Written by: Glendon, Techub News

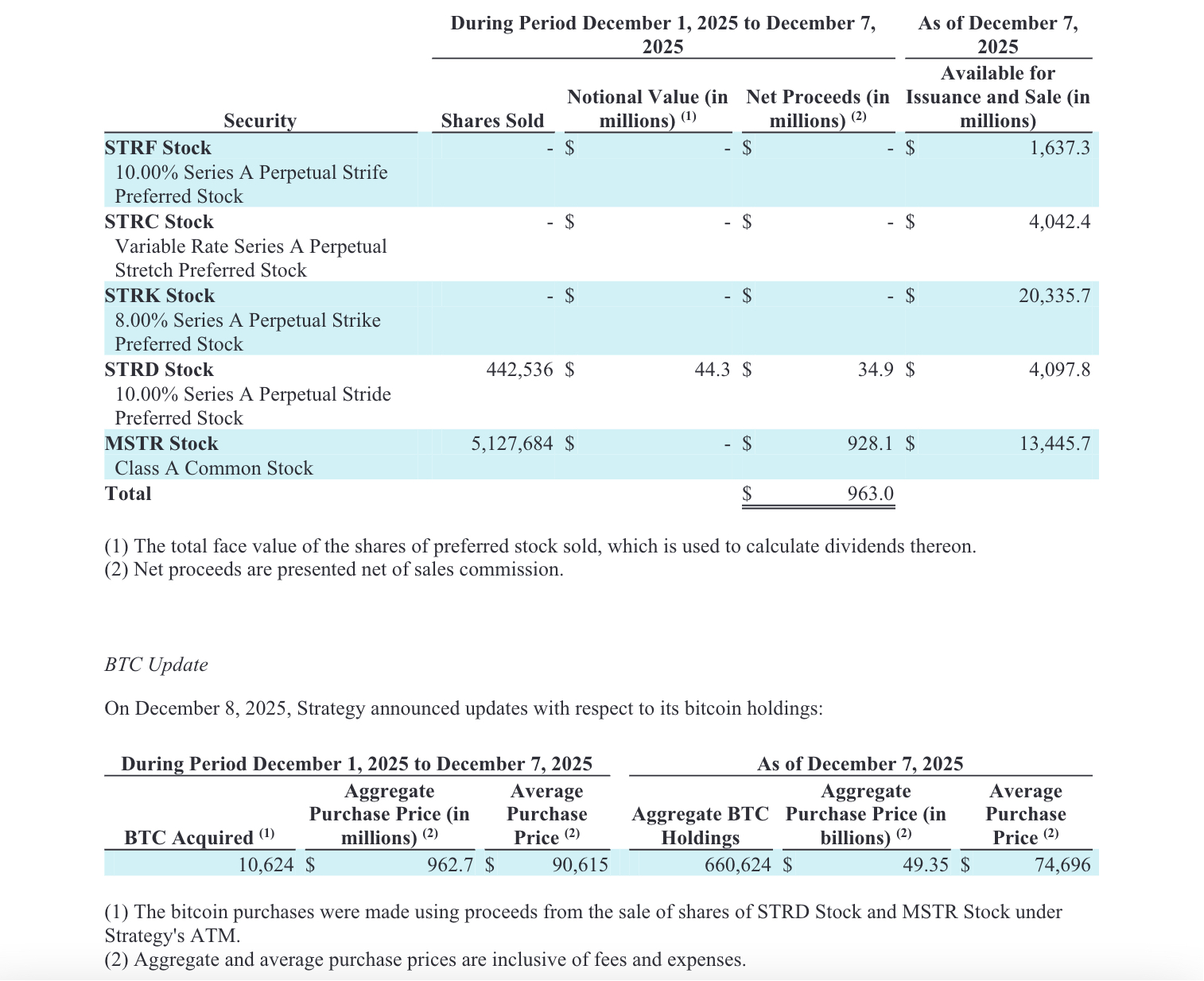

As the cryptocurrency market remains sluggish, Strategy revealed yesterday that it purchased 10,624 bitcoins for approximately $963 million last week, with an average price of about $90,615.

According to the Form 8-K filed by Strategy with the SEC, as of December 7, 2025, Strategy holds a total of 660,624 bitcoins, with a cumulative cost of approximately $49.35 billion, averaging about $74,696 per bitcoin. The annualized return on bitcoin (YTD 2025) has reached 24.7%. The funds for this bitcoin purchase came from the sale of STRD and MSTR stocks during the company's ATM financing.

