity transmission mechanisms. Loose monetary policy can enhance market risk appetite and improve the overall liquidity environment, which is particularly beneficial for high beta crypto assets.

● Fundstrat Chairman and BitMine Chairman Tom Lee believes: "It has been over eight weeks since the liquidation shock event on October 10, which is enough time for crypto assets to trade based on future fundamentals again."

5. Market Divergence

● Despite BitMine's strong confidence, there remains divergence in the market regarding Ethereum's short-term trajectory. Some analysts point out that Ethereum's price has not seen a significant increase following the upgrade, reflecting the complexity of market sentiment.

● Independent analyst Ted Pillows noted that if Ethereum falls below the key psychological support level of $3,000, it could further dip into the $2,800 range. This scenario is similar to the 20-25% pullbacks observed in October 2023 and May 2024.

● However, technical indicators also show some positive signals. Ethereum's daily Relative Strength Index (RSI) is currently around 46, indicating a neutral to weak market state, but also suggesting room for a rapid reversal.

6. Institutional Positioning

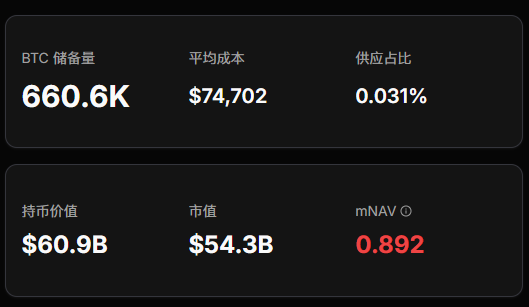

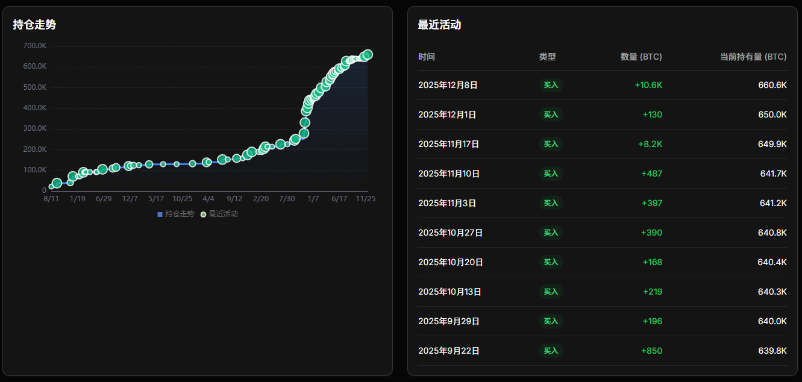

● BitMine is not the only institution increasing its holdings during the downturn in the crypto market. Strategy last week accumulated 10,624 Bitcoins at an approximate price of $90,615, bringing its total Bitcoin holdings to 660,624.

● Strategy currently holds Bitcoin worth approximately $59.82 billion, with an average cost of $74,696, resulting in a floating profit of $10.473 billion. Unlike BitMine, which primarily holds Ethereum, Strategy focuses on Bitcoin investments.

● These institutions, known as "cryptocurrency treasury companies," position themselves as "leveraged bullish options on cryptocurrencies." When cryptocurrency prices rise above their cost lines, these companies' profits and stock price elasticity will significantly amplify.

7. Industry Impact

BitMine's large-scale holdings and accumulation behavior have a profound impact on the Ethereum ecosystem. As the largest institutional holder of Ethereum, the company holds over 3.2% of the total Ethereum supply.

● This scale of holdings means that BitMine has significant influence and voice within the Ethereum ecosystem. The company has also announced plans to launch a staking solution called the "Made in America Validator Network" in early 2026.

● As its holdings increase, BitMine will have a greater impact on the security and decentralization of the Ethereum network. This concentrated holding may spark discussions about Ethereum governance and network security.

● The number of Ethereum held by BitMine is staggering, with its 3,864,951 ETH accounting for over 3.2% of the global Ethereum supply. As the company announces plans to increase this proportion to 5%, it is rapidly becoming an undeniable whale force within the Ethereum ecosystem.

As the effects of the Ethereum Fusaka upgrade gradually become apparent, the Federal Reserve's shift in monetary policy, and the recovery of the crypto market from the October liquidation shock, BitMine's $3 billion floating loss bet may ultimately turn into a well-calculated risk gamble.

Join our community to discuss and grow stronger together!

Official Telegram community: https://t.me/aicoincn

AiCoin Chinese Twitter: https://x.com/AiCoinzh

OKX benefits group: https://aicoin.com/link/chat?cid=l61eM4owQ

Binance benefits group: https://aicoin.com/link/chat?cid=ynr7d1P6Z

免责声明:本文章仅代表作者个人观点,不代表本平台的立场和观点。本文章仅供信息分享,不构成对任何人的任何投资建议。用户与作者之间的任何争议,与本平台无关。如网页中刊载的文章或图片涉及侵权,请提供相关的权利证明和身份证明发送邮件到support@aicoin.com,本平台相关工作人员将会进行核查。