This substantial increase in holdings indicates that the financing "infinite bullet" model adopted by Strategy has not been completely restricted.

Earlier this month, Strategy announced the establishment of a $1.44 billion cash reserve to pay preferred stock dividends and interest on existing debt. This decision has sparked controversy among the market and bitcoin investors. Many believe that Strategy did not "buy the dip" when bitcoin prices fell but instead chose to build cash reserves, which is clearly contrary to the long-term investment philosophy the company has consistently promoted.

In the face of a flood of criticism, Strategy's significant increase in bitcoin holdings can be seen as a silent yet powerful response. At the same time, this increase raises a question: is this merely a continuation of Strategy's long-standing buying strategy, or is it a positive signal indicating confidence in the recent trends of the cryptocurrency market?

Additionally, it is worth noting that although this increase has injected a boost of confidence into the market, many of the challenges facing Strategy have not been fully resolved. In this context, how will Strategy develop in the future?

Multiple Challenges Behind Strategy's Loss of Confidence

The reasons for the market's waning confidence in Strategy are multifaceted, with the slowdown in bitcoin accumulation, declining stock prices, and financing restrictions being the most significant factors.

As of December 8, Strategy has accumulated over 210,000 bitcoins this year, totaling 214,224 bitcoins. While this figure is somewhat acceptable, a deeper investigation reveals a clear decline in Strategy's purchasing power for bitcoin.

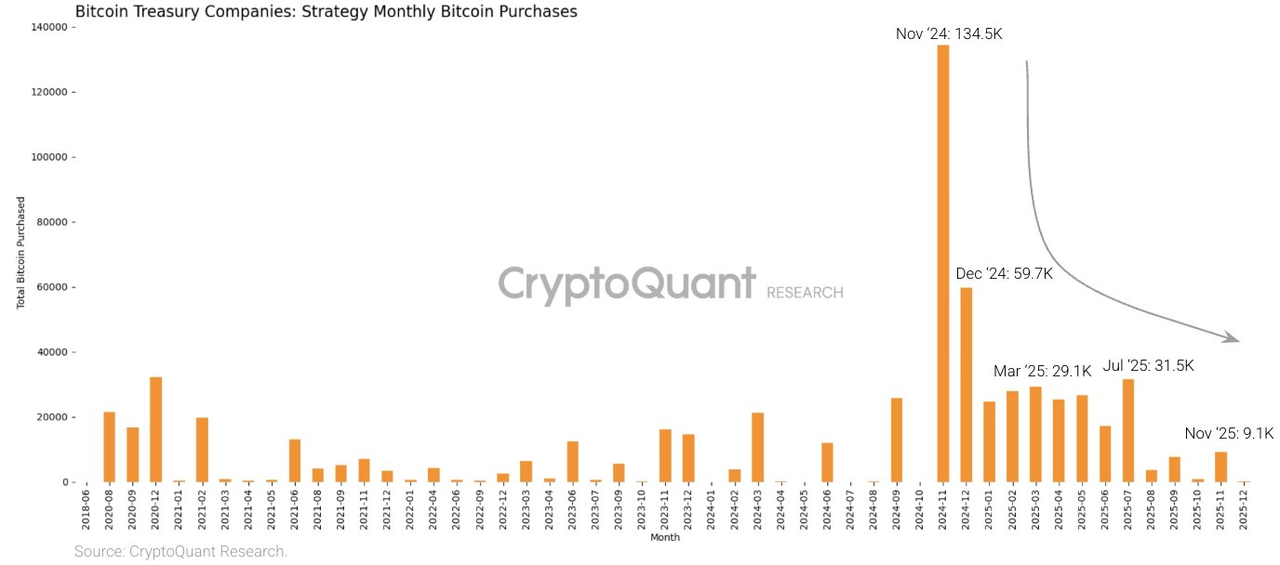

According to CryptoQuant's monitoring, Strategy's bitcoin purchasing volume has significantly declined in 2025, with monthly purchases dropping from a peak of 134,000 bitcoins in 2024 to just 9,100 bitcoins in November 2025. Particularly since August, the decline in Strategy's accumulation has become increasingly evident. If the previous slowdown was due to bitcoin prices reaching high levels, making further purchases less suitable from a cost and risk perspective, it could be understood. However, as bitcoin prices continue to fall and the market generally expects Strategy to "buy the dip," the largest DAT company in the entire cryptocurrency industry has still slowed its bitcoin accumulation. This attitude undoubtedly reflects the company's lack of confidence in the market, directly affecting the sentiment of other DAT companies and institutional investors, thereby hindering bitcoin's upward movement and potentially facing greater downward pressure.

So, why hasn't Strategy "bought the dip" in bitcoin recently? This can largely be attributed to changes in its stock price and financing situation.

Market data shows that as of the time of writing, Strategy (MSTR) stock is priced at $183.69, down nearly 60% from this year's high of about $457.

The direct impact of the declining stock price is a blow to Strategy's financing capabilities. Strategy announced its "21/21 Plan" financing initiative at the end of October 2024, aiming to raise $42 billion in new capital over the next three years to purchase bitcoin.

It is well known that Strategy's ability to continuously accumulate bitcoin in the first half of this year was due to its ATM equity financing plan. The core logic of this plan is that when Strategy's stock price has a premium relative to the value of its held bitcoins, the company can finance by issuing new shares to increase its bitcoin holdings.

This involves Strategy's net asset value ratio (mNAV, the ratio of enterprise market value to the value of held bitcoins). Previously, Strategy's mNAV was as high as 2.5 times, reflecting the market's high premium on its "issuing shares to buy bitcoins" strategy. However, as Strategy's stock price and market risk appetite have declined, this ratio has also begun to decrease. Once the mNAV falls below 1, Strategy will find it difficult to obtain funds through the ATM plan.

As of December 8, Strategy's market capitalization is approximately $52.784 billion, with a net mNAV of about 1.07. While it still maintains above 1, it is concerning that Strategy's mNAV data has dropped below 1 multiple times in November. TD Cowen noted in a report that Strategy's premium has significantly retreated from last year's peak and is gradually compressing to levels seen at the end of 2021 to early 2022.

At the same time, the market's view on Strategy's future stock performance has also changed. Investment bank Cantor Fitzgerald has set a 12-month target price for Strategy stock at $229, a reduction of about 59% from the previous expectation of $560. Even though Cantor reiterated a "buy" rating for MSTR, analysts generally expect that the funds Strategy will raise from the capital markets over the next year have been reduced from the previous expectation of $22.5 billion to $7.8 billion.

Moreover, JPMorgan believes that whether Strategy can maintain an mNAV above 1 and avoid selling bitcoins is a key driver of bitcoin's recent price movements. This viewpoint reflects the concentration of bitcoins held by Strategy and the potential risks of bitcoin sell-offs, which have become a focal point of market attention. Currently, Strategy holds about 3.14% of the total bitcoin supply, and a significant sell-off of bitcoins would undoubtedly trigger a chain reaction, leading to a market crash.

However, there is no need to be overly concerned about this potential risk. Strategy's CEO Phong Le clearly stated in the "What Bitcoin Did" podcast that the company would only consider selling bitcoins if its mNAV falls below 1 and it cannot obtain new funds through financing, referring to it as a "last resort." He emphasized that this is not a shift in its long-term policy or an active sell-off plan, but merely a "financial decision" that would be taken only in extreme market conditions and deteriorating capital environments.

Furthermore, Strategy's action of accumulating over 10,000 bitcoins through ATM financing also demonstrates that the company is far from reaching a "dead end."

In addition, global securities index publisher MSCI is considering a rule that would exclude companies with more than 50% of their balance sheet in digital assets from its main indices, and Strategy (MSTR) happens to fall into this category. This issue has sparked heated discussions in the industry, with JPMorgan stating that if MSTR is excluded from mainstream indices like MSCI USA or Nasdaq 100, it could trigger up to $2.8 billion in fund withdrawals, compounded by sell-offs from passive funds, further amplifying the impact.

MSCI is expected to make this decision on January 15, and if other index providers follow suit, the related fund outflows could reach as high as $8.8 billion. According to Reuters, Strategy is in talks with MSCI to address the potential issue of being "excluded from the MSCI index."

Seeking "Balance" in Long-Term Bitcoin Accumulation Strategy

In light of the aforementioned challenges, it is essential to clarify that Strategy's stance on bitcoin is resolute. Phong Le has explicitly stated that the company will hold bitcoin at least until 2065, continuing its long-term accumulation strategy.

Strategy tweeted that even if bitcoin falls to its average cost price of $74,000, its BTC assets would still be 5.9 times the convertible debt. Strategy founder Michael Saylor further emphasized at an event that "Strategy currently has about $60 billion in bitcoin reserves and about $8 billion in debt, which is a relatively low leverage ratio."

Secondly, regarding dividend payments, Phong Le specifically pointed out that Strategy faces an annual dividend payment issue of about $800 million. As the recently issued preferred stocks gradually mature, the annual obligation approaches $750 million to $800 million. He plans to prioritize paying these dividends through equity raised at prices above mNAV. For this reason, Strategy has launched a $1.44 billion cash reserve, aimed at paying dividends rather than selling equity, bitcoin derivatives, or bitcoins.

The funds for this cash reserve come from the proceeds of the company's issuance of Class A common stock according to market issuance plans. Strategy plans to maintain a reserve size that covers at least 12 months of dividend payment needs. On this basis, Strategy also intends to gradually strengthen the reserve size, with the ultimate goal of building a buffer fund pool that can cover 24 months or more of dividend payments, and this process does not require utilizing the $60 billion bitcoin position.

This is undoubtedly a robust defensive strategy and an effective means of risk avoidance. Even though this move has made Strategy a subject of market controversy, it has indeed moved past the "blindly buying" phase. In fact, in the current market environment, a strategy of blindly "buying the dip" during significant bitcoin declines is no longer applicable to Strategy. The decline in Strategy's stock price is not only accompanied by the decline in bitcoin but also impacted by the bitcoin ETF market. With the development of U.S. policies and increasing market competition, Strategy's stock, once an important alternative for bitcoin, is no longer the first choice for institutional investors seeking exposure to bitcoin.

Given this, Strategy needs to explore strategies that are more suitable for its development, finding a perfect balance between long-term bitcoin accumulation and maintaining normal company operations.

At this stage, Strategy seems to be exploring more ways to enhance asset utilization. Phong Le indicated that the possibility of lending bitcoins is not ruled out to strengthen financial flexibility. Meanwhile, Michael Saylor is actively promoting the development of a digital banking system backed by bitcoin in various countries, aiming to provide high-yield, low-volatility accounts to attract trillions of dollars in deposits.

Additionally, Strategy is working to reduce potential risks associated with its bitcoin custody. According to Arkham, to reduce its over-reliance on Coinbase, Strategy is advancing a decentralized custody layout. As of December 6, Strategy has transferred approximately 183,900 bitcoins to Fidelity Custody, which accounts for about 28% of the company's bitcoin holdings.

It is worth mentioning that despite the ongoing doubts and concerns regarding Strategy in the market, the overall sentiment towards the company remains optimistic. Taking the previously mentioned "MSCI exclusion risk for MSTR" as an example, Bitwise Chief Investment Officer Matt Hougan analyzed based on historical experience that the impact of index inclusion and exclusion on stock prices is far less significant than investors generally worry. Last year, when Strategy was included in the Nasdaq 100 index, passive funds bought about $2.1 billion worth of stock, yet "the stock price hardly fluctuated." The recent decline in stock price may simply be the market preemptively digesting the possibility of exclusion, and in the long run, significant volatility is not expected.

JPMorgan holds a similar view, believing that the risk of Strategy being excluded by MSCI has been fully digested by the market, and its stock price already reflects the impact of being removed from major stock benchmark indices. Furthermore, JPMorgan sees the upcoming MSCI decision as a potential catalyst for upward movement; although exclusion may lead to some passive fund outflows, if MSCI subsequently makes a positive decision, both Strategy's stock price and bitcoin price are expected to gain strong upward momentum.

Moreover, Wall Street broker Benchmark has also expressed optimism about Strategy's solvency, believing that the company's debt is within a controllable range and that its structure is far more robust than critics claim, stating that concerns about Strategy's survival are merely the noise that inevitably arises during bitcoin downturns.

Before Strategy disclosed its purchase of 10,624 bitcoins last week, the aforementioned views might have been seen as mere rhetoric to boost market confidence. However, as the market generally anticipates that bitcoin will enter a new upward cycle early next year, this latest accumulation by Strategy not only further strengthens market confidence in bitcoin but also indicates its belief that "bitcoin prices will not significantly decline," reflecting its firm bet on the long-term value of bitcoin. When the market warms up and funds flow back in, Strategy may find itself in a more advantageous strategic position.

免责声明:本文章仅代表作者个人观点,不代表本平台的立场和观点。本文章仅供信息分享,不构成对任何人的任何投资建议。用户与作者之间的任何争议,与本平台无关。如网页中刊载的文章或图片涉及侵权,请提供相关的权利证明和身份证明发送邮件到support@aicoin.com,本平台相关工作人员将会进行核查。